Research provides food-and-beverage demand outlook through 2020, and reveals performance and occupancy trends, investment plans and new food formats

ROCKVILLE, MD, April 4, 2018 – Avendra today releases findings from a new F&B trends report titled “Lodging Food & Beverage Outlook” that gauges demand for hotel F&B over the next two to three years. The findings reveal current F&B and occupancy performance, identify hoteliers’ investment plans, and detail new food formats for the future.

“Today’s restaurants face multiple pressures based on shifting consumer behaviors,” said Chip McIntyre, senior vice president of strategic sourcing, Avendra. “We worked with an independent third party to help identify those behaviors to ensure that the restaurants and food operations our hotel customers own and operate can remain relevant in an increasingly diverse and competitive environment.”

Avendra provides procurement and supply chain management services for food-and-beverage and other areas of hotel operations. In addition, Avendra F&B experts analyze various offerings within a hotel’s foodservice outlets to help operators enhance revenue, reduce overall costs, and provide exceptional guest service. Detailed analysis includes menu engineering and product cross-utilization and comparisons against local competitors, product applicability reviews, and the exploration of practical product alternatives to achieve cost savings that can be implemented without sacrificing product quality.

The researcher received approximately 900 unique responses, with about 90 percent coming from hotel general managers and directors of F&B, and roughly 10 percent coming from either hotel management companies or brand-level/corporate entities spanning luxury to economy and independent segments.

“In the United States, the lodging industry represents approximately $200 billion dollars in annual revenues, and it’s growing by 1.5% to 2% each year,” McIntyre said. “Food and beverage tends to represent 25% of that total expenditure, or around $50 billion, and it’s growing at about 2% to 3% each year.

“Through this study, we uncovered three notable trends supporting F&B growth,” he said. “First, groups frequenting full-service hotels are spending more and they’re moving up to higher-tier proteins or beverage options. We are also seeing a shift towards local restaurant concepts accompanied by an upscale bar. Second, limited-service hotels are seeing outsized volume growth coming from grab-n-go type occasions. This lodging segment is seeing a larger share of the 2% industry supply growth. Third, 75% of group demand is already booked (driven by conferences and events), we can see group business is pacing up 2% to 3% for 2018. This is the biggest, most important driver of F&B demand.”

Here are just a few notable findings from the Lodging Food & Beverage Outlook:

- Food and beverage is expected to be a growing area of the hotel business. About 60% of participants in this study expect the contribution of F&B (as percentage of revenues) to grow over the next 3 to 5 years (vs. the ~30% contribution today). A similar number of respondents also expect revenue/onsite bar revenues to increase in the years ahead. This is likely to come primarily from beverage sales in restaurants, bars, and other venues rather than in-room minibars – as this format seems to be going out of favor.

- One of the structural growth drivers for F&B revenue is likely that hotel owners and general managers are allocating a growing amount of square footage for F&B within new hotel builds and remodels. In general, this held true across all types of properties. This trend was most prominent in the luxury sector, where 40% of hotel owners and 33% of independents said they plan to increase F&B square footage.

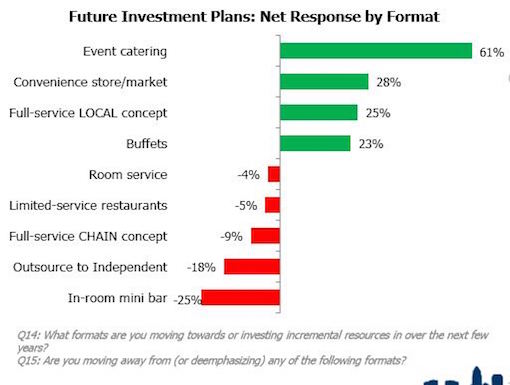

The biggest area of F&B investment is event catering, with 61% of respondents planning net growth in this area. Convenience/market concepts are also expected to proliferate, with a growing emphasis on fresh.

- Local restaurant concepts (managed internally) are likely to gain additional placement; whereas, hotels are moving away from outsourcing that space to a local independent concept (to be managed externally).

- In-room minibars and chain restaurant concepts will be less prominent formats in hotels the next 3 to 5 years.

- When it comes to room service, only 10% of respondents in the luxury segment said they plan to increase investments in this area.

- A net +5% of mid-scale properties were investing in limited-service restaurants. All other segments were moving away from this concept, particularly luxury/upper upscale (-10%).

- Luxury, upscale and independent segments are devoting resources to local restaurant concepts.

- While all chain scales looked to be working to grow the buffet format, independent hoteliers were least likely to invest in this format (+3% compared to +23% for the entire sample).

Just over half of the sample of hotel industry participants are selling fresh/refrigerated foods in convenience or a market format today. We expect this segment to see further growth as about one-third of those who do not offer fresh foods in a market concept are planning to do so within the next year. On average, about 45% of hotel sites that offer fresh foods within on-site convenience stores are seeing better-than-expected revenue growth.

- More than 40% of properties will add fresh food convenience options in the upper upscale, upscale, upper midscale, and economy segments. That would imply almost 25% growth in the number of points of distribution during the next 12 months.

- About 95% of luxury and independent hotel operators provide food benefits to employees today, and 35% to 40% of these properties are looking to expand that budget in the future.

“‘The Lodging Food & Beverage Outlook’ provides powerful insights on the growth in hotel F&B, identifies shifts in foodservice strategy for hotel owners, and gives perspective on the specific areas of the lodging business,” McIntyre said. “Overall, we found that hotel F&B growth is expected to pick up in 2018, likely driven by a combination of better group RevPAR trends plus more purposeful investments in growth formats.”