By Robert Mandelbaum

The definition of “select-service” within the lodging industry may vary from person to person, but there is no doubt that properties in this segment are the most popular among developers. Using the broadest definition of select-service, this category comprised an estimated 89 percent of the total hotel projects under construction according to the December 2016 U.S. Hotel Pipeline report from STR.

As the name implies, select-service properties offer limited degrees of services and amenities compared to full-service hotels. While most select-service properties do not contain extensive meeting, recreational and retail facilities, there is diversity when it comes to the offering of food and beverage (F&B) service for sale. Within the select-service category, there are brands that offer retail food and beverage service, and others that do not.

To gain a better understanding of the performance of select-service hotels, we analyzed a group of 233 properties that provided year-end operating statements for our firm’s Trends® in the Hotel Industry survey each year from 2010 through 2015. One-third of the properties in the sample offer some degree of retail food and beverage service (e.g. Hilton Garden Inn, Courtyard by Marriott, Hyatt Place), while the remainder of the sample is true limited-service hotels (e.g. Hampton Inn, Fairfield Inn, Comfort Inn). For the purposes of this analysis, we limited our analysis to properties that operate in the upper-midscale and upscale chain-scale segments, and are affiliated with brands that are generally considered to be “select-service”. Excluded from the analysis were extended-stay hotels and full-service suite hotels, as well as traditional full-service hotels, convention hotels and resorts.

Operating Efficiencies

For hoteliers, a large part of the reason for the popularity of owning and operating select-service properties is the relative ease of operations. Without the extensive array of facilities, services, and amenities, select-service hotels have fewer departments to manage, and are more efficient to operate. In 2015, the properties in our select-service sample achieved a gross operating profit (GOP) margin of 44.2 percent of total operating revenue. This compares to a 37.5 percent average GOP margin for all properties in our Trends® survey. GOP is defined as income before deductions for management fees and non-operating income and expenses.

Like all property types, labor is the largest expense item for operators to manage. However, labors costs are minimized at select-service hotels. This contributes to the efficiency and profitability of this segment. In 2015, the combined costs of salaries, wages, and benefits equaled 22.6 percent of total operating revenue, or $8,109 per available room (PAR). This compares to 31.6 percent, and $22,224 PAR for the overall Trends® sample.

Select F&B For Profits

It is generally accepted that limited-service hotels (no retail food and beverage outlets) are more profitable than full-services hotels. Within the overall lodging industry, this is true. According to the 2016 Trends® in the Hotel Industry report, limited-service hotels in the U.S. achieved a 44.6 percent GOP margin in 2015, compared to 36.9 percent at full-service properties. However, within the select-service segment, we have seen a recent shift in conventional wisdom.

In 2010, the select-service properties in our study sample that do not offer retail food and beverage service achieved a GOP margin of 42.9 percent. This was greater than the 41.9 percent GOP margin set by the select-service hotels with restaurants and lounges. Five years later, this trend reversed. In 2015, it was the select-service sample with food and beverage that achieved the greater GOP margin (45.6%) compared to the select-service hotels without food and beverage (42.9%). From 2010 to 2015, gross operating profits PAR at the select-service properties with F&B increased at a compound average annual rate (CAGR) of 7.5 percent, compared to 5.5 percent for the select-service hotels without F&B.

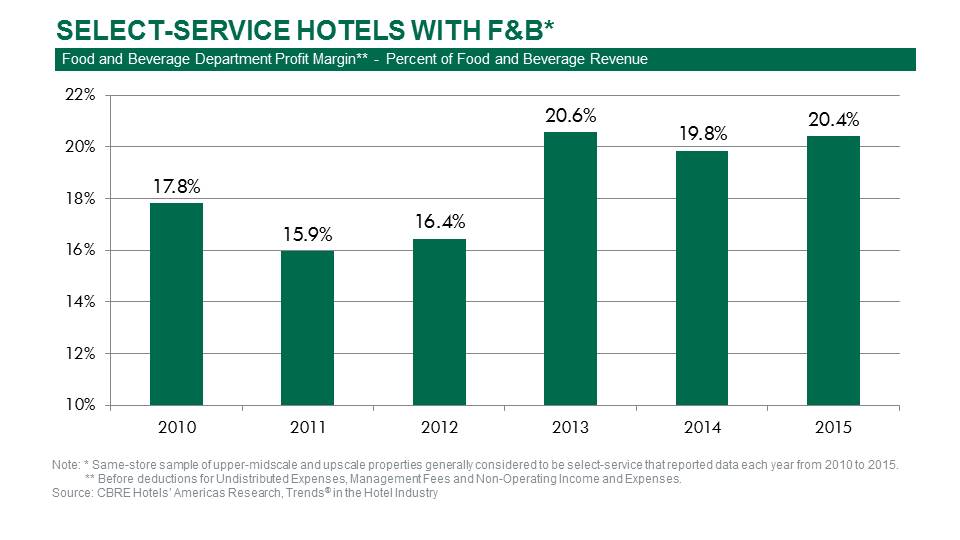

When analyzing the data, greater efficiencies in the food beverage department of select-service hotels contributed to the enhanced profitability. From 2010 through 2015, food and beverage department profits at select-service hotels have increased at a healthy CAGR of 8.7 percent.

Changes in the F&B offerings at select-service hotels appear to have contributed to the increase in department profitability. Most select-service hotels have limited the hours and extent of food and beverage service at their outlets. Select-service hotels have pioneered the grab-and-go, and lobby coffee-house styles of food and beverage service. While this has resulted in a slowdown in the pace of F&B revenue growth, is has also limited the increases in the cost of F&B operations. From 2010 through 2015, select-service F&B department profit margins have increased from 17.8 percent to 20.4 percent.

Another factor contributing to the enhanced profitability of the select-service with food and beverage sample has been the ability to control labor costs. Labor costs measured on a per-occupied-room (POR) basis at the select-service with F&B sample increased at a CAGR of 2.6 percent from 2010 to 2015. This compares to 3.5 percent for the select-service without F&B sample. The enhanced efficiency in the use of labor at the select-service hotels that offer food and beverage can be partially explained by the service changes made to the restaurants and lounges.

Development Decision

While select-service hotels are very efficient and profitable operations, the decision to develop a property requires additional information. In 2015 the gross operating profit PAR for our select-service sample was 40 percent less than the GOP for our overall Trends® survey sample because of lower average daily rates and lack of other revenue sources. After considering the cost of capital and desired level of return, developers need to determine if the 40 percent deficiency in profits can still cover the assumed lower cost of development. Then, once the decision has been made to enter the select-service segment, owners need to choose between select-service properties with, or without, food and beverage.