2015 marked the second-highest year on record for hotel transactions globally, with trades topping US$86 billion and posting 50% growth on 2014. With 2015 surpassing all expectations in terms of the amount of capital flowing into the hotel sector, we expect transaction volumes in 2016 to reach US$70 billion, marking the second-highest level of the cycle.

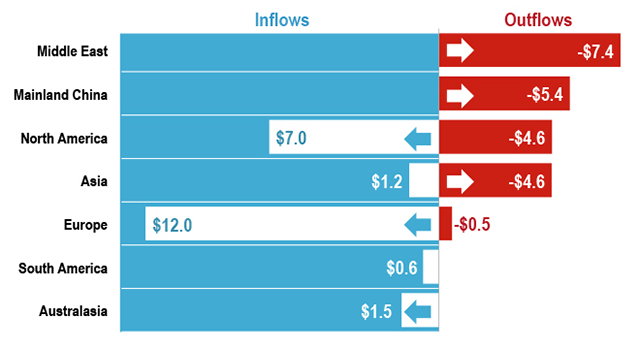

Hotel investment – capital flows Outflows and inflows in 2015 (US$ billions)

Global hotel investment up 50% to US$86 billion

2015 marked the second-highest year on record for hotel transactions globally, topping US$85 billion and posting 50% growth on 2014. With 2015 surpassing all expectations in terms of the amount of capital flowing into the hotel sector, we expect transaction volumes in 2016 to reach US$70 billion, marking the second-highest level of the cycle. There is positive momentum as we transition into this stage of the expansionary cycle, though investors will take a more cautious approach.

Volumes across the Americas to notch US$37 billion

The Americas region is forecast to see transactions total US$37 billion in 2016. As in recent years, the United States is likely to be the single most liquid country in terms of transaction volume. 2015 broke a new record in this cycle, boosted in part by Blackstone’s US$6 billion purchase of Strategic Hotels & Resorts. Activity across the board is slated to soften by 20% in 2016.

In the U.S., investors are re-trading assets purchased earlier in the recovery cycle and momentum is being further fuelled by the weight of private equity raising funds and pursuing large single-assets and portfolios. With historically low cap rates in primary markets, we expect to see robust activity in secondary regions such as the Midwest.

The year for single-asset transactions in Europe's secondary markets

The Europe, Middle East and Africa (EMEA) region will continue its stride with a projected US$25 billion in hotel deals in 2016, down 15% on last year. Sales activity will be driven by single-asset transactions, with an increasing share taking place in secondary markets. 2015 saw a remarkable volume of portfolio deals and these are set to return to more normalised levels in 2016. Given the culling of portfolios and prime single-asset properties coming to market this year, we anticipate that single-asset transactions will increase by 35%.

In order to find yield, investors will look beyond the mainstay markets with provincial UK, secondary German cities, Spain (both the major cities and resort markets), Italy and Portugal receiving more attention. At the same time, lenders will be increasingly busy across non-gateway cities.

Japan and Australia to be the standouts in Asia Pacific

On the back of one of the most robust years for Asia Pacific in terms of transactions, the region is forecast to see volumes of US$8.5 billion in 2016, a 5%-10% decline on 2015. Japan saw its highest level of transactions ever in 2015 and there remains a strong bench of domestic investors as well as interest from U.S. private equity funds. In addition, early trends are emerging of Chinese investors evaluating purchases in secondary Japanese locations.

Mainland China has started to witness hotel deals in excess of US$1 billion annually and this level is likely to continue, if not increase, in 2016 due to government policy. Australia will remain active as well, though given the large number of prime single assets having traded to long-term holders of late, the amount of product on the market will be smaller.

Published February 2016