U.S. Hoteliers Operate in a Low Inflation Environment

Atlanta – September 7, 2016 – The magnitude of change in the major industry indicators is not pleasing U.S. hotel owners and operators. New development activity continues to accelerate, while growth in average daily room rates (ADR) has decelerated. The sluggish start during the first half of the year resulted in another downgrade by CBRE Hotels’ Americas Research of its forecast for the entirety of 2016.

“It has been very interesting dissecting the performance of the U.S. lodging industry during the first half of 2016,” said R. Mark Woodworth, senior managing director of CBRE Hotels’ Americas Research. “On the one hand, we are comforted by the continual growth in accommodated demand. After all, if people stop traveling, nothing else really matters. On the other hand, there continues to be a disconnect between the record occupancy levels and the inability of hoteliers to increase room rates.”

According to STR, U.S. lodging demand increased by 1.6 percent during the first half of 2016 compared to the first half of 2015. At the same time, hotel rooms supply rose by just 1.5 percent, resulting in a 0.1 percent boost to occupancy. With demand and occupancy on the rise, ADRs did increase by 3.1 percent, but this is less than the 4.1 percent pace seen during the first half of 2015 and the annual 2015 growth rate of 4.4 percent.

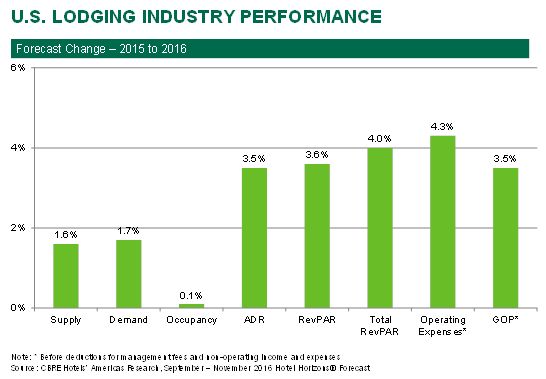

Based on the first half performance data, CBRE Hotels’ Americas Research adjusted its forecast for the year 2016. According to the firm’s September 2016 Hotel Horizons® forecast that was released at the STR Hotel Data Conference, U.S. hotels will enjoy a 0.1 percent increase in occupancy for the year, concurrent with a 3.5 percent rise in ADR. This results in a RevPAR gain of 3.6 percent. The occupancy forecast represents an improvement over the 0.1 percent decline presented in June 2016 edition of Hotel Horizons®, but the ADR and RevPAR forecast rates are 0.8 and 0.6 percentage points less, respectively.

The Reality of ADR

“Because changes in ADR have an over-weighted impact on profits, it is the metric most closely monitored by owners and operators. That is why everyone is disappointed with a reduction in the outlook for changes in ADR, especially with such high occupancy levels,” Woodworth said. “We have developed some thoughts as to why room rates are growing as they are. Some are very obvious. Others require deeper analysis.”

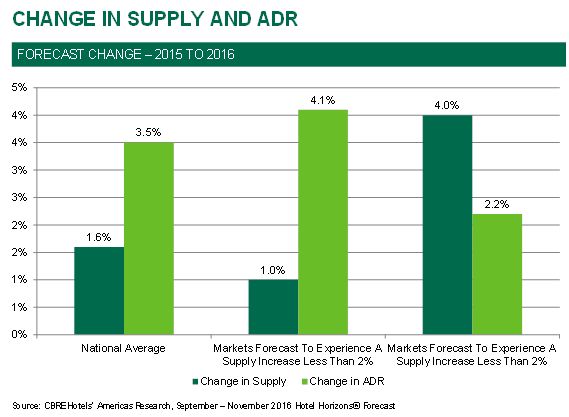

An analysis of ADR growth within each of the 60 markets in the Hotel Horizons® universe finds a fairly consistent relationship between changes in supply and changes in ADR during 2016. On average, the 25 markets projected to experience a supply increase greater than two percent are forecast to achieve an ADR rise of 2.2 percent. Conversely, the remaining 35 markets should enjoy an average ADR gain of 4.1 percent. The two percent mark was chosen because that is the long-run average annual change in supply for U.S. hotels. “When hotel sales and revenue managers look out the window and see construction cranes, they are reluctant to be too aggressive with their pricing policies,” Woodworth noted.

“When analyzing prices in any industry, it is common to gauge movements relative to the pace of inflation, or real change,” said John B. (Jack) Corgel, Ph.D., professor of real estate at the Cornell University School of Hotel Administration and senior advisor to CBRE Hotels’ Americas Research. “In real terms, the 3.5 percent nominal increase in ADR forecast for 2016 represents a 2.5 percent real change. This will be the eighth greatest real change in ADR since 1988.”

The Real Problem

“One reason we analyze real changes in prices is because the pace of inflation is typically a good proxy for changes in operating expenses,” said Corgel. “Unfortunately for U.S. hoteliers, we are starting to see a divergence between changes in inflation and changes in hotel operating costs.” According to the 2016 edition of CBRE’s Trends® in the Hotel Industry, hotel operating expenses increased by 4.7 percent in 2015. Given the 0.1 percent rise in the Consumer Price Index (CPI) for the year, this equates to a real expense change of 4.6 percent. The 4.6 percent mark is the greatest real change in expenses recorded by CBRE since 1978.

Two of the components keeping the CPI low are food costs and energy prices. Fortunately for hoteliers, these two costs declined 3.5 and 2.7 percent respectively in 2015. Conversations with hotel controllers indicate that these trends have continued into 2016.

While hotels are benefiting from declines in food cost and utility expenses, there are some expenses that are not directly tied to inflation that are cutting into hotel profitability. “Management fees, franchise fees and credit card commissions are all influenced heavily by changes in revenue. Therefore, with revenue growing, it is not surprising to see these costs growing from five to seven percent,” Corgel noted. “What is somewhat contrary to historical economics is the rising cost of hotel labor in such a low inflation environment.”

In 2015, hotel labor costs grew by 4.6 percent, the result of a 5.2 percent increase in salaries and wages and a 3.0 percent rise in employee benefits. “Increases in hospitality labor compensation primarily are attributable to the continued decline in the nation’s unemployment rate. With the unemployment rate expected to remain low, this will continue to put pressure on hotels to increase wage rates in an effort to remain competitive with other industries,” Corgel noted. “While hotels are enjoying significant real change in revenues, the realities of hotel expense growth represent a strong headwind against significant gains on the bottom-line.”

“We understand why hotel owners and operators are disappointed by the downgrade to our forecasts following a slow start to the year. Life at the top of the business cycle is characterized by moderate changes in performance. Through it all, it is important to note that we are forecasting continued, less volatile revenue and profit increases for the foreseeable future. That is not a bad combination,” Woodworth concluded.

To purchase copies of the September 2016 editions of Hotel Horizons® for the U.S. lodging industry and 60 major markets, please visit: https://pip.cbrehotels.com

CBRE Hotels is a specialized advisory group within CBRE providing brokerage, valuation, consulting, research and capital markets services to companies in the hotel sector. CBRE Hotels is comprised of more than 375 dedicated hospitality professionals located in 60 offices across the globe.