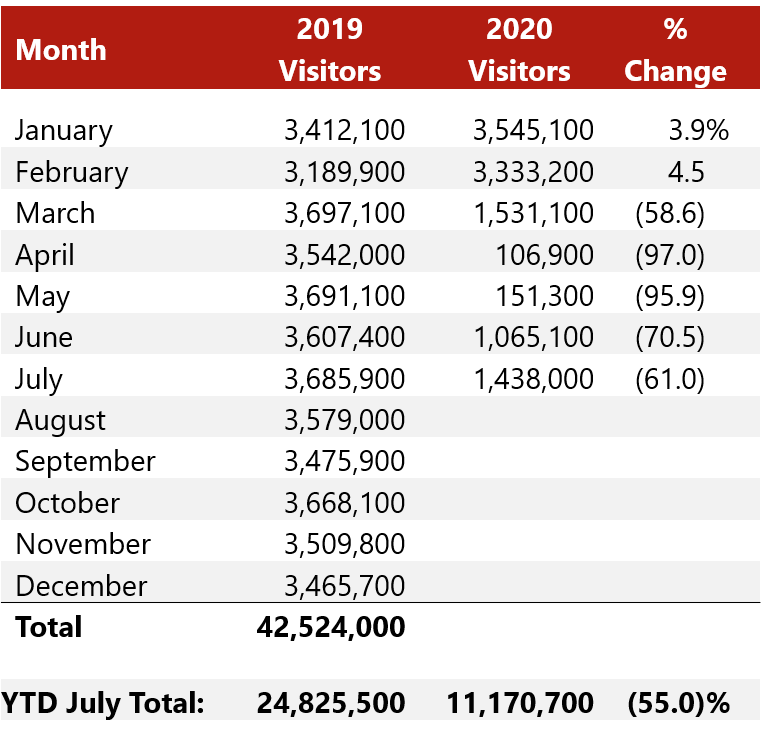

The Las Vegas Convention and Visitors Authority (LVCVA) reported that the number of visitors to Las Vegas in June and July of 2020 totaled 2,503,100, which represented a 65.7% decrease from 7,293,300 visitors in June and July of 2019. Visitors to Las Vegas in the year-to-date period through July 2020 totaled 11,170,700, a 55.0% decline from the 24,825,500 visitors during the same period of 2019. However, visitor numbers increased 35.0% from June 2020 to July 2020.

Las Vegas Visitor Statistics

Source: Las Vegas Convention & Visitors Authority

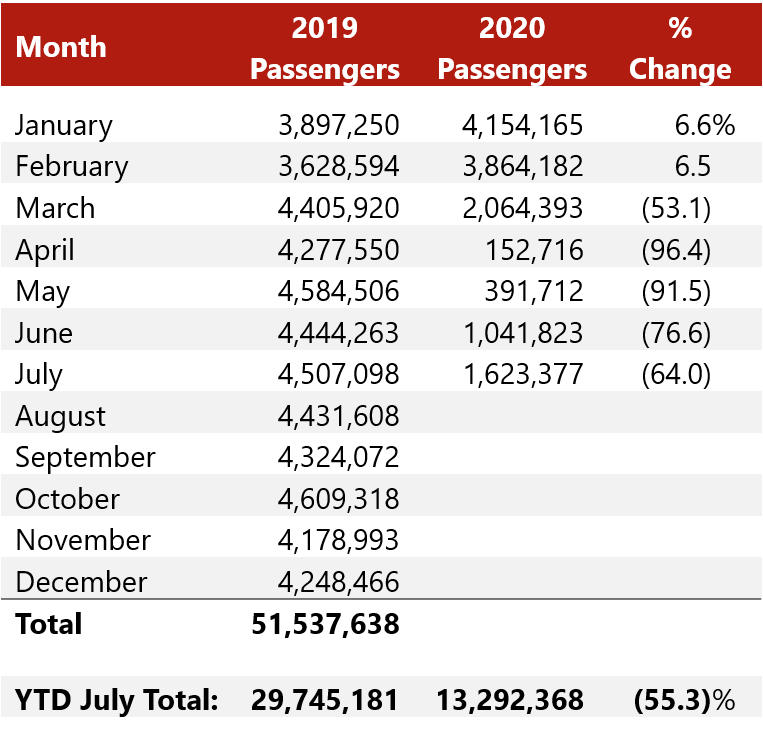

McCarran International Airport reported passenger traffic of 2,665,200 in June and July of 2020 combined, a decline of 70.2% from the 8,951,361 passengers in June and July of 2019. Mandatory and voluntary quarantines imposed on travelers from Nevada to certain other U.S. states, as well as foreign travel bans and mandatory quarantines imposed on international passengers deplaning from flights originating in the U.S., are serving as deterrents to travel to Las Vegas. Only 5,441 of the passengers that traveled through McCarren International Airport during June and July of 2020, or 0.2%, were traveling to/from international destinations. In comparison, approximately 7.4% of the airport’s 51.5 million passengers were classified as international passengers in 2019.

McCarran International Airport Passenger Statistics

Source: Las Vegas Convention & Visitors Authority

On a positive note, an August 11, 2020, report from travel-organizing app TripIt indicated that Las Vegas had the most U.S.-origin, round-trip flight reservations with a travel date between September 4 and September 8, 2020, that were made between January 1 and July 30, 2020. U.S. travel destinations, including Las Vegas, will continue to benefit if travel options for U.S. citizens to other countries worldwide remain limited.

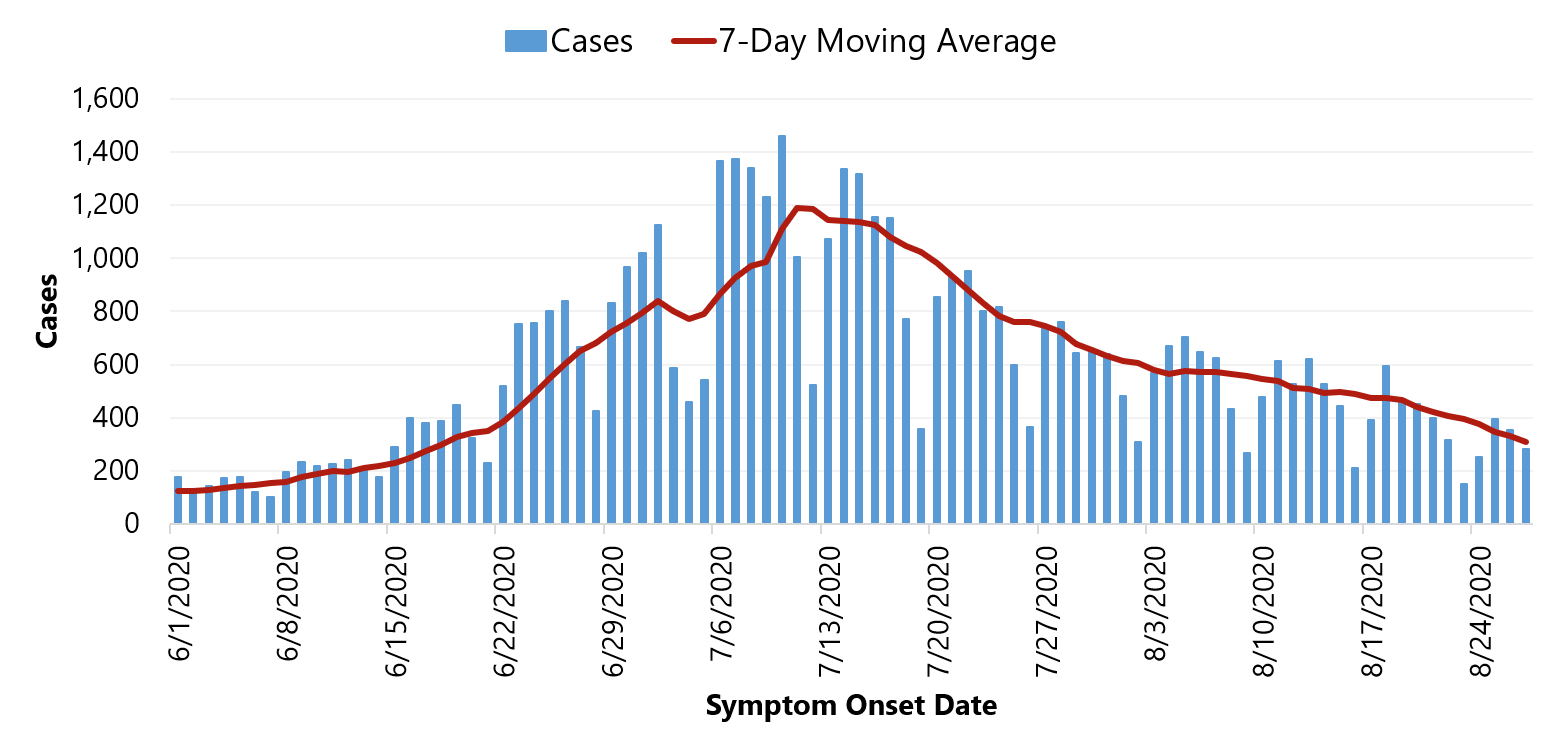

COVID-19 Cases

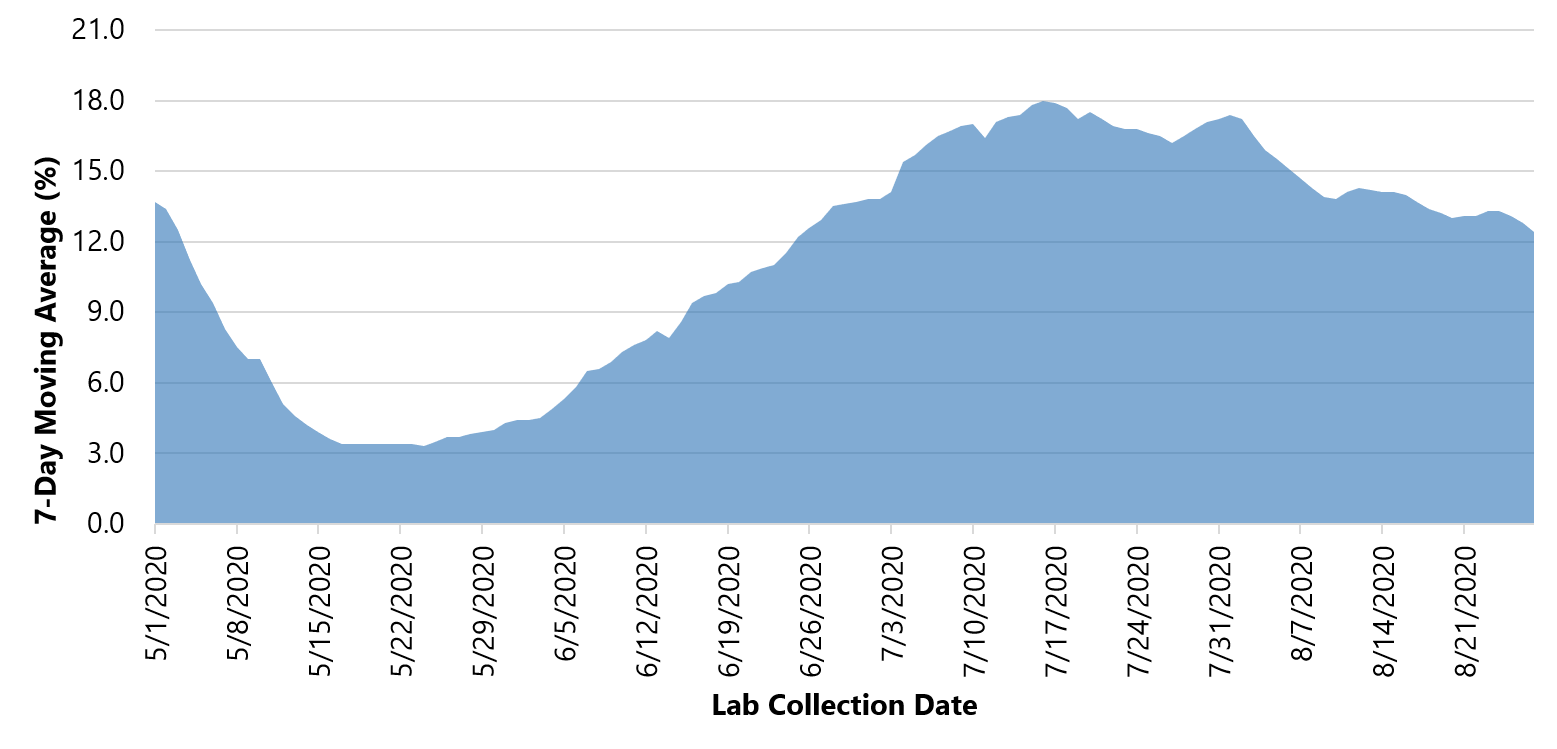

The number of COVID-19 cases and the seven-day average of positive results in Clark County increased subsequent to Nevada’s casinos reopening, but the initial surge has subsided somewhat with recent mitigation efforts. The number of new COVID-19 cases in Clark County peaked on July 10, 2020, with 1,462 cases. The surge in COVID-19 cases was a factor in the National Hockey League (NHL)’s decision to hold its playoffs in select “bubbles” of Canada; at one point, Las Vegas was considered as a potential host city for its 2020 playoffs.

Daily COVID-19 Cases – Clark County, NV

Source: Southern Nevada Health District

Percentage of People with Positive COVID-19 Viral Test Results – Clark County, NV

Source: Southern Nevada Health District

On June 29, Governor Sisolak issued a new directive mandating the use of facial coverings or masks in public locations, including inside casinos and other gaming properties, in an effort to slow the spread of COVID-19. On July 10, 2020, bars and bar-top areas inside restaurants, taverns, and casinos in certain Nevada counties, including the Clark and Washoe counties, which include Las Vegas and Reno, were closed given the excessive non-compliance exhibited by both bar businesses and patrons with the state’s coronavirus health/safety protocols and guidelines. Many casino bars, especially locals’ gaming properties, have slot machines embedded into the bar tops, some of which were converted to allow for stand-up play following the ban on July 10, 2020.

On August 3, 2020, Governor Sisolak revealed the state’s new long-term precision strategy to combat the COVID-19 pandemic, designed to track and target specific outbreak trouble spots without relinquishing gains made in other areas where mitigation is working better. The specifics of the plan include a weekly assessment all of the state’s 17 counties, according to three-level criteria for elevated disease transmission. The state’s COVID-19 response task force will review those criteria to gauge which counties are experiencing declining or advancing risk. If a county is seeing expanding risk, it will enter an assessment and review process that could result in changing the county’s mitigation level. In that assessment, the task force and county representatives will review metrics such as hospital and testing capacity, case investigation and tracing, and protection of vulnerable residents, such as nursing-home inhabitants, to determine what’s causing the spread and how to address it. That could lead to possible increased enforcement, shrinking permitted gathering sizes, and limiting occupancy for certain businesses.

Phased Openings

Boyd Gaming Corp., Caesars Entertainment Corporation, MGM Resorts International, and Red Rock Resorts, Inc. did not open all their Las Vegas properties initially when permitted on June 4, 2020, preferring to reopen select properties until demand ramped up and in order to gain insight into consumer behavior. Opening of the casinos provided some cash flow and also allowed operators the opportunity to begin implementing safety protocols and new procedures for employees and guests on a rollout basis.

- Boyd Gaming opened nine properties in Las Vegas initially (Orleans, Gold Coast, Suncoast, Aliante Casino, Cannery, Fremont, California, Sam’s Town, and Joker’s Wild). It is not clear when Boyd Gaming will reopen Main Street Station, Eastside Cannery, and Eldorado.

- Caesars Entertainment initially reopened Caesars Palace, Flamingo Las Vegas, and Harrah’s Las Vegas Hotel & Casino, followed by the Paris Las Vegas on June 18, 2020. No opening dates for several Caesars Entertainment properties (The Cromwell, Planet Hollywood, and Rio) have been announced.

- MGM Resorts reopened Bellagio, MGM Grand, New York-New York, and The Signature initially, followed by the Excalibur Hotel & Casino on June 11, 2020; the Luxor and The Shoppes at Mandalay Place on June 25, 2020; and ARIA, Delano, and Mandalay Bay on July 1, 2020. The Mirage opened on August 27, 2020. MGM Resorts has not indicated when the Park MGM would reopen.

- Red Rock Resorts has reopened Red Rock, Green Valley Ranch, Santa Fe Station, Boulder Station, Palace Station, and Sunset Station, as well as its Wildfire division properties. Red Rock Resorts is reportedly uncertain whether Texas Station, Fiesta Henderson, Fiesta Rancho, and the Palms will reopen.

Penn National Gaming has indicated that the Tropicana will reopen on September 17, 2020. After reopening in June 2020, the Las Vegas Sands Corp. announced in July that it would shut down The Palazzo’s 3,000-room hotel during midweek due to soft demand.

Health/Safety Measures

Casino operators have taken steps to provide a safer environment for employees and guests in accordance with government-mandated requirements. Gaming floors now look and operate differently than before the pandemic. Elements addressed by Las Vegas casino operators due to the COVID-19 pandemic include education, employee/guest health, physical distancing, cleanliness, and use of personal protection equipment. There also appears to be an increase in the availability of electronic table games (ETGs) in casinos.

Combating COVID-19 is an ongoing effort, and properties have taken steps in addition to requirements mandated by the State of Nevada and the Nevada Gaming Control Board. Some properties have incorporated thermal cameras or non-invasive temperature scans at entrances to screen and turn away those who exhibit high temperatures. However, there are no standards for how, or even if, Las Vegas casinos check their customers for fevers. The Nevada Gaming Control Board requirements only specify that temperature checks be given to hotel guests upon arrival, and different operators have different procedures. Preventive measures also include the increased availability of hand sanitizers/hand wipes, use of plexiglass, shutting down of machines, and spreading out of seats for players. Cashless gaming options continue to be explored, such as cashless payment technology that allows players to purchase casino chips using their debit card at table games.

Facilities/Amenities

Las Vegas resorts are limited to 50% capacity in hotels and on the gaming floors, and restaurant and retail offerings have been reduced. Not all facilities and amenities traditionally found at Las Vegas’ casino-resort properties are open, or they are open on a limited basis. Spas, theaters, convention centers, nightclubs, bars, and other facilities that are not permitted or are unfeasible to operate due to social-distancing guidelines continue to remain closed at this time. On July 27, 2020, MGM Resorts International notified the majority of its entertainment and sports division employees that they will be laid off effective August 31, 2020. Additionally, on August 14, 2020, the cast and crew of “Le Rêve” at Wynn Las Vegas was informed that the show is closing permanently.

Some operators have begun to adapt to the current conditions and are offering modified products that comply with health and hygiene guidelines (e.g., modified buffets are now available at Wynn Las Vegas, The Cosmopolitan, and the South Point). Other amenities, such as movie theaters, have begun to reopen. The Century-branded theaters inside The Orleans, Sam’s Town, Santa Fe Station, South Point, and Suncoast were the first to reopen in Las Vegas on August 14, 2020. The Regal theaters at Aliante, Boulder Station, Green Valley Ranch Resort, Red Rock Resort, and Sunset Station reopened August 21, 2020, and the Regal Palace Station reopened on August 28, 2020.

Gaming Demand

Gaming revenue in Clark County in June and July of 2020 was $1.1 billion, down 40.4% from $1.8 billion in June and July of 2019. The Clark County gaming market can generally be divided into three segments: the Las Vegas Strip, Downtown, and the balance of the county. The Las Vegas Strip segment experienced the largest year-over-year decline in June and July of 2020 (50.9%), followed by the Downtown segment (38.0%) and the balance of the county segment (16.5%), indicating that the Las Vegas casinos that cater primarily to those residents living in Clark County is recovering faster than those venues that are more reliant on demand from visitors to the market. It appears that the Las Vegas Strip segment will take longer than the local resident market to recover due to its relative exposure to international customers, domestic airlift, and meeting/group business. Additionally, as all entertainment options and amenities that contribute to make Las Vegas the iconic city that it is are not currently open/available, it is reasonable for some visitors to choose to just gamble at venues that are closer to home or do not require air travel. It is noted that traffic on I-15 near the California/Nevada border was reported by the Regional Transportation Commission of Southern Nevada to be down 16% during the first three weeks of August.

Generally speaking, gaming operators have reported that casinos have seen a relative increase in the number of players that are younger and have higher average spends per visit, as there is more to do in Las Vegas than in the guests’ hometowns due to ongoing restrictions. However, the pent-up demand from such patrons has been mitigated by other segments of the population that have greater concerns regarding the continuing potential for exposure to COVID-19, including a portion of the population that will wait for the development of a vaccine, effective treatment, or herd immunity, before resuming pre-pandemic activities.

It is incumbent upon operators to ensure that new players are converted into loyal customers who will continue to spend money after the health crisis ends. Operators should focus on younger generations becoming the mass customer for the destination in a post-pandemic Las Vegas and continue to offer promotions and incentives for these younger guests. It is still too early to determine what the long-term potential is for this customer base given the presence of pent-up demand, stimulus checks, and additional unemployment insurance benefits, but traffic from younger, high-worth visitors mitigates the absence of the segment of patrons that are more hesitant to return to casino gaming due to higher susceptibility to complications from COVID-19.

Midweek business in Las Vegas is soft at this time due to the lack of meeting and group travel; the LVCVA reported no convention attendance for the months of April through July 2020. The loss of meeting and group business combined with the absence of large events that drive visitation and demand (i.e., concerts, shows, and athletic events) has inhibited the market’s ability to fill rooms and increase gaming and other revenue Monday through Thursday, as reflected by Las Vegas Sands Corp.’s decision to close Palazzo midweek. Rescheduled and/or canceled events due to the pandemic include some of the city’s largest tradeshows: the Consumer Electronics Show, the auto industry’s SEMA Show, the Global Gaming Expo, and the Electric Daisy Carnival (EDC), which has been rescheduled for May 2021.

Hotel Performance

Total available rooms for Las Vegas in July 2020 was reported by the LVCVA to be 123,684, compared to 149,422 rooms available at the end of 2019. Occupied rooms in July 2020 was 1,633,400, 61.1% below what was recorded in July 2019. Total occupancy in July 2020 was 42.5%, weekend occupancy was 54.4%, and midweek occupancy was 36.9% for the month. Average daily rate (ADR) for the market in July 2020 was $104.39, 17.8% below what was achieved in July 2019, while RevPAR during the month was $44.37, down 61.6% from July 2019.

Opportunity for Improvements in Profitability

Operators appear to be examining and streamlining their operating structure to improve profit margins, despite the additional costs associated with the implemented safety measures. Numerous operators have indicated that they are adjusting labor usage, focusing on profitable segments, and/or making efforts to specifically target marketing and promotions on high-value patrons. A focus on profitable segments, such as high-worth clients, is especially important due to capacity restraints, particularly on weekends.

Construction Status

Construction of several major projects, including Allegiant Stadium, Resorts World Las Vegas, and Circa; the redevelopment of the former Hard Rock into the Virgin Hotel Las Vegas; and the expansion of the Las Vegas Convention Center, has continued through the COVID-19 shutdown period.

- Allegiant Stadium: Construction of the $2-billion Allegiant Stadium, the new home of the National Football League (NFL)’s Raiders, has been completed. The first public event that was scheduled at the new Allegiant Stadium, a concert by Garth Brooks on August 22, 2020, has been postponed until late February 2021. Additionally, the Raiders will play their home games during the 2020-21 season without fans, as ownership has decided that it is only fair or equitable that no fans be allowed for games this inaugural season since it will not be possible for all fans to attend games given the NFL’s current policy for the 2020/21 season. The Las Vegas Raiders are scheduled to participate in four prime-time nationally televised regular-season games at Allegiant Stadium this year, but the fate of the NFL’s 2020-21 season is far from certain.

The University of Nevada, Las Vegas’ football team is expected to eventually play the majority of its home games at Allegiant Stadium. However, UNLV will not be playing football this season as the Mountain West Conference has postponed fall semester sports in 2020. It has not yet been determined if UNLV football will return in the spring.

- Resorts World Las Vegas: Construction of the $4.3-billion, 3,500-room Resorts World Las Vegas, being built by Malaysia-based Genting Berhad, has continued through the pandemic, and the property is still anticipated to open in the summer of 2021. In June 2020, Resorts World submitted plans for a proposed passenger station and tunnel that could connect to the Las Vegas Convention Center’s underground transportation system currently under construction by Elon Musk’s the Boring Company. Wynn Las Vegas, located directly across Las Vegas Boulevard from the 88-acre Resorts World site, has submitted a similar plan. Resorts World Las Vegas will add to the Las Vegas market, as it is expected that the property will be able to eventually induce new demand to Las Vegas market due the numerous cross-marketing opportunities with its parent company’s businesses, which includes integrated resorts in the U.S., Malaysia, Singapore, the United Kingdom, and the Bahamas.

- Circa Las Vegas: Construction of the first five floors of Circa Las Vegas, the first new resort in Downtown Las Vegas since 1980, is expected to be completed and open on or around October 28, 2020. The remainder of the resort, essentially everything except the hotel tower, is anticipated to open before the end of the year. Circa is taking reservations for its sportsbook, expected to be one of the world’s largest. There are several sportsbook reservation options, including VIP single-seat cushioned chairs in front of the high-definition screen, plush recliners just behind the VIP seating, and booth-style seating.

- Virgin Hotel Las Vegas: Construction work at the former Hard Rock Hotel, which is being converted to a Virgin-branded property, remains on schedule and is slated for completion in November 2020. Property management has indicated that the ownership group is currently evaluating when to open the converted property because of pandemic-related regulations, market conditions, and event cancellations.

- Las Vegas Convention Center: Construction has continued on the 1.4-million-square-foot convention center expansion. The $980.3-million West Hall expansion of the Las Vegas Convention Center and its $52.5-million underground people-mover is more than 90% complete. The convention center expansion is anticipated to be completed by the end of 2020. The underground people-mover, expected to be completed by January 2021, will allow convention attendees to travel across the 200-acre convention center campus in under two minutes, free of charge, in all-electric Tesla vehicles. Plans are being considered for extensions of the Tesla-based underground people-mover system to Wynn Encore, Resorts World Las Vegas, and Allegiant Stadium.

Construction of the 17,500-seat MSG Sphere arena on the Las Vegas Strip was put on hold due to COVID-19 pandemic delays but has resumed. The project is now expected to be finished sometime in 2023. About 300 workers will be on site every day, and the project has shifted to completing all superstructure concrete and structural steel work, as well as building the steel domed roof. Once the venue is completed, it will feature a 160,000-square-foot wraparound screen. MSG Entertainment expects the MSG Sphere to be the busiest event venue in its portfolio, which includes Madison Square Garden and Radio City Music Hall in New York.

Conclusion

Las Vegas is facing a number of challenges due to the COVID-19 pandemic. The many attractions and activities that make Las Vegas unique are not available, people are more reluctant to travel, hotels and casinos are subject to capacity limits, and meeting and group business is non-existent. Pre-pandemic Las Vegas as a market had become much more dependent on business generated throughout the week and on revenues from sources other than gambling. As many operators in the market have moved away from being gaming-dependent, air travel to Las Vegas will need to increase, which will not happen until visitors feel safer, and are permitted to travel. Operators are being forced to focus on high-worth gamblers, those willing to spend more per visit on average, in the current environment.

Nevada has slowed the surge in new coronavirus cases, but Las Vegas continues to struggle through the pandemic. It appears that the Las Vegas Strip and Downtown segments will take longer than the local resident market to recover in terms of gaming revenues due to its relative exposure to international customers, domestic airlift, and meeting and group business. Health issues need to be controlled in order for air travel and visitation to rebound fully. With Las Vegas’ offerings limited during the pandemic, convenient regional properties may be viewed as safer and better options to potential consumers at this time and, thus, could lead to a long-term change in consumer behavior. It is unknown whether leisure customers will continue to return to a Las Vegas until the full range of facilities and entertainment options historically offered, and which have distinguished the market from neighborhood/regional gaming facilities, becomes available. The fundamentals that have made Las Vegas an iconic destination before the pandemic, including the variety of entertainment offerings, large amount of state-of-the-art meeting and convention space, and new resorts, will be a catalyst for the market’s eventual recovery.