By Brett E. Russell

Owning and operating a hotel always has some degree of risk. However, for hotels located in ski-resort regions, this risk continues to be amplified. Risk factors include continued growth of the online home-sharing industry (Airbnb, VRBO, etc.) introducing new supply from non-hotel assets, as well as the seasonal nature of these mountain communities. Another factor that can greatly affect the performance of a ski resort-dependent hotel is weather. The initial snow totals at the beginning of a ski season (November through January) can have a profound impact on the total season’s bookings at hotels. The 2017/18 ski season in Colorado is a prime example of how a poor snow year can affect hotel performance. While 2017/18 will be remembered as one of the worst on record, the first month of the 2018/19 ski season has offered an encouraging sign that could lead to a potential rebound.

Historical Snowfalls

The hotels supporting the Interstate 70/Front Range ski resorts in Colorado were negatively affected by the limited early-season snowfall during the 2017/18 ski season. Poor snow reports led to many cancelations, as skiers vacated these Colorado resorts in favor of other resorts in the Rocky Mountain region and/or other parts of the United States that were experiencing more consistent, measurable snowfall.

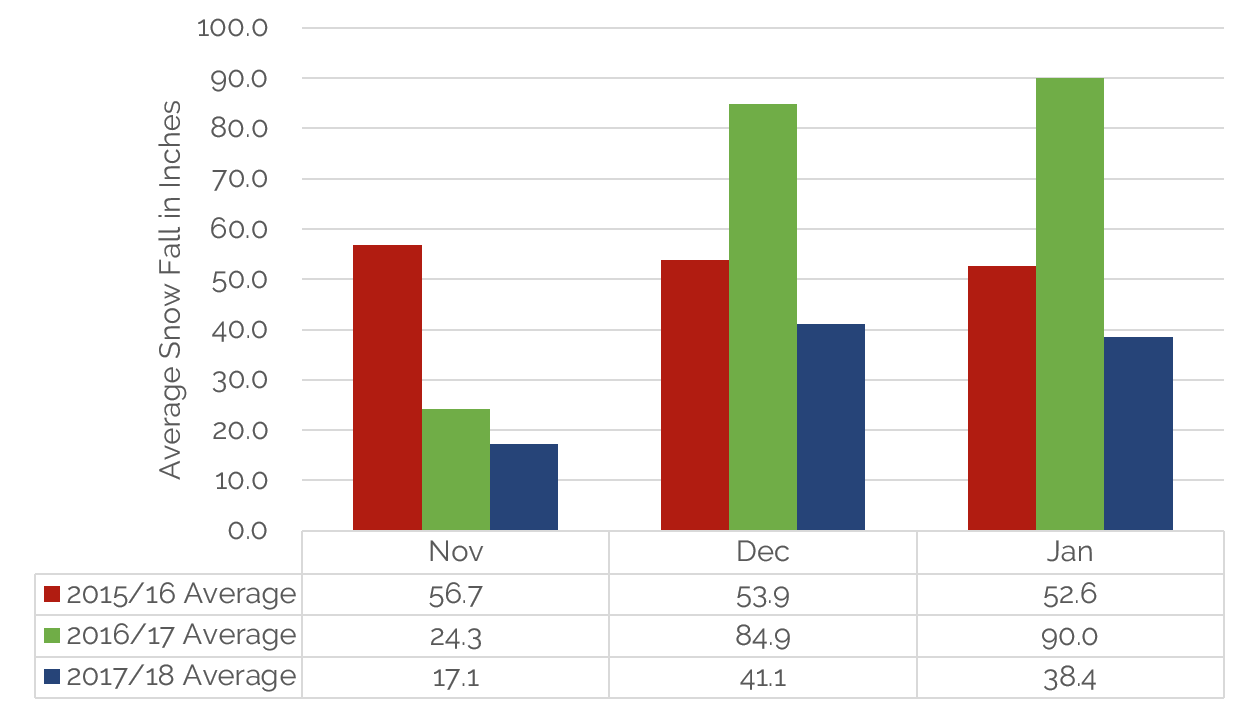

Early-Season Average Snowfall

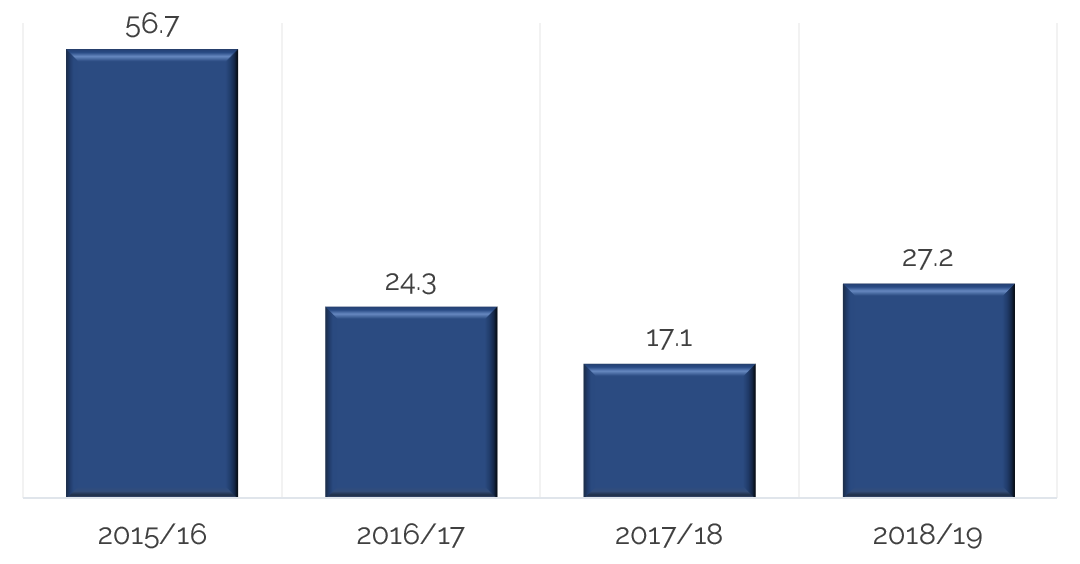

As detailed in the respective chart, early-season snowfall totals for the three-month period from November through January were significantly lower in the 2017/18 early season. It is important to note that the 2015/16 snowfall levels reflect amounts that are more consistent with the 25-year averages. Therefore, the early-season snowfall recorded in 2016/17 is considered above average, while the early-season snowfall recorded in 2017/18 is below average.

Impact on Lodging

Despite strong and similar economic conditions across the three comparative ski seasons, hotel performance suffered in 2017/18, particularly in terms of occupancy given the lower demand levels, further providing support for risks associated in weather-dependent demand markets.

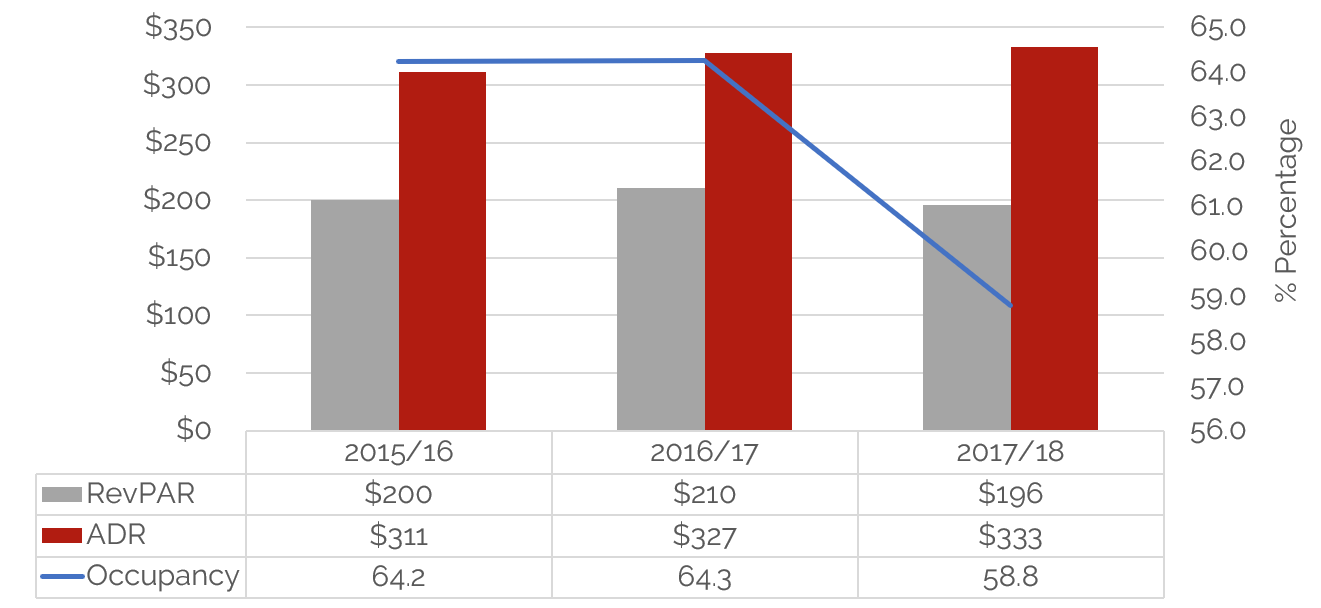

Hotel Market Performance – Ski Season

As detailed above, average rate (ADR) growth occurred year-over-year, largely attributed to the strong underlying economic conditions; however, the rate of ADR growth declined because of the poor snow year. Given the lower occupancy, RevPAR in the 2017/18 ski season was $4 and $14 below the levels achieved the last two ski seasons prior, respectively.

HVS interviewed several hotels in 2017/18 as part of typical due diligence on projects in the area. The various sales and marketing teams at the resort hotels spoke about low levels of bookings and the high rate of cancelations due to poor snow totals in November and December of 2017. Given similar economic conditions and lack of other additional issues that may have influenced demand, the declines registered in the 2017/18 ski season are directly related to poor snow conditions in the area.

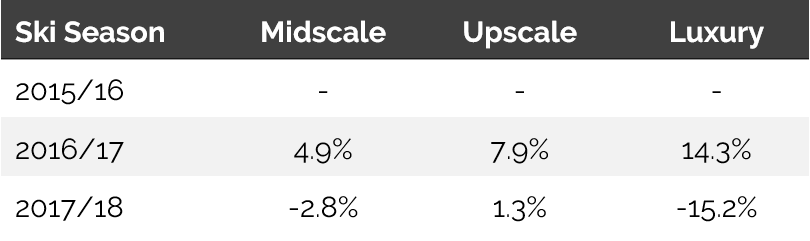

Furthermore, the overall impact increases as one moves higher up the chain scale, with the luxury hotels affected more significantly than other hotels of a lower classification.

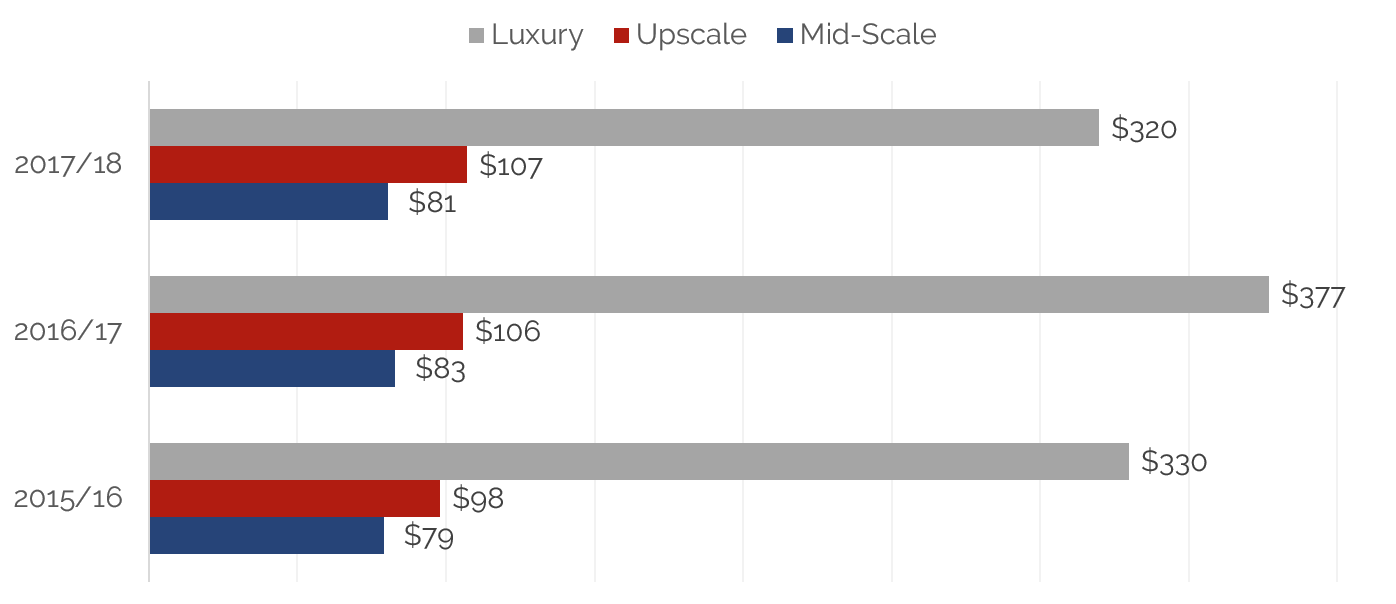

RevPAR Performance by Chain Scale

The luxury segment of hotels was most directly affected by the poor snow conditions in the 2017/18 ski reason; as illustrated by the preceding graph, RevPAR dropped considerably for the luxury segment. Hotels belonging to the midscale and upscale segments realized little change, indicating that visitors to the market were still in need of accommodation, but many were unwilling to pay top dollar for a sub-average experience.

Annual Change in RevPAR by Chain Scale

Fortunately for ski-resort hotels, the underlying economic conditions in the United States remain strong, and thus discretionary spending is still plentiful for a large percentage of the population that may be looking to spend a week or so vacationing in one of the numerous Colorado ski-resort communities. Of course, as evident from the review of historical trends, the quality of snowfall can have a significant impact on a hotel’s overall performance. Both the 2016/17 and 2017/18 ski seasons started out slow in November; however, in 2016/17, the below-average snowfall in November was quickly erased by above-average snowfall in December and January, leading to the strong overall hotel performances for that season. In 2017/18, the poor snowfall conditions from November through January resulted in lower bookings and rate discounts for the peak holiday period, including the week between Christmas and New Year’s Day, as well as holiday weekends in January and February. This year, the early snowfall amount in November 2018 shows promise.

November Snowfall Averages

The snow total recorded in November of the 2018/19 ski season is comparable to being on the first chair of the day after a foot of fresh powder has fallen. The November 2018 snowfall total for the Interstate 70/Front Range-area resorts reflects a 59% increase over the snowfall recorded in November 2017, and a 12% increase over the snowfall recorded in November 2016—an encouraging sign for hotels in the region. Our conversations with the various resort sales and marketing teams indicate that the booking pace is strong, particularly for the important upcoming holiday periods. If the early-season snowfall trend continues through December and January, then hotels serving the Colorado ski resorts are likely to experience a fruitful season—one that’s worth remembering—after the one that many want to forget.