By Rachel Roginsky

Despite a slow start in the first Quarter 2022, the Boston & Cambridge lodging market ramped up quickly, and by year-end, the Revenues Per Available Room (RevPAR) reached a 90% index compared to its 2019 (pre-covid) top-line performance. Like many urban gateway cities, the city struggled in its recovery from the negative effects of the pandemic in 2021, as compared to other cities located in warmer climates, which showed strong recoveries one year following the outbreak of Covid in March of 2020. Yet despite the slower recovery, in 2022, leisure demand came roaring back in Boston, while corporate and group travel picked up steam starting in Q2. One of the missing links to a full recovery in Boston was international travel which was subject to federal travel restrictions but has recently begun to open up. Despite sizeable year-over-year increases in occupied room nights in 2022, the actual occupancy metrics remained behind 2019 due to the substantial increases in lodging supply (available rooms) in 2021 and 2022. However, hotel guests in all segments of demand were paying premium room rates and as a result, the average daily rate (ADR) in Boston exceeded the city’s pre-covid ADR. Given the trajectory of the recovery in 2022, owners and operators are optimistic that favorable trends will continue through 2023. The expectation is that 2023 will feel more like 2019 in terms of overall travel in the Boston market.

2022 Retrospective

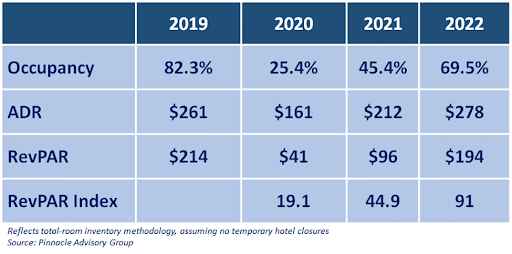

The Boston & Cambridge lodging market had an occupancy of 45% in 2021, only 55% of its level in 2019. By yearend 2022, occupancy increased to 69.5%, representing an 84% index to 2019. The market’s ADR has recovered at a faster pace than its occupancy, climbing to $279 in 2022, a 31% increase over 2021 and a 7% premium to 2019 levels. As a result, the market’s revenue per available room (RevPAR) was 90% of its level in 2019. By comparison, the U.S. lodging market’s RevPAR in 2022 was 105% when indexed to 2019. The country’s top-25 markets reached 66.5%, an ADR of $173.35 and a RevPAR of $115.27, according to STR. Through year-end 2022, the top-25 market’s RevPAR was 100% when indexed to 2019.

A Late Start

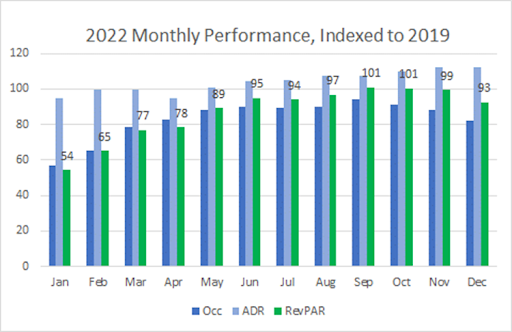

The recovery did not begin to take shape in Boston until late spring of 2021. In January 2021, the RevPAR index (to 2019) was 20%. By December 2021, the RevPAR index climbed to 72%, with a yearend average of 44%. Unfortunately, this upward trend at the end of 2021 took a backward turn due to the onset of the Omicron variant which once again, slowed the recovery in early 2022. Starting in May of 2022, the RevPAR index climbed to 89% of 2019, and hoteliers in the City no longer looked backward. For the 8-month period between May and December, the RevPAR index averaged 96% to 2019. The table below shows the market’s performance metrics for occupancy, ADR, and RevPAR, indexed to 2019 levels as a measure of its recovery to pre-pandemic levels.

The Boston market has always been a seasonal market with January, February, and December categorized as low season with occupancies in the 60s. March, April, May, and November represent the shoulder season with occupations in the 80s. Peak season from June through October typically reaches high 80s/low 90s. In 2022 the city operated in this same pattern, but at much lower occupancies than what was experienced pre-covid. For example, in the low period, the monthly occupancies averaged in the low 40s, and shoulder season averaged in the low 70s and the peak season averaged in the low 80s. Room rates are also seasonal in the Boston market. By way of example, in 2019 the ADR in January and October was $170 and $310, respectively. In 2022 the same pattern emerged but with an ADR of $161 in January and $342 in October. As you can see in the prior table, the monthly ADR in 2022 began to exceed the 2019 ADR. Specifically, from May and for every subsequent month, the ADR index exceeded 100% of the 2019 ADR. Given the substantial improvements in demand, and aggressive room rates, the RevPAR in both September and October exceeded the 2019 RevPAR, and was above a 90% index for six additional months in 2022.

New Supply

The market accommodated approximately 7.2 million room nights in 2022, compared to 7.7 million in 2019. The yearend occupancy in 2022 was estimated to be 70%, a far cry from the 82% occupancy recorded in 2019. As just discussed, the market experienced a very strong recovery in demand in 2022, but one must also consider how quickly the market can absorb new lodging supply. Presented below is a table that outlines the new supply in 2021 and 2022 in Boston and Cambridge. The new supply represented a 9% increase in lodging supply since 2019.

While hypothetical, if you apply the actual occupied rooms in 2022 to the available rooms in 2019, the city’s 2022 occupancy would have been 77%, seven points higher than actual year-end 2022 occupancy.

Outlook for 2023

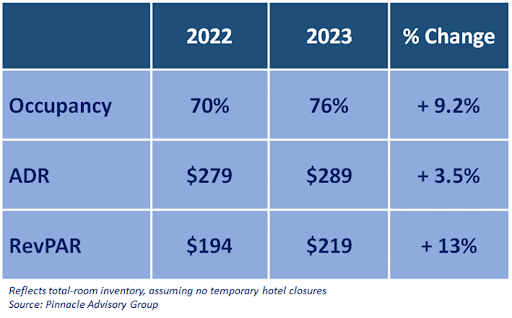

It has been very challenging to prepare a forecast since the start of the pandemic. The impact of the pandemic on the lodging industry has been significant, and the pace of the recovery was and continues to be unknown. There are still effects from the pandemic with new variants impacting travel. Economists have wide-ranging opinions as to when, how long, how strong, and if a 2023 will occur. The war in Ukraine has yet to impact travel in the US, but no one knows how that might change in the future. Work from home – work from office – hybrid work remains uncertain for 2023. With this in mind, Pinnacle believes that demand will improve in Boston and room rates will increase. Our expectations for demand growth, coupled with limited new supply in 2023, along with several properties that are expected to be offline, results in a projection of 76% for yearend occupancy.

Presented below is our 2023 forecast for the Boston/Cambridge

All demand segments will improve in 2023. Business travel gained significant momentum since May of 2022 and it will continue its upward trajectory. Leisure has proven to be resilient and while it may moderate in 2023, Boston has clearly proven itself to be a leisure destination. Small and large groups and conventions are back. Accordingly, to Meet Boston, the BCEC will have a record year of room nights in 2023, beating the record set in 2019 of 488,000 room nights. Most international travel restrictions have been lifted. Colleges have re-opened and the events that are generated from these institutions are out in force. With demand back, hotel managers will continue to drive rate, even if rate growth is closer to inflationary levels and that was experienced in 2022.

There is much to be optimistic about as we move into 2023 although the hospitality industry has become accustomed to surprises. In addition to continued uncertainty with demand and pricing, hotel owners and operators have managed both a challenging labor market and supply chain issues which have created wage pressures and increased operating costs. Nevertheless, all signs point to a healthier lodging market in 2023.