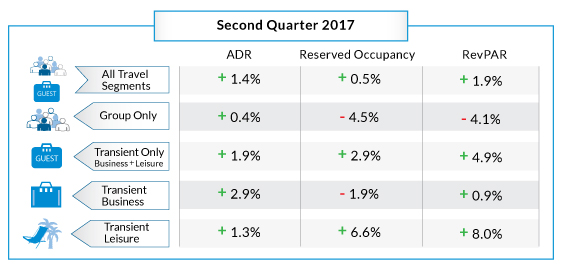

Transient Leisure Travel Remains Strong in Second Quarter of 2017

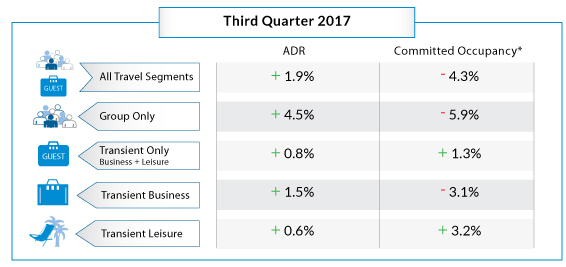

NEW YORK – April 27, 2017 – As North American hoteliers forge ahead in 2017, average daily rates (ADR) are holding strong in both the second and third quarters of 2017 despite declines in committed occupancy*, according to new data from TravelClick’s April 2017 North American Hospitality Review (NAHR).

In the third quarter, for example, ADR for group travel is up 4.5 percent, but bookings are down -5.9 percent. Similarly, across all travel segments for the same quarter, ADR is up 1.9 percent, but bookings are down -4.3 percent. The transient leisure segment is showing positive gains in both bookings and ADR during the second quarter of 2017, up 6.6 percent and 1.3 percent respectively.

“Despite a reduced spring / summer booking bounce, rates have managed to remain steady during the first half of 2017, which is music to hoteliers’ ears,” said John Hach, TravelClick’s senior industry analyst. “While this may not represent a lasting trend, there is some positive news in the data that could indicate more growth across the board moving forward.”

Twelve-Month Outlook (April 2017 – March 2018)

For the next 12 months (April 2017 – March 2018), transient bookings are up 2.5 percent year-over-year, and ADR for this segment is up 1.8 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 5.6 percent, and ADR is up 1.3 percent. The transient business (negotiated and retail) segment is down -2.1 percent; however, ADR is up 2.8 percent. Lastly, group bookings are slightly down -0.9 percent in committed room nights over the same time last year, while ADR is slightly up 1.1 percent.

“Without any evident trends set in stone for 2017, hoteliers must focus on differentiating themselves within their local markets by using business intelligence tools to tackle inconsistencies in the numbers during this time,” added Hach. “There are many factors that could ultimately affect the health of the hospitality industry at any given time. Forward-looking data is the key to understanding the marketplace and making the right business decisions for any hotel.”

The April NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by April 1, 2017, from the period of April 2017 to March 2018.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The second quarter is based on forward-looking data (April – June 2017).