By Manos Tavladorakis, Pavlos Papadimitriou

Introduction

The Sporades are an island complex along the east coast of Central Greece, northeast of the island of Euboea, in the Aegean Sea. They consist of 24 islands, four of which are permanently inhabited, namely Alonnisos, Skiathos, Skopelos and Skyros. Skiathos is the westernmost island in the Sporades group, east of the Pelion peninsula in Magnesia on the mainland, and west of the island of Skopelos.

Source: Greecetravel.com

Island of Skiathos

The island has an area of 49,90 km² and a permanent population of 6.088 (2011) inhabitants, with the majority living in Skiathos town. Despite its small size, Skiathos with its many beaches and wooded landscape is a popular tourist destination for domestic as well as international travelers. It is considered to be the most cosmopolitan member of the Sporades and one of the busiest Greek islands.

The climate of the island is Mediterranean with mild winters and warm but comfortable summers. Its economy has developed around tourism, as evidenced by the numerous hotels, bars, and clubs that operate on the island. The destination experiences an intense seasonality pattern, even steeper than other Greek islands; the tourism season is limited to 5.5 months period (from early May to late September) with peak visitation occurring in August; however, various efforts have been made towards the extension of the seasonality of the island’s visitation. The recent concession of the airport, which will be further analyzed below, is a key factor that could play a major role in extending the operating season of the hotels and other tourism businesses on Skiathos up to six or seven months in the longer term. Up until 2008, when ‘Mamma Mia’ was shot and made Sporades famous around the globe, Skiathos was considered as a relaxing and quiet island. Since then, its tourist brand became widespread, especially in the United Kingdom, and international tourist arrivals became to rise with an exponential growth rate. At the same period, the island became increasingly appealing to youngsters due its vivid nightlife that was a common secret among domestic travelers until then. However, despite its appeal, hotel investments passed through a period of stagnation whereas up until now there is lack of internationally branded hotels.

Skiathos Town

Source: Skyframe.gr

Major Tourism Attractions

Skiathos is the birthplace for a plehora of remarkable people. The most noteworthy one is Alexandros Papadiamantis, one the greatest modern Greek novelists. In 1954, his house, where he was born, lived and died, bought by the State and was characterized as a preserved monument; years after it was transformed into a museum. Additionally, the old Venetian fort located in the Skiathos’ port operates as a nautical museum, honoring the long tradition of Skiathos’ nautical history. Moreover, Skiathos island is the home of the only pine forest habitat on an island in the Mediterranean Sea. The forest is located in the area of Koukounaries and it is protected by Natura 2000 while it is surrounded by turquoise waters creating a breathtaking landscape. It is remarkable that the 2/3 of the island is covered by pine tree forest, shaping a landscape of unparalleled natural beauty. The island features over 60 mostly sandy, beaches scattered around its 44 kilometers of coastline. Some of the most renowned ones are Troulos, Vromolimnos, Asselinos, Megali Ammos, Lalaria, Mandraki as well as Koukounaries and Maratha that are the only ones awarded with a Blue Flag.

Accessibility

By Air

Skiathos International Airport, ‘Alexandros Papadiamantis’, is located in the outskirts of the town, two kilometers northeast from Skiahtos town. It is the main entrance point for the international tourism arrivals offering charters flights, through numerous international airlines, from a wide range of airports from all major European countries, such as UK, France, Austria, Germany, Italy, the Netherlands and so forth. Olympic Airlines, Aegean Airlines and Sky Express are the only ones servicing the island on a year-round basis, connecting the island with Athens International Airport. However, the flight frequency between Skiathos and Athens, the largest airport hub in Greece, is considered as relatively low. Hence, the island has space for improvement with regards to domestic connectivity.

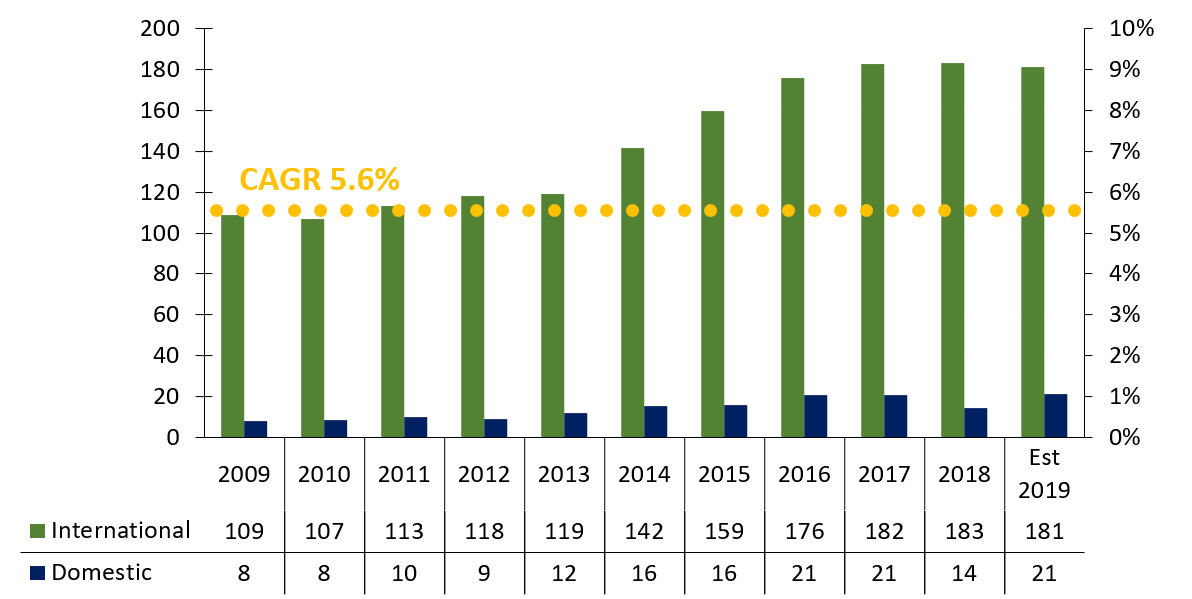

Figure 1: Domestic and International Arrivals 2009-19 (000s)

Source: Hellenic Civil Aviation Authority

In December 2015, the privatization of operations of the Skiathos International Airport and 13 other regional Greek airports was finalized with the signing of the agreement between the Fraport AG/Copelouzos Group joint venture and the state privatization fund. Immediate actions have already been taken after Fraport Greece took over operations, including reorganizing the airport apron area and increasing the number of check-in counters, departure gates, security-check lanes. According to press releases, a further expansion and remodeling of the terminal is planned, leading to improved international tourism arrivals and the stretching of the touristic period. Fraport has projected a Compound Annual Growth Rate (CAGR) of 0.89% aiming at 0.39 million arrivals in 2055.

Total airport arrivals in Skiathos grew at a CAGR of 5.6% during the past ten years, primarily attributed to the high increase in foreign passenger arrivals. International tourists dominate the market as they contributed, constantly, over 90% of the total airport arrivals. It is remarkable that despite the economic crisis the country went through and a plethora of destinations experienced a significant decrease, Skiathos maintained its positioning overtime and keep increasing, reaching a peak in 2017, when total arrivals exceeded for the first time the level of 200,000 passengers. More significantly, during 2014-16, the airport achieved double-digit annual increase.

By Sea

Skiathos island is connected by boat with the mainland Greece through Volos, Aghios Konstantinos and Mantoudi seaports. The port is located on the east side of the peninsula occupied by the town of Skiathos. Additionally, there are scheduled ferry connections with the other islands comprising the Sporades complex.

Figure 2: Total and Cruise Passengers Arrivals at Skiathos Seaport 2013-18

Source: Hellenic Statistical Authority, Hellenic Ports Association

Total arrivals by sea in Skiathos port grew at a moderate CAGR of 2.2% during the past six years primary driven by the scheduled ferries passengers. Although the cruise passengers have more than doubled since 2013, they remain relatively low representing less than 5% of the total seaport arrivals over the examined period. The low level of cruise passengers could be attributed to the location of Skiathos, which is not in proximity with other already established Greek cruise destinations. In contrast, the vast majority of domestic travelers prefer the scheduled ferry, due to its frequency compared with the airplane.

Demand for Transient Accommodation

Basic Visitation Factors

Visitation at hotels in Skiathos has been mainly of international nature; foreign visitation accounted for 90% in 2018, a number which was constantly growing over the past decade (international bednights represented less than 60% in 2010). Skiathos has always been, but even more during the past few years, a popular tourism destination in Greece for European and other travelers, owing to its cosmopolitan character, pristine beaches and intense nightlife.

In general, the international segment has demonstrated increased resilience over the last ten years, as the bednights kept rising at a CAGR of 4.6%, despite the global economic uncertainty prevailing in 2008-10 together with the negative publicity Greece received over the 2010-12 period. The exceptional performance of the 2017-18 period, during which the international bednights rose by 16% in comparison to 2016, outpaced the significant shrinkage of the domestic segment recorded during the same period of time. The decrease in local business activity and the consequent reduction in the disposable income by Greek citizens resulted in a cumulative plummet of 61.6% since 2010.

Figure 3: Accommodated Bednights in Skiathos 2010-18 (000s)

Source: Hellenic Statistical Authority

The 2019 tourism season involved a moderate improvement in the international arrivals, following the trend recorded during the past five years. On 23 September 2019, the tourism industry of Skiathos was severely affected by the collapse of Thomas Cook, the oldest tour operator in the world. Thomas Cook accounted for an estimated three million tourist arrivals in Greece on annual basis. According to the president of Skiathos Hoteliers Association, Thomas Cook was related in one or another way with approximately 40% of the international tourists arriving in the island. Major other tour operators, which are the key players in Skiathos’ tourism market, are acting towards recovering the gap left behind by the collapse of Thomas Cook. However, it is considered as an extremely challenging task and there are numerous difficulties that need to be overcome. Hence, it is essential, not only for Skiathos, but for the entire country as well, to restructure its marketing strategy and destination management policy in an effort to counter the enormous impact of the collapse of Thomas Cook on the hospitality sector and maintain the strong correlation between Greece’s tourism industry and its national economy.

Seasonality

As in the majority of leisure tourism destinations in Greece, the highest arrival figures in Skiathos occur during summer months, peaking in August, with the airport recording almost 75% of the total annual arrivals and hotels reaching or sometimes exceeding 95% of occupancy.

The tourism industry on the island is purely seasonal, with the majority of hotels operating for slightly less than six months from mid-May to late September. In more details, the seasonality follows a typical trend for summer resort destinations where the distinct bell-shaped curve peaks in mid-July/August, the traditionally busiest summer vacation period in Greece. Various efforts have been made towards the extension of the seasonality of the destination’s visitation. However, long time is required, as it is a slow process and smalls steps are made year-by-year.

Figure 4: Seasonality 2018 (Airport Arrivals)

Source: Hellenic Civil Aviation Authority

Source Markets

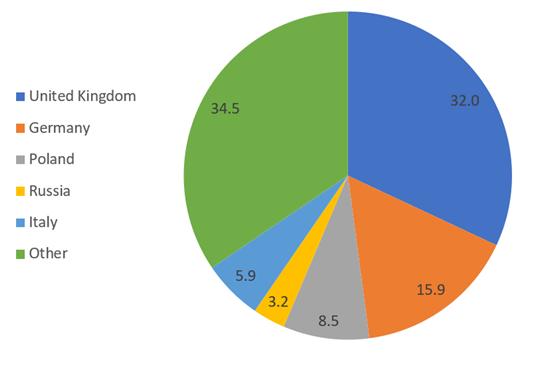

Based on the recorded airport passenger movements, United Kingdom and Italy have the lion’s share, as the dominant visitation markets. Furthermore, paramount importance for the island’s tourism industry is the Scandinavian market, which includes sophisticated, high spending travelers.

Figure 5: Top 5 International Feeder Markets in 2018

Source: Fraport

Hotel Supply

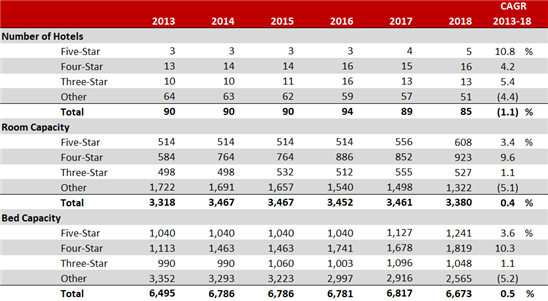

Most hotels are classified as one- and two-star, while the absence of five-star units is quite evident, representing only 5.8% of the total hotel supply in 2018. Nevertheless, five- and four-star hotel units together represent almost half of the island’s room and bed supply accounting for 45.3% and 44.8%, respectively.

Furthermore, the five- and four- star properties experience a constant growth over the last six years. On the other hand, during the same period the one- and two- star properties have decreased by 19%. As a result, the total number of hotels on the island have decreased by an average annual rate of 1.1%, despite the aforementioned improvement in bednights overtime. In 2018, the average five-star hotel in Skiathos featured 121 rooms and 248 beds, figures which are significantly lower than the average of 2013. Overall, the average capacity of a property is 40 rooms and 78 beds, which is that low due to the predominance of small-family enterprises.

Figure 6: Hotel Supply in Skiathos Island 2013-18

Source: Hellenic Chambers of Hotels

Recent and Forthcoming Tourism Developments

The most notable recent tourism developments in the island of Skiathos are the following:

· The concession of the former Xenia Skiathos hotel, was sold for €2.6 million from Hellenic Republic Asset Development Fund (HRADF) to a Greek construction company for 99 years, in 2013. The new five-star property complex consists of three separate hotel concepts, namely Xenia, Grace, and Nest, all branded under Elivi Hotels. Following significant restoration of the Xenia building and the construction of the Grace and Nest, the entire complex was launched in the market in 2018 tourism season with 108 rooms, suites and bungalows, in addition to several food and beverage outlets, a spa and four privately accessed beaches. Additional development plans have already been materialized with the expansion of Elivi Grace and Nest in 2019 whereas further expansion of the property is anticipated within the period 2020-22;

Aerial Photo of Elivi Hotel

Source: Elivihotels.com

· In 2018, the management of the Skiathos Holidays Resort, overlooking the beach of Vromolimnos, was undertaken by HotelBrain the leading white-flag hotel operator in the country;

· The Amira Suites is the newest hotel development on the island that opened its doors for the first time in 2019. It is a boutique aparthotel, located in the suburbs of Skiathos town, featuring 19 rooms.

With regards to long-term new developments coming into the market, the most noteworthy ones are:

· Erveni S.A., plans to develop a beachfront resort within a 50,000 m² land plot, half of which is characterized as forest area. The site is located 15 to 20 minutes away from Skiathos town and the airport. The hotel is planned to feature 212 beds in addition to a spa and thalassotherapy, swimming pools, food and beverage outlets and private beach access;

· According to recent press releases Anatolikes Sporades S.A. is planning to develop a five-star resort overlooking the beach of Aghia Eleni, next to the Koukounaries beach. The site is stretched in an area of more than 90,000 m² with a gross development area of 37,000 m². The complex is envisaged to feature 121 rooms in four buildings as well as one indoor and eight, six of which private, outdoor swimming pools in addition to other facilities typically found in five-star properties.

Hotel Performance

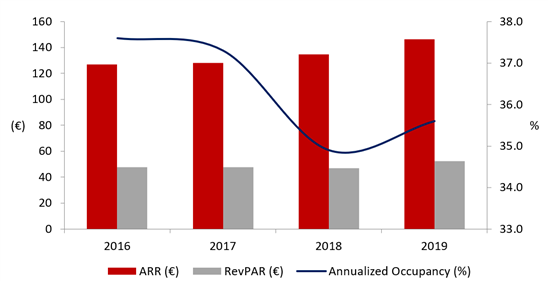

Recent trends in hotel operating performance in Skiathos is illustrated in the following table. The data is composed from 11 upscale hotels featuring in total 1,061 rooms and positioned in the upper segment of the market spectrum, located across the island over the last four years and based on the actual hotels’ performance. It should also be noted that all occupancy percentages refer to 365 days of operation for consistency reasons, although on average the tourism season in Skiathos lasts for 5.5 months.

Figure 7: Upscale Hotels Performance – Skiathos Island 2016-19

Source: HVS Research

During 2016-19, the average rate of the examined sample improved by €20, increasing from €127 to €147. Elivi hotels stand out of the competition as a brand-new product, newly built and with distinct marketing strategy for Skiathos hospitality sector. However, it is essential to underline the exceptional performance of other five-star properties which, in their majority, record figures within a range of €180 and €220. Other properties on the island, which are heavily dependent on tour operators recorded, as expected, lower-than-average room charges.

With regards to demand, occupancy rate recorded a moderate fluctuation, ranging between 35% to 37% (when annualized). The drop occurred in 2018 is attributed to the launch of Elivi Hotels while occupancy levels were partly corrected during 2019, when occupancy levels began to grow. Further growth is expected for the future with the market anticipated to fully recover by 2022. The area is a purely leisure destination where resort hotels usually operate between 160 and 170 days per tourism season; less than the average of the country. In other words, hotels in Skiathos operate with more than 90% seasonal occupancy.

.png)

.png)

.png)