By Chris Mumford, Thomas Mielke, and Dominic Maurer

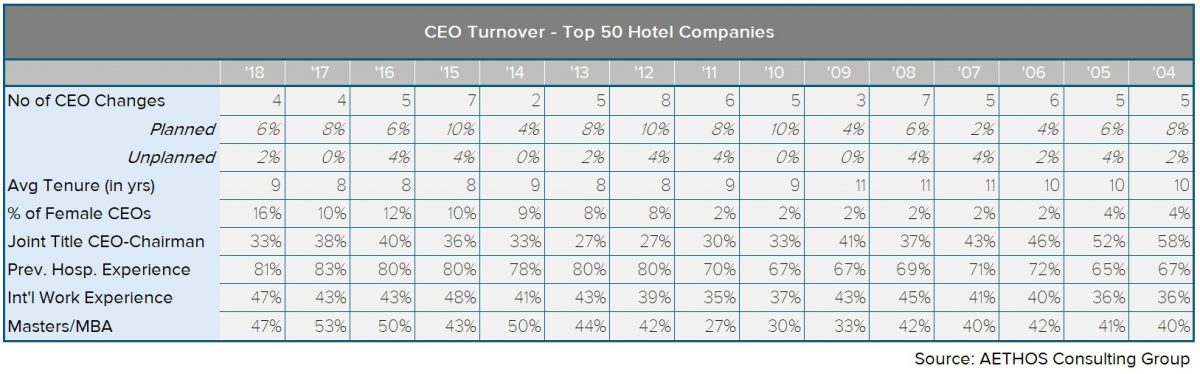

Turnover of Chief Executives at the world’s 50 largest hotel groups (as per HOTELS 325 2018 Listing) remained flat for 2018, with new faces appearing at the head of four companies, the same number as for the prior year. Changes in CEO positions were seen at G6 Hospitality, Extended Stay, Millennium & Copthorne and B&B Hotels. Of these, three were planned moves. Jennifer Fox’s three-month stint at Millennium & Copthorne, though, can only be assumed to have been anything but planned. A sector turnover rate of 8% is well under the average for the general industry and speaks to a current period of leadership stability that has run since we last saw a spike of 14% in 2015.

This sense of stability is enhanced further when we carve out the majors, the ten largest global hotel brands. Among this group there was not one change in the CEO role in 2018, and the two in the previous year had been very smooth, well-planned, succession events at Choice (Pat Pacious) and InterContinental Hotels Group (Keith Barr). Having tracked CEO turnover for the hotel industry since 2004, we have discerned a correlation between market conditions and the profile of required leadership. The days of the Global Financial Crisis witnessed a surge in new CEO appointments as boards sought the requisite executive direction to steer them out of economic difficulties – seven changes in 2018. Once out of recovery mode, stabilised and firmly into expansion mode, another spike in turnover was seen five to six years later when firms went after leaders who could deliver aggressive growth – eight changes in 2012.

As David Mansbach, Managing Director at AETHOS Consulting Group, recently highlighted in his article on the lack of diversity at US restaurant groups (click here), so too is the hotel sector under-delivering in its representation of women in CEO roles. We are pleased to see a gradual climb in the number of female CEOs, having risen from 2% in 2011 to 16% in 2018, with the addition of Sabina Fluxa at Iberostar and Avia Mizrachi-Magen at Fattal. The pace of change however is glacial and, more disturbing, when we look at our Top 10 group, there is not one woman on the list. This issue seems especially pertinent in North America, where none of the largest hotel groups has a woman in the driver's seat.

The time to be a CEO is clearly in one's 50s. Most assume office at the beginning of their sixth decade and leave shortly before hitting 60. The youngest CEOs are to be found in Asia and at private companies as opposed to publicly listed firms in which a few extra years of experience appear to be valued. When it comes to experience, boards of directors have shown a stronger preference for in-depth knowledge of and track record in the hospitality sector. The number of CEOs from the hotel space has gone up, particularly during the past few years of dynamic sector growth.

If we focus on the Top 10 largest multinationals, we see that industry expertise has become much more highly valued over the past 15 years, with every CEO in this group having cut their teeth in the hospitality sector prior to taking the top job. The days of opting for a CEO hire from alternate sectors, such as FMCG, appear to be a thing of the past. Similarly, as global expansion has been at the forefront, the individuals holding these leadership positions have become increasingly better travelled than their predecessors.

The percentage of CEOs with prior experience working in a foreign country rocketed from 20% to 60% over the 2004 to 2018 period. A positive trend has hotel ceo studybeen the increased separation of CEO and Chair titles. When we began surveying, half of the CEOs were also Chairs of the board of directors. The pressure for better, more transparent, corporate governance has – we are pleased to say – resulted in clearer distinctions between the role of the Chairperson and CEO and their related accountabilities. The average tenure of CEOs at these Top 10 firms is heading back to tracking with the industry average of nine years. This had slipped in 2012 to an average tenure of three years, but the past few years of stability have seen this climb to six.

According to industry talk, we may be at or near the peak of the cycle. If that is true, we should not be surprised to see turnover potentially picking back up in 2020/2021. As we have seen, economic adversity typically triggers a higher degree of scrutiny placed on those running businesses by their shareholders and owners, which often results in a new nameplate being fixed to the door of the CEO office.