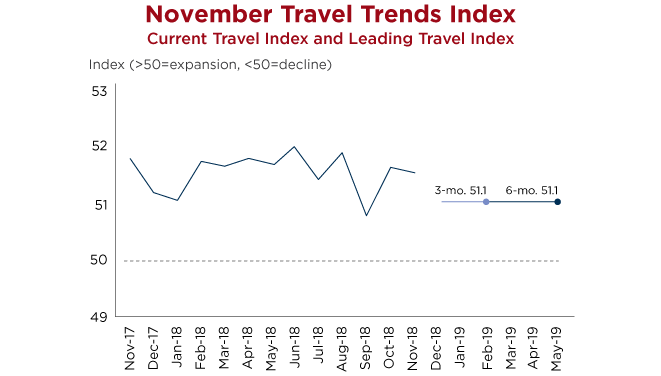

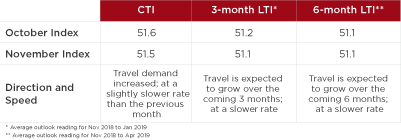

WASHINGTON (January 8, 2019)—Travel to and within the U.S. grew 3.0 percent year-over-year in November, according to the U.S. Travel Association's latest Travel Trends Index (TTI)—marking the industry's 107th straight month of overall expansion.

But the growth of both international and domestic travel are projected to decelerate in the first few months of 2019, owing to a number of worrying trends.

Though international inbound travel grew 3.8 percent year-over-year in November—higher than the sluggish 2.4 percent figure for October—the Leading Travel Index (LTI) projects growth in that segment to slow to around 1.0 percent growth through May 2019.

"A number of factors—notably rising trade tensions, softening global growth and the increase in the value of the dollar against other currencies throughout 2018—have the potential to dampen international inbound travel in the near-term," said U.S. Travel Senior Vice President for Research David Huether.

The decelerated rate of international inbound travel growth will impede U.S. efforts to increase its share of the global international travel market.

Domestic travel grew 3.0 percent year-over-year in November, with both business and leisure travel registering gains thanks to historically high levels of consumer confidence. At the moment, that segment's year-over-year growth is expected to slow to 2.4 percent through May 2019, with the business segment outpacing leisure travel.

However, U.S. Travel economists caution that the road ahead for domestic business travel could become rocky as well, as recent volatility in the markets could dampen what has been a strong investment trend.

The TTI is prepared for U.S. Travel by the research firm Oxford Economics. The TTI is based on public and private sector source data which are subject to revision by the source agency. The TTI draws from: advance search and bookings data from ADARA and nSight; airline bookings data from the Airlines Reporting Corporation (ARC); IATA, OAG and other tabulations of international inbound travel to the U.S.; and hotel room demand data from STR.

Click here to read the full report.