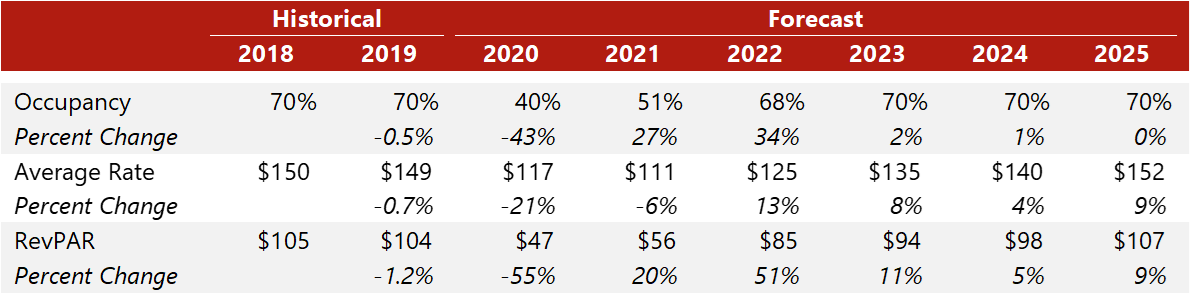

Amid a worldwide pandemic, the lodging industry is facing a downturn that is greater than the past two lodging-market declines combined. Occupancy declined for two years (roughly five points per year) following the landfall of Hurricane Katrina in August 2005, despite the decline in supply due to long-lasting storm damage. Because rooms in the city were limited and recovery work was protracted, average rate (ADR) increased in 2006 before normalizing in 2007. RevPAR for the New Orleans market declined 4.6% in 2006 and a further 9.7% in 2007, which were growth years for the top 25 U.S. markets. Conversely, the city fared relatively well during the 2008 recession, with RevPAR declining less than 12% in 2009, compared to the 19% decline in the top 25 markets; furthermore, RevPAR increased 14.5% in 2010 as the market benefited from the cleanup demand following the Deepwater Horizon oil spill in April 2010 and a subsequent government-mandated Gulf Coast advertising campaign. As such, our recovery forecasts are based more on leisure demand and group recovery, with a focus on the benefit of major events and the resumption of the festival schedule. By the end of 2020, occupancy had been impacted more than rate, and RevPAR was more than half of what was achieved in 2018 or 2019.

Major factors contributing to our forecast are summarized as follows:

- After Mardi Gras moved from March 8 in 2019 to February 25 in 2020, the mayor issued a “Stay at Home” order on March 20, 2020, as cases soared in the city.

- Phase 1 began on May 16 (non-essential businesses closed, but 25% capacity allowed for retail outlets and restaurants to remain open, and most all attractions closed).

- Phase 2 in September had stronger restrictions than state regulations (indoor and outdoor gatherings and bars were still limited to 25% capacity, but 50% capacity was allowed in restaurants, retail outlets, and casinos, and to-go alcohol sales were reinstated).

- Phase 3 gradually expanded capacities, per stages, as follows:

- Phase 3.1 on October 3 allowed 75% capacity for shopping, dining, and attractions, with only to-go alcohol sales allowed.

- Phase 3.2 on October 15 allowed for permitted special events, bars with food service at 50% capacity (25% capacity in those without food service), event venues at 50% capacity, and stadiums at 25% capacity or 500 people (whichever is less).

- Phase 3.3 added allowances for 100-person indoor gatherings and 150-person outdoor gatherings.

- The state and city moved back to Phase 2 just before Thanksgiving on November 24.

- On January 6, 2021, a modified Phase 1 was enacted given the rise in COVID-19 cases, and restrictions lessened slightly when the city moved into a modified Phase 2 on January 29.

- Leisure travel has been the fastest to recover. New Orleans benefits from its accessibility as a drive-to destination. Year-to-date airport passenger counts were down more than 65% from 2019 levels by November, versus the 40% decline in occupancy for the same period.

- Projections for the convention center show a slower group recovery for the city. The pace for 2020 was 21% of the three-year average; the Ernest N. Morial Convention Center was closed in April and served as a medical monitoring station until November. According to CVB officials, 2021 is still pacing slower, with only November and December ahead of pace to bring in more than 100,000 guaranteed room nights. However, a relatively normal convention year is projected for 2022, with both the spring and fall seasons exceeding the three-year pace average, and definite room nights surpassing 1,100,000 that year.

- Festivals are gradually being rescheduled. All parades leading up to Mardi Gras have been canceled in 2021, and no major festivals are taking place this spring or summer. Both the French Quarter Festival (usually held in April) and the New Orleans Jazz & Heritage Festival (usually held over the last weekend of April/first weekend in May) have been rescheduled for October 2021.

- Projections for occupancy and ADR are based on the initial return of leisure travel, albeit at a discount to prior years, as hotel operators compete for the limited demand in the early recovery period. Group and commercial travel should gradually follow. Major events, such as the NCAA Final Four in 2022 and Super Bowl LIX in 2025, should support rate recovery, with RevPAR increasing above 2019 levels by 2025.

- The transactions market nearly halted in 2020. The Sleep Inn Metairie sold for just over $76,000 per room, and the Royal St. Charles Hotel sold for less than $145,000 per key; an adjustment of 15% was applied to these sales in comparison with transactions completed prior to the impact of COVID-19. The Pelham Hotel also sold in 2020, but its allocated purchase price was not disclosed.

We are confident the greater New Orleans market will begin to recover with the wide distribution of a vaccine, relaxation of distancing protocols, and the return of leisure and group travel, as well as conventions and festivals. We continue to watch the factors affecting New Orleans lodging, and our many consulting engagements throughout the metropolitan area allow us to keep our finger on the pulse of the market. We update our forecasts monthly.

For more information, contact Lauren Hock or Adam Lair, MAI, MRICS, on our New Orleans team.