Numbers are up despite the devastating hurricane season; international inbound travel remained stable.

WASHINGTON (November 7, 2017)—Domestic leisure travel led all travel segments in September 2017 despite the destructive hurricanes that pummeled U.S. states and territories during a normally busy season, according to the latest Travel Trends Index (TTI).

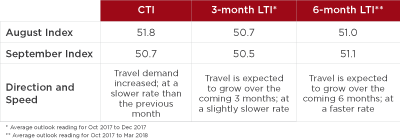

The increase marked the 93rd consecutive month of travel growth. However, overall travel volume grew at a slower year-over-year rate in September than in August.

Domestic business travel dipped modestly, likely due to a calendar shift in Jewish holidays and Hurricanes Harvey and Irma.

"Both the domestic and international travel markets are showing remarkable resilience in the face of some significant headwinds," said U.S. Travel Association President and CEO Roger Dow. "Pretty much every challenge you can imagine—both natural and man-made—has been thrown at travel this year, and yet this industry continues to do far more than its share for export and domestic job growth.

"It doesn't take much for the travel industry to achieve a favorable return on investment—America just needs to compete for market share by facilitating safe, legitimate travel and increasing connectivity by upholding Open Skies and modernizing our airports."

Dow continued: "We continue to urge the Trump administration to make clear that new security measures are squarely aimed at bad actors, while legitimate business and leisure travelers are as welcome as ever in the United States."

Total U.S. travel volume is expected to grow at a rate of around 2.2 percent through March 2018. Forward-looking metrics suggest a positive outlook for international travel, but tempered expectations are very much in order.

The TTI is prepared for U.S. Travel by the research firm Oxford Economics. The TTI is based on public and private sector source data which are subject to revision by the source agency. The TTI draws from: advance search and bookings data from ADARA and nSight; Airline bookings data from the Airlines Reporting Corporation (ARC); IATA, OAG and other tabulations of international inbound travel to the U.S.; and hotel room demand data from STR.

Learn more about the Travel Trends Index.

Click here to read the full report.