By Kim Lindell , Scott Killheffer

Philadelphia lays claim to many firsts in the U.S., including the first state capital, public library, hospital, stock exchange, and even the nation’s first zoo. Today, revitalization efforts continue to fuel the city’s engine of innovation, building on a base of airport, tourism, education, and convention demand drivers.

Strong group demand in recent years, combined with rising levels of transient corporate and leisure travel, has boosted occupancy and average daily rate (ADR), especially within Philadelphia’s Center City submarket.

Major Economic Drivers

Center City Philadelphia, which includes the Central Business District and central neighborhoods of Downtown Philadelphia, has grown into the second-most-populated downtown area in the United States, after Midtown Manhattan in New York City. Many colleges and universities make Philadelphia a top international-study destination, and the area continues to evolve as the educational and economic hub of the Delaware Valley. Higher-education institutions located within the city include the University of Pennsylvania, Temple University, Drexel University, Philadelphia University of the Sciences, and Philadelphia College of Osteopathic Medicine.

The healthcare sector also contributes to the economic vitality of Center City, further supporting hotel demand in the area. Jefferson Health System’s flagship hospital, Thomas Jefferson University Hospital, and Hahnemann University Hospital, which is affiliated with Drexel University College of Medicine and St. Christopher’s Hospital for Children, are located in Center City. Additionally, Independence Blue Cross is the region's largest health insurer.

The Pennsylvania Convention Center (PCC) plays a vital role in the area's economy; its success is supported by the city's convenient location with respect to both New York and Washington, D.C., as well as its popular facility layout and capacity. In July 2016, the convention center hosted a number of caucus meetings related to the 2016 Democratic National Convention, which attracted approximately 60,000 participants. According to officials at the PCC, activity at the convention center is expected to be down in 2017 and 2018; however, numbers are anticipated to increase in the ensuing years.

Future Business Capture

The aforementioned demand generators in the education, healthcare, and convention sectors have the potential to attract additional price-sensitive guests seeking midscale hotel accommodations in Center City.

Existing Hotel Supply

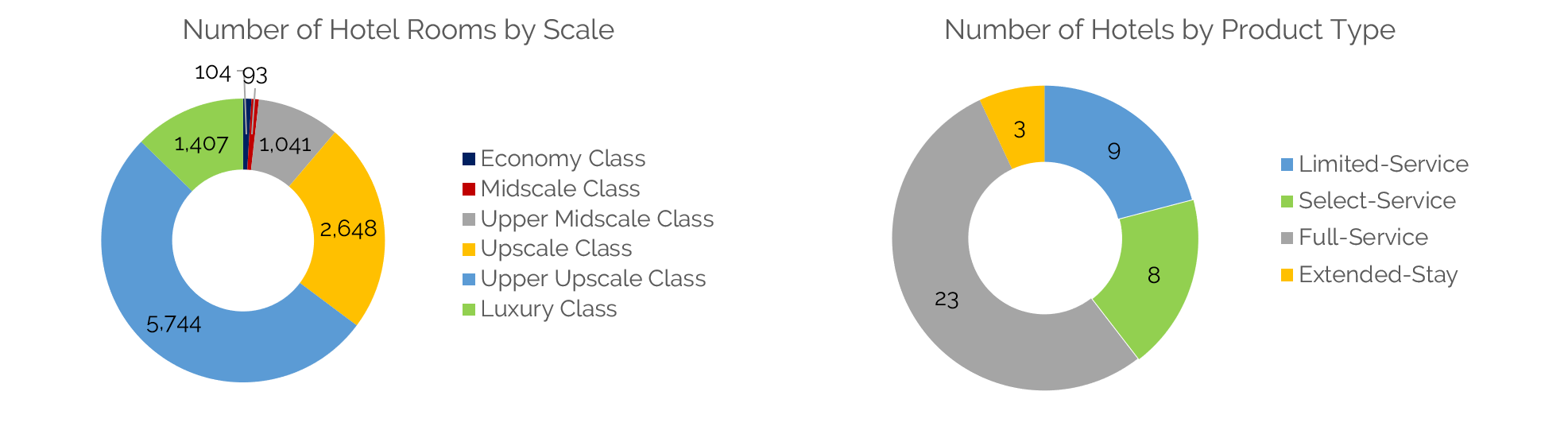

The Center City submarket currently includes approximately 11,000 hotel rooms, comprising primarily upscale and upper-upscale, full-service hotels; moreover, the submarket’s existing luxury hotels include the Ritz-Carlton, Rittenhouse Hotel, and Hotel Monaco. However, there is a notable void of limited-service hotels within the Center City submarket, and no limited-service properties are in the anticipated pipeline of new supply.

Proposed Supply

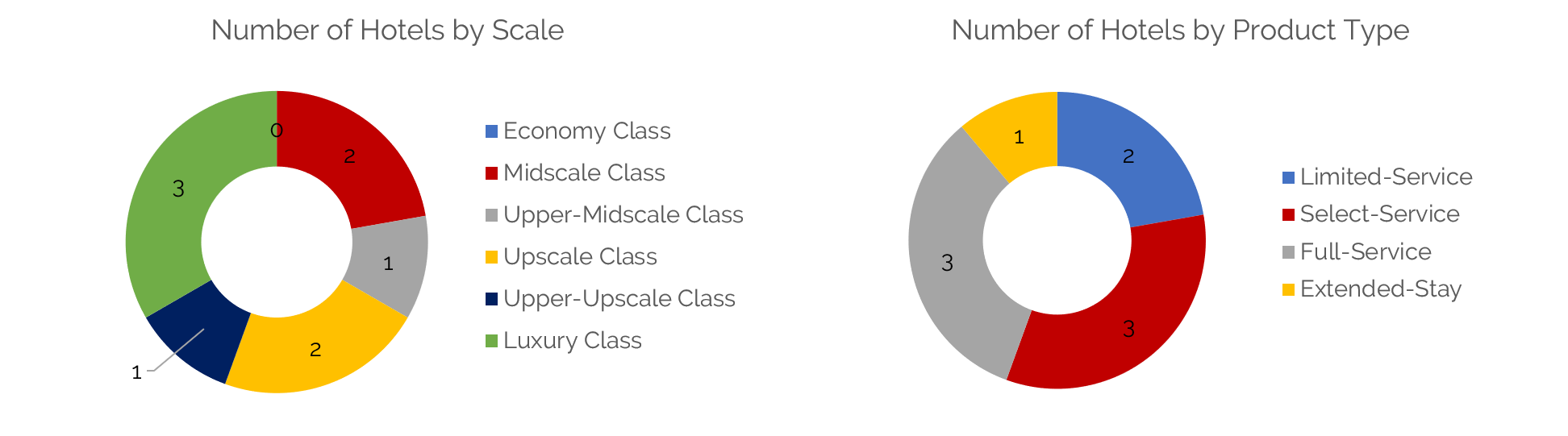

Supply growth in Center City Philadelphia is positioned to exceed 18% over the next two years. The most significant growth is occurring within the luxury chain scale, which represents 32% of the proposed new supply, with upscale hotel development falling just behind it.

The development of a new Four Seasons hotel is underway atop the under-construction, 1.28-million-square-foot Comcast Innovation & Technology Center; the 60-story, 1,121-foot tower will neighbor Comcast Center, Comcast Corporation’s global headquarters, and become a dedicated home for the company’s growing workforce of technologists, engineers, and software architects. Additionally, the Courtyard by Marriott is currently undergoing a $23-million renovation in its rebranding to an Autograph Collection by Marriott affiliate, a higher-rated hotel product.

The construction and renovations of higher-tiered hotels in Center City come on the heels of some record sales in the submarket, including Hersha Hospitality Trust’s purchase of the Westin Philadelphia for over $495,000 per key in June 2017. Furthermore, the dual-branded W Hotel and Element, now under construction, will represent the largest hotel property in Downtown Philadelphia.

Even with the expected introduction of nine hotels in the downtown area over the next two years, there are still areas of opportunity for hotel development in this rapidly growing city.

Potential Opportunities for Midscale Hotels

Three of the nine proposed hotels in Philadelphia—one third—are luxury properties, a reflection of strong demand generation from the city’s corporations, among other high-end generators. At the same time, the city's relatively low number of midscale to upper-midscale, limited-service supply is expected to increase by just one hotel.

Hence, even after the completion of the proposed new supply in Philadelphia’s Center City, limited-service hotels will be the most underserved hotel type, currently representing just 7% of the total guestroom supply, and anticipated to move up less than 1% in the next two years.

Additionally, midscale and upper-midscale hotels will only represent 3.3% and 8.9% of guestrooms, respectively, with the completion of the new supply entering the market. Given the availability of a well-located site, coupled with an appropriately priced construction cost, the Center City Philadelphia submarket represents a favorable option for the development of additional properties in this hotel class.

Conclusion

Growth and expansion are undoubtedly underway in Philadelphia’s Center City, with ongoing projects such as the construction of the Comcast Innovation & Technology Center and a ramping up of the Philadelphia Convention Center creating jobs and hotel demand. Furthermore, city officials have been actively working on attracting large events, such as the Papal visit in 2015, the Democratic National Convention in 2016, and, most recently, the NFL draft, which should continue to bode well for hotel demand growth in the near term.

The significant increases in proposed supply over the next two years are anticipated to be easily absorbed by unaccommodated demand in the submarket. Furthermore, a larger, more diverse hotel base will allow for substantial citywide conventions to be accommodated in Philadelphia.

While the influx of new supply may seem like a dissuasion for potential hoteliers, midscale to upper-midscale, limited-service hotel properties do have potential to gain a foothold in the Center City submarket over the next several years.