Third-Quarter 2018 Bookings Increase Significantly

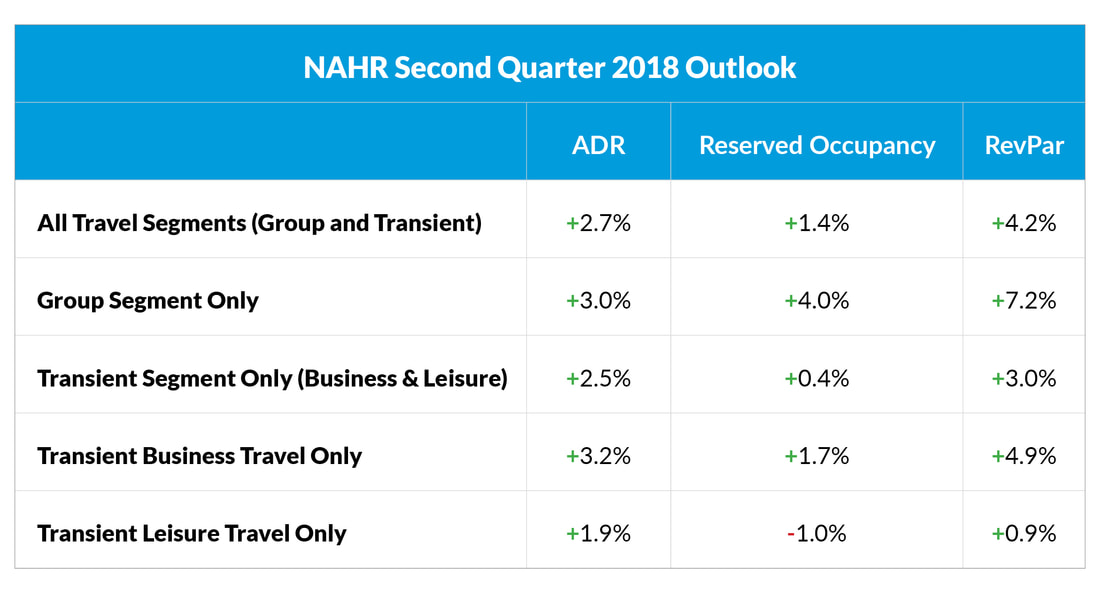

NEW YORK – May 31, 2018 – TravelClick, a leading global provider of data and revenue-generating solutions for hoteliers, today released new data from the Company’s May 2018 North American Hospitality Review (NAHR). According to this data, North American hoteliers continue to experience significant growth in the second quarter of 2018 across all travel segments, up 2.7 percent in average daily rates (ADR) and 1.4 percent in bookings.

Group travel is particularly strong in Q2, up 3.0 percent in ADR, 4.0 percent in bookings and an impressive 7.2 percent in revenue per available room (RevPAR). Transient travel also steps up in Q3, increasing 6.0 percent in bookings and 2.9 percent in ADR overall. More specifically, transient leisure travel is up 6.6 percent in bookings and 2.9 percent in ADR, and the transient business segment is up 4.6 percent in bookings and 3.8 percent in ADR.

“Hoteliers in the first half of 2018 experienced consistent rates and steady bookings growth, and TravelClick’s forward-looking data predicts that the third quarter will be just as promising,” said John Hach, Senior Industry Analyst at TravelClick. “In fact, it will offer the strongest level of organic growth that North American hoteliers have seen in recent years, which is welcomed news to hoteliers across the industry.”

Twelve-Month Outlook (May 2018 – April 2019)

For the next 12 months (May 2018 – April 2019), transient bookings are up 2.9 percent year-over-year, and ADR for this segment is up 2.8 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 3.5 percent in bookings, and ADR is up 2.7 percent. Additionally, the transient business (negotiated and retail) segment is up 1.8 percent in bookings, and ADR is up 3.2 percent. Lastly, group bookings are slightly up 0.8 percent in committed room nights* over the same time last year, and ADR is up 1.7 percent.

“In advance of Q3, hoteliers currently have a unique window of opportunity to capture growing summer transient demand," added Hach. “To capitalize on this, hoteliers should invest in online media to stand out from the competition and leverage market data to ensure that their investment is locally optimized."

The May NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by May 1, 2018, from the period of May 2018 – April 2019.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The second quarter combines historical data (April) and forward-looking data (May through June).