By Simon Hulten, Russell Kett

Foreword

The restrictions imposed due to the COVID-19 pandemic have severely hit every sector across the globe, and the hospitality industry is undeniably among the hardest hit. In Israel, strict lockdown measures were implemented in mid-March, forcing all except non-essential businesses to close, including most of the country’s hotels.

Fortunately, there is light at the end of the tunnel for the lockdown phase and, on 4 May 2020, Prime Minister Netanyahu outlined a gradual easing of lockdown restrictions; the focus of hoteliers has thus shifted from how to manage the closure to developing a sound reopening strategy. While this was a positive sign for hoteliers, it is important to make a distinction between when hotels will be allowed to reopen and when they should reopen. As with the rest of Europe, we expect hotels to reopen gradually in Israel and that they will likely need to continue making use of the government’s unemployment benefits until demand returns in sufficient quantities, especially from international visitors, to justify a more profitable operation than the cost of remaining closed.

No-one knows the timeline as to how long this pandemic will last or the final net impact on the economy. What we do know is that the hospitality industry is extraordinarily resilient. Past ‘shock’ events and downturns have caused business to plummet; however, the industry performance has always recovered and Israeli hotels have become especially adept at managing the impact of such events. Even though the pace and degree of the COVID-19 downturn are unparalleled, we are of the opinion that the hospitality industry in Israel will recover and, as in the past, this downturn will create the opportunity for strong returns through well-timed and well-executed investment strategies.

In this report, we examine a set of recovery scenarios addressing the range of potential impacts on hotel values in Israel. We analyse the past hotel performance to determine the baseline for this and we review the tourism market profile to understand the factors affecting the anticipated short- and mid-term return of travel.

Key Takeaways

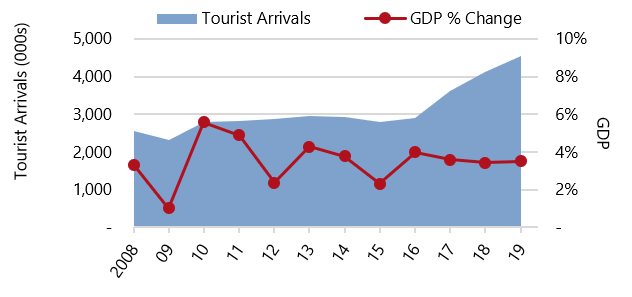

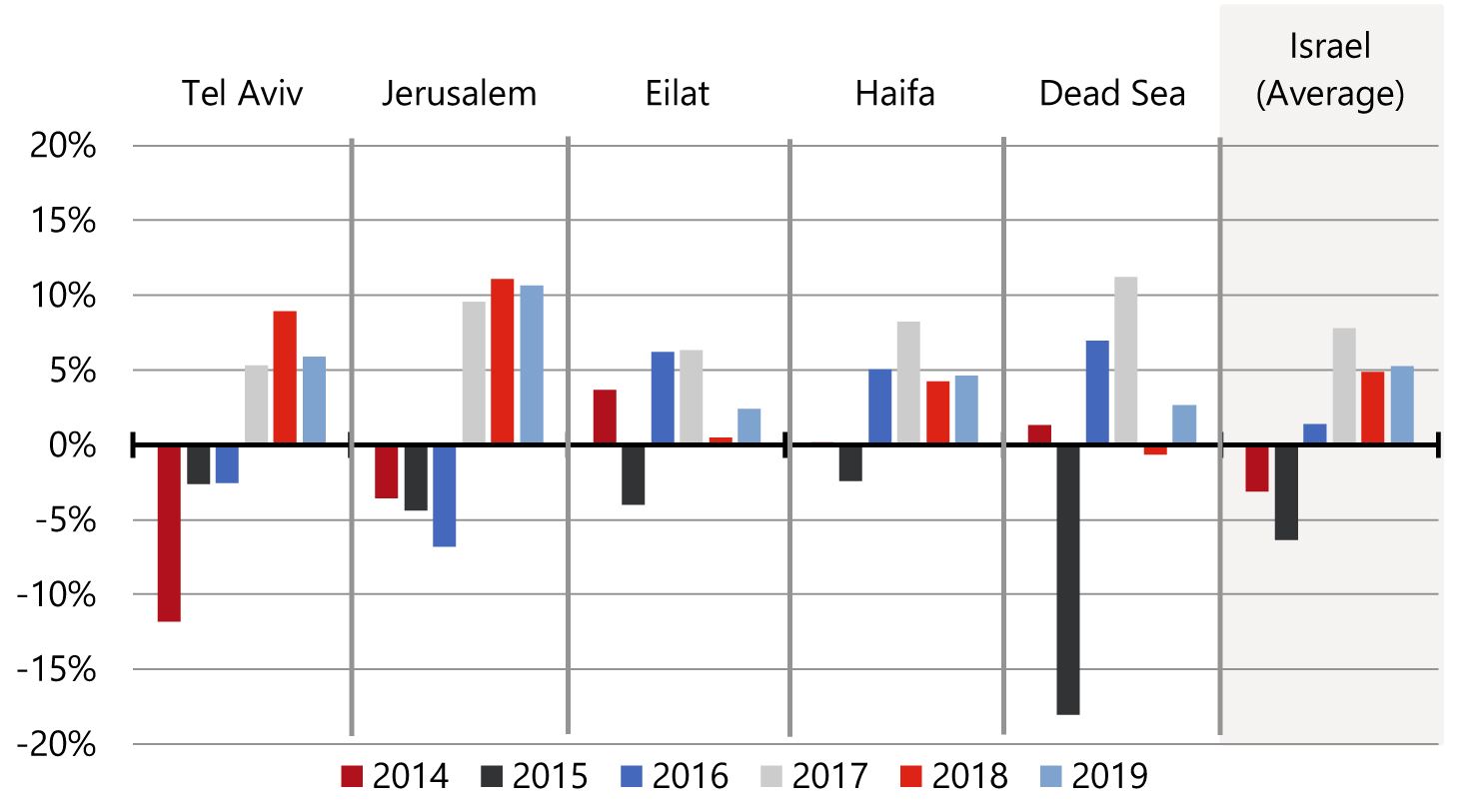

- Tourism arrivals to Israel hit another record in 2019, growing to 4.5 million (see Figure 1) and resulting in improved hotel performance throughout.

- Hotel values across Israel gained a further 5.2% in 2019 on the back of similar average RevPAR growth for all markets.

- We expect a gradual but accelerated recovery following COVID-19 – RevPAR projected to return to 2019 levels by 2024.

- Supply growth slows – projects will be delayed or abandoned altogether.

- Hotel values to decline in 2020 – to remain depressed until EBITDAs ‘hit the bottom’ and there is evidence of recovery.

- Longer term, values will recover as cash flows improve and capital markets return to more traditional parameters.

- Opportunity for high returns – well-capitalised buyers could take the opportunity to buy distressed assets well below replacement cost and recent norms.

The Context in Recent Years

A Thriving Economy

The Israeli economy has flourished over the last decade and has recorded one of the best performances across all OECD countries. Since 2008, GDP growth has averaged 4.0% a year, which compares to the OECD average of 2.9%. Israel’s economy is characterised by its strong service and industrial sectors, which mainly focus on high-tech products, biomedical equipment, chemicals, and military technology. The country is also referred to as the ‘Start-up Nation’ owing to its incredible number of start-ups, rumoured to be the highest per capita in the world.

Undeniably, the travel and tourism industry has also played an important role, being one of the largest economic sectors in Israel. It contributed US$22 billion (5.6%) to GDP in 2019 and provided close to 230,000 jobs (5.7% of total employment), according to the WTTC.

Figure 1: Tourist Arrivals and GDP Change (Israel)

Tourism Acceleration

The political situation in the region has had a crucial impact on inbound and outbound tourism flows. Following years of geopolitical tension in Israel and the neighbouring states, 2017 marked the turning point and was among the best years in the country’s history in terms of international visitation. Combined with targeted marketing actions, easing of regulations for visas and an increased number of air routes thanks to the Open Skies agreement which came into effect in 2013, the Israel tourism industry showed impressive growth from 2.9 million tourist arrivals in 2016 to 4.5 million in 2019 (see Figure 1). Local hoteliers benefitted from this inflow, as reflected in the solid performance of all markets under review (see Figure 3).

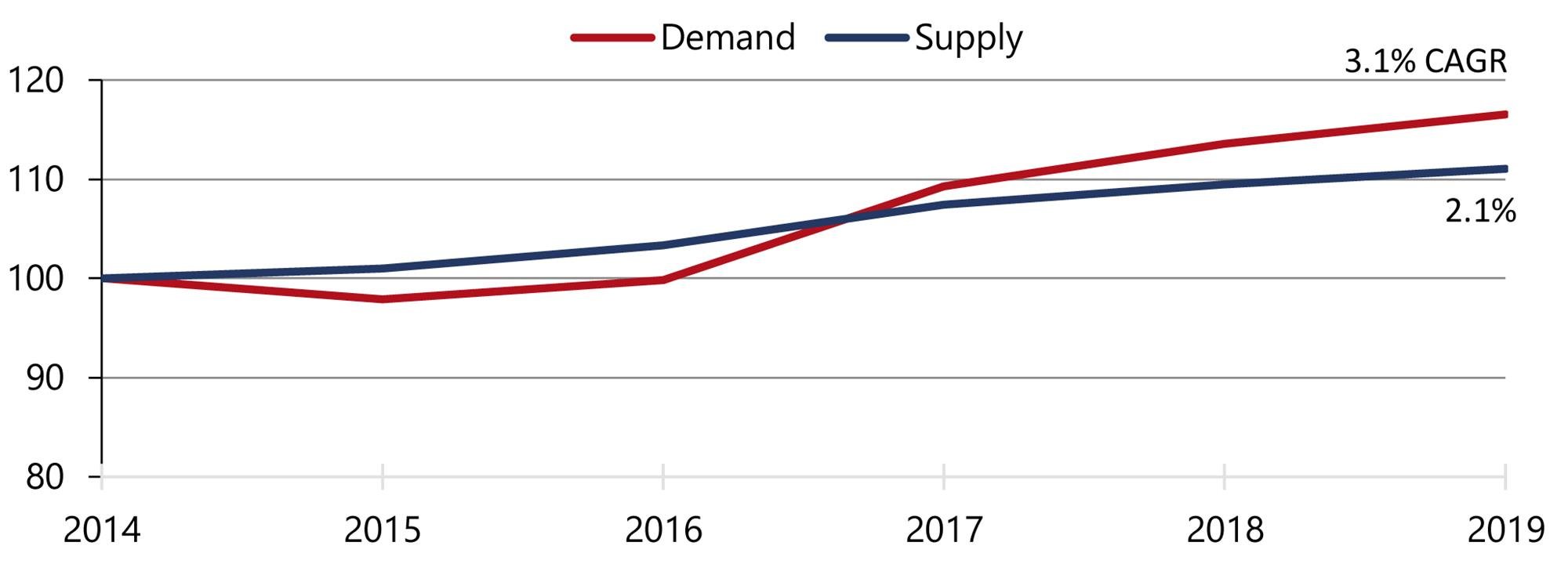

Figure 2: Supply and Demand Growth in Israel (Index, 2014 = 100)

Supply is Lagging Behind

As shown in Figure 2, demand growth has outpaced supply growth over the last three years, highlighting the strong potential of the destination to welcome new hotels, especially at the budget end of the spectrum. To accelerate the construction of new hotels, the Ministry of Tourism launched a number of initiatives in 2016. One of the main pillars was the creation of a governmental grant scheme in order to provide additional support to developers in a country where banks are generally hesitant to lend for hotel purposes. Another important initiative was the implementation of a centralised planning process and other regulatory improvements. Before this was introduced, investors had to deal with a number of different planning committees in order to obtain a permit, thus making the entire process extremely lengthy (sometimes between five and ten years). This process has now been centralised and is handled by the National Infrastructure Committee, thus cutting bureaucracy. These initiatives have been proven to be effective; more than 22,000 rooms are expected to enter the market in the next couple of years, albeit that the realisation of this might be delayed owing to the current pandemic.

Hotel Market Performance

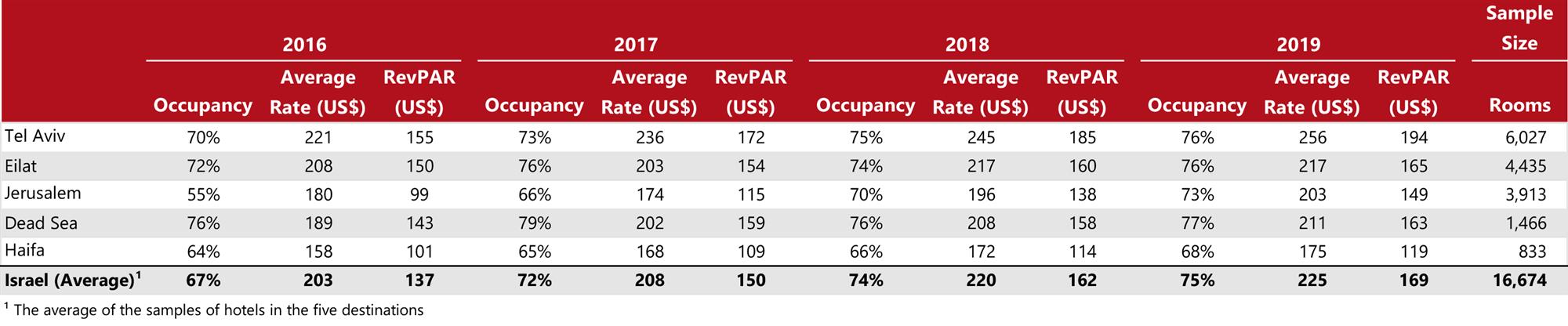

Mirroring the positive trends in demand and limited supply growth, Israel’s hotels recorded a RevPAR increase from US$137 in 2016 to US$169 in 2019, representing a compound annual growth rate of 7%.

The strongest RevPAR growth was recorded in Jerusalem at a compound annual growth rate of 14% between 2016 and 2019. This was followed by Tel Aviv (8%), Haifa (6%), the Dead Sea (4%) and Eilat (3%).

Figure 3: Occupancy and Average Rate Comparison

Like much of the world, Israel’s hotel industry took a massive nosedive as travel came to a halt in mid-March 2020. Only a small number of hotels remained in operation, and the occupancy levels for these opened hotels are generally in single digits.

The Path to Recovery

Israel began reopening the country to domestic tourism with a phased approach on 4 May 2020. Simultaneously, the Tourism Recovery Task Force has been working alongside Ministry officials to outline a recovery strategy by implementing the appropriate health and safety measures to keep travellers safe, including the ‘Purple Standard’ protocol, a new Standard Operating Procedure for hotels operating in the country. Our report next year will clearly need to contain a deeper reflection of what actually transpires. As many countries in Europe reopened their borders in June, many of Israel’s hoteliers had hoped to see their country taking a similar decision but, as the country is currently experiencing a second wave of the virus, this is likely to be delayed. However, Greece, Cyprus and Israel are considering setting up a ‘corona corridor’, allowing cross-border travel between those countries in a common effort to partially revive international tourism; it is planned to take effect on 1 August, although the situation remains unclear.

In terms of fiscal policy, the Israeli government announced a NIS94 billion (US$27 billion) economic stimulus package to support vulnerable sectors and some NIS300 million (US$86 million) will be allocated to the tourism sector.

While regulations and stimulus packages will frame and assist recovery, they will represent just a fraction of the rebound equation. The characteristics of the market, from its demand sources to the destination’s transport links or its supply dynamics, will play a significant role in the recovery of the hospitality industry once international travel resumes.

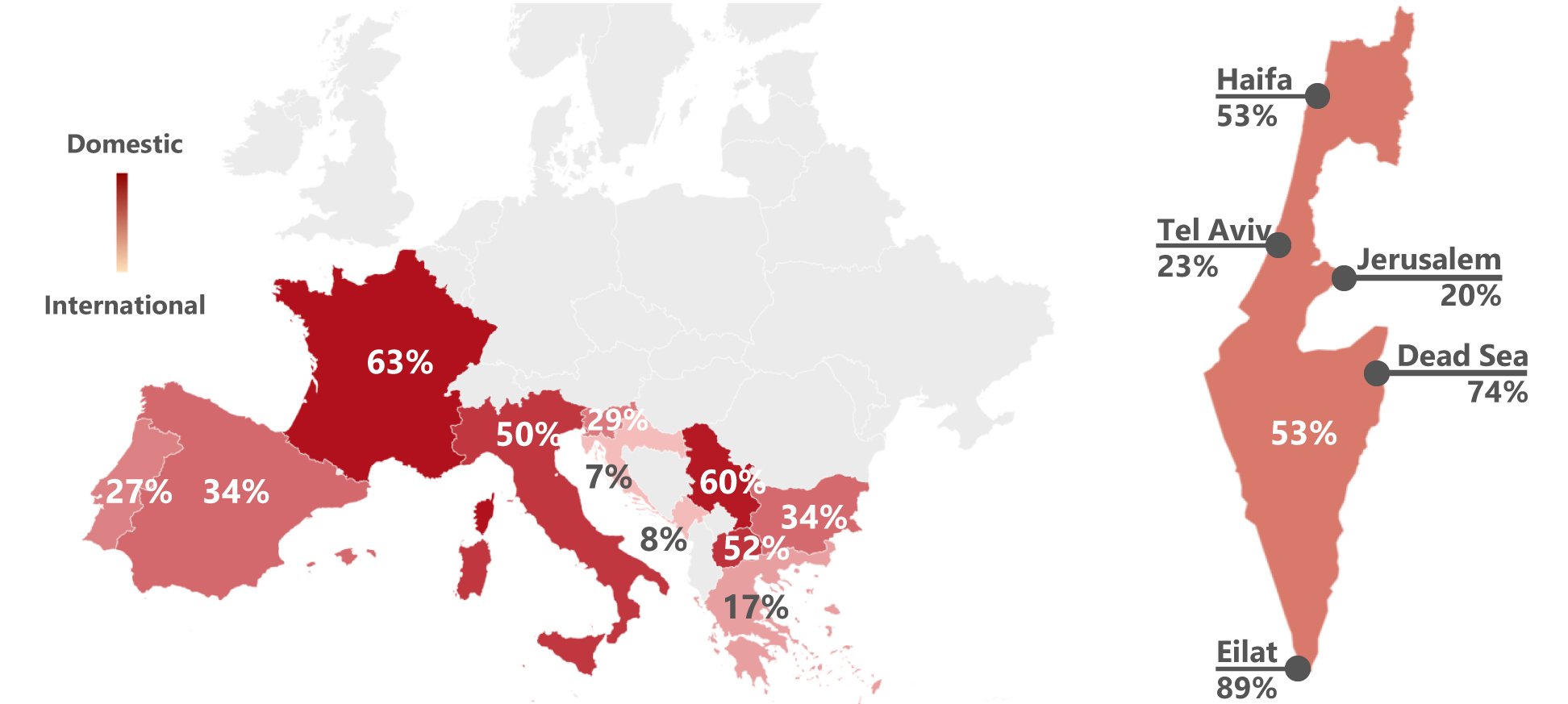

The Tourism Market is Going Local

Countries and markets with less reliance on international demand and air travel are likely to see a faster recovery than others. Figure 4 provides an overview of the proportion of room nights arising from domestic guests. In comparison to many southern Mediterranean countries, Israel should be in a relatively good position with more than 50% of overnight demand derived from domestic tourism. However, in markets such as Tel Aviv and Jerusalem, overseas tourists represent some 80% of total overnights, implying a greater challenge than those relying primarily on domestic demand such as Eilat and the Dead Sea region.

It is also important to look at this from the other side of the equation and consider what happens when holidaymakers who typically travel overseas for their holiday instead book ‘staycations’. In 2019, Israelis took more than 9 million trips abroad, and we are carefully monitoring this space and to what extent these holidaymakers will replace the international demand in the short term.

Figure 4: Comparison of Domestic Share of Tourism Overnights (%)

Assessing Israel’s Traveller Profile

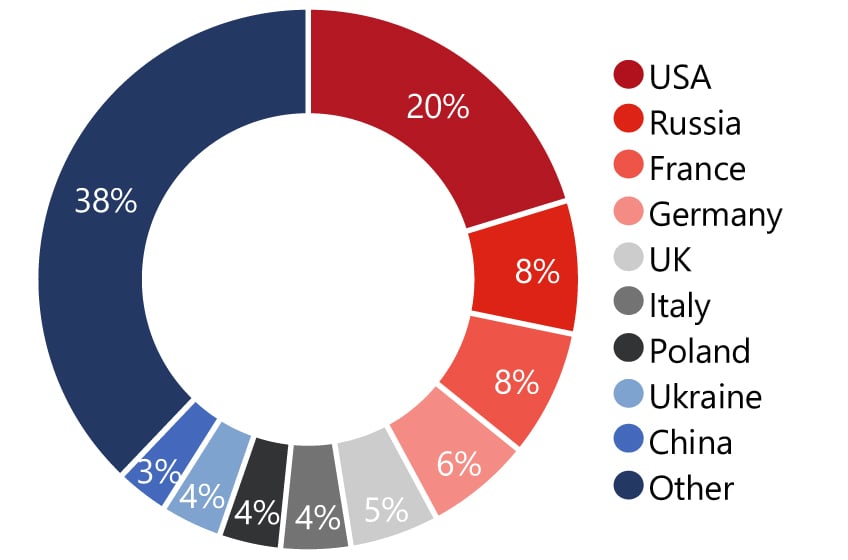

Hoteliers must drill down into the details of their region’s source markets, demographics and segmentation to guide their strategy for recovery. As shown in Figure 5, the top feeder market visiting Israel in 2019 was the USA with more than 1.25 million visitors, followed by Russia, France, Germany and the UK. These five markets together accounted for 47% of total international visitation to the country in 2019 and the economic recovery and containment of the virus in those countries, as well as the rate at which international travel resumes, are crucial for Israel’s tourism recovery.

Figure 5: Key International Source Countries (% of International Arrivals, 2019)

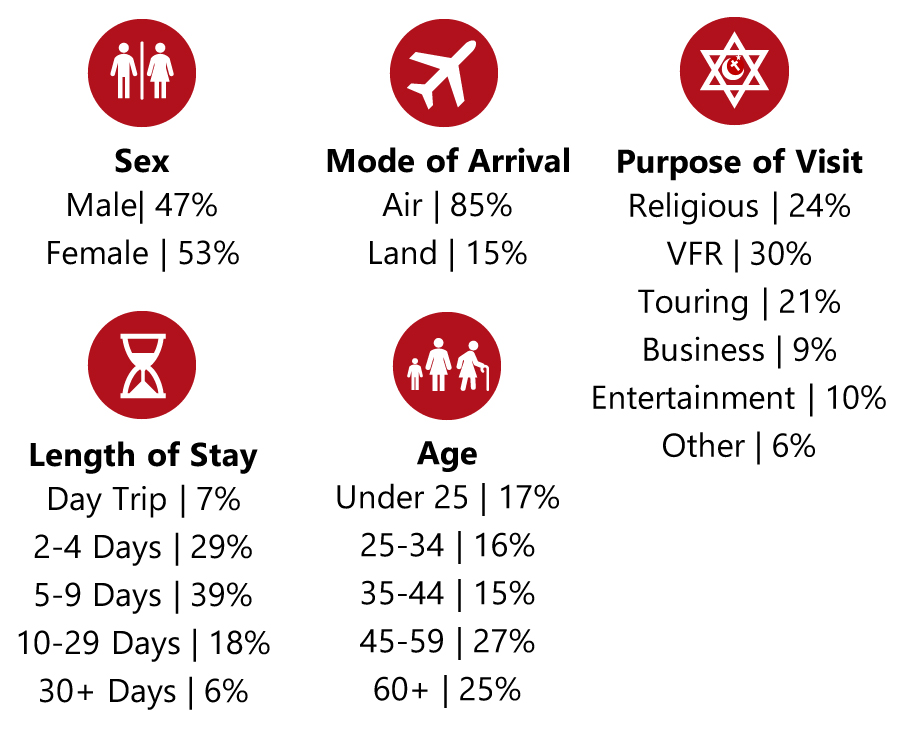

Leisure Tourism to Recover First

As shown in Figure 6, the vast majority of Israel’s visitors are leisure-related, and we expect those to return first – particularly those visiting friends and family – whilst long-haul travellers are likely to be slower to return. The country also has a high percentage of returning guests (some 50% of all international tourism to Israel), which we hope hoteliers recognise and take advantage of. People in the age group of 45 and under account for almost half of total visitation. Not surprisingly, recent trends from China show that the young and the non-family segment are resuming travel earlier, and we expect a similar trend in Israel. Business demand is likely to return unevenly and more slowly depending on company travel policies and type of sector. We expect MICE (meetings, incentives, conferences and events) and group business to be the slowest to return.

Figure 6: Traveller Profile (Israel, 2019)

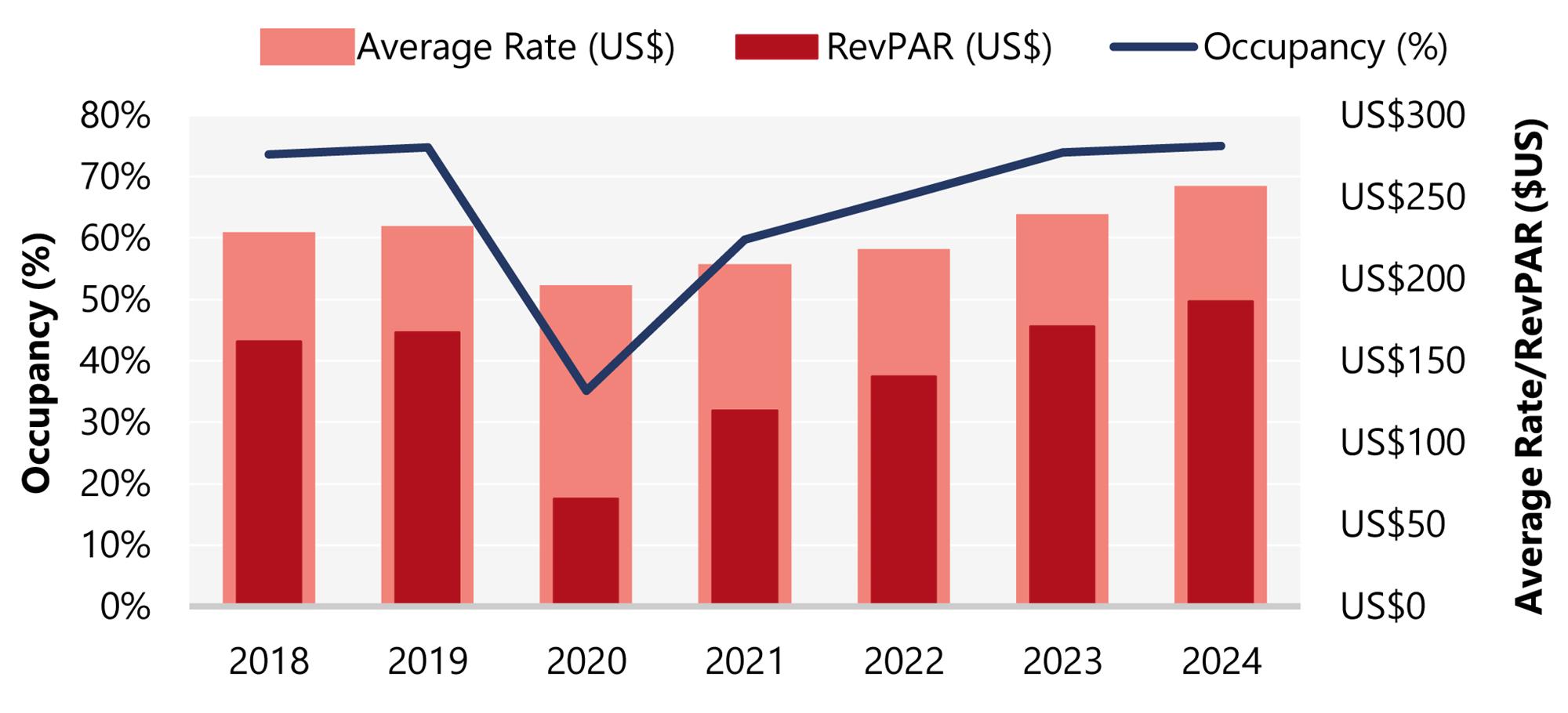

RevPAR Recovery Anticipated by 2024

Taking into consideration the factors mentioned in this report, along with the performance thus far in 2020, the forecast presented in Figure 7 reflects the current expectation for the timing and pattern of recovery.

HVS’s RevPAR outlook for Israel envisages a 60% decrease in 2020 followed by a sharp increase, driven primarily by occupancy, in 2021. Occupancy is expected to recover by 2023, roughly 3½ years from now, followed by average rate a year later (in real terms). We note that the situation remains fluid; forecasts may change as time passes and as more light is shed on the rate of recovery.

We expect occupancy in economy and midscale hotels to be less vulnerable, especially those which primarily rely on transient segments. The more vulnerable hotels are likely to be luxury and upper-upscale hotels and those most reliant on meetings, incentives, conferences and events (MICE). These general trends are consistent with what we have seen in previous downturns. Following 9/11 and the Global Financial Crisis, hotel RevPARs typically took some six years to be restored to their previous peak levels, and we consider it likely that this will be the case with regard to COVID-19, albeit that the pace of growth will be slower owing to certain markets taking longer to return.

Figure 7: Performance Outlook for Israel’s Hotel Market

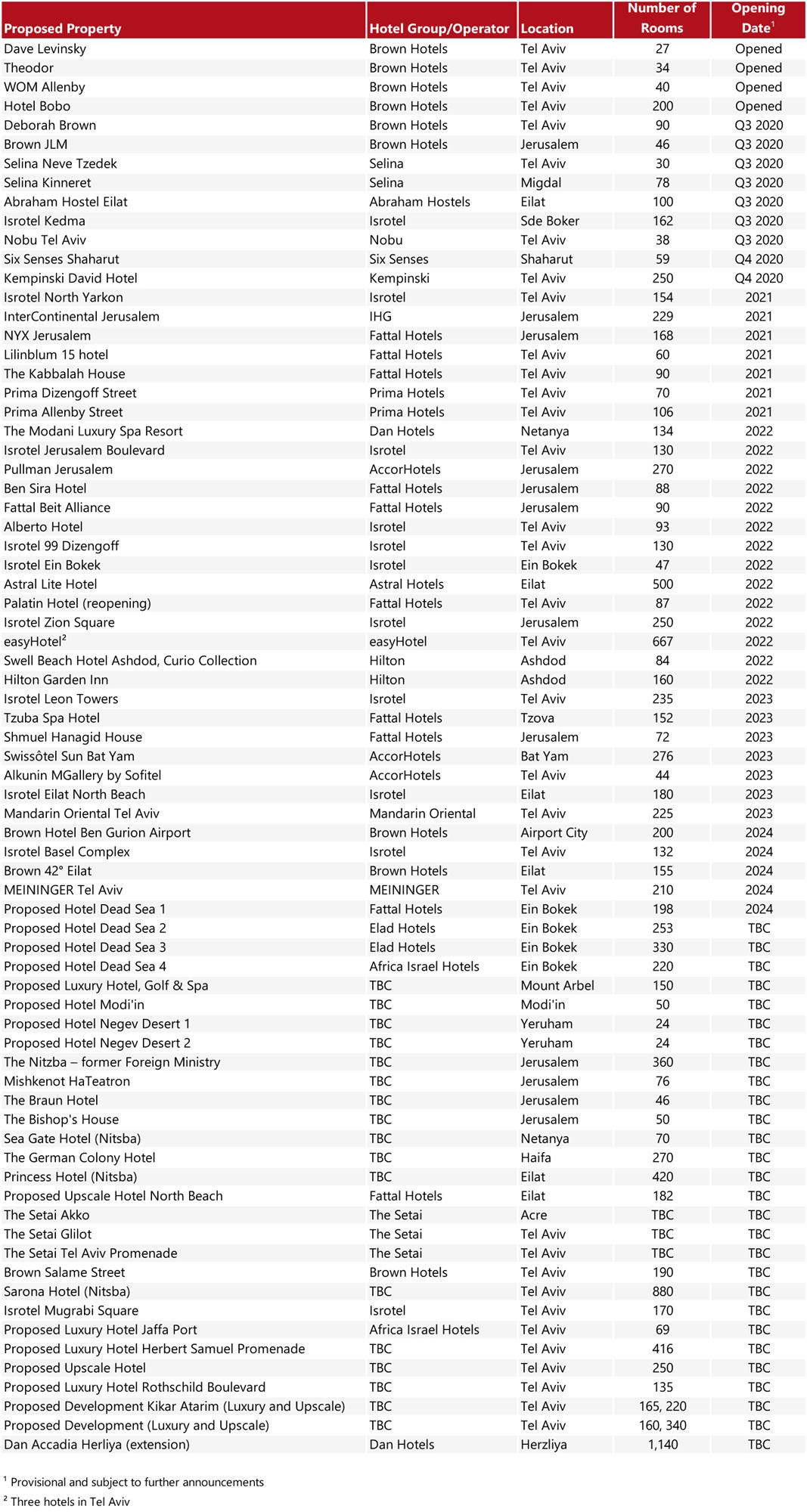

Hotel Development

At the start of 2020, the pipeline across the country had never been as strong, with more than 12,000 rooms (22% of existing supply) expected to open in the next few years. However, we expect the current situation to delay the construction and opening of some of the hotels, while some projects in the planning phase may be cancelled. Moreover, there may also be some hotels, currently closed, which might never reopen because of cash or capital shortages and may need to be repurposed. We are carefully watching this space to determine which projects will be delayed or cancelled.

Figure 8 provides an overview of recently opened properties and new supply in Israel. The opening dates exclude possible delays caused by the current situation, and we expect more certainty around those projects over the next 12 months.

Figure 8: New Supply and Recently Opened Properties

Hotel Values and Investment

Historical Market Value Changes

The indications for changes in hotel values in Israel are based on trading results from 2013 to 2019 and our view of trading prospects and investment appetite as of 31 December 2019.

2019 saw increased momentum with an overall increase in values of 5%, with growth recorded across all markets. Jerusalem and Tel Aviv hotels led the growth, which is not surprising given the impressive performance of hotels in both markets.

Figure 9: Percentage Change in Hotel Values (Based on US$)

Scenario Analysis: Estimating Future Values of Israeli Hotels

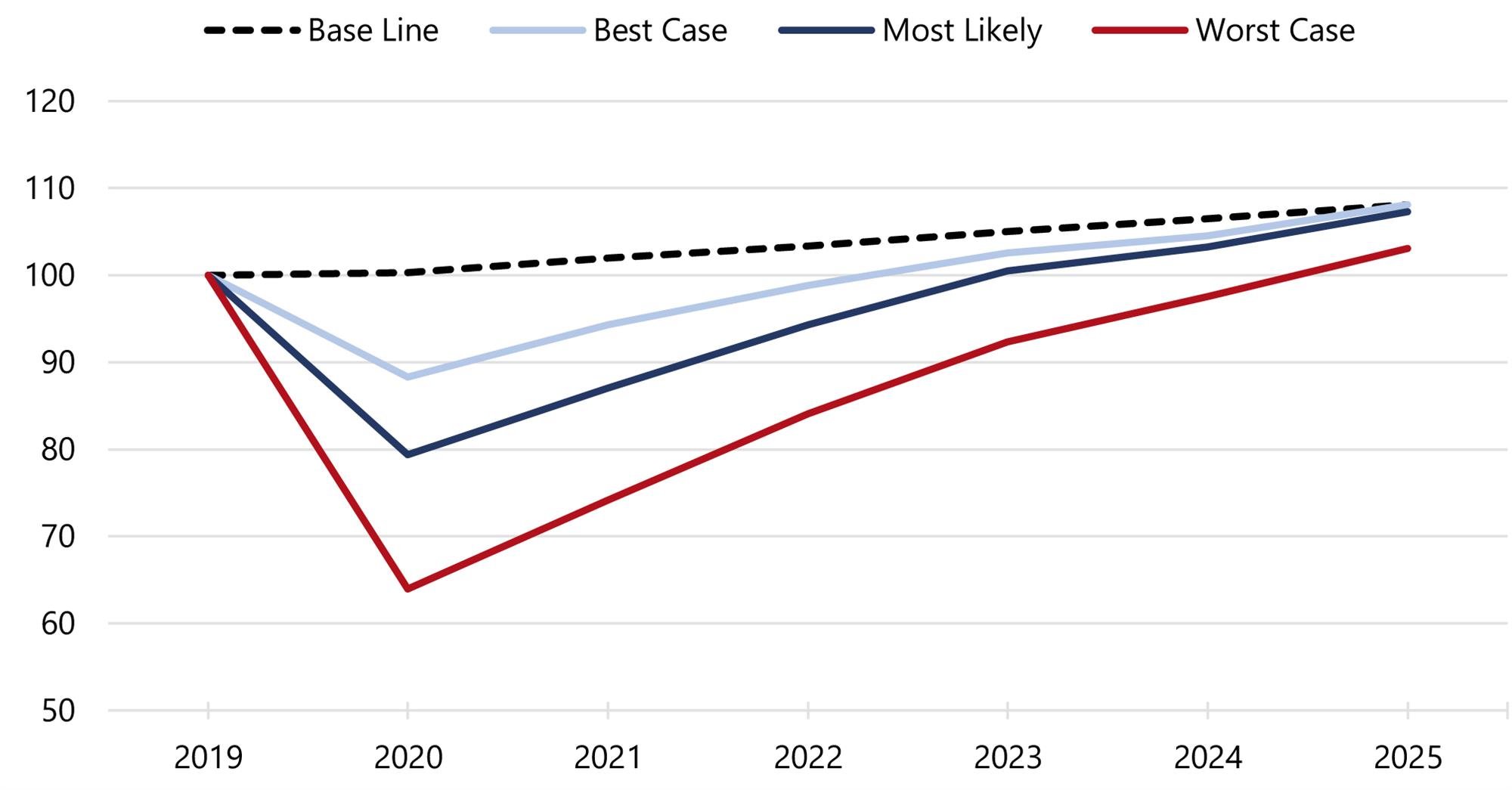

Looking forward, and to give some perspective in these uncertain times, we have modelled three scenarios addressing the range of potential impact on hotel values in Israel. Our model considers a base line and three alternative scenarios which reflect the range of potential impact on hotel performance. We stress that the impact of current conditions on an individual property will depend on the characteristics of the property, its market, and its location – some hotels might experience a stronger recovery and appreciation, while some may take longer to recover.

Similarly, creativity and flexibility are likely to be the fuel of the recovery. Hotels that will thrive after this crisis are likely to be those that embrace agile principles and rapidly understand customers’ evolving needs beyond the health and safety measures now being implemented. We consider that Israel’s history of volatility has not only demonstrated the value of being agile, but also how to succeed in such environments. We therefore remain cautiously optimistic when considering the Israel hotel industry’s ability to recover at an accelerated pace compared to other countries in the Mediterranean region.

Figure 10 illustrates our base line and valuation scenarios as described, leading to our conclusions of value in Figure 11. We stress that these are illustrative only and an actual valuation of an individual hotel may not produce the same results.

Figure 10: Scenario Analysis and Key Assumptions

| Baseline | Best Case | Most Likely Case | Worst Case |

| Stable market conditions ignoring impact of COVID-19. | Moderate declines in EBITDA. Decline is assumed to diminish over time as the market recovers. | Significant EBITDA impact in the first year. Degree of impact and decline to diminish over time as the market recovers. | Greatest negative EBITDA in the first year, followed by a slower recovery period. EBITDA does not return to baseline in the immediate future. |

Figure 11: Hotel Value Evolution (Index, 2019 = 1)

Source: HVS Research

| Best Case | Most Likely Case | Worst Case |

| Values fall by 5-10% in 2020 and return to pre-crisis levels in 2023/24. | Values fall by 10-25% in 2020 and recover by 2024/25. | Values fall by 25-35% in 2020 and recover by 2025 or later, depending on the recovery pace of international tourism. |

For context, the overall European market showed a 23% decline in value in the Global Financial Crisis in 2008-09 (please refer to our 2020 European Hotel Valuation Index report).

Conclusions

No-one knows the timeline as to how long this pandemic will last or the final net impact on the economy. What we do know is that the hospitality industry is extraordinarily resilient. Travel will return in the long run and we are cautiously optimistic when considering the Israel hotel industry’s ability to recover at an accelerated pace compared to other countries in the Mediterranean region. Although this crisis is unprecedented and still deeply uncertain, Israel’s hoteliers have had exceptional experience on how to thrive in periods of uncertainty.

Hotel values in Israel will remain depressed until EBITDAs ‘hit the bottom’ and there is evidence of recovery, but we strongly consider they will recover as cash flows improve and capital markets return to more traditional parameters. Last year saw a phenomenal increase in the number of visitors to Israel, and hoteliers will benefit greatly from persuading a proportion of them to return as quickly as circumstances allow to help spearhead the recovery of international demand.