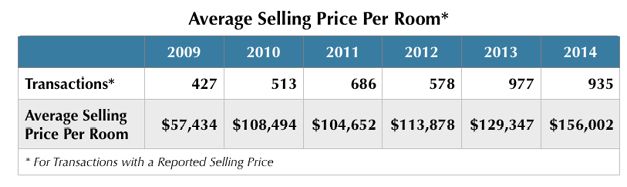

MARCH 9, 2015 – PORTSMOUTH, NH – Lodging Econometrics reports that In 2014 total investment in the lodging industry was an estimated $30.8 billion. Of the 1,292 hotels that were transacted 935 reported a selling price into the public domain. The average selling price per room for those hotels was $156,002, up a dramatic 20.6% Year-Over-Year (YOY).

The healthy increase in selling prices is due to record-setting hotel revenues and profits, low interest rates and the availability of attractive financing terms. LE foresees selling prices continuing to accelerate for the next several years as hotel performance continues to shine in the absence of any significant new supply. A critical part of the equation is that interest rates, although expected to rise, still remain attractive causing competition to intensify for prized single assets and portfolios.

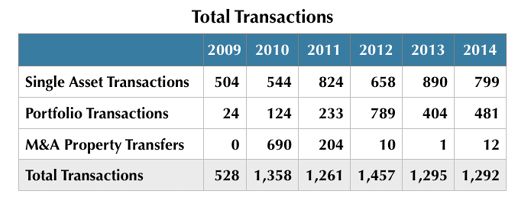

In 2014 a total of 1,292 hotel assets transacted or transferred ownership. Since the bottoming in 2009 of 528 transactions, total transaction volume over the last five years has ranged between 1,261 and 1,457 hotels. It is a narrow range far distant from the 3,218 transactions and transfers reported in 2007.

In 2014 there were 799 single-asset transactions and another 481 hotels that changed ownership as part of a portfolio sale. A mere 12 hotels were recorded as part of merger activity. It is thought that any significant industry-wide consolidation of companies and brands may still be at least two years away, after the expansion phase of the current real estate cycle concludes and the maturity phase begins in 2017.