By Jim Butler and the Global Hospitality Group® Hotel Lawyers | Authors of www.HotelLawBlog.com 19 October 2017

Note: If you are a consumer with a Resort Fee issue, please do NOT contact us! We do not represent consumers with complaints against hotels. We are part of the fabric of the hotel industry and are committed to informing, educating and assisting players in the hotel industry.

What does the FTC say is your potential liability for mandatory hotel charges?

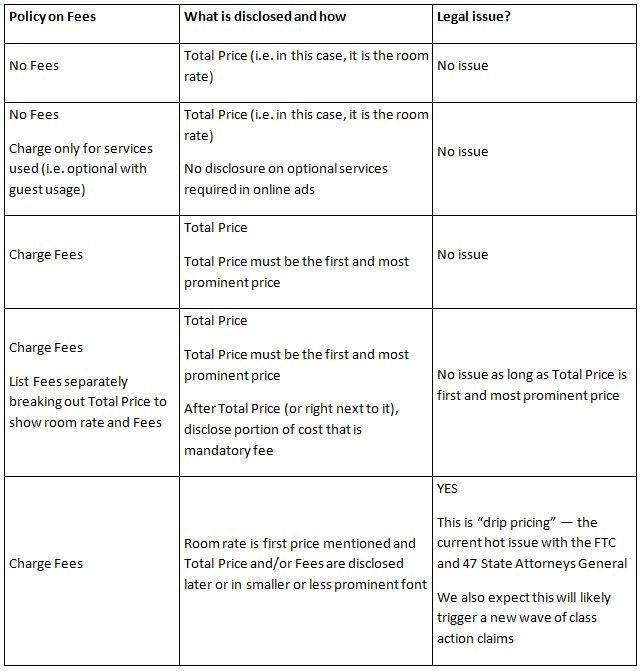

In evaluating what you should do about the new furor over mandatory hotel charges, it would be helpful to have a clearer understanding of what the FTC seems to be saying on the issue. The chart below is our translation into “street English” of the FTC pronouncements discussed earlier. (See How Resort Fees became an explosive $2.7 billion issue which contains links to the original FTC press release of November 29, 2012 and the most recent FTC Economic Analysis of Hotel Resort Fees of January 2017.)

We believe we understand what the FTC is saying. We may not agree with it. We do not know whether the Trump administration will rein in the FTC on its perceived mission regarding resort fees, and we do not know whether the current FTC position will be upheld as a valid interpretation of the law. However, courts normally accord great deference to the interpretation of agencies charged with administering their laws, and it is imprudent to ignore the FTC’s recent actions.

In weighing options, even if they ultimately win on legal issues, hoteliers should also consider the negative effects of litigation — including direct costs in terms of legal fees, senior management time, and good will. And there are a number of worrisome plaintiffs who may pursue the issue, including the FTC, State Attorneys General, other governmental and consumer groups, and class action plaintiffs’ lawyers. Any victories by the hotel industry may be largely offset by the costs to obtain them.

So what are your options on mandatory Resort Fees?

The basic thrust of the actions by the FTC, the investigation by the State Attorneys General and most consumer class action suits is that it is a deceptive and misleading business practice for hotels to advertise their room rate online unless the first and most prominent price given includes all mandatory Resort Fees and other charges. They say that it is not sufficient to give the room rate and then have a less prominent disclosure of additional charges.

The issue here is really about what disclosure must be made and how it should be made if you charge mandatory fees that are not included in the room rate you quote in advertising and online.

For the sake of argument, let’s say that the FTC position expressed in the January 2017 analysis was “the law” or that for business reasons you want to develop policies and procedures for Resort Fees that should avoid these Resort Fees issues. The following matrix provides a general guideline as what to options or approaches you might take and the corresponding disclosures.

Key terms used in the matrix

In the matrix below, “Fees” is used as a shorthand expression for all mandatory fees and charges, i.e. resort fees, service fees, amenity fees, surcharges or other non-optional charges to the guest which are not included in the quoted room rate.

“Total Price” means the total of room rate plus any mandatory fees or charges as a single sum. For these purposes, Total Price does not include applicable taxes because we are not aware of any claim that taxes are a necessary part of price disclosure, although one can imagine such a claim being made. Taxes are distinguishable from other Fees or charges for services in that they are a direct pass through of governmental impositions which must be paid over to third parties, they are not at the discretion of the hotel, and they do not benefit the hotel.

Resort Fee Litigation Exposure Matrix (mandatory fee options and necessary disclosures)

Remember: Resort Fees are not illegal. This is all about disclosure.

For the last two decades — as long as this issue has been rankling consumers and government agencies — no one has ever suggested that mandatory fees are illegal or improper! The only issue is about the disclosure that must be given on pricing.

So even if a hotel decides to take the most conservative approach on disclosure, the hotel can still charge the Resort Fee and display this charge separately. The Uniform Standards of Accounting for the Lodging Industry, 11th edition, provides that these mandatory charges are not accounted for as rooms revenues (but rather as “Miscellaneous Income”). Therefore, the significant mandatory fees should still be exempt from various charges on “rooms revenues” such as transient occupancy taxes, franchise fees, frequent traveler program charges and the like. And hotels can still provide their guests with a big bundle of amenities and value at a discounted price.

The biggest problem for a hotelier in moving to position advocated by the FTC and consumer groups is the competitive disadvantage when consumers compare pricing online. The first hotels listing Total Price as the first and most prominent price may lose business to those that list only room rate with mandatory fees in the fine print. But that is part of a different discussion for another day.

How to get help with Resort Fee litigation issues

We understand the history and complexities of the Resort Fee litigation and we are advising industry stakeholders on these matters currently. If you would like some help to evaluate your situation and options, then call one of the members of our Resort Fee Litigation Advisory Group. There is no cost for an initial discussion.

Jim Butler, +1-310-201-3526 or jbutler@jmbm.com

Mark Adams, +1-949-623-7230 or mxa@jmbm.com

Anthony Pacheco, +1-310-785-5309 or axp@jmbm.com

For more information about Resort Fee issues, including the latest updates, go to www.HotelLawBlog.com, scroll down the right-hand side under LEARN MORE ABOUT and click on “Resort Fee Litigation” where you will find all the articles on the subject.

For your convenience, here are a few popular Resort Fee articles that may be of interest:

Impending eruption of litigation over Resort Fees? What’s the fuss?

The FTC takes aim at hotel Resort Fees — The FTC 2017 Report

National task force of 47 Attorneys General goes after hotel Resort Fees

How Resort Fees became an explosive $2.7 billion issue

This is Jim Butler, author of www.HotelLawBlog.com and hotel lawyer, signing off. Please contact us if you would like to discuss any issues that affect your hotel interests or see how our experience might help you create value and avoid unnecessary pitfalls. Who’s your hotel lawyer?