By Anne R. Lloyd-Jones, Suzanne R. Mellen, Tanya J. Pierson

The COVID-19 pandemic and the related restrictions on travel, business activity, and individual movement are having an unprecedented impact on our industry and economy. Hotel owners, operators, lenders, and investors are all facing greater challenges than ever anticipated, as they grapple with plummeting occupancy, average rate (ADR), and RevPAR and seek solutions to mitigate the impact on EBITDA. Owners and operators are dealing with the current crisis day-to-day, making hard decisions regarding staffing, continuing or suspending operations, and having difficult conversations with their management companies, franchisors, lenders, and investors. Management companies and franchisors are working to identify ways to support their hotels while maintaining a coherent business strategy, while lenders and investors are grappling with fundamental questions concerning risk, returns, and value.

We don’t know how long the pandemic will last, how long the related restrictions will be in place, or how much worse this could get for our industry. We also don’t know the final net impact on the economy, or the depth and duration of the downturn. We do know that these events will have, and have indeed already had, a significant impact on hotel values. While it is difficult to assess the full impact, an examination of value trends in prior cycles can provide some useful guidance. Those historical patterns, together with an understanding of the market’s current expectations for the ultimate recovery of the industry and its performance, provide guidance for the probable trajectory of decline and recovery for hotel values.

Hotel Values and Market Cycles

EBITDA is defined as earnings before interest, taxes, depreciation and amortization, and for hotels, it includes a deduction for management fees and a reserve for replacement.

The volume of hotel transactions and the price paid for individual assets are influenced by two principal factors: the availability of capital and the performance of the lodging sector as a whole. When the industry is performing well and financing is available on favorable terms, investors are attracted to the market, and both prices and the number of transactions increase. These market conditions often induce sellers to put their properties on the market, further fueling the pace of transaction activity. Conversely, when hotel performance declines significantly, generally due to a contraction in demand caused by an economic downturn or, in this case, the pandemic, owners refrain from selling their assets until the market improves. Additionally, many hotel lenders withdraw from the market, making hotel financing less available; the debt that is available is usually characterized by lower leverage and higher interest rates. As a result, transaction activity drops off significantly. The impact of these influences results in a cyclical investment market, recording peaks and valleys in response to changes in the capital markets and the economy.

Value Trends Evident Through the Great Recession and Recovery

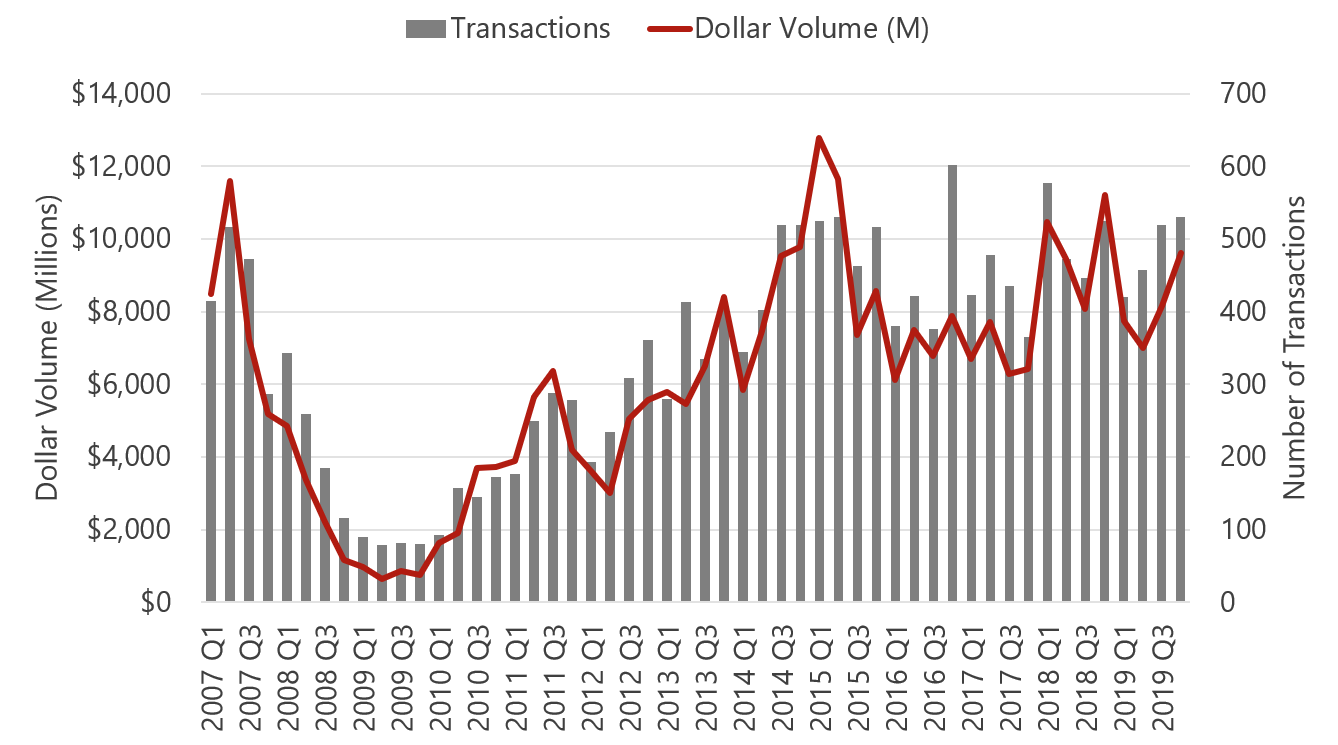

To provide a basis for our analysis, we looked at hotel sales transaction trends from Q1 2007 through the end of 2019. As illustrated in the graph below, hotel sales transactions started to decline markedly in late 2007 as the market began to falter. The financial crisis in the fall of 2008 stalled out the transaction market, with few sales occurring in late 2008 and 2009. Once hotel performance bottomed out in late 2009, hotel investors jumped in, and the number of transactions began to accelerate mid-year 2010.

Historical Hotel Transactions

Source: RCA

Lodging industry performance bottomed out in Q4 2009, with demand growth turning positive in early 2010. With a recovery in fundamentals underway, transaction activity began to recover in 2010, fueled in large part by the aggressive acquisition programs of newly formed and existing REITs and investment funds. Mortgage capital became increasingly available in the latter half of the year, including both on-book loans and renewed CMBS lending programs. The substantial improvements in the performance of the lodging industry, combined with widespread optimism concerning the outlook for the sector, contributed to the resurgence of interest in hospitality investments. These trends are evident in the data for 2010, which indicate that the number of transactions was more than triple the total recorded in 2009. Once hotel performance bottomed out, and hotel EBITDA had nowhere to go but up, investors jumped in. Transaction activity continued to rise in 2011 and then moderated in the latter half of the year and in 2012 given the uncertainty caused by the debt crisis in the U.S. and Europe. Sales activity resumed in 2013 and continued at a healthy pace throughout the remainder of the cycle, up to and including 2019. Sales volume spiked in 2015 given the high number of large high-priced asset transactions that year, including the sale of Strategic Hotels & Resorts’ portfolio of 16 large, luxury hotels. That year’s volume was not reached again in the cycle.

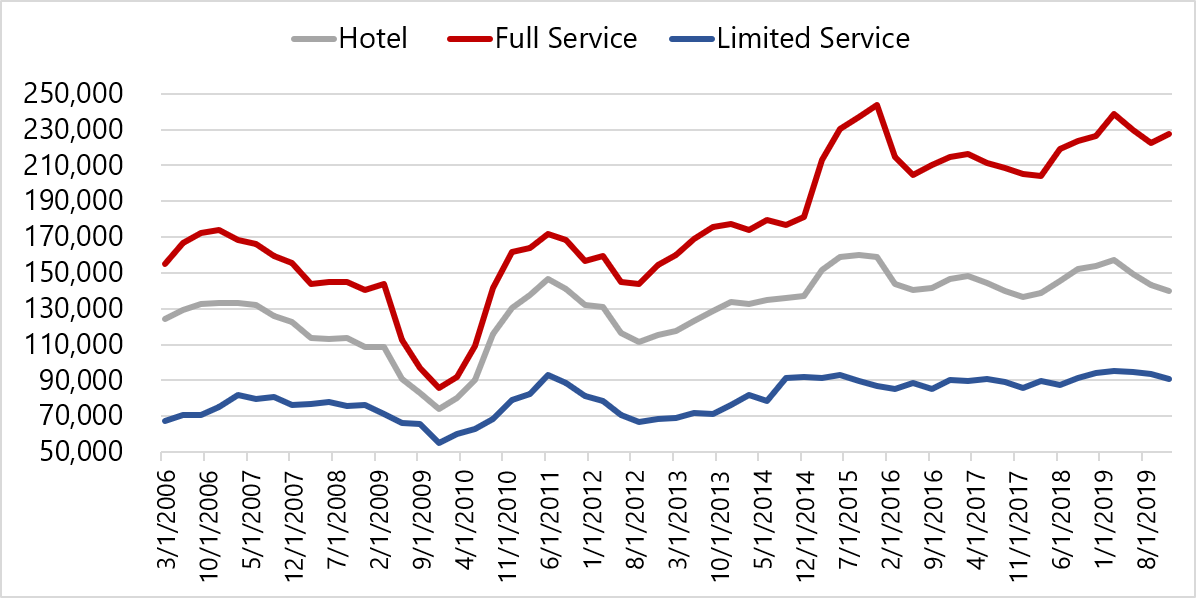

The average sales price per key parallels trends in transaction volume. The following chart reflects the average price per key, as reported by RCA. This metric is calculated by dividing total sales volume in a given period by the total number of rooms transacted and thus is greatly influenced by the type, size, and price of hotels transacted and thus can be misleading.

Average Sales Price Per Room

Source: RCA

While prices bottomed out across the hotel spectrum in late 2009, the dramatic rise in hotel price per room in 2010 and 2011 was greatly influenced by well capitalized hotel investors, including REITs and private equity funds, pursuing the purchase of large, high-quality assets; similarly, the sale of higher-quality limited-service hotels also drove up the average price per key. Thus, the data should not lead one to conclude that hotel values fully recovered during that period. Indeed, when the lodging REITs pulled back on their acquisition activity because of the stock market volatility in late 2011 and 2012, the average sales price per room declined. Unit prices continued to recover through the cycle and increased significantly in mid-to-late 2015 as high-priced assets, including the Strategic Hotels & Resorts portfolio, as mentioned previously, came to market.

The average sales price per room data indicate that full-service hotel asset pricing is more volatile than that of limited-service hotels during an economic cycle. Full-service hotels experience greater swings in revenue and EBITDA when demand is disrupted, due primarily to high labor and other operating costs. Limited-service hotel values are less volatile due to their lower operating leverage, which lessens EBITDA fluctuations during an economic cycle. Transactions are also less affected by the capital markets due to the smaller size and lower value of these assets, as well as the entrepreneurial profile of the typical buyer/owner operator.

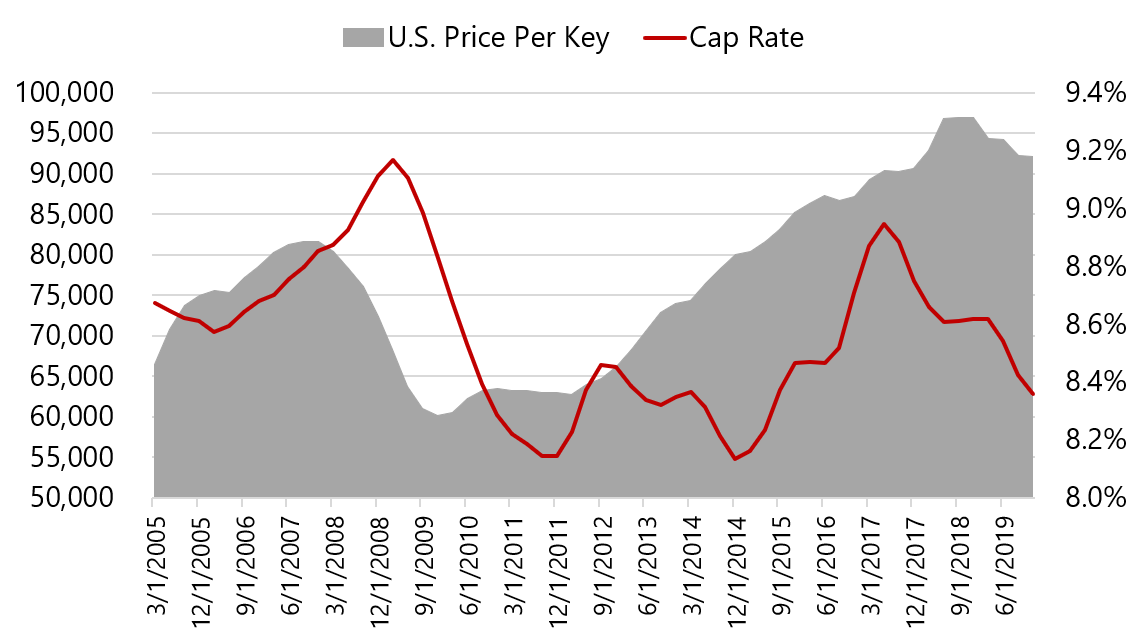

In recognition of the volatility of the average price per room data based on actual transactions, RCA has developed a Hedonic Series (RCA HS) to reflect the sales price of an average hotel room in a given period, as opposed to the average per room price indicated by hotel sales. The RCA HS from late 2005 through Q3 2019 is presented in the following chart. These data reflect a much longer recovery period, five-and-a-half years from Q4 2009 to Q2 2015, for the price of an average hotel room to recover. Based on current market conditions, these data provide the most useful guidance for what lies ahead for the hotel investment market in this downturn and recovery.

Sales Price of an Average Hotel Room Over Time (RCA Hedonic Series)

Source: RCA

While these price trends provide insight into the overall timing of the cycle, it is important to keep in mind that they should not be applied to the valuation of a single hotel asset, which is affected by numerous property-specific factors including the health of the local economy and demand generators; additions to competitive supply; the hotel’s product tier, quality, and condition; the need for a PIP/capital improvements; and its historical and anticipated financial performance. For example, in the last cycle, hotels located in tech-influenced markets recovered much more quickly and to a greater degree than hotels located in markets reliant upon manufacturing.

The following chart indicates that capitalization rates correlate inversely with hotel prices. As prices decline, capitalization rates typically rise until the hotel operating performance bottoms out. Because cap rates from sales transactions are derived by dividing a hotel’s trailing-twelve-month (TTM) EBITDA by its sales price, cap rates will inherently rise in a downturn because historical hotel earnings are elevated relative to a price that is based on current and anticipated performance. The cost of capital also impacts the cap rates during a downturn, as the terms of hotel financing become less favorable due to lower LTVs and elevated interest rates. The lessened availability of financing may necessitate an all-cash transaction, which puts additional pressure on cap rates.

Hotel Capitalization Rates During Previous Downturn

Source: RCA

During healthy economic periods, full-service hotel cap rates generally average 150 basis points (bps) below those of limited-service hotel cap rates. During the Great Recession, this differential decreased to 50 bps. Full-service cap rates increased by almost 150 bps from Q1 2008 to Q4 2009, while limited-service cap rates increased by only 75 bps, reflecting the greater impact on full-service EBITDA during the downturn. Once the recovery commenced, full-service cap rates declined more rapidly and to a greater degree than limited-service cap rates, reflecting buyers’ expectations of significant full-service hotel EBITDA upside. The traditional differential between full-service and limited-service cap rates resumed post recession.

Values in the Current Cycle

Despite the variables that result in the volatility of the data, it’s clear that hotel prices decline during a downturn. We know that hotel RevPAR closely correlates with GDP. In past cycles, hotel RevPAR declines were driven by GDP contractions, and the resulting decline in values were exacerbated by the pullback of lenders and investors from the market. Once hotel performance bottomed out, buyers entered the market looking to purchase assets at significant discounts to pre-downturn values. The result was a rapid increase in sales volume and the start of value recovery.

In the current crisis, the decline in hotel RevPAR and EBITDA is being caused by an external factor, the coronavirus (COVID-19) pandemic, which has virtually ceased travel around the globe. This external factor is in turn resulting in a GDP contraction, which will likely make this current cyclical downturn more comparable to and potentially worse than the Great Recession. Nevertheless, the market forces that influence value declines and recovery in the past cycle are expected to influence the market in the current cycle.

Market conditions going in to 2020 are also relevant. As of December 2019, when coronavirus was not yet recognized as an influence, the outlook for revenue and EBITDA growth was modest. The absorption of new supply, including further additions anticipated for 2020, was expected to constrain both occupancy and ADR growth. The resulting minimal revenue growth, combined with rising labor costs, was anticipated to limit EBITDA upside. The capital markets were strong, with debt and equity capital available, and interest rates remained low. In these circumstances, the overall outlook was that values would remain stable in the near term, followed by moderate increases.

Based on the impact that COVID-19 has had on the lodging market, along with the related effects on the economy, we conclude that the current downturn will have a significant impact on hotel values.

- Sharp revenue declines will result in significant decreases in EBITDA, with the real possibility of negative EBITDA in the near term.

- The pullback of the debt market from the hotel sector, with lenders reporting lower loan-to-value ratios and/or higher spreads, will result in higher interest rates, despite the cuts by the Federal Reserve.

- Capital market disruption may lead to all-cash transactions, seller financing, and other capital solutions that could put downward pressure on values.

The HVS Valuation Model

To evaluate the potential impact of the current downturn on hotel values, HVS has modeled three valuation scenarios based on a hypothetical typical hotel. The model considers a base-case scenario and three alternate scenarios, which reflect the range of potential impact. This analysis is intended to reflect the current market as viewed through the eyes of potential buyers and sellers. While the outlook for hotel performance is uncertain at present, hotel investors are accustomed to dealing with the risk of performance volatility and will look for opportunities to buy assets well below replacement cost, with the anticipation of strong asset appreciation and high returns once we move past the current crisis. Most sellers will sit on the sidelines and wait to sell when price discounts subside, but a rebound in transaction activity could occur quickly once travel resumes. At present, most hotel investors anticipate that a recovery in hotel performance will commence in the second half of 2020 following containment of COVID-19. The degree and timeframe of the recovery will vary from asset to asset and market to market.

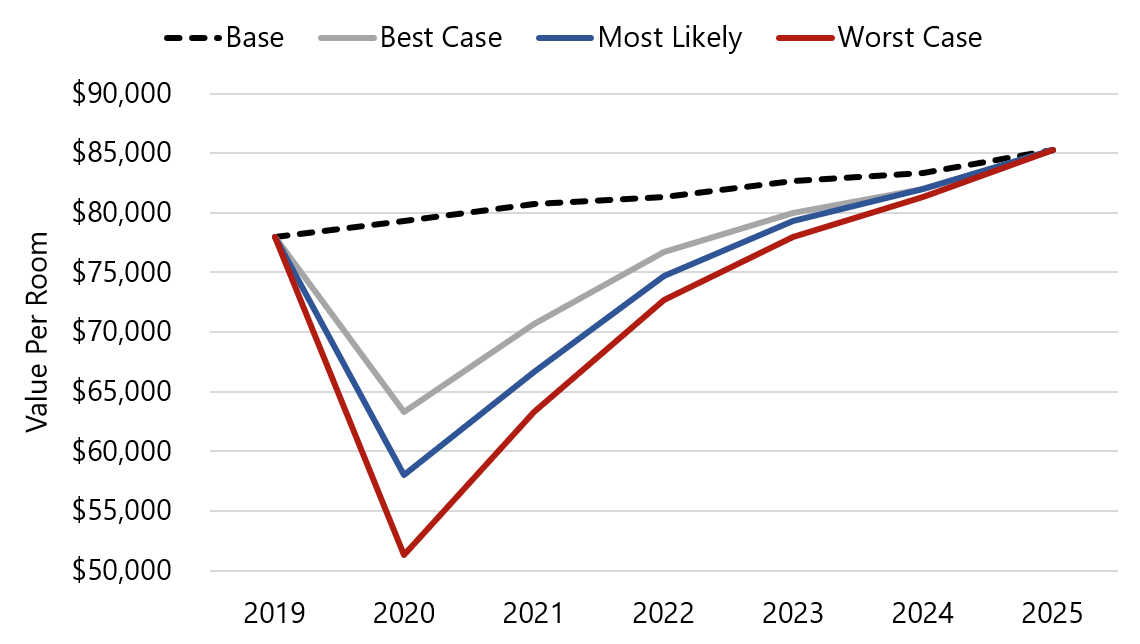

Valuation Parameters: A ten-year discounted cash flow (DCF) analysis was performed for each year from 2020 through 2025 to reflect the trend in value recovery year-over-year for the base case and each 2020 scenario. In the base case, a 10% discount rate, an 8.25% terminal capitalization rate, and a gradually increasing income stream were employed to establish a value for the 2019 base year and each year thereafter through 2025. Discount rates were raised by 100 bps to 11% in each of the 2020 scenario values to reflect the higher cost of capital (less or no debt, more equity) during a period of market disruption. Terminal capitalization rates were also increased by 100 bps to reflect the uncertainty regarding future appreciation and the reduced pressure to make the deal (i.e., with less competition, buyers will raise their investment requirements). As the recovery proceeds, the discount rates employed in the 2020 scenarios are modeled to decline by 25 bps per year as the cost and availability of capital improves, stabilizing at 10%. Terminal capitalization rates for all scenarios are modeled to decline over time to 8% by 2025.

Additional assumptions modeled for each individual scenario are summarized as follows:

- Base Case – Reflects the anticipated value of a hotel over time, based on stable market conditions; this case assumes that the capital market conditions as of 1/1/2020 remain in place. A discount rate of 10% and a terminal capitalization rate of 8.25% are assumed. Value is projected to grow modestly through 2025.

- Best Case – Anticipates significant decline in RevPAR and EBITDA in Q2 2020, with moderate recovery during the rest of the year; 2020 EBITDA is greatly diminished but still positive. A gradual recovery in hotel performance is projected for 2021, with annual gains thereafter until 2024 when EBITDA reaches base-case levels in current dollars.

- Most Likely Case – Assumes more significant impact in the first year (breakeven EBITDA) and a return to positive cash flow in 2021. The degree of the impact and decline is assumed to diminish over time as the market recovers, with EBITDA reaching base-case levels in current dollars in 2024.

- Worst Case – Assumes extreme negative EBITDA in 2020, followed by minimal EBITDA in 2021, with diminishing negative impact as the market recovers. EBITDA is modeled to equal base-case levels by 2025.

The following graph presents the results of our model. This model is intended to reflect the potential range and degree of impact on hotel values. The impact of current conditions on an individual property would depend on the characteristics of the property, its market, and its location.

Value Per Room of a Typical Hotel Over Time

Source: RCA

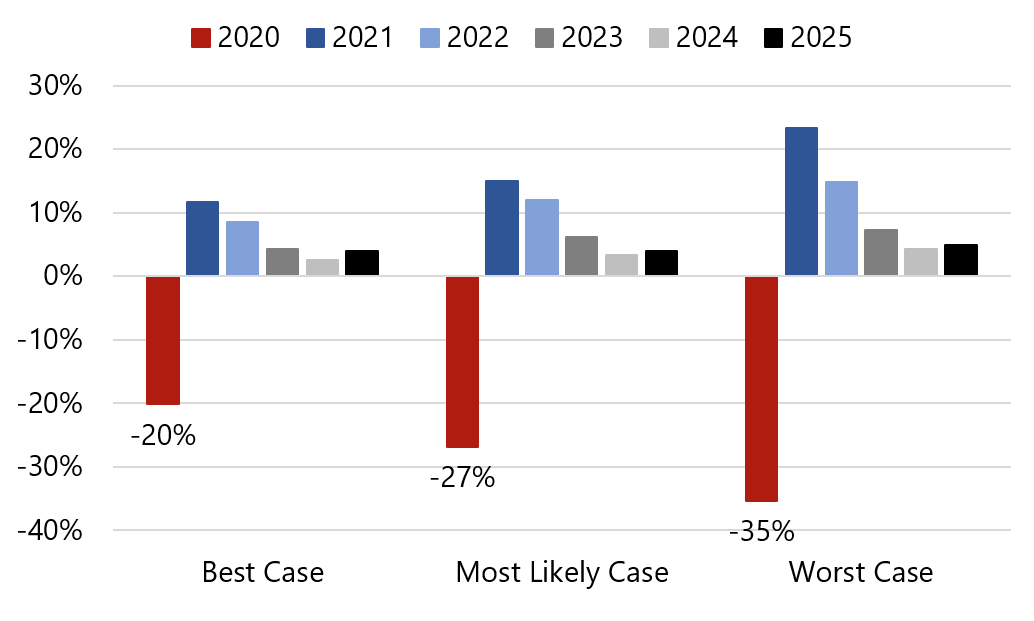

The following graph illustrates the annual change in market value for each scenario.

Annual Percent Change in Value

Source: RCA

Value declines in 2020 range from 20% to 35%, as shown in the three scenarios. For comparative purposes, according to RCA Hedonic data, the value of an average hotel declined by 27% from peak to trough in the last downturn.

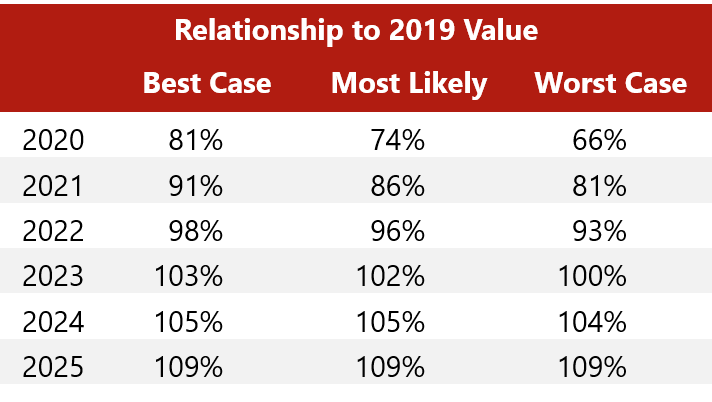

The following table illustrates the relationship of the modeled values under each scenario to the value as of the base year (2019). As illustrated, in all scenarios, the modeled value ultimately surpasses the 2019 value, reaching a value 9% higher by 2025.

Source: RCA

The data also illustrate the nature of the investment opportunities that typically arise during a recovery. Under the most likely scenario, an investor acquiring a hotel in 2020 would realize a 47% increase in value by 2025. Even if they did not acquire the property until 2021, the potential appreciation would be 28%. Moreover, these rates of appreciation are based on current market conditions and expectations and assume no changes to the property in question. Upgrades and renovations could potentially enhance the return on investment; a stronger and/or faster recovery would also enhance the appreciation. The potential to achieve such strong returns on investment is what attracts opportunistic buyers to the market; in the past, these buyers contributed to the recovery of the transaction market and values.

As noted previously, the specific impact of COVID-19 and the economic downturn on an individual property will depend on the characteristics of that property, its market, and its location. Some hotels will be more vulnerable to performance and value declines than others in this current downturn; factors to be considered are listed below.

As a general rule, secondary and tertiary markets can be expected to hold up better and trade at a smaller discount to 2019 values. Gateway and top 10 metro markets will be more volatile; larger value declines are anticipated in the near term, with greater potential for accelerated appreciation thereafter.

A Note on “Closed” Hotels

Historically, hotels that are “closed” carry a stigma that can have an adverse impact on value. Typically, these properties have closed as a result of some property-specific problem, such as condition or physical defect, or management or ownership issues. The tasks associated with correcting the underlying issue and reopening and re-establishing the hotel in the market are perceived as high risk and, as such, put downward pressure on value.

In the present environment, the causes of a hotel ceasing operations are clearly external and should not be interpreted as a stigma on that property. The hotels that have suspended operations (a more accurate term) have done so with the expectation of resuming operations when market conditions (i.e., demand) warrant. From a valuation perspective, the impact of suspended operations will influence the EBITDA forecasts in the near term, but assuming the property is positioned to resume operations, there should be no other material impact on value.

Conclusion

A review of historical cycles illustrates that the lodging industry will experience a significant decline in asset values due to COVID-19 and the economic downturn. While in recent years, lending has been more disciplined with generally lower leverage and stricter due diligence than in prior cycles, the current magnitude of revenue and EBITDA decline will likely require a myriad of solutions, including debt service deferment, and loan modifications and restructuring. Given the lending freeze, the transactions that are likely to occur will reflect capitalization and discount rates above historic averages, given the high level of uncertainty, as well as low-leverage or all cash transactions. Once hotel performance bottoms out and assets come to market, well-capitalized buyers will be in a position to acquire hotels at prices well below both replacement cost and recent norms, creating an opportunity for high returns.