Nigeria’s new administration has been in power for more than a year now. President Muhammadu Buhari took power on an anti-corruption platform, the total defeat of Boko Haram and a return to significant economic growth. With the country in a state of limbo due to the President’s protracted absence from office because of illness, what has been the government’s performance record thus far? And how has this impacted the hotel industry?

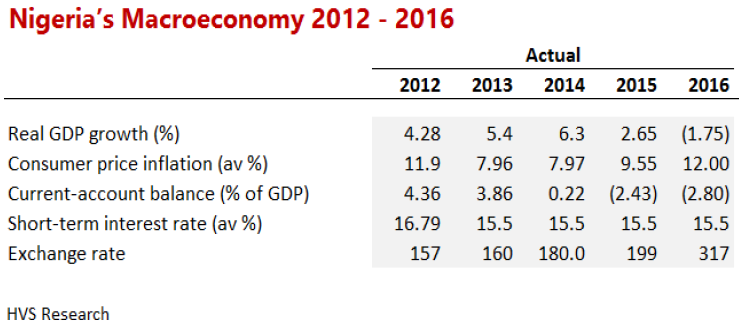

Nigeria’s GDP growth over the last five years has been a rollercoaster ride. In 2012, the IMF recorded 4.3% rising to 5.4% in 2013 and in 2014 growth came in at 6.3%. From there the wheels started coming off and 2015 growth dropped to less than half of the previous year’s performance at 2.7% until the country experienced a recession in 2016. GDP was recorded at -1.8%.

Whilst the Nigerian economy is well-known for its oil production, this resource is only one of several sectors that fuel the country’s GDP growth. Nigeria is Africa’s largest economy and its position as the most populous nation on the continent ensures that its agricultural product has a captive market. Domestic demand for financial services also helps to sustain this economic sector. Sadly though, oil is the commodity that drives Nigeria’s economic performance narrative in global markets and when Brent Crude prices drop, the resulting perception is negative on the overall Nigerian economy. To overcome this, Nigeria has a massive task of marketing its other economic sectors and the tourism industry can play a significant role towards achieving the country’s economic goals. The dollar exchange rate picture for Nigeria has been a bleak one, with a rapid deterioration from NGN157 to the greenback in 2012 to NGN317 at the close of 2016. Closer to mid-2016 the exchange rate peaked at NGN350 before settling at NGN317 at the time of writing this article. Media reports are now putting the currency at NGN520 on the black market. The outlook for Nigeria’s economy is however positive with projected GDP growth of 0.7%, 1.6%, 3.2%, 3.8% and 3.3% in 2017, 2018, 2019, 2020 and 2021 respectively. The GDP growth picture in the graph below illustrates a steeply rising trend over the four-year period leading up to the end of the decade in 2020.

The population of Nigeria is also projected to grow from 183,000,000 in 2016 to 210,000,000 in 2021. All these factors bode well for the economy of Nigeria

Nigerian Tourism & Its Drivers In Lagos

Whereas Nigeria is blessed with ample ecological and cultural resources, leisure tourism has however not taken root for a country with such a rich tourism asset base and a large population. Nigeria has a large middle class when one considers the country’s high population density, and most of this sector of the populace lives in the cities. In addition to the middle class, Nigeria has one of Africa’s highest diaspora, which lives in most of the world’s richest countries. Some of the wealthiest of them work in the professions and others are businesspeople. They generate massive incomes which they remit to Nigeria. Many of them also visit home regularly and travel home with their families, during which time they stay in hotels. Nigeria is well-supplied with airports 54 in total, 40 of which have paved runways. Other road, rail, port and marine infrastructure is also well-supplied. The main city centre infrastructure is unfortunately not properly maintained as witnessed by the high levels of gridlock in Lagos. Nigeria’s National Tourism Development Corporation (NTDC) is the state entity tasked with the rapid development of tourism in the country. Its programmes are unfortunately not very well-communicated with the world and this creates problems for the industry. Linked to this challenge is the unavailability of reliable data. The internet is awash with tourism pieces from even some of the most respected digital sources, however most of the them refer to point data when the industry is need of time series statistics. For example, the NTDC has recently boasted that Nigeria generated US$1.1bn from tourism in 2015. Whilst this figure is not being compared with any other period, it is still a significant achievement.

The African Union has started work on the planned creation of an African Univisa to facilitate seamless mobility between the continent’s 54 member states. Nigeria stands to gain much from this initiative as she is reputed to charge one of the world’s most expensive visa fees and the acquisition thereof is very prohibitive with many documentary and application process requirements. In Lagos tourism is driven by the corporate and cultural segments. Nigeria has a strong cultural and religious heritage and this type of tourism takes place on weekends as large numbers of rural dwellers flock to the cities for marriage engagements, wedding ceremonies, graduations, festivals and funerals. The strong social scene also makes for a good mix of weekend life the two main religions bring many more people together more frequently. Consequently, Lagos enjoys a significant influx of tourists over weekends, the bulk of whom come from the rural areas.

Nigeria’s oil deposits are unique in that they have low levels of Sulphur, thus enabling a more efficient extraction of crude. This property makes oil drilling very attractive to oil companies and that is one of the main reasons they continue to do business in the country. Also, the relative proximity of the oil deposits in Lagos, the country’s economic and business centre, means that the corporate segment supports a significant amount of hotel industry’s weekday demand. More good news, if a little less exciting, is the slow and steady recovery of the price of oil. At the time of writing, Brent Crude was trading at US$55.47, a vast improvement year-on-year, but still way below the peak. The chart on the left with data from Index Mundi depicts Nigeria’s oil production trend between 2006 and 2015. The combination of falling output and price is a clear indication that Nigeria needs to diversify its economy away from oil and to urgently look at growing its tourism industry. Armed with a large economy and population, the country is well-positioned to achieve this.

Hotel Market Performance Update

How has the Nigerian hotel industry performed in the last 12 months? Trading conditions are tough for businesses. Sun International Group has made an early exit out of the Federal Palace Hotel in Lagos. On the positive side, the Marriott International’s Renaissance Hotel has recently been opened. In the third quarter of 2016, Hotel News Now has reported that Lagos experienced a double-digit occupancy drop of 11,3% to 44.7%. Whilst this occupancy looks very low, it must be borne in mind that during this period Nigeria’s economy experienced negative GDP growth. Revenue per available room was however up by 8,5% to NGN41,487 and this translates to US$136 at a rate of NGN305 to the US dollar as published by the Central Bank of Nigeria. The online booking service JumiaTravel in its recently released Hospitality Report Nigeria for 2016, has reported that Lagos hotels achieved an average occupancy rate of 58% and an average room rate during the year of US$78. JumiaTravel conducts bookings for all hotel types in Nigeria, which includes unbranded properties. It is our assessment that the average room rate could have been influenced significantly by the unbranded properties.

Nigeria’s hotel industry performance was impacted upon by the country’s economic recession during the third quarter of 2016 and a deteriorating NGN/USD exchange rate. In an effort to mitigate the consequences of the devaluation of the Naira, hotel operators cannot double the price of rooms in Naira to compensate for the loss in value against the dollar, meaning the all-important foreign currency earnings are no longer supporting the industry. Other challenges experienced by the industry include expensive but erratic power supply, a steadily increasing number of hotels entering the market, lack of grading standards and inadequate hospitality skills.

If the NTDC and the government can address the challenges listed above, Nigeria’s hotel industry performance can achieve its objective of higher occupancy and room rates. For instance, tapping into the massive weekend tourism from the rural areas can help achieve this objective.

The Investment Climate

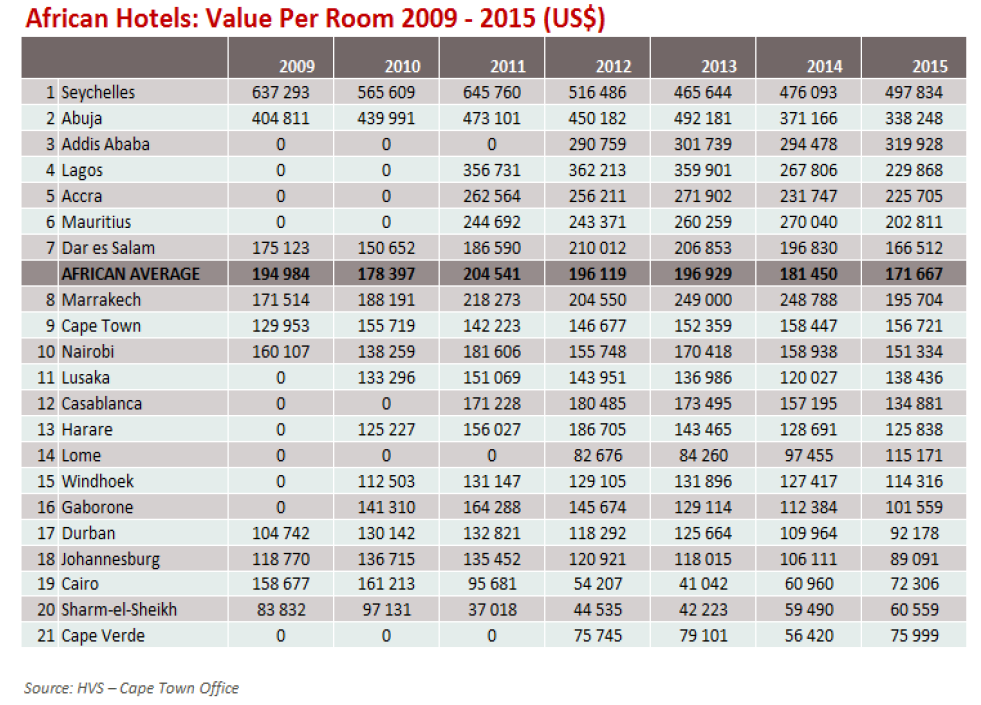

Nigeria has dropped one place in the Top 10 African Investment Destinations. The current standings are as follows: South Africa, Egypt, Morocco, Ghana, Kenya, Nigeria, Ethiopia, Ivory Coast, Tanzania and Algeria. One of the main reasons for Nigeria’s poor performance is the security situation in the country. The Boko Haram insurgency is growing in its attacks in the northern states. Whilst the country has put in place many ambitious plans of growing the tourism pool through investment in infrastructure, not much action has taken place. A recent government investment in a major housing development has however been very well received by the media. Much as it shows a good response by the state to national needs, this type of investment needs to be accompanied by similar initiatives in public infrastructure expenditure. Foreign direct investment is the favoured vehicle for the creation of much needed tourism facilitation infrastructure on the continent. For Nigeria to take the most advantage of its rich natural and cultural heritage, the government needs to also invest significantly in public access infrastructure and in the upgrading of the country’s tourism assets. A few tax incentives for hotel developers have been put in place. For example, investment related guidelines published by the government state that 25% of income derived by hotels from tourists in convertible currencies would be tax-exempted provided such income is put in a reserve fund to be utilized within 5 years for expansion or the construction of new hotels, conference centres, and similar utilities that are useful for tourism development. An additional 100% tax holiday for seven years and an additional 5% depreciation over and above the initial capital depreciation have also been announced. Private sector investment in the hotel industry has been robust over the last half decade or so, with Nigeria having the largest hotel development pipeline in Sub-Saharan Africa. The table below lists some hotel developments that are in construction and have been earmarked to enter the Lagos market in the next five years. Building cost per room for a hypothetical four-star hotel in Lagos is estimated between $300,000 and $400,000. As shown in the accompanying room values table above, the value per room of a hypothetical four-star hotel in Lagos is just below $230,000. The difference in these values can be explained by the impact of Nigeria’s high inflation rate and the import content premium that developers face for new assets as most of the development cost elements are unavailable in Nigeria, from construction skills to materials to labour.

According to an article in Africa Property News, “private equity investors were the main source of funds in the office and retail sectors. The likes of Actis, RMB Westport and then local funds including Africa Capital Alliance and Landmark have been at the forefront of allocating capital to real estate developments across different sectors and locations in Nigeria.” Some of the more notable non-hotel developments in Lagos include the Eko Towers II Mixed-Use Development, phase three of the Victoria Mall as well as The Sphere Office Development. According to Construction Review Online, the Dangote Group of Companies has pushed the construction button on a US$ 100m truck assembly plant. This facility will target an output of 10,000 trucks per annum. The group has also started with the construction of a US$17bn Dangote Refinery, petrochemical and fertilizer plants. The latter is slated to open in 2019 and will have output capacity of 650,000 barrels per day of product.

In Conclusion

Nigeria is a very important market for the growth of the tourism and hotel industry in Africa. To regain its prime position as one of the most attractive markets in West Africa, the Nigerian government must work hard to retake the initiative from some of the other regional cities like Accra and Freetown. Leisure tourism growth initiatives must be intensified to help the country diversify its economy from oil and gas. All the other initiatives that have been put in place to increase security must also be intensified. There are signs that the worst may be behind us and the beleaguered hotel industry may now enjoy a slow but steady recovery. It may be some years until Nigeria regains its previous stellar status, but steady growth would be a welcome start.

.png)