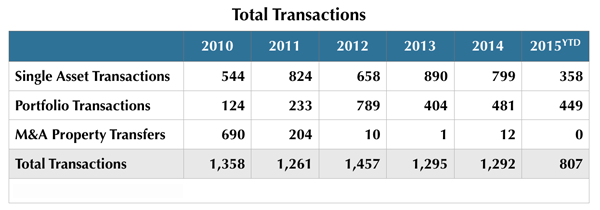

August 10, 2015 – PORTSMOUTH, NH – Hotel transaction volume increased modestly in the first half of 2015 as privately held equity funds and hotel companies continued their disposition strategies. For 1H 2015 transactions and property transfers trended upward to 807 hotels caused by a substantial increase in portfolio sales. Single-asset transactions actually declined for the period and there was no M&A activity recorded.

Investors are basking in the fifth consecutive year of double-digit earnings growth and although the rate of growth is slowing. They do not foresee a top-out of earnings for a least another two to three years. However, many equity funds feel compelled to sell because their scheduled holding periods are expiring. Hotel companies implementing asset-light strategies are sellers as well. For them, it is a solid strategy to secure profits from asset appreciation even though we are only half way through the expansion phase of the cycle.

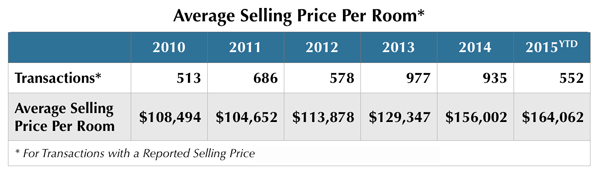

SELLING PRICES ARE MUTED, FOR NOW. Of the 807 Hotel Transactions and Property Transfers that occurred in the first half of 2015, 552 reported selling prices in the public domain. The Average Selling Price Per Room (ASPPR) for these sales was $164,062.

A sample size of 552 hotel sales is usually large enough to properly blend selling prices from all chain scales within a normal “bell curve” distribution. Not this time however. There is a significant skew. The sale of the 1,413-room Waldorf Astoria in New York City by Hilton (BlackStone) to the Anbang Insurance Group of Beijing for $1.95 billion had an unprecedented $1,380,042 ASPPR. This outlier drove the national ASPPR up by $24,335, from $139,727 to $164,062.

Eliminating the Waldorf from industry totals, the restated ASPPR of $139,727 is down significantly from the $156,002 recorded in 2014. This decline is due to an increase in the sale of smaller hotels with less than 200 rooms in suburban locations and secondary cities and in the slowdown of larger CBD transactions in major markets.

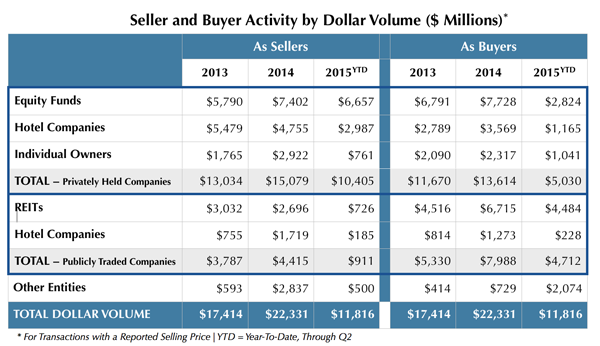

SELLER AND BUYER ACTIVITY Total investment in 1H 2015 for hotels with a reported selling price was $11,816 million, about half the total for all of 2014. The Waldorf transaction accounted for $1.95 billion, or 16.5%, of the 2015 year-to-date (YTD) total. Given that the mix of transactions is shifting away from larger properties, this year may not seesignificant year-over-year growth in investment dollars.

Privately held equity fund dispositions may exceed $10 billion this year to cement a new cyclical high. Although it may be an excellent time for equity funds to sell, they are finding it quite difficult to locate new assets for sale with appreciation potential that will merit a 5-7 year holding period.

With interest rates locked at record lows and lending still readily available for investors, publicly traded REITs and private equity groups are the major investors on the buy side, absorbing the disposition volume of private equity funds and hotel companies implementing asset-light strategies.

There is plenty to be optimistic about; a recovering economy set to accelerate forward, operating statistics at modern-day highs, hotel earnings on an extended streak, interest rates at all-time lows, lending still readily available and supply in check for at least another two years.