By Simon Hulten and Sophie Perret

During the last 12 months, the serviced apartment sector in Europe continued to see strong momentum in both demand and supply. This year’s report looks at the recent trends, discusses our analysis of the 2019 lenders survey results and recent transaction evidence and provides an outlook in terms of pipeline.

Year in Review

From our survey we can identify that serviced apartments account for roughly 10% of the total hotel loan portfolio in Western Europe. The lending criteria remain broadly similar to hotels, although lending parameters are somewhat different for serviced apartments outside of gateway cities. We would like to thank all of the survey participants for their generous input into the study. Your opinions and experiences are crucial in facilitating understanding of this thriving sector. We urge more operators, investors and lenders in the sector to recognise the value of sharing data to enable serviced apartments to continue to gain more attention from potential investors.

We would like to thank all of the survey participants for their generous input into the study. Your opinions and experiences are crucial in facilitating understanding of this thriving sector. We urge more operators, investors and lenders in the sector to recognise the value of sharing data to enable serviced apartments to continue to gain more attention from potential investors

Industry Highlights and Announcements

Quest Apartment Hotels will open its first European property in Liverpool in September this year and it will be operated under a franchise agreement with Cycas Hospitality. The aim is to open eight to 12 properties across the UK by 2023, adding to Quest’s existing portfolio of over 170 properties throughout Australasia.

In France, Staycity is set to open its first resort-style property in Marne-la-Vallée, close to Disneyland Paris, in August 2019. The property will feature 284 apartments, 22 holiday villas, an outdoor swimming pool, a café and a restaurant. Also this year, Staycity will open properties in Edinburgh, Manchester and Berlin, as well as making its entry into Italy in Mestre (Venice), contributing to the group’s target of having 15,000 apartments by the end of 2023 (currently around 2,000 units).

OYO Hotels & Homes, India’s largest hospitality group and one of the fastest growing hotel companies in the world, has rapidly expanded in the UK since its debut in October 2018, spanning over 1,400 rooms to date. In 2017, OYO launched OYO Homes, a marketplace for short-term managed apartment rentals similar to Airbnb, which has more than 15,000 apartment and villa units globally. OYO is arguably tapping into a niche area, sandwiched between co-living and serviced apartments, and should be considered as a serious contender within both sub-sectors. In May 2019, OYO announced the acquisition of the Amsterdam-based holiday rental company @Leisure Group from German media group Axel Springer for an estimated €369 million. This deal included 30,000 holiday homes in 13 European countries, as well as its online operating platform with more than 85,000 units.

On a similar note, Marriott is also tapping into the home-sharing market with the launch of the Homes & Villas by Marriott rental platform in over 100 destinations across Europe, the USA and the Caribbean in May 2019. The product will be positioned in the upscale and luxury segment where Marriott’s platform will be launched in partnership with selected property management firms in return for access to Marriott’s robust distribution and sales system. This launch follows AccorHotels’ acquisition of Onefinestay in 2016 and Hyatt’s temporary collaboration with Oasis (which ended in October 2018 following the acquisition of Oasis by Vacasa), adding new ‘layers’ to its core competencies.

Bridgestreet announced that it secured the operations of the newest apart-hotel: the ‘removable’ Stow-Away Waterloo. The 20-room property is built using repurposed shipping containers, offering space of around 18 m², which allows the entire hotel to be relocated if needs be. This project is arguably one of the most environmentally conscious, innovative and affordable hospitality projects in London and is planned to be applied on a larger scale in Manchester (172 units) and Birmingham (75 units) over the next three years.

Cuckooz entered a partnership with sleep specialist Simba and experience and atmosphere curators Studio Stilton to develop ‘sleep-centric’ rooms in London. The rooms are designed to encourage REM-rich[1] sleep – stimulating brain activity, promoting learning and creating dreams. The bedrooms mimic the safety and security of a womb and feature facilities such as muted lighting, blackout blinds, sound absorbing curtains and restorative scents.

Adagio has announced major expansion plans, aiming to double its global portfolio by 2023 to 220 apart-hotels. In 2018, Adagio opened its first London property in Brentford, followed by properties in Bremen, Casablanca, Jeddah and Amsterdam. In Europe, the company aims to have 170 properties, with new signings regardless of the operating structure, by 2023. Adagio’s new concept ‘The Circle’, a programme intended to create a more modern and dynamic identity, such as redesigned public spaces, shared kitchens and co-working spaces has been rolled out in over 20 apart-hotels so far.

New Brands and Concepts

IHG has announced its third extended stay brand – Atwell Suites. It will be a new-build brand aimed at a pricing point below Staybridge Suites and tailored towards stays of four to six nights. The properties are planned to be ‘all-studio’ suites with kitchenettes, while the public areas will include limited food and beverage offerings, flexible meeting space and ‘huddle areas’, as well as private and public working spaces. The brand will initially be established in the USA with the first hotels expected to open in 2021. The target build cost is between US$105,000 and US$115,000 per key.

Ascott has launched Citadines Connect, a select-service apartment hotel brand designed for business travellers. The hotels will consist of mainly studios, ranging from 18 m² to 21 m². The debuting properties are located in Sydney and New York, while the first European properties to be part of the brand will be announced at a later stage. Furthermore, in 2018, Ascott acquired a 70% stake in Tauzia Hotel Management, one of Indonesia’s top five hotel operators, for approximately US$26 million. This deal includes approximately 20,000 units across Indonesia, Malaysia and Vietnam, with half currently under development, putting Ascott’s total portfolio at more than 90,000 units globally.

ONYX Hospitality Group has launched Shama Hub, its new serviced apartments and co-living concept, developed to meet the demand for short to medium term living solutions in space-efficient venues. The pipeline will initially be focused on the Asia-Pacific region, with the first signed deals in Haikou and Changchun in China.

Survey Results

The availability and cost of debt have a direct impact on values. Consequently, financing parameters play a significant role in the feasibility of new developments and the transactions of existing properties. Given the importance of debt parameters for hotel and serviced apartment investments and developments, we surveyed leading Western European banks that are active both nationally and internationally. This short survey consisted of three topics: (1) availability of debt, (2) lending parameters and (3) lending criteria. We highlight the main findings in the following paragraphs.

Senior debt is available

A vast majority of the lenders currently active in the hotel sector have reported that debt for serviced apartments is available, although primarily in gateway cities in Western Europe. While debt is available for existing serviced apartments, the market for development financing is smaller; just over half of the participants in our survey are willing to issue loans to such projects. This attitude mirrors banks’ perception of the broader hotel market with more cautious lending for new developments and some concerns of possible oversupply, particularly in some parts of Western Europe.

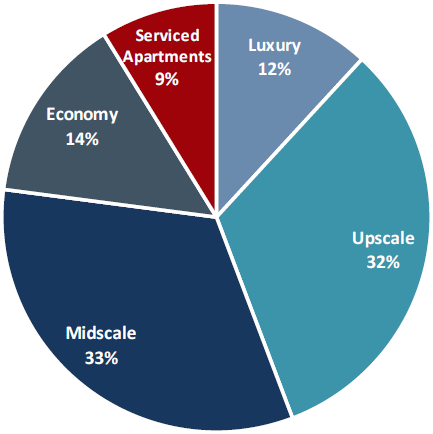

Serviced apartments account for 9% of the total hotel loan portfolio in Western Europe. With data extracted from our 2018 European Hotel Lending Survey, an indicative breakdown of loans given by chain-scale has been estimated. Interestingly, the allocation to serviced apartments is only marginally smaller compared to luxury and economy hotels.

CHART 1: PROPORTION OF LOANS GIVEN BY CHAIN-SCALE SEGMENT IN WESTERN EUROPE

Source: HVS Research

Lending Parameters

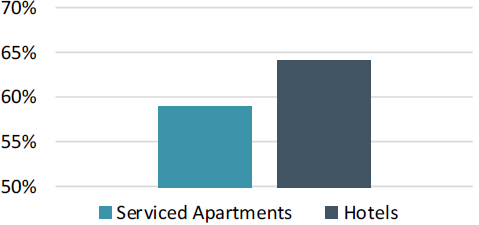

Owing to strong performance in the serviced apartment sector over the last couple of years, the respondents indicated a loan to value (LTV) ratio ranging from 50% to 65% for serviced apartments in primary cities, an average of 60%. The difference compared to traditional hotels, shown in Chart 2, reflects the perception of risk around serviced apartments to be somewhat higher and thus more conservative maximum LTVs are applied. The transparency of information in the sector has significantly improved over the last few years, although it is still a concern, especially access to key performance indicators.

CHART 2: LTV RATIOS – WESTERN EUROPE

Source: HVS Research

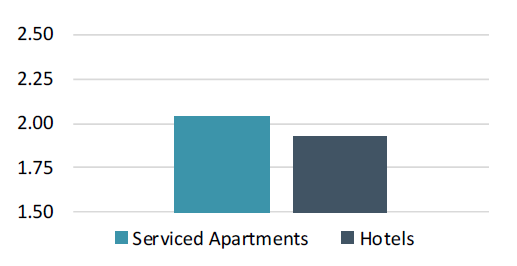

The average debt service coverage (DSC) ratio is 2.0 for serviced apartments in Western Europe, compared to 1.9 for hotels. However, these ratios are highly dependent on the covenant strength of the developer, operator, brand or investor.

CHART 3: DSC RATIOS – WESTERN EUROPE

Source: HVS Research

While these figures might seem relatively high, it is important to keep in mind that banks are operating in a very low interest rate environment. These low financing costs, along with compressed margins and long amortisation periods, all act as factors that increase DSC ratios.

Branding remains key

Lending criteria for serviced apartments remain broadly similar to those of traditional hotels where branding and location remain two of the key lending requirements. Lenders consider brands to provide an extra layer of security by delivering consistent and efficient service levels as well as providing access to their distribution systems, an invaluable benefit that large established hotel groups have over smaller ones.

Performance Update

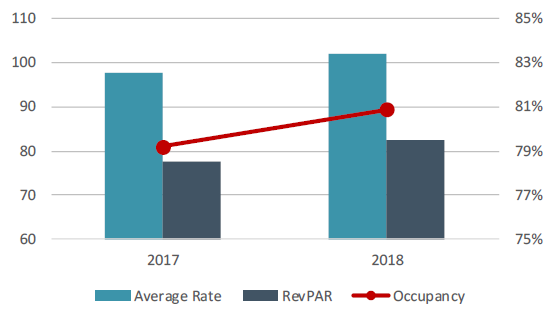

The following chart presents an overview of the recent occupancy and average rate performance in Europe, as provided by the main operators in the market.

CHART 4: EUROPE PERFORMANCE DATA (€)

Source: HVS Research

Both occupancy and average rate recorded year-on-year growth in 2018, resulting in a RevPAR increase of broadly 7.0%, indicating that the sector is still growing at a quicker pace than the traditional hotel industry at 5.0%.

We make the following comments on market-specific performance.

- The London serviced apartment market saw a steady year-on-year increase in both occupancy and average rate in 2018, resulting in a RevPAR growth of around 4.0%, (compared to the performance of the hotel market at 3.0%);

- The regional UK markets experienced a slight increase in occupancy at a rate growth above inflation, resulting in a RevPAR growth in 2018 of 3.5% (compared to the performance of the hotel market at 1.5%);

- The rest of the European markets (excluding the UK) recorded faster growth in both occupancy and average rate, resulting in significant RevPAR growth of 7.0% in 2018.

European Pipeline

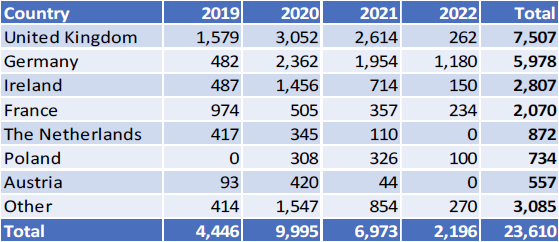

Some 23,600 serviced apartment units form the European pipeline for the coming four years (projects that have been publicly announced). 4,450 units of the pipeline should be complete before the end of 2019, followed by a larger number of openings in 2020 (10,000), 7,000 in 2021 and 2,200 in 2022. The sizes of the planned projects vary from 15 to 457 units, with an average of 137 units.

CHART 5: NEW SUPPLY (UNITS) BY COUNTRY

Source: HVS Research

Similar to previous years, the UK and Germany represent the vast majority of the total pipeline (32% and 25%, respectively). Unsurprisingly, London’s pipeline represents 39% of the total UK pipeline, followed by Manchester with around 16% of the pipeline and Edinburgh and Cambridge with approximately 10% of the UK pipeline, respectively. This mirrors the overall hotel pipeline trends.

Germany’s development distribution is well diversified across cities such as Frankfurt (20%), Berlin (15%), Hamburg (11%), Düsseldorf (10%) and Munich (9%). The serviced apartment market in Germany is experiencing a changing environment with increasing support from international brands marking their entry and expansion into the German market.

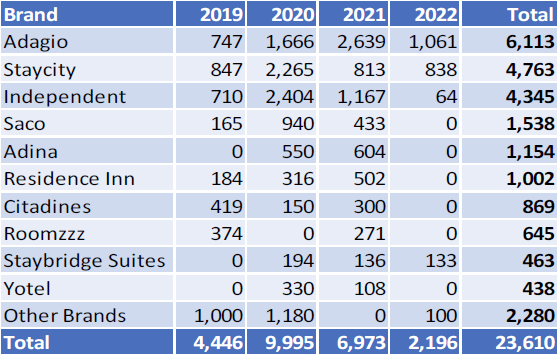

CHART 6: NEW SUPPLY (UNITS) BY BRAND

Source: HVS Research

Adagio has the largest pipeline with more than 50 hotel projects (just over 6,100 units) across Europe. Notably, the brand is expanding its horizons outside of Europe (not accounted for in our analysis) with destinations such as the UAE, Saudi Arabia and Morocco. Staycity’s pipeline is just under 4,800 units in Europe, primarily in the UK and Ireland, but also in Germany, France and Italy. Notably, the brand is expanding its horizons outside of Europe (not accounted for in our analysis) with destinations such as the UAE, Saudi Arabia and Morocco. This is followed by Saco (1,500), Adina (1,150), Residence Inn (1,000) and Citadines (900). Interestingly, independent developments are gaining strong development momentum with more than 4,300 units in the pipeline, unsurprisingly primarily in gateway cities in the UK and Germany. Although branding is becoming more important for lending purposes, it is less so in key destinations with established, somewhat self-sustainable demand generators.

A more detailed and extensive list of recently opened properties and planned new supply can be found in Charts 8 to 11 at the end of this report.

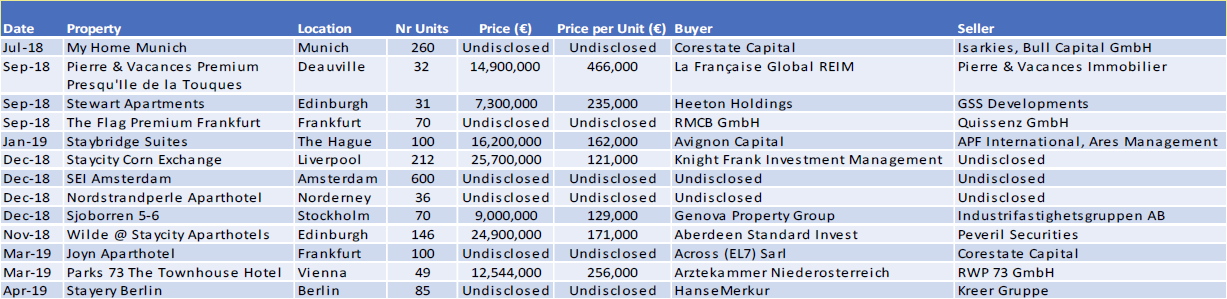

Transactions Activity

The investment landscape is represented by developers, operators and institutional investors. As the serviced apartment industry continues to mature, transaction volumes accounted for roughly 10% of all hotel transactions in Europe in 2018, although this figure was somewhat skewed by the sale of the Saco portfolio to Brookfield for approximately £430 million in February.

Recent single asset transactions are shown in Chart 7. In terms of portfolio deals, M&G Investments, a London-based investment manager, purchased the long leasehold interest of a development site in Paddington for a reported £203 million. The two hotels planned to be built will be operated under lease agreements with Premier Inn-owner Whitbread and Staycity for 30 years. The Premier Inn will have 373 rooms while the Staycity property will offer an aparthotel of 247 studios and one-bedroom units under its premium brand Wilde Aparthotels by Staycity. The hotels are set to open by 2021.

Furthermore, Union Investment purchased a portfolio of four hotel development projects from Benchmark Real Estate Development for an undisclosed sum via a forward purchase agreement in October 2018. The 675-room portfolio includes two proposed Super 8-branded hotels and two planned long-stay formats by Hyatt House and Adagio Access, all of which will be operated under long-term leases.

CHART 7: RECENT SINGLE-ASSET TRANSACTIONS ACROSS EUROPE (€)

Source: HVS Research

Conclusion

Demand for serviced apartment accommodation remains vigorous across Western Europe. European RevPAR performance in 2018 indicates that the sector is still growing at a quicker pace than the traditional hotel industry. Meanwhile, the industry continues to innovate with exciting new brands being introduced or traditional brands reinvented. Alternative concepts – co-living, co-working, student-accommodation, home-sharing, and so forth – are merging with the serviced apartment concept, creating hybrids as a response to changing demand behaviours. The pipeline in the sector remains robust, with many large operators set to double their portfolios within three years. Our survey results confirm that the sector is becoming more mainstream. Debt is available for all project types, although primarily in Western Europe so far, leading to the increased popularity of serviced apartments as an alternative real estate investment.

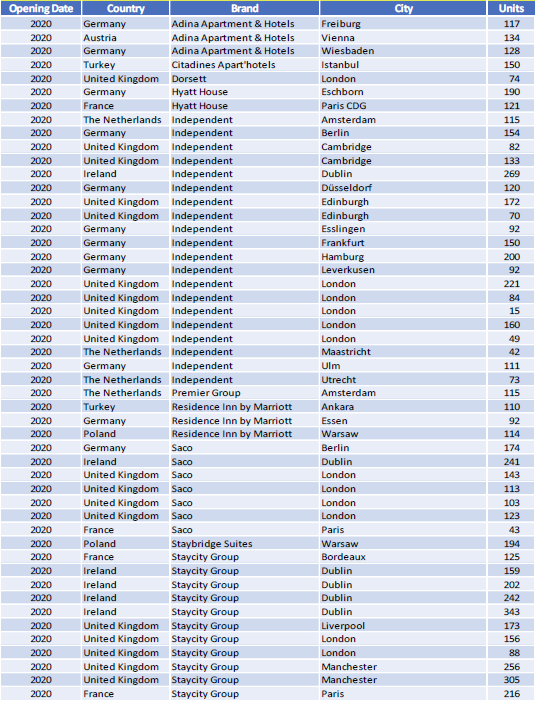

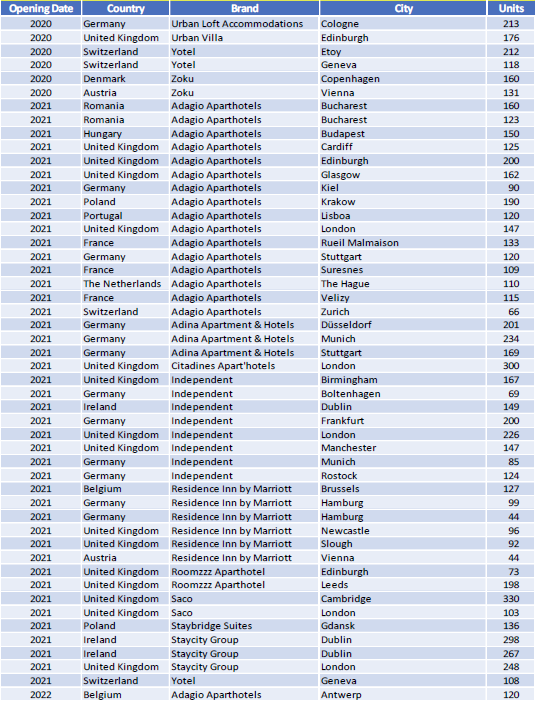

CHART 8: NEW SUPPLY PIPELINE ACROSS EUROPE – 2019-23 OPENINGS

Please note that these lists are not exhaustive

Sources: HVS Research; Tophotelprojects

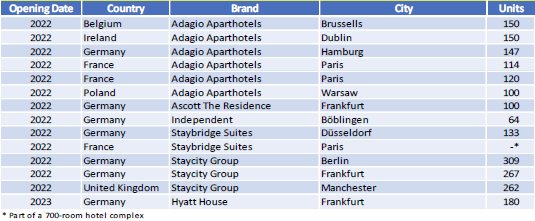

CHART 9: NEW SUPPLY PIPELINE ACROSS EUROPE – 2019-23 OPENINGS (continued)

Please note that these lists are not exhaustive

Sources: HVS Research; Tophotelprojects

CHART 10: NEW SUPPLY PIPELINE ACROSS EUROPE – 2019-23 OPENINGS (continued)

Please note that these lists are not exhaustive

Sources: HVS Research; Tophotelprojects

CHART 11: NEW SUPPLY PIPELINE ACROSS EUROPE – 2019-23 OPENINGS (continued)

Please note that these lists are not exhaustive

Sources: HVS Research; Tophotelprojects