By Anne R. Lloyd-Jones, McKenna Luke

The strong growth that characterized the last three quarters of 2022 continued through Q1 2023 to complete a full twelve months of recovery. Despite inflation, an active Fed, and persistent recessionary concerns, the lodging industry continued to benefit from robust leisure and “bleisure” demand, supplemented by accelerating group demand. Overall, total demand exceeded 2019 levels beginning in September 2022, and this trend continued through March 2023.

Trends through the middle of the year have been mixed. Occupancy levels remained relatively stable to modestly lower from April through August 2023 as growth in commercial and group demand was not enough to offset the loss of peak domestic leisure demand seen in 2022. With more Americans choosing international destinations this summer and in-bound international travel still muted, leisure demand has softened in many domestic markets. Particular highlights thus far in 2023 include Taylor Swift’s Eras tour and improving meeting and group demand. According to an analysis by HVS Convention, Sports, & Entertainment, the Eras tour had an estimated $4.6-billion impact on the U.S. economy, including a notable effect on hotel performance generated by the estimated 3.7 million people who traveled 100 miles or more to see the shows. Strong convention center calendars, increased social and association event attendance, and in-the-year for-the-year bookings have supported a group demand rebound thus far in 2023, especially in urban city centers. Furthermore, although the pace of ADR growth has slowed, the overall national trend for ADR has remained positive.

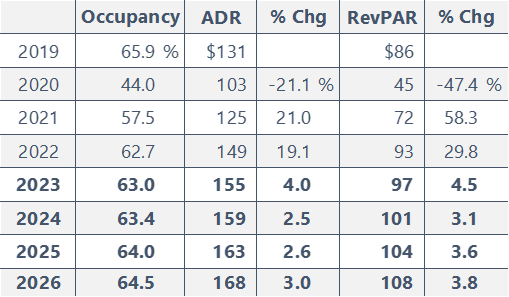

The national averages reflected in the following chart encompass a wide array of markets and trends. While this has always been the case, current trends reflect more widely divergent results than others in recent memory. Resort markets that achieved strong leisure demand and ADR growth through the recovery are softening, with some seeing declines in ADR, while many urban markets are experiencing continued strong growth in both demand and ADR as group activity accelerates and business travel improves. This volatility is expected to continue through the balance of the year, resulting in net RevPAR growth of 4.5%.

The outlook for the next few years is challenging given the multiple mixed messages concerning the economic outlook. Fears of a recession have diminished but persist, and while the pace of inflation has slowed significantly, prices remain well above pre-pandemic levels. Continued job growth on the one hand conflicts with high-profile layoffs on the other, and union activity is likely to result in further escalations in labor costs. Taken together with higher capital costs and lower debt availability, the opportunity for both supply and demand growth is unclear.

One of the greatest uncertainties affecting the market outlook is the office sector. It is increasingly clear that office utilization will not return to traditional norms, and while office occupancies can be expected to improve further, hybrid work patterns are the new normal. Although the lodging market has begun to adjust to these new realities, the full ramifications of this new normal are not yet clear, including the impact on business travel (likely to be negative) and corporate group activity (emerging as a positive factor). The shifts in office utilization and work dynamics have also had a notable influence on the financial sector given the downgrading of some banks with a high exposure in the office sector, concerns regarding pending loan defaults, and the failure and/or rescue of several banks earlier this year. These conditions can be expected to constrain the outlook for lending in the commercial real estate (CRE) sector.

Within the leisure segment, demand is expected to continue to moderate in response to inflationary price increases, recessionary concerns, and decreased pandemic savings, compounded by the availability of additional international travel options. Inbound international travel should recover but will be constrained by increased visa restrictions, reduced flight capacity from Asia, and a strong dollar. A correction for the Eras tour will also affect this segment in 2024. These factors are expected to constrain ADR growth in the segment as a whole, with some markets seeing negative results and others experiencing modest growth. All that being said, leisure demand is expected to remain well above historical norms, and ADR should retain at least some of the premium realized during the pandemic—another aspect of the new normal.

The rising cost of capital, driven by the 525 bps increase in the federal funds target rate, has dramatically shifted expectations for the cost of debt. Initially, the cost was anticipated to decline in the second half of 2023 or into 2024; however, the current expectation is for the Fed to increase rates one more time in late 2023, followed by moderate declines over the next two years, with the rate settling in the mid-three-percent range. Although this rate would be roughly one-third lower than the current level, it would be well above rates during the pandemic and thus represents another new normal.

On the investment side, high interest rates and limited debt availability continue to curtail transaction activity. Although the gap between buyer and seller expectations has narrowed as sellers recognize the new reality of higher interest rates, many remain reluctant to sell at the pricing necessary to meet most buyers’ return requirements. The transactions and refinancings that have occurred tend to be at the upper and lower ends of the market. The higher end of the market is being driven by expectations of long-term appreciation of high-profile assets, the desire to enter high-barriers-to-entry markets, and the strong yields traditionally generated by the luxury hospitality sector; these deals also frequently feature institutional-grade sponsorship. Buyers/borrowers at the lower end have been able to find more financing options through USDA, SBA, PACE, and other financing mechanisms; furthermore, the economy and midscale sectors rebounded at a faster pace, supporting higher cash flows. Pending debt maturities can be expected to induce some transaction activity, but the nature of these deals and their impact on value are not yet clear. Nevertheless, there continues to be a strong appetite for high-quality deals, and hotels remain a popular investment asset class in the prevailing inflationary environment.

In terms of values, market conditions over the past twelve months have put downward pressure on values, mitigated somewhat by the expectations of refinancing and decreasing equity yield requirements. More available debt at lower costs, pressure to transact from pending maturities, and stronger interest in the hospitality sector compared to other commercial real estate sectors are expected to be bright spots on the horizon that should support increased transaction volume in 2024.