By Magali Castells and Sophie Perret

Introduction

This article presents recent supply and demand trends for Barcelona, before discussing some of the sociopolitical events that have impacted the market over recent months, as well as their effect on hotel performance and the outlook for the coming year.

Barcelona is Spain’s second-largest city, with a population of approximately 1.6 million in 2017, and is the capital of Catalonia. Located on the Mediterranean coast, 180 km southwest of the French border, Barcelona is the country’s principal seaport and is the third-largest port in the Mediterranean region.

Since the organisation of the Olympic Games in 1992, Barcelona has become a favourite short-break leisure destination in line with cities such as Paris, London and Amsterdam. It is also an increasingly important port for cruise ships. In addition, Barcelona is an established centre for meeting, incentive, conference and exhibition (MICE) business: the city was 3rd in the International Congress and Convention Association (ICCA) ranking in 2016 with a total of 181 meetings.

Tourism Demand

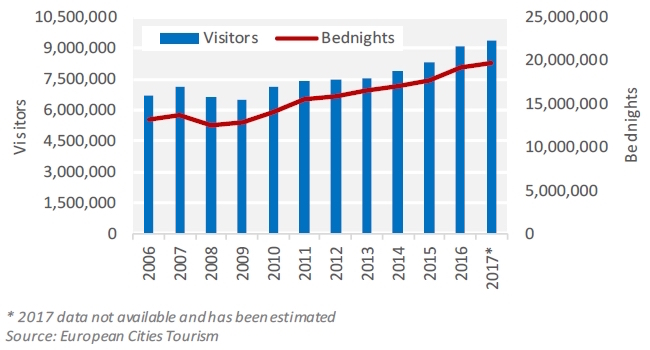

Since the global economic slowdown after the financial crisis in 2009, the total numbers of visitors and bednights in Barcelona has been increasing year-on-year, resulting in an overall compound annual growth rate of 2.8% and 3.8%, respectively, from 2006 to 2017. 2016 was a very good year with approximately 9 million registered visitors to the city, 9.2% more than 2015, driven by both domestic and international tourists. This growth continued throughout 2017, which was the best year so far with more than 9.3 million visitors and just short of 20 million bednights, an increase of around 3% on the previous year (see figure 1).

FIGURE 1: VISITATION AND ACCOMMODATED BEDNIGHTS IN BARCELONA

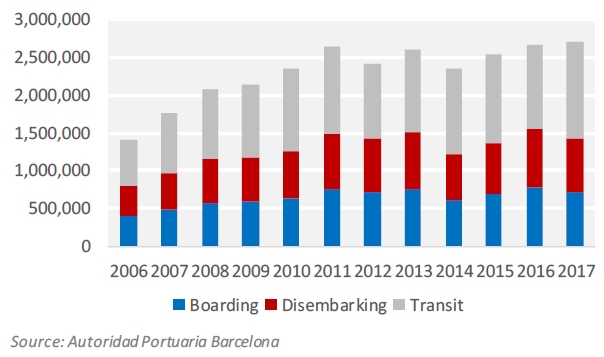

A substantial number of visitors to the city arrive on cruise ships that choose Barcelona as one of their preferred Mediterranean destinations (see figure 2).

FIGURE 2: PASSENGER MOVEMENTS – CRUISE SHIPS

There is a substantial influx of day tourists, especially during the summer. Passenger movements more than doubled from 2006 to 2017. In order to curb this growth (or at least take a financial advantage of it), a new day tourist tax is currently being evaluated; this could substantially impact cruise tourism, since one ship alone can bring several thousand tourists to the city for the day.

Source Markets

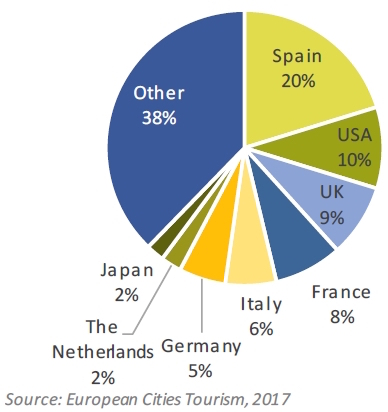

In 2017, the main feeder markets in terms of arrivals to the city of Barcelona were domestic visitors (20%) followed by the USA (10%), the UK (9%), France (8%), Italy (6%) and Germany (5%) as the main sources of international visitors (see figure 3). This distribution of demand has remained fairly unchanged over the past eight years.

FIGURE 3: VISITOR SOURCE MARKETS 2017

Seasonality

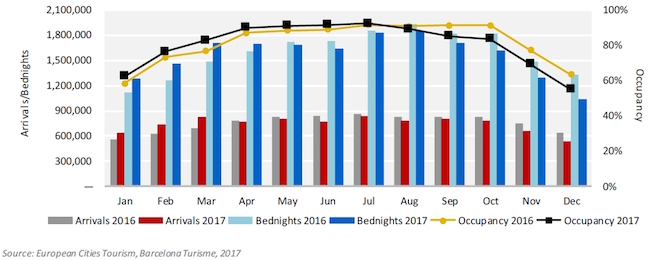

Barcelona is one of the major short-break leisure destinations in Europe and, as such, has a relatively broad seasonality, with the lowest months being December and January. Its strong reputation as a MICE destination also contributes to this. In 2017, hotel room occupancy was over 50% every month of the year. During the summer, market occupancies hover around 80-90%, demonstrating the city’s popularity (see figure 4).

FIGURE 4: SEASONALITY IN BARCELONA 2016 AND 2017

Conventions

The city of Barcelona has long been and still is an internationally recognised destination for meetings, inentives, conferences and exhibitions (MICE) business. According to the ICCA, in 2016 Barcelona was in third position in the world ranking of organisers of exhibitions and congresses, directly after Paris and Vienna (see figure 5).

FIGURE 5: CONVENTION CENTRE STATISTICS IN BARCELONA

Hotel Supply

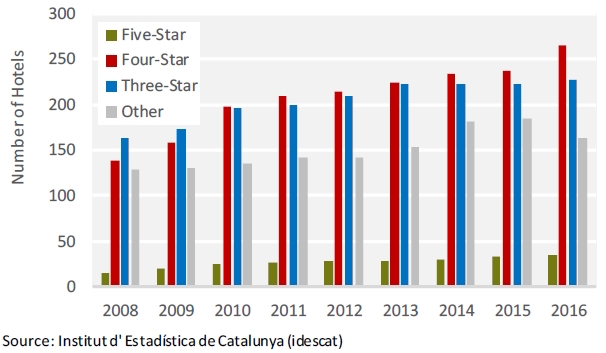

The number of hotels and rooms in Barcelona has been growing steadily over the past few years, in line with the increase in demand. As a result, the total number of hotels and rooms have increased at a compound annual growth rate (CAGR) of 5.6% and 5.4% respectively, from 2008 to 2016. This increase has been especially driven by the increased supply in four-star hotels, growing at a CAGR of 8.5% over the same period (see figure 6).

FIGURE 6: HOTEL SUPPLY IN BARCELO

However, as expected, the tourism moratorium put in place in July 2015 (see panel to the right) has had a major effect on the hotel supply. Since the start of the moratorium, the strategy has resulted in the paralysis of at least 38 hotel developments in the city, accounting for expected losses valued at approximately €3 billion and several thousand jobs. Only the few projects that were granted permission before this new law will be able to enter the market in the coming years, and the future for new hotels thereafter remains uncertain. Accordingly, only six hotels have either recently opened or are expected to open in the next two years in the city, adding up a total of approximately 1,000 new rooms to the market, a mere 2.5% of the current supply (see figure 7).

FIGURE 7: NEW SUPPLY

Tourism Moratorium

In May 2015, Ada Colau was elected the new mayor of the city. Leading a coalition of environmentalists and social activists, she announced that the city’s tourism strategy would change radically in order to ensure more ‘quality tourism’ for the city. As a first step, in July 2015 the mayor placed a moratorium on approving new hotel developments and short-term rentals for the following 12 months. This tourism moratorium was extended in 2016 for an additional year, preventing the opening of new hotels and other tourist accommodation.

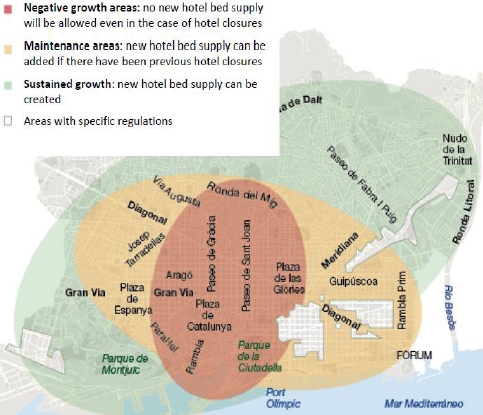

Eventually, in March 2017, the tourism moratorium was substituted by the Special Tourist Accommodation Plan (PEUAT), approved by Full Council on 27 January 2017. This law regulates the introduction of tourist accommodation establishments, as well as youth hostels, collective residences with temporary accommodation and tourist apartments. According to the city mayor, it will allow for a sustainable and responsible tourism model and will reduce the pressure in the most saturated neighbourhoods in the city. The different areas are presented in the map below.

Market Performance

Partially due to the moratorium, supply growth since 2015 has been limited, but demand has continued to grow, leading to an increase in occupancy and average rate. As a result, RevPAR increased by 3.7% in 2015 and a further 10.7% in 2016 reaching €111(see figure 8).

2017 figures indicate a continued upward trend mainly due to an increase in average rate, with sustained RevPAR growth over the same period last year. Although hotels in Barcelona experienced substantial performance declines following the 1 October Catalan Independence Referendum (see panel to the right), 2017 still shows positive results overall. The year can be clearly divided into before and after the vote. Year-to-September 2017 figures showed double-figure RevPAR growth of around 15%. This trend was reversed from October onwards, with a reduction in RevPAR of between 10% and 20% each month to December. However, results for the year were still positive by the end of 2017.

FIGURE 8: MARKET PERFORMANCE

2018 performance is expected to recover as long as the political situation does not create any further civil unrest and demonstrations. However, 2018 is expected to be a relatively slow year for the conference segment, as normally these events get booked some time in advance and several for this year have already been changed to a more stable destination. We understand, for example, that Seville had the strongest Q4 on record on the back of the Catalonian strife. In the meantime, year-to-date performance for Barcelona up to February 2018 shows RevPAR up by around 4% on the back of a strong ADR.

1 October Catalan Independence Referendum

The quest for Catalonia’s independence from Spain has generated instability in the region and Spain overall.

Although deemed illegal by the Spanish government and Constitutional Court, a referendum on independence was held on 1 October 2017. Results showed a 90% vote in favour of independence, although with a low turnout of only 43%. On the day of the referendum, the National Police Corps and the Guardia Civil intervened and raided several polling stations, creating social unrest, continued demonstrations and riots which became an international issue. This impacted both national and international demand to Barcelona for the following months.

In new regional elections held in Catalonia on 21 December 2017, pro-independence parties retained control of parliament. Forming a government, however, remains extremely complicated as the former president, Mr Puigdemont, remains in exile in Belgium and the former vice president, Mr Junqueras, is in prison.

There is still a palpable fear that sustained political instability will continue to negatively affect the Catalan region and Spain overall. Several businesses have changed their corporate addresses to other parts of Spain in recent months to guarantee continued access to the domestic market and the wider European Union in case of independence. As a result, the level of economic uncertainty in the region has increased while the crisis has also hit tourism and foreign investment in Catalonia. It is expected, however, that should the political situation be resolved without creating any further civil unrest, tourist demand in 2018 and thereafter should soon recover to historical levels. The economic impact on the sector from potential independence is still too difficult to assess, and is likely to only become somewhat measurable once there is more clarity about the political direction for the region.

Investment Environment

2016 and 2017 have been characterised by a slowdown in the purchase of new hotels as well as the acquisition of buildings for hotel development in Barcelona. This has been mainly due to the strong uncertainty affecting the city of Barcelona after the introduction of PEUAT and the activities of the independence movement.

The most notable single asset transaction in Barcelona in 2017 was the 430-room Hilton Diagonal Mar, which was acquired by AXA Investment Management from Iberdrola in November (see figure 9). For further details please refer to our report HVS European Hotel Transactions published in March 2018.

FIGURE 9: TRANSACTIONS (€)

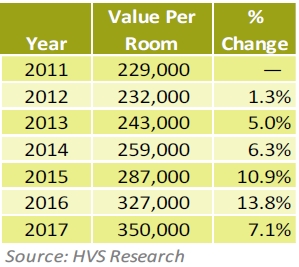

FIGURE 10: VALUES PER ROOM (€)

On the back of strong rate growth, from a pricing perspective values per room have shown impresive growth in Barcelona in the last seven years (see figure 10). Values per room already surpased the 2007 peak of €316,000 in 2016, on a nominal basis. For further details please refer to our report HVS European Hotel Valuation Index published in March 2018.

Conclusion and Outlook

Barcelona continues to be one of the most successful European short-break destinations and is likely to continue to be so over the years to come, regardless of the political and governmental changes that may lie ahead.

Without the shadow of a doubt, the introduction of the moratorium and PEUAT has been beneficial for existing hotels by increasing occupancy and average rate levels, for the foreseable future. It has also, nevertheless, generated a certain level of uncertainty in the development of projects, which could potentially dent some investors’ appetite for the city. Other detinations such as Madrid have somewhat benefited from this situation.

In the short term, the political state of affairs has generated a period of uncertainty which impacts the property investment market in Barcelona. A prolongued period of political instability could cause deals to slow down or even stop. However, a softening of demand for hotel accommodation is only likely to happen should there be more civil demonstrations. Overall, we remain strongly optimistic that the Barcelona hotel sector will continue to be a key source of investment for those global players who are interested in the medium- to long-term growth perspective, as well as knowledgeable intra-regional investors who are seeking to consolidate their ownership position in markets that they are already familiar with.