By Kasia Russell and Breanna Smith

Amid a worldwide pandemic, the Anchorage lodging industry continues to experience a downturn that is greater than the past two lodging-market declines combined. The major factors that have affected this market since the onset of the pandemic in March 2020 are highlighted below.

Key Factors in 2020

- Unlike many other U.S. markets, Anchorage did not initially experience the severity of the pandemic given that oil and gas operations, Alaska’s largest economic driver, remained essential; thus, no major layoffs or furloughs were instituted, and workers continued to travel to/from drilling locations. Furthermore, the tourism season had yet to begin, as the peak season for tourism in Alaska is during the warmer months of the year and is bolstered by cruises. However, by late April, cruise lines began suspending operations, and by mid-summer, virtually all 2020 sailings had been canceled. Prior to this, a record 1.44 million cruise-ship passengers had been projected to visit Alaska in 2020, with in-state spending estimated at approximately $800 million.[1]

- Many national parks and surrounding areas in the continental U.S. benefited from increased leisure travel in the summer of 2020; however, due to Alaska’s relatively isolated geographic location, the state, which is known for its outdoor parks and recreation, did not have the same opportunity. Moreover, also due to the state’s geographic location, more stringent travel restrictions were enacted in response to the pandemic. In June 2020, the State of Alaska implemented travel mandates requiring travelers from other states and countries to quarantine for 14 days and provide a negative COVID-19 test result upon arrival. While the regulations were revised in August 2020, visitors must still provide proof of a negative test result or must pay a fee to be tested upon arrival; at that point, they must quarantine at their own personal expense until the test results have been received. These mandates have further deterred visitors.

- The city’s budget/economy and extended-stay hotels have performed better than other hotel types, showing some resiliency during the pandemic, largely attributed to demand generated by the oil and gas industry, medical tourism, and food production companies. As oil and gas-related business has remained essential during the pandemic, travel to/from the drilling locations has continued. These trips often require pre- or post-travel stays near the Anchorage International Airport. Medical tourism has also provided demand to this segment of hotels given that residents of rural areas often travel to Anchorage for medical services. Furthermore, food production companies that operate on boats have negotiated contracts with hotels to quarantine employees immediately before and after travel to limit the spread of COVID-19 aboard the fishing vessels.

- Aside from the pandemic, in August 2020, the Trump administration began to finalize plans to open the Arctic National Wildlife Refuge to drilling. The area is believed to sit atop billions of barrels of oil but has historically been protected given that it is home to polar bears and caribou, among other wildlife. According to economic development officials, drilling activity would translate to greater economic activity in the area; however, critics cited that the drilling could result in lasting climate and environmental impacts. By early January 2021, the Trump administration had opened the refuge to oil leases. Reportedly, demand from major oil companies was low due to the ongoing lawsuits opposed to the program. State-owned organizations represented the majority of the demand, and nine ten-year leases were finalized.

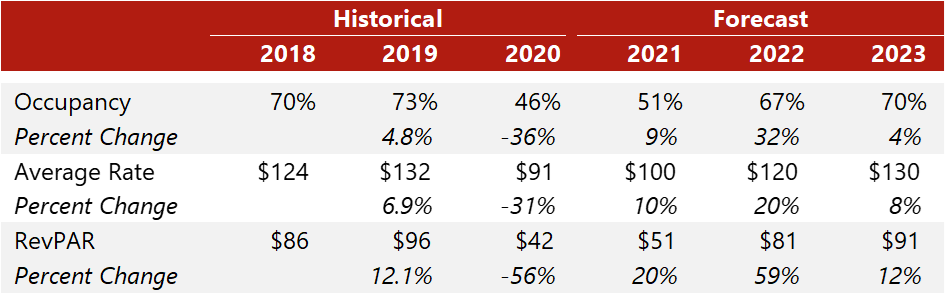

- Considering the COVID-19 pandemic and the above-mentioned factors that have influenced this market, we estimate that local hotel occupancy declined from the benchmark of roughly 73% in 2019 to 46% in 2020, reflecting a 36-point correction, while average daily rate (ADR) declined 31% ($132 to $91).

Looking Forward

- On October 30, 2020, the Centers for Disease Control and Prevention (CDC) issued a framework for a Conditional Sailing Order. The sailing order outlines requirements for resumption of cruise-ship operations. According to the framework, initial phases address testing and safety for crew members and passengers, followed by simulated voyages to test operations and certification for ships that have met the requirements. As of January 2021, major cruise lines had postponed their sailings until mid-May or June, all of which contribute to a reduced sailing season. However, cruise lines reported strong demand in the latter half of the year, as well as into 2022. Despite the expected return of demand, Alaska’s 2021 cruise season will likely be muted, with the outcome of the Passenger Vessel Services Act (PVSA) as a contributing factor.

- The PVSA is an important consideration for the cruise season, as the Act mandates that foreign-flagged ships (with more than 100 passengers) dock at one foreign port on any U.S. itinerary. Typically, that stop is in Canada for Alaskan cruises; however, Transport Canada has prohibited cruise ships to operate in Canadian waters throughout the pandemic.[2] Although these regulations were originally set to expire February 28, 2021, the ban was extended until February 2022 on February 6, 2021. Reportedly, officials have pledged to find a solution for the majority of the cruise lines that sail through Alaska. Some ideas have included changing the law, creating a temporary amendment, or negotiating a “technical stop” that will allow a ship to dock without any passengers disembarking. Moreover, most foreign nationals cannot travel to Canada for non-essential reasons because of the ongoing travel restrictions.

- UnCruise Adventures is one of the few cruise lines that will be allowed to sail to Alaska, as it sails under the U.S. flag. Additionally, cruise ships under 100 passengers are permitted to sail; however, according to tourism representatives, the smaller cruise ships do not have the same economic impact. In addition to cruise operations, the State of Alaska created a Return to Cruise Committee to help address challenges on land, which include where tourists will be allowed to visit, guidelines for excursions, and how to manage a potential outbreak.

- Plummeting oil prices over the last several years and especially during the last nine months of the COVID-19 pandemic have resulted in a nearly $2-billion state budget deficit. Roughly 16% of the state’s annual budget is funded through oil-related taxes, including a production tax, corporate income tax, oil and gas property tax, and royalties. Although oil prices showed signs of recovery in December 2020 after the announcement of a viable vaccine, a full recovery is not expected to take hold until demand for oil returns to pre-pandemic levels, resulting in further economic challenges.

- Following the inauguration of President Biden, the Biden administration imposed a temporary moratorium on all oil and gas leasing activities in the Arctic National Wildlife Refuge. The executive order directs the Interior Department to provide a new analysis of its potential environmental impacts of the oil leasing program. Given that the oil leases had only been finalized in the days prior to the executive order, any potential development plans for drilling activity were in the early development phases.

- A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from pandemic restrictions, and the widespread distribution of the vaccine should be well underway. Given the impact of the pandemic on major metro areas, Anchorage’s occupancies did not exceed 60% during the summer months; in 2021, we expect summer occupancy to reach 65% across the market, although this assessment remains highly uncertain given the extension of Canada’s cruise-ship ban. In a normal year, Anchorage experiences occupancy levels near 90% in the summer.

We are confident the Anchorage market will rebound upon the wide distribution of a vaccine, the retirement of group meeting restrictions, and the resumption of cruise-line operations. We continue to watch the factors affecting Anchorage lodging, and our consulting engagements throughout the area allow us to keep our finger on the pulse of the market.