By Eileen Bosworth, Kirsten Z. Smiley

When Disneyland Resort, Anaheim’s crown jewel, was forced to close in 2020 at the onset of the COVID-19 pandemic, area hotels faced some of the greatest demand losses in the nation. The park system welcomed back its local fanbase in 2021 with the introduction of a new reservation system. Once Disney attendees were more familiar with the park’s new reservation system, which requires advance planning and makes it more difficult to book same-day tickets, leisure demand rebounded, spurring double-digit ADR growth in 2021 and 2022.

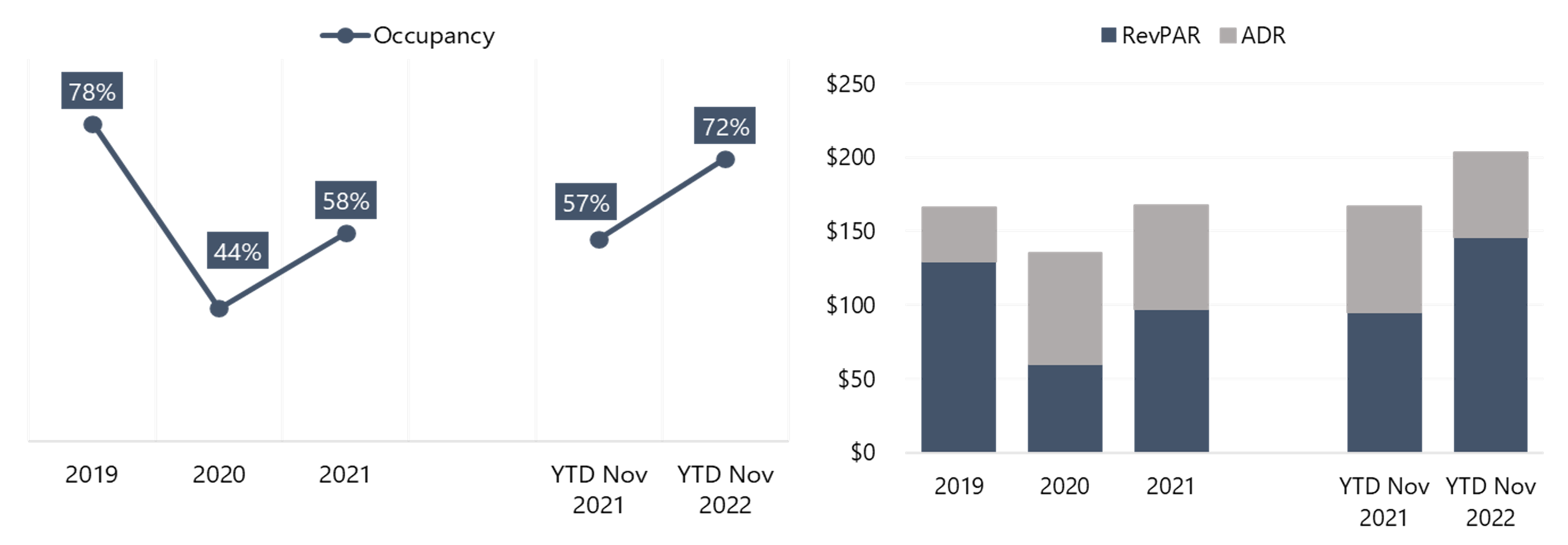

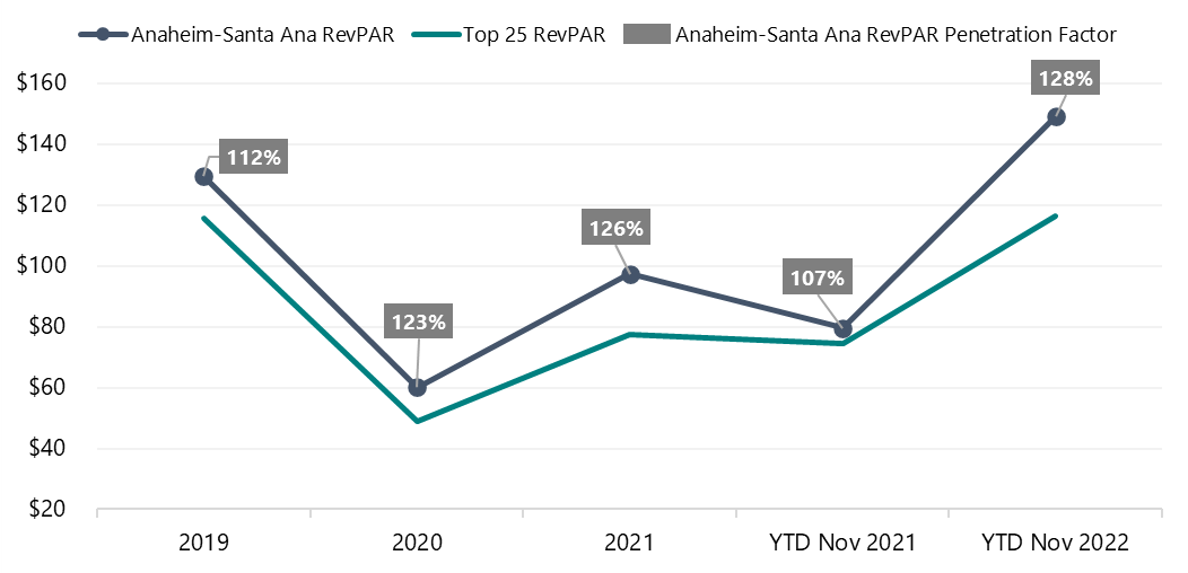

However, the Anaheim-Santa Ana hotel market has not caught up to pre-pandemic occupancies. In addition to reduced Disneyland ticket availability and a muted convention calendar, local hoteliers have struggled to meet the surge in demand due to a lack of staffing, as the local employment base has been affected by the prolonged Disneyland closure. According to market participants, many places shuttered or laid off workers because Disney closed, and many area workers subsequently moved or found other employment, resulting in a smaller workforce for local hotels. As a result, in 2021, both occupancy and RevPAR performed at roughly 75% of the level achieved in 2019. Despite this lag in demand, overall hotel revenue rebounded rapidly as ADR soared to never-before-seen heights, ending November 2022 more than 20% above 2019 levels.

Anaheim-Santa Ana Hotel Trends

The question remains whether Orange County hotels will have to adjust to below-pre-pandemic occupancy levels, as ADRs are unlikely to decline. With a U.S. recession likely to set in during early 2023, a potential future gap in pricing expectations may affect Orange County hotels in the near future. Disney visitation and Anaheim-Santa Ana hotel stays became more expensive in 2022, and customers and businesses have become more price sensitive during past recessions. With a possible looming recession, area hoteliers reported that leisure travelers, especially larger families, have begun to push back on rate increases; overall, however, the higher rates have not deterred the loyal fanbase from the parks. Despite the economic uncertainty, leisure demand is expected to remain strong in the near term, driven by the centennial celebrations at the Disney theme parks in 2023.

Disney Centennial

In honor of the 100th anniversary of the Walt Disney Animation Studios founding, the worldwide Disney 100 Years of Wonder celebration kicked off on January 27, 2023, with the “Wondrous Journeys” and “World of Color – ONE” nighttime shows, to be followed by the “Magic Happens” parade on February 24, 2023. Additionally, the park will feature special decorations, limited-edition merchandise, and novelty food offerings. Attendance is expected to surge to record levels this year given the strong brand following.

“Disneyland will never be completed. It will continue to grow as long as there is imagination left in the world.” ― Walt Disney

Major Development Projects in Anaheim

Some of the major developments currently underway or recently completed are highlighted below.

Recently Opened

- Star Wars: Galaxy’s Edge opened on May 31, 2019, at Disneyland Park.

- The highly anticipated Avengers Campus, a Marvel Comics-themed area, opened on June 4, 2021, at Disneyland California Adventure Park.

- Mickey & Minnie’s Runaway Railway, a trackless dark ride for all ages, opened on January 27, 2023, at Disneyland Park.

Nearing Completion

- Mickey’s Toontown will feature the reopening of CenTOONial Park on March 8, 2023, with new play areas and a showpiece Mickey Mouse fountain.

Under Construction

- The Indiana Jones Adventure ride in Adventureland at Disneyland Park has been closed for renovation since January 9, 2023, and should reopen in the spring of 2023.

- The 115-acre ocV!BE, a mixed-use development in Anaheim anchored by the Honda Center, is scheduled to partially open in 2024, with full completion by 2028. The project will include a new 5,700-seat concert venue, more than 30 restaurants, 1.1 million square feet of office space, 550 hotel rooms, 230,000 square feet of retail space, and roughly 1,700 housing units.

- Downtown Disney’s updated western portion will feature new restaurants and retail offerings, anticipated to be completed by 2025.

Pending Approval

- On March 25, 2021, the Disney Company announced its major, long-term expansion plan known as DisneylandForward. Projects include a new integrated experience for guests on the current Toy Story Parking Lot, to feature restaurants, hotels, live music, shopping, ticketed shows, and theme park experiences modeled after the popular Disney Springs at Walt Disney World Resort in Orlando. The plans also include the creation of a new parking hub with upgraded accessibility for hotels and businesses located along Harbor Boulevard and Disney Way, effectively shifting the park further east.

Canceled

- The Angel Stadium project, originally planned to include 2.7 million square feet of office space, over 5,000 apartments, and in-stadium improvements, was canceled in 2022 due to a legal dispute.

Convention & Group Business Trends

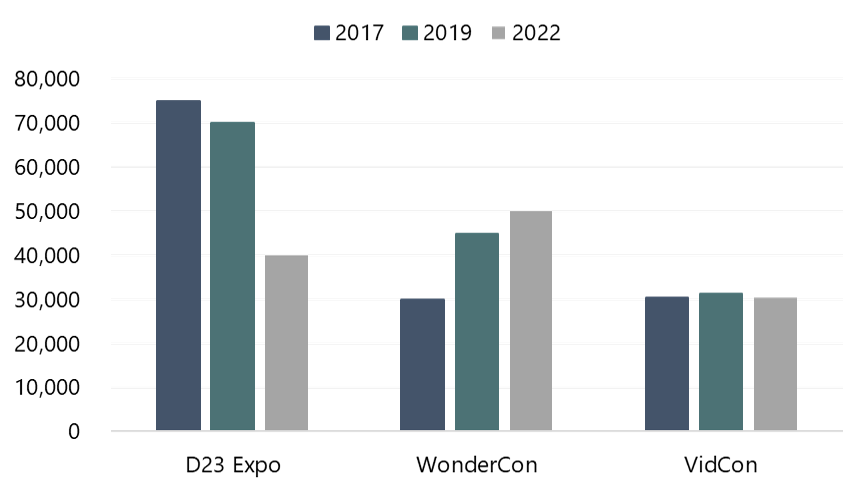

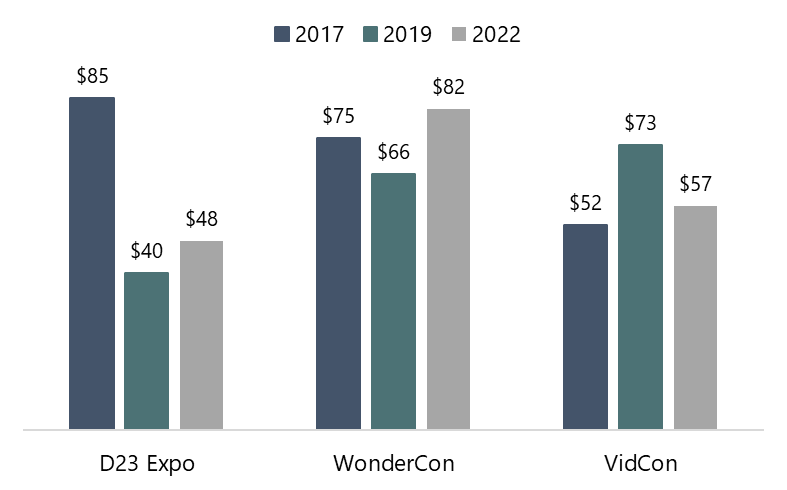

The Anaheim Convention Center (ACC) reopened on April 23, 2021, after the COVID shutdowns. However, major events, such as National Association of Music Merchants (NAMM) and Natural Products Expo West, did not reoccur until 2022, and they attracted lower attendance than expected. NAMM is scheduled to return in April 2023 and will move back to its typical event month of January in 2024. While these legacy events recorded lower attendance, representatives at Visit Anaheim reported that fan-type conventions, such WonderCon, VidCon, and Disney’s D23 Expo, boasted higher-than-anticipated attendance in 2022, illustrating a positive trend among fan-based events.

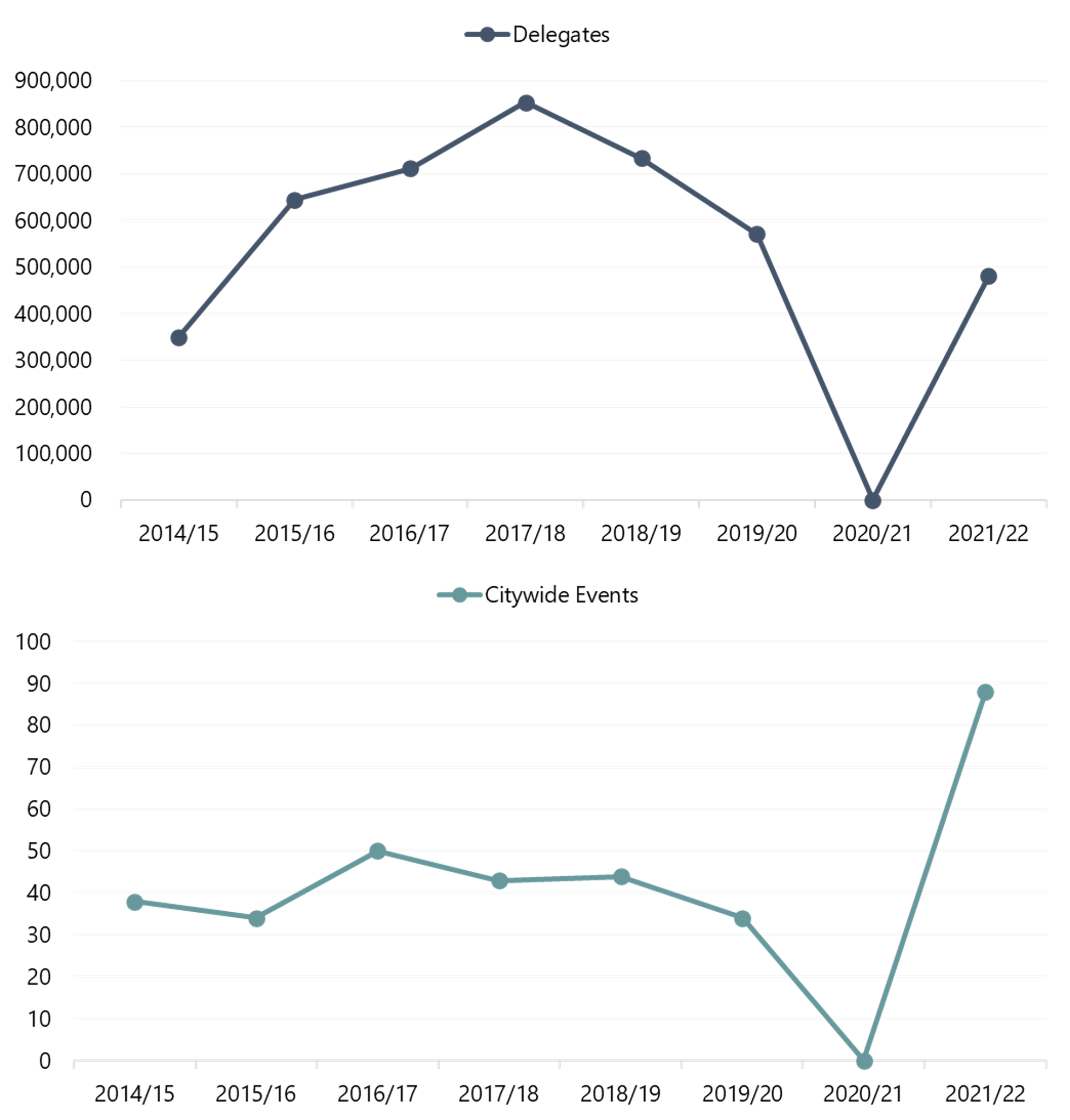

The following tables highlight historical attendance figures for some fan-based events at ACC, as well as overall citywide event statistics.

Source: Visit Anaheim

Economic Impact (Millions)

Source: Visit Anaheim

Citywide Event Statistics

Source: Visit Anaheim

According to Visit Anaheim representatives, group demand is estimated to be 60–65% of 2019 levels in 2022. Due to the typical booking window for major events and the potential economic headwinds for 2023, group demand is expected to reach roughly 75% of 2019 levels in 2023 and should recover fully by 2025, which illustrates the prolonged demand challenge that Anaheim convention-focused hotels are facing.

Supply Changes

Recent Hotel Openings and Re-brandings The Anaheim area has experienced a notable uptick in the construction or rebranding of upscale and luxury hotel properties, as listed below.

- Staybridge Suites Irvine John Wayne Airport opened in June 2020

- JW Marriott, Anaheim Resort opened in August 2020

- The Westin Anaheim Resort opened in June 2021

- Hotel Lulu, BW Premier Collection rebranded from a Red Lion in May 2021

- Dual-branded Hilton Garden Inn and Home2 Suites by Hilton Anaheim opened in the summer of 2021

- Element by Westin Anaheim Resort Convention Center opened and sold in 2021

- Element by Westin Irvine opened in June 2022

- Viv Hotel, a Tribute Portfolio Hotel, opened as a Radisson Blu in 2020 and rebranded in August 2022

New Supply The market experienced tremendous supply growth in the past decade, but the new supply pipeline has shrunk since the onset of the pandemic. The only upcoming new inventory in Anaheim is the Villas at Disneyland Hotel & Timeshares, a 350-unit timeshare property that is highly anticipated by many Disney fans.

High-Profile Transactions

Several noteworthy transactions have occurred in Orange County since the beginning of 2021.

- In 2021, the newly opened Element by Westin Anaheim Resort Convention Center was reportedly sold for over $60 million.

- The 252-room Montage Laguna Beach, which sold at roughly $2,600,000 per key in 2022, set a record in the nation.

- The Fashion Island Hotel sold for $145 million in February 2022, and the Hotel Irvine Jamboree Center sold for $133.6 million in August 2022. Both assets were owned by the Irvine Company. The Fashion Island Hotel’s leasehold interest was sold, and the property will be rebranded to a Pendry Hotel after substantial renovations, while the Hotel Irvine Jamboree Center is now wholly owned by Hyatt and will be rebranded back to a Hyatt Regency, after becoming independent in 2015.

Conclusion

Despite the looming concerns of a recession, the outlook for the Anaheim market is optimistic given the ramp-up of new Disneyland attractions, the centennial celebrations, and the gradual return of major conventions, including the promising trend of fan conventions. Other positive factors that bode well for the market’s recovery include the strong population base in the Los Angeles Basin and other major development projects in Anaheim such as ocV!BE.

Our team constantly monitors the Anaheim-Santa Ana hotel market, and our many consulting engagements throughout the greater area keep us abreast of the latest trends and shifts in the market. We update our forecasts monthly.

For more information, contact Kirsten Smiley, Luigi Major, or Marcus Lee of HVS Los Angeles or Eileen Bosworth of HVS Portland.