Manhattan Lodging Overview

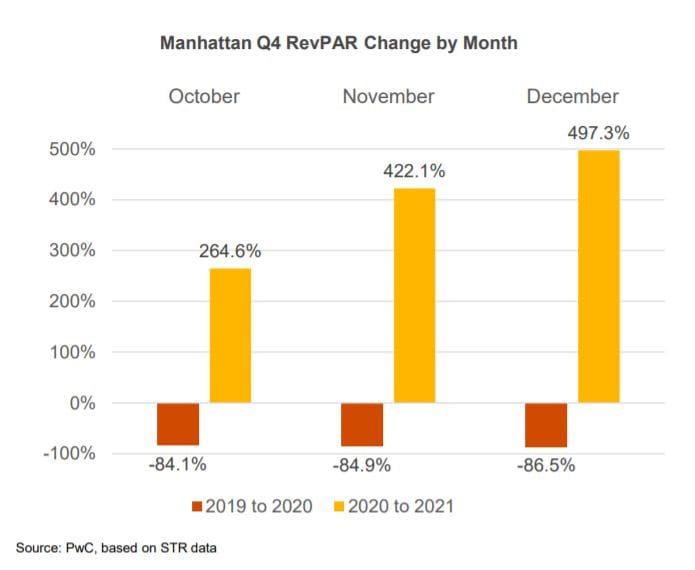

Increases in occupancy, ADR and revenue per available room (“RevPAR”) accelerated across Manhattan during the fourth quarter, as vaccination levels increased across the city during second half of the year and the city continued to reopen following the depths of the pandemic. Fourth quarter RevPAR experienced a year-over-year increase of 389.1 percent, heavily weighted to performance during the last two months of the year.

“While RevPAR continued to rebound throughout 2H 2021, November and December showed the most significant year-over-year increases. However, omicron’s impact on hotel metrics in Manhattan had yet to surface by year end, and early indications suggest that hotels will experience a setback from initial expectations of Q1 2022 performance as a result of this variant of the virus.” — Warren Marr, Managing Director, PwC

RevPAR increased 389.1 percent year-over-year during the fourth quarter of 2021, as both occupancy and average daily rate (“ADR”) benefited from Manhattan COVID-19 protocols being loosened, enabling offices, restaurants and tourist destinations to more fully function with either mask mandates or vaccination requirements. Year-over-year increases in RevPAR were highest in December – up 497.3 percent. With overall occupancy for the quarter at 69.2 percent and ADR at $292.98, Manhattan RevPAR nearly doubled for the year overall, increasing from $67.95 in 2020 to $130.88 in 2021.

Of the four market classes tracked, upper upscale properties exhibited the most notable year-over-year increase in RevPAR – up 457.4 percent to $186.85 for the quarter, driven by a 196 percent increase in occupancy and an 88.3 percent increase in ADR. For luxury hotel properties, where occupancy grew by 202.4 percent and ADR experienced an increase of 82.9 percent, Q4 RevPAR finished the quarter up 452.9 percent to $430.65.

Upscale and upper midscale properties posted relatively lower, but still significant increases in RevPAR of 288.1 and 255.3 percent, respectively. With increases in occupancy of 94 and 83.5 percent, respectively, RevPAR finished the quarter at $156.37 and $149.15, respectively.

Of the five Manhattan neighborhoods, all experienced year-over-year increases in RevPAR with occupancy and ADR growing across the island. Midtown East had the largest increase in RevPAR – up 697 percent, driven in large part by a 286.2 percent increase in occupancy year-over-year. Lower Manhattan RevPAR grew at 416 percent, driven by a 134.6 percent increase in ADR and 119.9 percent increase in occupancy. Midtown West and Midtown South posted increases of 411.3 and 305.9 percent, respectively. Of the five Manhattan neighborhoods tracked, Upper Manhattan had the lowest increase in RevPAR – up 261.4 percent.

During the fourth quarter, RevPAR at full-service hotels had a more significant percentage increase in occupancy and room rates compared to limited-service hotels. With year-over-year increases in occupancy of 149.9 and 73.8 percent, respectively, and increases in ADR of 111.8 percent and 92.2 percent, respectively, RevPAR increased 429.2 percent for full-service properties, while limited-service hotels saw an increase of 234 percent over the same period.