By Lana Yoshii

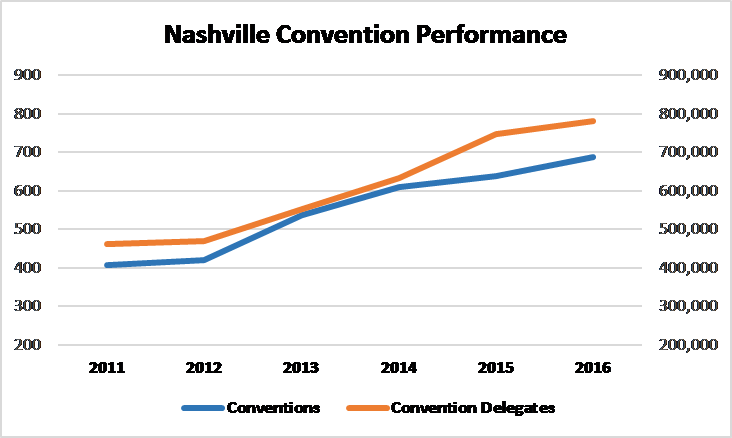

Nashville has been blowing and going in recent years: The area MSA’s employment has grown at a 2.8% compounded annual growth rate from 2011 to 2017, as of February 2017. The MSA gains about a 100 new residents every day. The new Music City Convention Center, which opened in May, 2013, was well received, and convention activity has shown good growth, with an 11% compound annual growth rate since 2011.

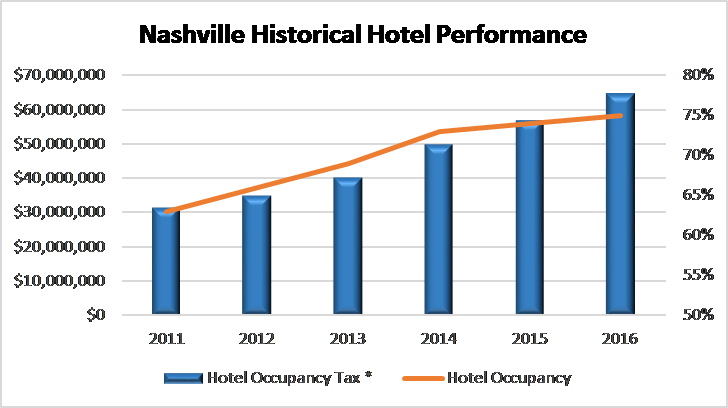

Occupancy and ADRS have grown, such that citywide hotel TOT tax receipts have growth even faster, at 15.4% annual since 2011. That’s the good news. The bad news is that the new center is stabilizing, and convention attendance grew by only 5% last year, less than half the historical compound annual growth rate.

Rooms have been opening in this frothy market since 2013, and continue to open, most recently the 224-room Thompson Hotel (2016), the 453-room Westin (2016), and the 122-room Fairfield Inn & Suites MetroCenter (2017).

Unfortunately, there are still many developers that do not recognize the fundamental growth rates slowing absorption. Currently, there are 24,100 hotel rooms in the city of Nashville. If no discipline is introduced in this market, developers are planning to add 13,000 rooms.

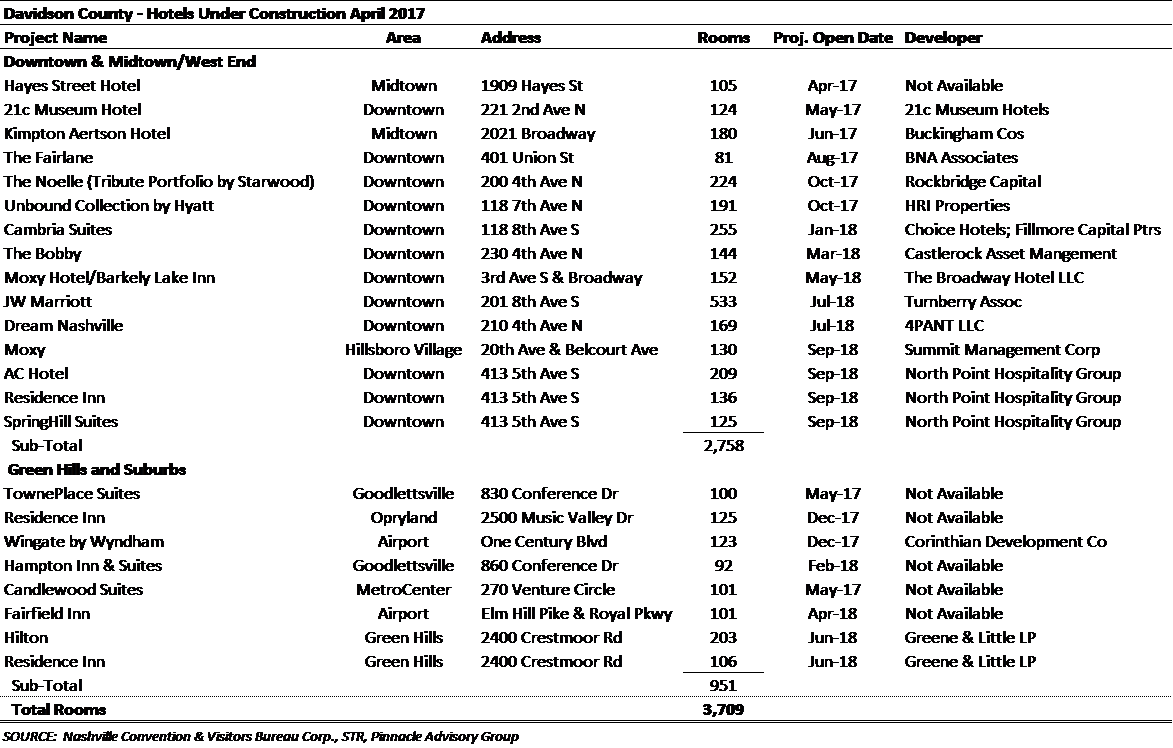

Twenty-three projects, with 3,700 rooms, are currently under construction in the MSA. Some 49% of the total rooms under construction are for luxury and upper upscale tiered hotels in a market while only 2% of the existing supply[1] caters to top-tier guests, and 20% to upper-upscale travelers. And as the list shows, ¾ of the additions are in the Downtown and Midtown/West End neighborhoods. In the Downtown and Midtown/West End neighborhoods there are 2,758 rooms under construction.

In these two sub-markets, demand growth has exceeded supply growth thus far, and the new supply has been readily absorbed. Though the 2,758 room listed above constitute a 28% increase over the sub-markets’ existing supply, within a few years these 15 hotels are likely to be absorbed.

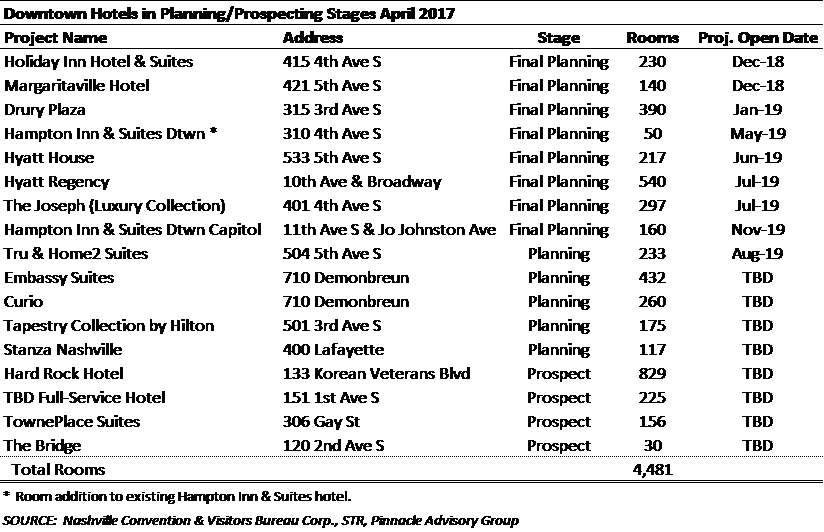

We are concerned however about the proposed supply. Another 4,481 rooms are proposed for the Downtown/Midtown/West End markets:

With low-and mid-single digit growth in the fundamentals, can Downtown Nashville be expected to absorb another 48% on top of the 28% increase that is now under construction?

It is true that Bridgestone is moving its US headquarters into a 506,000 SF building downtown, but 1,100 of the 1,700 employees are moving from space near Nashville’s airport. With so much entertainment to offer, did their visitors confine themselves to the Airport hotels? The new HCA headquarters came on line, but this was a consolidation of offices around Nashville, and some divisions were housed only a mile west. Having sold their 9 building/15 acre holdings in Downtown, Lifeway will be moving to the same complex as HCA, but this is not new hotel demand.

Over the last 6 months, demand growth has still nominally outpaced supply growth, with a 2.8% increase in supply and a 2.9% increase in demand, but when looking at the monthly results, the 4 of the 6 months had declining occupancy percentages. In the same 6 months of 2015/16, year-over-year demand growth was nearly twice the rate of supply growth, with 5.4% demand growth, compared to 2.9% supply growth.

The rate of ADR growth is decelerating. From September through November, the MSA’s ADR grew by 5.6% in the 2016/17 Fall & Winter months, down from an 8.9% growth in the Fall & Winter of 2015/16. The warning bells should be ringing in Nashville.

[1] 122-room Hermitage Hotel, the 229-room Loews Vanderbilt Plaza, the 247-room Hutton Hotel, and the 224-room Thompson Hotel.