By Katy Black

Equity yields and discount rates remain at or below pre-COVID levels; however, rising debt costs will result in changing investor return expectations.

HVS continually tracks the discount rates and equity yields for the assets on which we consult. In the case of hotels that were sold near the date of our valuation, we were able to derive the equity yield rate and unlevered discount rate by inserting the ten-year projection, total investment (purchase price and estimated capital expenditure and/or PIP), and debt assumptions into a valuation model and solving for the equity yield.

Equity yield is the rate of return that an equity investor expects over a holding period. The equity yield specifically considers a long-term holding period (generally ten years), annual inflation-adjusted cash flows, property appreciation, mortgage amortization, and proceeds from a sale at the end of the holding period. Most importantly in today’s environment, the equity yield rate considers the effect of debt financing on the cash flow to the equity investor.

The total property yields (discount rates) presented reflect the “free and clear” internal rate of return to an all-cash purchaser, or a blended rate of debt and equity return requirements. The discount rate takes into consideration the degree of perceived risk, anticipated income growth, market attitudes, and rates of return on other investment alternatives, as well as the availability and cost of financing.

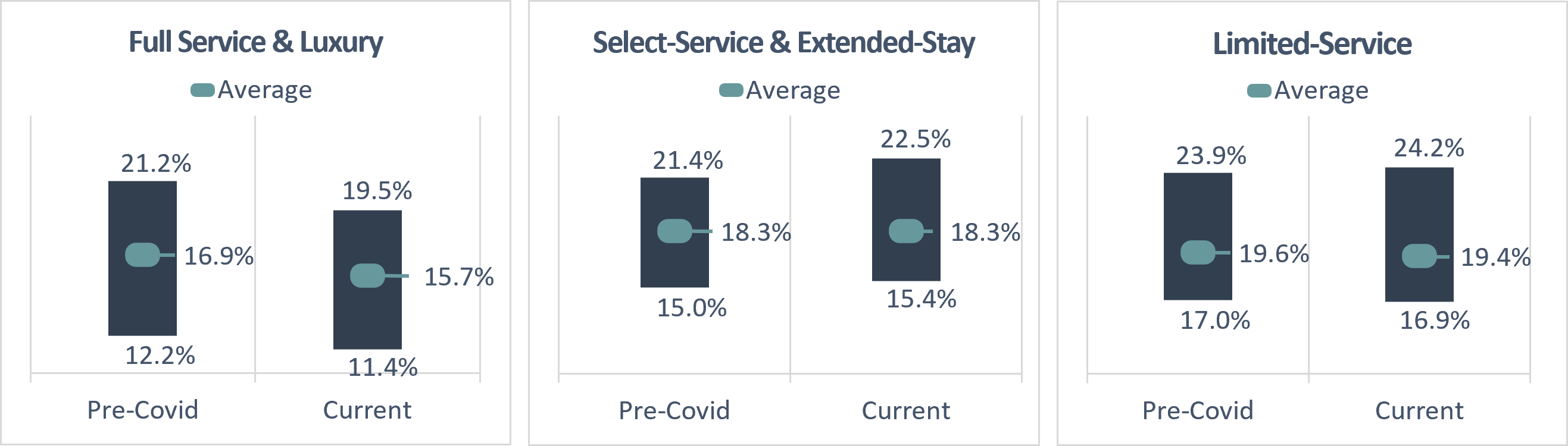

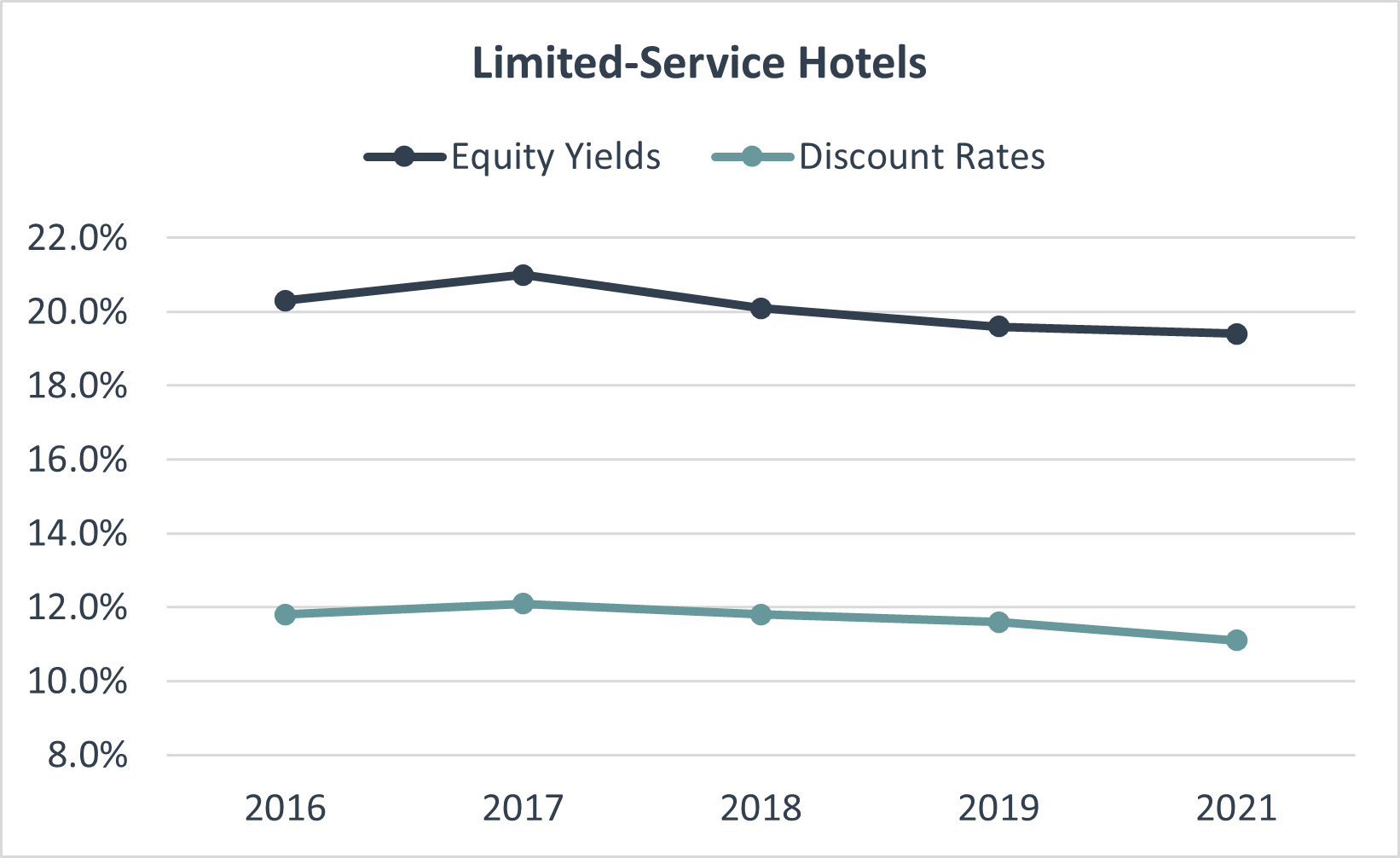

The following charts summarize the range of equity yields and discount rates indicated by hotel sales. We note that there tends to be a lag between the sales data and current market conditions; thus, the full effect of the change in the economy and capital markets may not yet be reflected.

Source: HVS

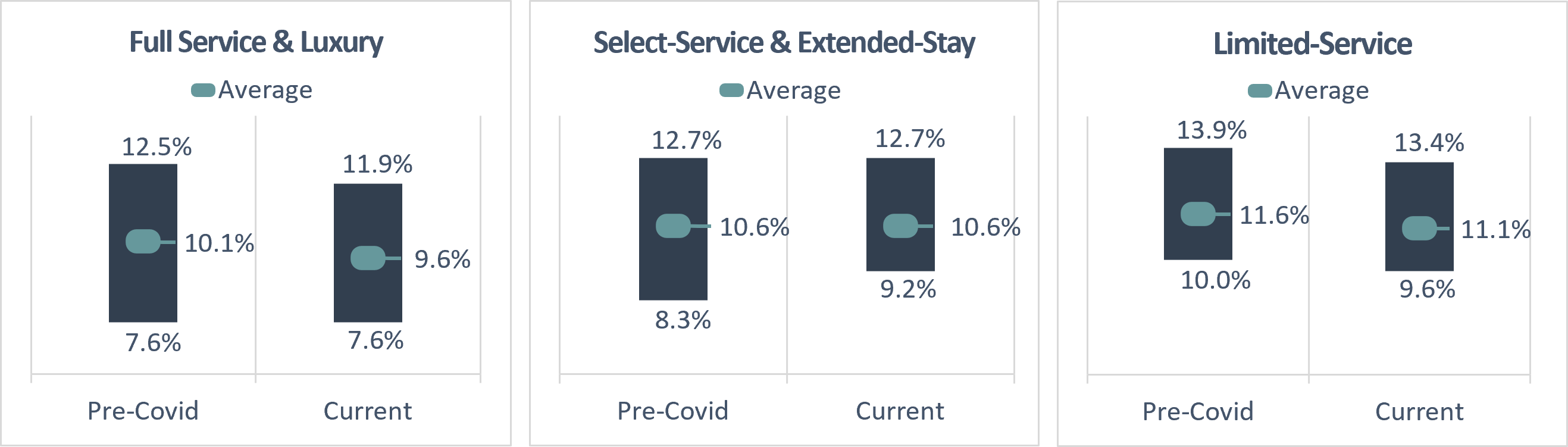

Discount Rates Derived from Hotel Sales

Source: HVS

In our most recent review, we found that equity yield rates, on average, have shown a continued decline in the full-service and luxury hotels sector, as well as the lower-tier limited-service sector, with the select-service and upscale limited-service/extended-stay sector showing stability. In today’s environment, the downward pressure on equity yields is being largely driven by rising debt costs.

Equity yield rates were notably lower for full-service and luxury hotels, averaging 15.7% currently, which is 120 basis points below the 16.9% level recorded pre-COVID. This decrease was driven largely by a decline in the number of transactions and an increase in transactions of high-end hotels in well performing markets, such as Scottsdale and coastal resort markets. More than 30% of the transactions, which collectively had an average equity of 13.9%, were located in these areas. After removal of these transactions, the average was 16.6%, which is only slightly below the pre-COVID equity yield average.

Equity yield rates for the select-service and upscale limited-service/extended-stay hotels currently average 18.3%, which is in line with the pre-COVID level. The average equity yield rate for lower-tier limited-service hotels similarly showed a very modest decline from 19.6% to 19.4%.

Overall discount rates (total property yields) similarly declined for the full-service and luxury hotels, as well as the lower-tier limited-service category, while holding steady in the select-service and upscale limited-service/extended-stay category. Total property yields are averaging 9.6% for the full-service and luxury category. Higher levels of 10.6% for select-service and upscale limited-service hotels and 11.1% for lower-tier limited-service hotels were recorded.

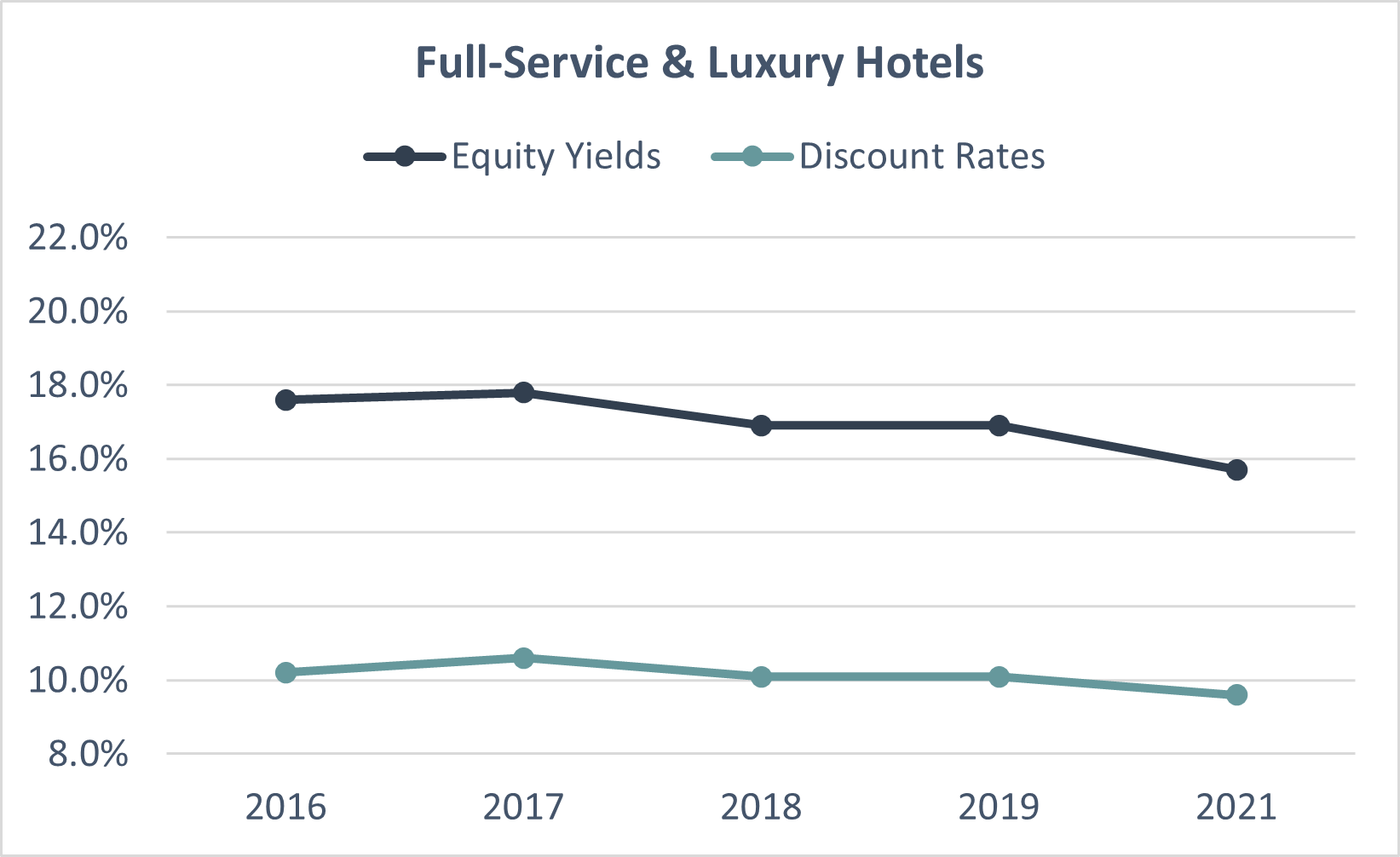

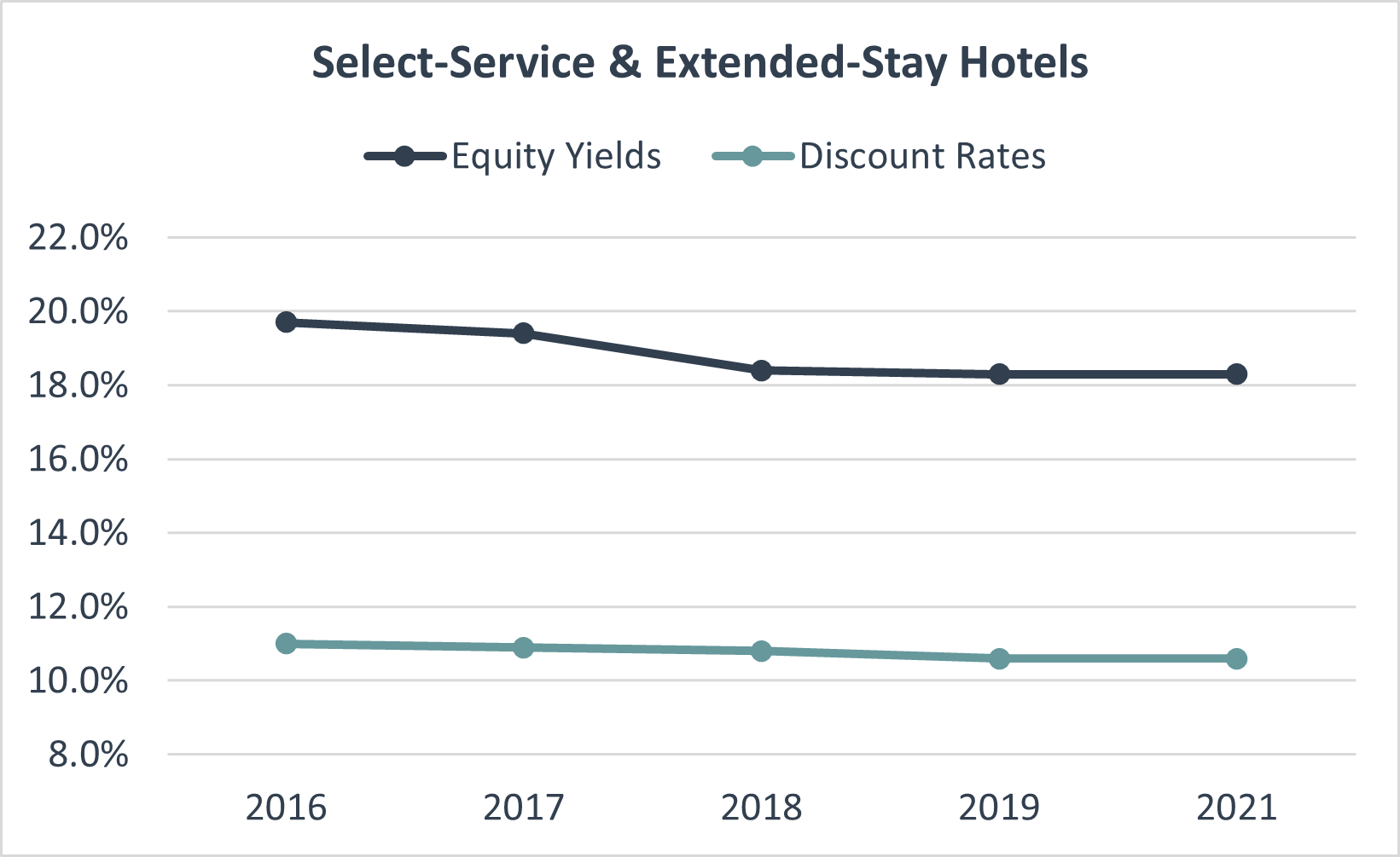

The charts below illustrate historical trends for both equity yields and discount rates by hotel service level. It is important to note that sufficient data were not available for 2020.

Overall, rates of return remain well below 2016 and 2017 levels. It is our expectation that as interest rates increase, the availability of debt becomes more challenging, and loan-to-value ratios compress, equity yields will either hold steady or decrease slightly, while overall discount rates will likely trend upward. However, the rates of return will ultimately be influenced by individual asset and market characteristics.