by Susan Furbay

MAY 2015

Years of rising average daily rates and demand, among other factors, have made the ground fertile for new hotel supply. How will the growing pipeline of new hotels impact hotel markets in the near term?

The U.S. hotel industry has reaped sizable benefits from the remarkable growth in the U.S. since the Great Recession. Nationwide lodging demand has been up year after year. RevPAR growth in 2014 was one of the highest on record, and demand across all chain scales shows every sign of accelerating in 2015. This is particularly true for urban gateway markets, where high demand for rooms allows owners to raise rates, thus improving this year’s bottom lines.

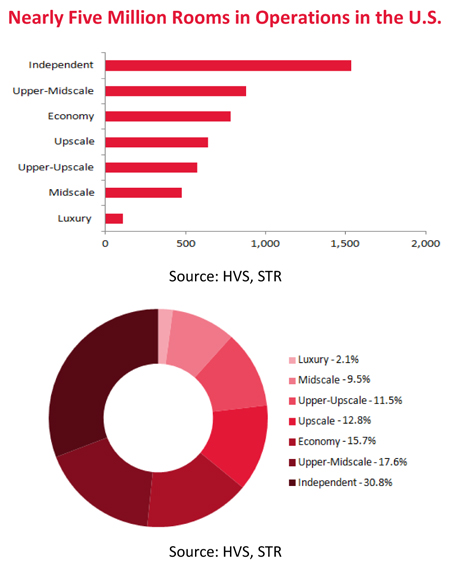

Increasing demand, improving operating and performance metrics, and favorable financing terms have led to the recent (and anticipated) surge in new hotel supply. The chart below shows the number of rooms in the U.S. (as of March of 2015) and percentage of the total per chain scale.

Among these categories, independent hotels account for highest number of rooms currently in operation. Upper-midscale hotels, a category that includes such brands as Hampton Inn, Holiday Inn, and Best Western Plus, account for the next highest number of rooms, followed by economy properties. Of the approximately 4.99 million rooms in the U.S., the luxury category has the smallest footprint.

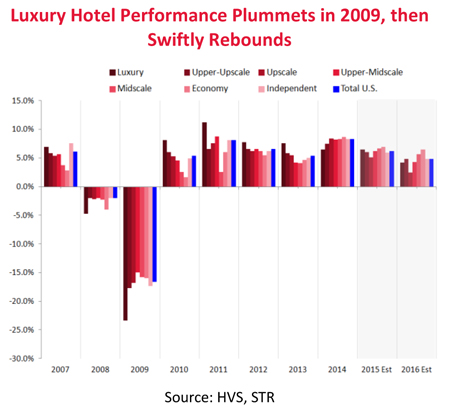

The following chart illustrates RevPAR performance for all chain scales from 2007 through 2016 (projected).

In the torrential downturn of 2009, upper-midscale properties suffered the least precipitous fall in RevPAR–and luxury hotels suffered the worst. The following year, however, the luxury category rebounded, outpacing all others in terms of RevPAR growth, and this trend continued through 2013. Expectations for 2015 point to strong RevPAR rises across the board, but particularly for upper-midscale properties. Upscale and upper-midscale properties should realize the greatest increase in demand in 2015; these categories are also expected to expand the most as new hotels open this year.

Increasing Pipeline; Supply Growth Remains in Check

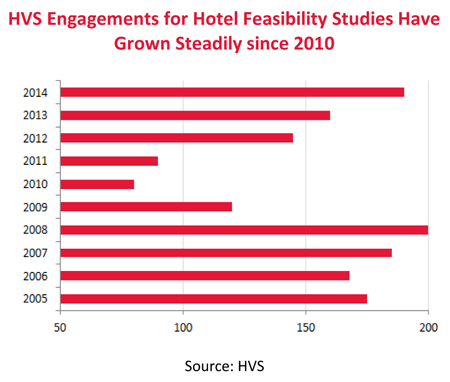

As hotel performance continues to trend upward and hotel values and sales prices increase, many investors and developers are moving toward constructing versus buying a hotel. Some developers have been biding time with their parcels of land, engaging or in some cases reengaging (since we first performed work in 2006 and 2007) HVS for feasibility studies as construction and takeout financings become increasingly available at attractive rates.

As illustrated in the following chart, HVS engagements on feasibility studies peaked in 2008, just before the economic downturn. In the following three years there was relatively little interest among developers in researching the feasibility of new builds. As performance, demand, and financing have improved, however, this interest has resumed.

Nationally, strong business activity, solid job growth, falling unemployment rates, lower energy prices, and improving consumer confidence have substantially improved performance and operational efficiency at hotels. Most importantly, interest rates remain low, which has promoted activity from developers. As of March of 2015, roughly 126,000 rooms spread across 988 hotels are under construction and poised to open over the next 24 to 36 months. The influx of supply is evident in the country’s major gateway markets. In Manhattan, 23 new hotels (4,151 rooms) opened in 2014, with another 68 properties on track to follow over the next three years. Approximately 1,777 rooms have recently opened in Houston, with another 6,173 rooms under construction and 6,000 rooms in the final planning stage.

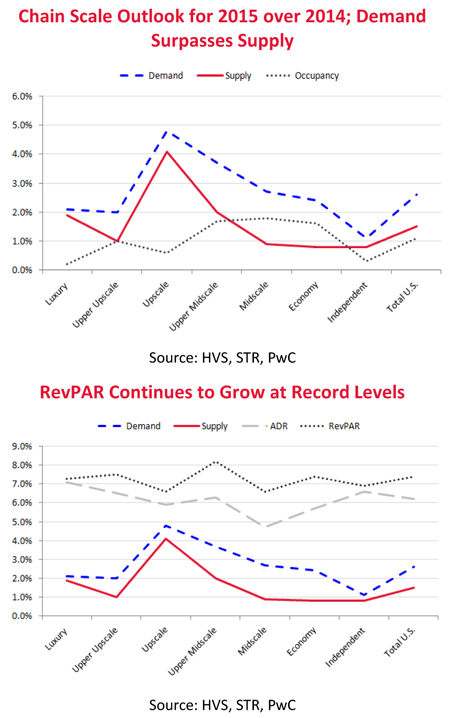

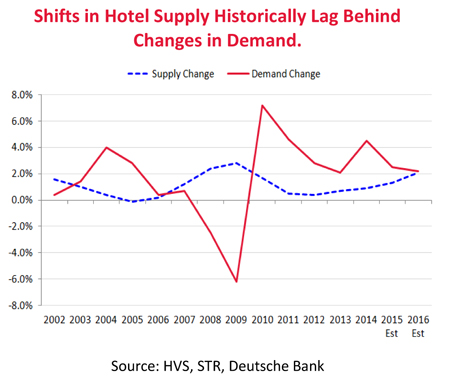

Despite the ever increasing number of new hotel projects, hotel development has notably fallen behind the pace of other real estate sectors such as multifamily, office and industrial. The historical data shows that hotel supply growth has remained below demand growth levels; this is especially evident from 2011 to 2014, as illustrated in the following chart.

The current TTM demand-to-supply growth rate spread is 3.8% in favor of demand, well above historical norms, and the spread is likely to remain positive for at least two more years given still-limited supply growth and solid demand trends.

Closer Look at the Current Pipeline in Different Stages

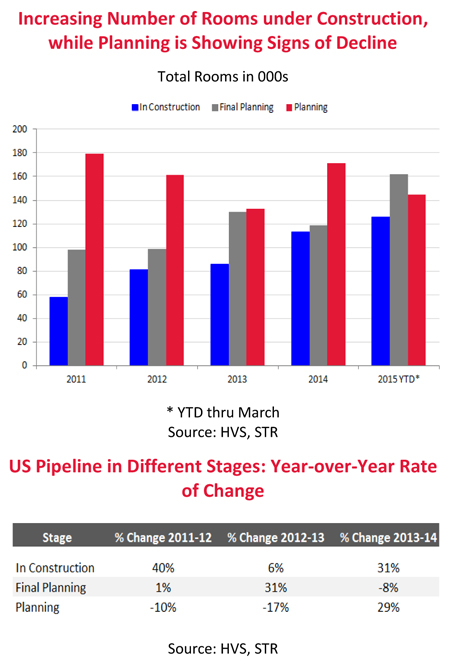

Since all but drying up in 2011, the U.S. hotel pipeline, in terms of total rooms under construction, realized 31% growth between 2013YE and 2014YE. As mentioned above, dual circumstances have led to this increase in new rooms. First is the cost of existing hotels, which have increased in value over the past several years; even with rising costs of construction, new builds remain a more viable route for many investors. Second is the fact that many owners have been holding land since, in some case, before the recession; when this land is in a reasonably stable market, or one that has seen significant growth in the upturn, developers stand to profit considerably from new construction.

Projects that have been stuck in the final phases of planning in the last few years are continuing to move into construction. Between March of 2014 and March of 2015, 635 hotels have opened adding roughly 71,000 rooms to the overall supply. The number of rooms in all branded chain scale segments increased slightly, but development has been heavily concentrated in the upscale and upper-midscale categories, which include select-service and mid-market properties such as

Marriott’s Residence Inn, Courtyard by Marriott, and Fairfield Inn & Suites; Hilton’s Homewood Suites and Hampton Inn; Starwood’s Aloft; and InterContinental Hotel Group’s Holiday Inn Express.

The following lists the number of proposed hotels in the planning phases or under construction in the U.S. since 2011 and percentage change by year.

Whether or not projects in the final planning stage ultimately enter into construction may depend on securing the construction loan and permanent take out. While financing availability for hotel real estate has improved significantly since 2011, the number of lenders active in construction financing is still somewhat limited. Furthermore, even while construction often appears a better route than purchasing an existing asset, high construction costs are curtailing new hotel developments in certain markets, making it less economically feasible to build. The recent announcement of GE Capital’s disposition of its real estate lending platform to Blackstone raises the question of how this year’s financing market may remit, and how this would impact new construction going forward.

Conclusion

After a disappointing start, the U.S. economy grew at a solid pace in the last three quarters of 2014, with GDP increasing 2.7% for the year. Similarly, the hotel recovery is gaining momentum, and signs point toward continuing growth over the next two or three years. The surge of new supply should accelerate throughout 2015, and even further in 2016. Nevertheless, given the high demand and performance numbers, hotel stakeholders have met the influx with optimism.