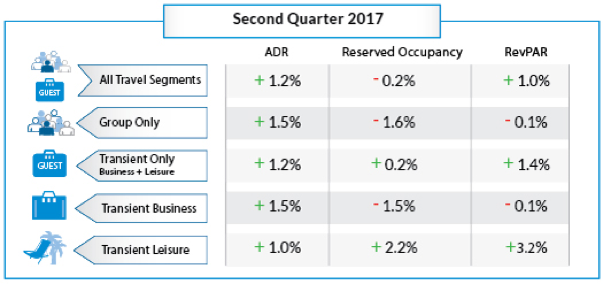

NEW YORK – June 29, 2017 – Heading into the second half of the year, North American hoteliers are continuing to experience stable average daily rates (ADR) alongside declines in bookings during the second quarter of 2017, according to new data from TravelClick’s June 2017 North American Hospitality Review (NAHR). This marks an ongoing trend for hoteliers this year.

Despite strong transient leisure travel, with positive gains in both ADR and bookings, all other travel segments are experiencing inconsistencies across the board. For example, ADR for transient business travel in the second quarter is up 1.5 percent, but bookings are down -1.5 percent. ADR for the group segment is also up 1.5 percent, but occupancy is down -1.6 percent.

“Our latest data predicts a prolonged decline across many North American markets, indicating that this bleak outlook may not ease up anytime soon,” said John Hach, TravelClick’s senior industry analyst. “Transient leisure travel is the exception, however, up 1.0 percent and 2.2 percent for ADR and bookings, respectively, during the second quarter.”

Twelve-Month Outlook (June 2017 – May 2018)

For the next 12 months (June 2017 – May 2018), transient bookings are slightly down -0.6 percent year-over-year, but ADR for this segment is up 1.0 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 0.7 percent, and ADR is up 0.6 percent. The transient business (negotiated and retail) segment is down -1.8 percent; however, ADR is up 1.5 percent. Lastly, group bookings are slightly up 0.4 percent in committed* room nights over the same time last year, and ADR is up 2.7 percent.

“As we move deeper into the summer season and start the second half of the year, hoteliers should remain cautious of unpredictable booking trends and take advantage of business intelligence tools to endure this period of uncertainty,” added Hach. “Forward-looking data is a powerful asset to ensure that hoteliers stay ahead of the competition, both locally and overall, to prepare for unforeseeable events that may affect the industry.”

The June NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by June 1, 2017, for the period of June 2017 to May 2018.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The second quarter combines historical (April – May) and forward-looking data (June), plus third quarter forward-looking data (July – September).