February 11, 2015 – MCLEAN, Va. – Hilton Worldwide Holdings Inc. ("Hilton Worldwide") today announced it closed its previously-announced sale of the Waldorf Astoria New York to Anbang Insurance Group Co. Ltd. ("Anbang") for $1.95 billion. In addition, Hilton Worldwide has signed agreements to redeploy the proceeds of the sale to add five landmark properties in strategic resort and urban locations to its owned portfolio:

- Hilton Orlando Bonnet Creek in Orlando, FL (1,001 rooms)

- Waldorf Astoria Orlando in Orlando, FL (498 rooms)

- The Reach, A Waldorf Astoria Resort in Key West, FL (150 rooms)

- Casa Marina, A Waldorf Astoria Resort in Key West, FL (311 rooms)

- Parc 55 in San Francisco, CA (1,024 rooms)

The Parc 55, which represents over one third of the purchased portfolio by number of rooms, will be a new addition to the Hilton Hotels & Resorts brand that will be managed by Hilton Worldwide. The other acquired hotels are currently managed by Hilton Worldwide.

As part of its long-term relationship with Anbang, Hilton Worldwide will continue to operate the Waldorf Astoria New York under a 100-year management agreement. Anbang also plans to complete a major renovation to restore the property to its historic grandeur.

"These transactions will enable us to unlock the embedded value of the Waldorf Astoria New York and acquire great institutional quality assets that we expect will drive significant incremental value for the company," said Christopher J. Nassetta, president and CEO, Hilton Worldwide. "Our relationship with Anbang will ensure the Waldorf Astoria New York will continue to be a marquee hotel for the Waldorf brand long into the future, and will enable Hilton Worldwide and Anbang to build on the hotel's rich legacy and traditions."

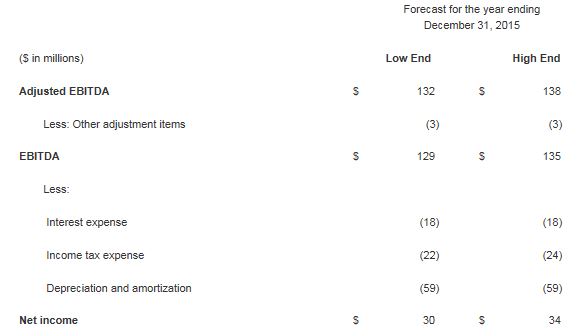

The five U.S. hotels to be acquired with the proceeds from the sale of the Waldorf Astoria New York are expected to be part of a like-kind exchange under Internal Revenue Code Section 1031. The total purchase price of these five hotels of $1.76 billion represents approximately 13x the midpoint of the five properties' combined full-year forecasted 2015 Adjusted EBITDA of between $132 million to $138 million. Hilton Worldwide expects that these hotels will not require meaningful incremental capital expense in the near term, and will expand the footprint of Hilton Worldwide's portfolio of iconic owned hotels in Florida resort markets and San Francisco, a key growth market. Hilton Worldwide expects to close on the purchase of these five hotels in February of 2015, and use the balance of the proceeds of the sale of the Waldorf Astoria New York net of prorations, adjustments and transaction expenses, estimated to be approximately $100 million, to purchase additional assets within the next six months.

Eastdil Secured advised Hilton Worldwide on the sale of the Waldorf Astoria New York and the hotel acquisitions.

Non-GAAP Financial Measures Hilton Worldwide refers to "Adjusted EBITDA," a measure that is calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America ("U.S. GAAP"), in this press release. Hilton believes that Adjusted EBITDA is useful to investors as a key measure of the operating performance of the five new U.S. hotel assets. Adjusted EBITDA for the new hotel assets is defined as earnings before interest expense, taxes and depreciation and amortization, as further adjusted to exclude charges for third party management fees for the Parc 55 hotel that will be eliminated in consolidation upon acquisition of that hotel. Adjusted EBITDA has limitations as an analytical tool and should not be considered either in isolation or as a substitute for measures derived in accordance with U.S. GAAP. Please see the "Reconciliation of Non-GAAP Financial Measure" schedule to this press release for additional information and a reconciliation of Adjusted EBITDA to net income.

Forward-Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to Hilton Worldwide's ability to complete the acquisition of new hotels, expectations regarding the performance of hotels acquired and Hilton Worldwide's overall business, financial results, liquidity and capital resources and other non-historical statements. You can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "projects," "predicts," "forecasts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including risks related to consummating the acquired properties on the anticipated schedule or at all, risks related to integrating the acquired properties in Hilton Worldwide's business and those risks described under the section entitled "Part I -Item 1A. Risk Factors" of Hilton Worldwide's Annual Report on Form 10-K for the fiscal year ended December 31, 2013, filed with the Securities and Exchange Commission ("SEC"), as such factors may be updated from time to time in Hilton Worldwide's periodic filings with the SEC, which are accessible on the SEC's website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in Hilton Worldwide's filings with the SEC. Hilton Worldwide undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

With respect to forecasts regarding the five hotel properties to be acquired, Hilton Worldwide's independent registered public accounting firm has not compiled, examined, or performed any procedures with respect to this information, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with it. Any forecasts of the operating statistics or financial results of the five hotel properties to be acquired included in this press release or in the "Reconciliation of Non-GAAP Financial Measure" schedule to this press release are based on assumptions and are inherently speculative, are subject to substantial uncertainty, and the actual financial results may differ materially from our forecasts. Forecasts rely in large part upon assumptions and analyses developed based on Hilton Worldwide's due diligence review and on experience and perception of historical trends, current conditions and expected future developments, as well as other factors that are considered appropriate under the circumstances including the historical operating results of the five hotel properties to be acquired. Although Hilton Worldwide believes the expectations reflected in such forecasts are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material.

Schedule:

Reconciliation of Non-GAAP Financial Measure

Combined Results of Properties to be Acquired with the Proceeds from the Sale of the Waldorf Astoria New York

Forecasted financial information included in this press release and in the "Reconciliation of Non-GAAP Financial Measure" schedule to this press release presents estimates of the full year 2015 results for the five hotel properties to be acquired with the proceeds from the sale of the Waldorf Astoria New York for purposes of analysis and comparability. Hilton Worldwide's financial results will include the results of operations for the acquisition of the five hotel properties for the period from the date of acquisition, and accordingly full year forecasted information should not be considered to be a presentation of Hilton's expected operating results for 2015 for these five hotel properties. The forecast operating results for the five hotel properties to be acquired (both individually and on a combined basis) are based on Hilton Worldwide's estimates of results of operations for these properties. See "Forward-Looking Statements," above with respect to risks and uncertainties regarding this information.

EBITDA and Adjusted EBITDA Earnings before interest expense, taxes and depreciation and amortization ("EBITDA"), presented herein, is a financial measure not recognized under U.S. GAAP that reflects net income, excluding interest expense, a provision for income taxes and depreciation and amortization. Hilton Worldwide considers EBITDA to be a useful measure of operating performance, due to the significance of its long-lived assets and level of indebtedness.

Adjusted EBITDA, presented herein, is calculated as EBITDA, as previously defined, further adjusted to exclude certain items, including, but not limited to, management fees for the Parc 55 hotel paid to third parties in 2014, which will be prospectively eliminated in consolidation upon acquisition and management of that hotel by Hilton Worldwide.

EBITDA and Adjusted EBITDA are not recognized terms under U.S. GAAP and should not be considered as alternatives to net income or other measures of financial performance or liquidity derived in accordance with U.S. GAAP. In addition, Hilton Worldwide's definitions of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

Hilton Worldwide believes that EBITDA and Adjusted EBITDA provide useful information to investors about Hilton Worldwide and its financial condition and results of operations for the following reasons: (i) EBITDA and Adjusted EBITDA are among the measures used by management to evaluate its operating performance and make day-to-day operating decisions; and (ii) EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in the industry.

EBITDA and Adjusted EBITDA have limitations as an analytical tool and should not be considered either in isolation or as a substitute for net income, cash flow or other methods of analyzing results as reported under U.S. GAAP.