By Michael Smithson

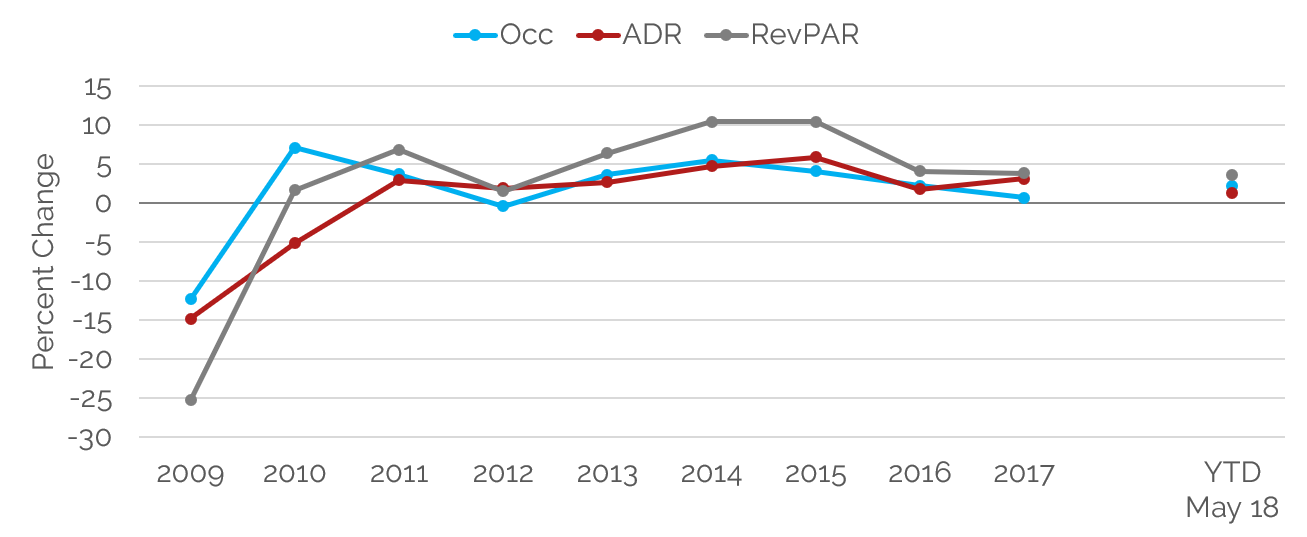

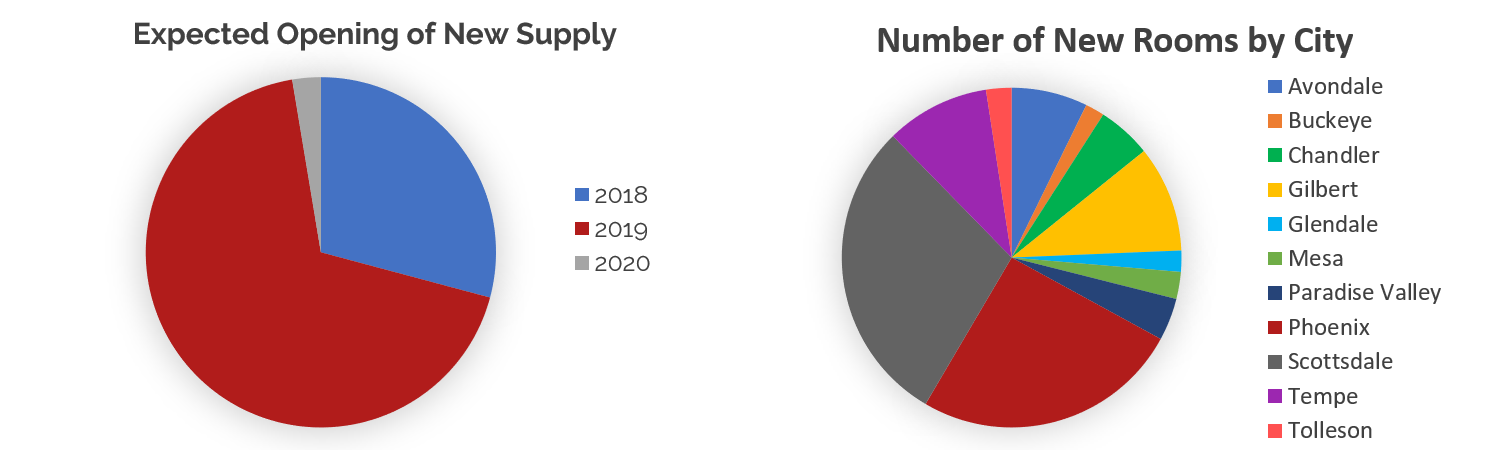

Following several years of strong RevPAR growth leading up to Super Bowl XLIX in 2015, growth in the Phoenix market has slowed somewhat. ADR growth was modest in 2016, as much of the market experienced a post-Super Bowl correction, but ADR rebounded in 2017. Occupancy growth has remained relatively modest since 2016, slowing even more in 2017 but remaining positive. Year-to-date data through May 2018 illustrate modest increases in both occupancy and ADR, resulting in moderate RevPAR gains.

Phoenix Market Performance

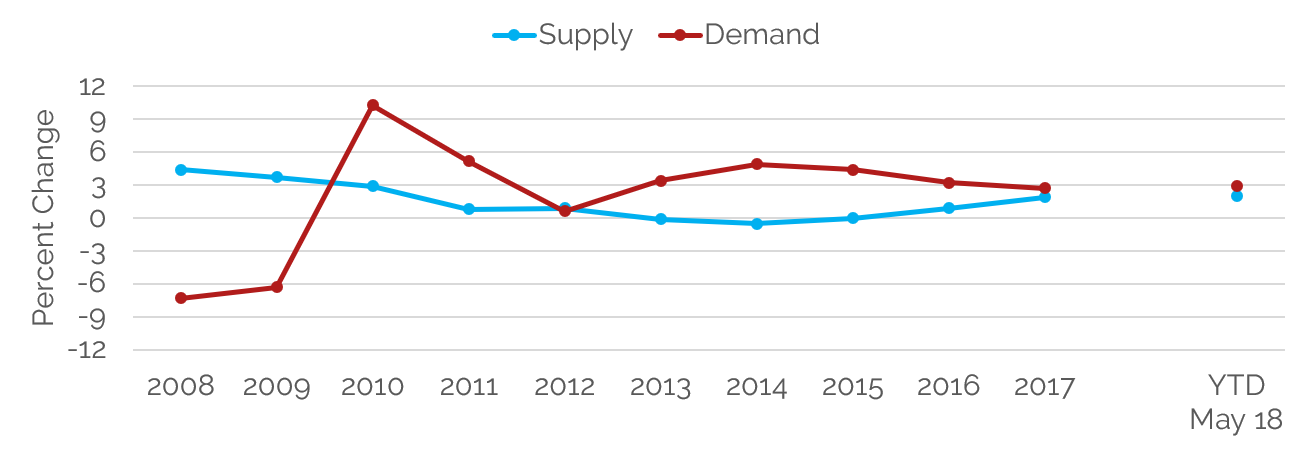

The introduction of new supply has contributed to slowing RevPAR growth over the past couple years. Supply growth reached a low point of -0.5% in 2014, followed by a year of no net growth in 2015. Although demand continued to increase in 2016 and 2017, new supply entering the market increased over the same period; thus, occupancy growth slowed as a result. Year-to-date data through May 2018 illustrate a rebound in demand growth; however, occupancy is expected to decline in the next couple years given the substantial amount of new supply in the pipeline.

Supply & Demand Chart

Market Developments

Greater Phoenix serves as a hub for aerospace, high-tech, bioscience, advanced business services, and sustainable technologies companies. Major companies such as Banner Health, Wells Fargo, and Intel maintain a strong presence in Phoenix, while multiple universities and hospitals further support the local economy. While lodging demand growth has slowed somewhat in recent years, economic fundamentals remain strong. Unemployment through December 2017 was down 0.2% from 2016.[1] According to research firm Woods & Poole, construction employment was up 2.5% in 2017; it is projected to continue to increase 2.4% per year through the end of the decade. Employment should continue to grow, with educational services registering the strongest compounded growth through 2020.[2] Furthermore, development and economic expansion continue. Below is a sample of major developments in different submarkets throughout Phoenix:

- Downtown Phoenix: Arizona State University’s Thunderbird School of Global Management announced in December 2017 that it would be moving its graduate school to Downtown. Starting in the Fall 2018, graduate-level classes will be held in a recently renovated portion of One Arizona Center until Thunderbird’s $50-million building is completed at the corner of 1st and Polk Streets.

- Midtown & Uptown Phoenix: In September 2017, Plaza Cos. and Hulualoa Cos. purchased Park Central Mall. The companies are reportedly spending approximately $57 million to revitalize Arizona’s first mall, converting it to a modern, mixed-use development.

- Scottsdale: Scottsdale Fashion Square Mall is currently undergoing a twelve-phase, comprehensive renovation and expansion. Phase I, which comprises the mall’s luxury wing, is scheduled for completion during the third quarter of 2018.

- Tempe: In December 2017, Transwestern Investment Group and JDM Partners LLC acquired Marina Heights. State Farm relocated its regional headquarters to this two-million-square-foot development upon completion earlier in 2017; it is anticipated to employ 8,000 workers by 2019.

- Chandler: In February 2017, Intel announced plans to invest $7 billion to tool and outfit its Fab 42 facility, which had been sitting unused since its construction in 2014. Intel is expected to open Fab 42 in 2020 or 2021 and create 3,000 permanent, high-paying jobs.

- Mesa/Gilbert: Governor Doug Ducey announced in January 2018 that Phoenix-Mesa Gateway Airport would be home to SkyBridge Arizona, the nation’s first international air-cargo hub to house customs’ facilities for both Mexico and the U.S. SkyBridge is expected to create roughly 17,000 direct and indirect jobs and lead to 10,000 annual cargo flights out of Phoenix-Mesa Gateway Airport by 2036.

- West Valley: After years of legal battles, the Desert Diamond West Valley Casino broke ground on its $400-million expansion in December 2017. The expanded casino and resort, which will take two years to complete, is anticipated to generate roughly 1,000 new jobs. A TopGolf facility and an IKEA retail outlet are also being developed near Glendale’s Westgate District. TopGolf is expected to open in late 2018, while Ikea is slated to open during the spring of 2020.

Meeting & Group Segment

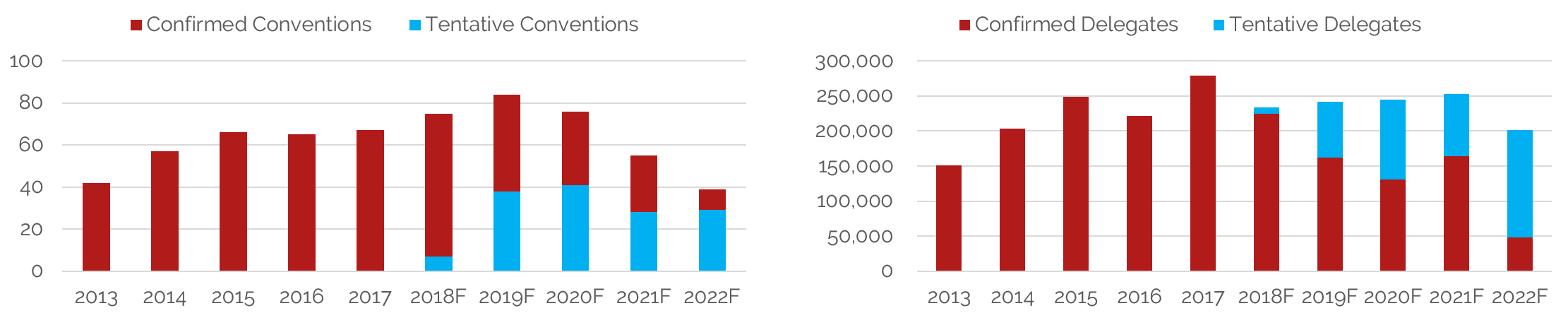

Furthermore, with more than 16 million annual visitors from throughout the U.S. and Canada attracted to the warm weather and sunshine in the Valley of the Sun, Phoenix is an important resort and regional meeting destination. While the Phoenix convention market did struggle somewhat at the beginning of the decade because of bad publicity surrounding the controversial S.B. 1070 immigration law, the market recovered toward the middle of the decade. Furthermore, major sporting events over the past few years, such as Super Bowl XLIX in 2015 and the NCAA Final Four in 2017, allowed the City to showcase itself to meeting planners. Representatives with Visit Phoenix indicated that the next few years are on pace, with 2021 anticipated to be an especially strong year. The outlook for convention business is overwhelmingly positive, largely attributed to the revitalization of the Downtown Phoenix submarket and strong pace indications.

Conventions

Phoenix’s abundance of resorts, eleven of which have undergone major renovations over the past few years, also allows it to host a variety of small and mid-sized groups. According to representatives from Visit Phoenix, in-house group business set a record in 2017, and most resorts are at or above pace through 2021. Therefore, expectations related to meeting and group demand remain favorable.

New Supply

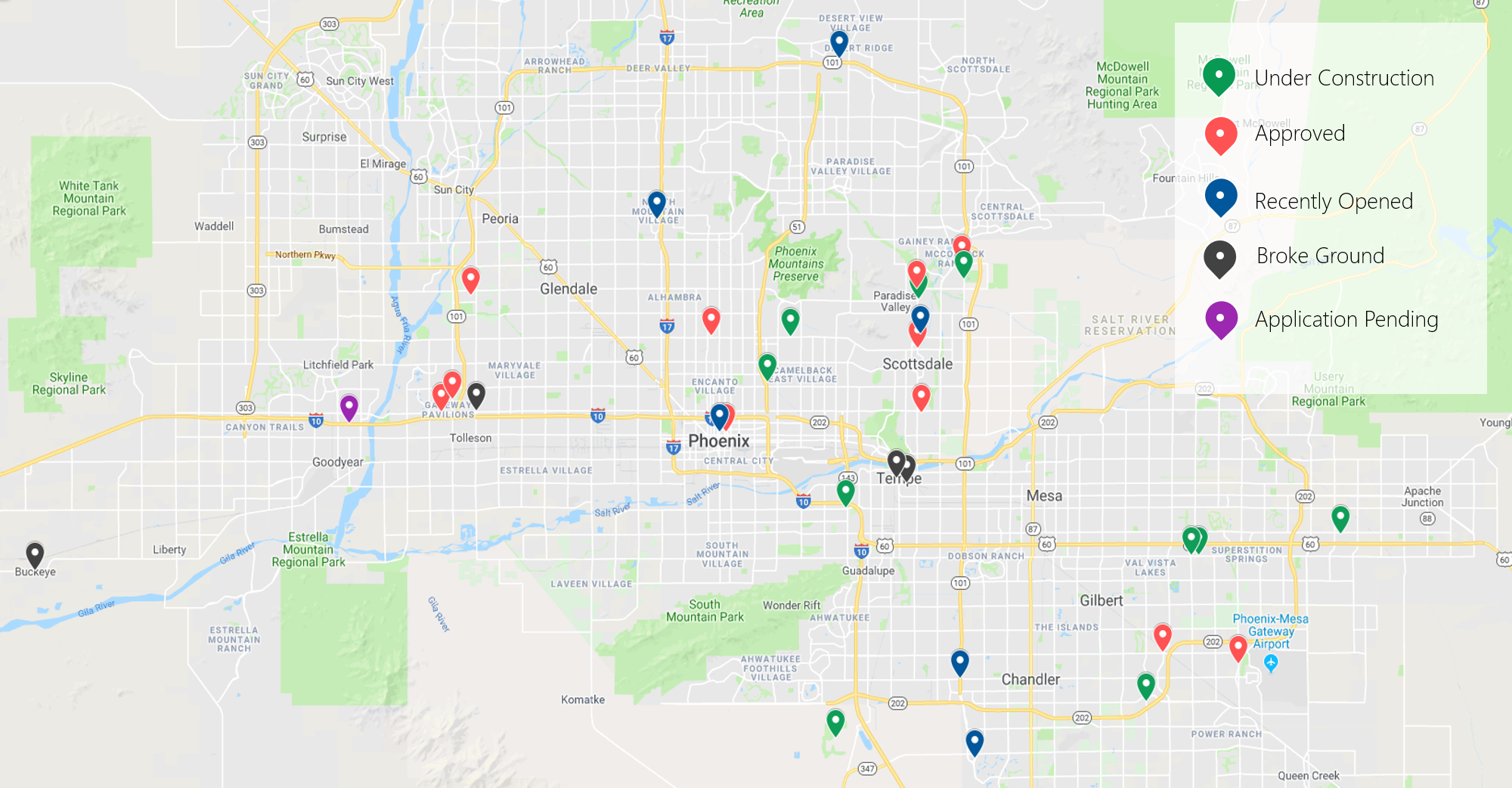

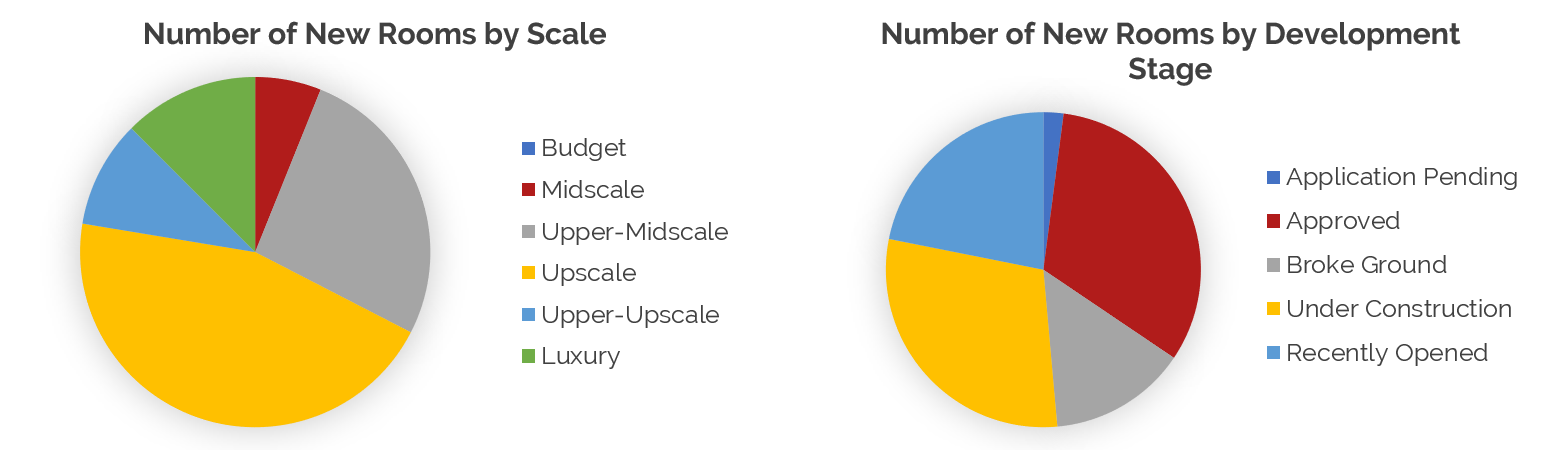

According to our research, approximately 31 hotels, encompassing roughly 4,750 rooms, have opened since the beginning of 2018 or are proposed for development in the greater Phoenix area. In addition, many other more-speculative hotel projects have been proposed. The highest level of new supply is concentrated in Scottsdale and Paradise Valley, followed by the East Valley (Tempe, Chandler, Gilbert, and Mesa), and then Phoenix-proper, with the West Valley pulling up the rear.

New Supply

Most of the proposed hotels and rooms belong to the upscale tier, followed by upper-midscale properties, with the remaining tiers representing the balance. Roughly a third of the proposed hotels and rooms are approved but have yet to break ground, while more than two-thirds of the hotels and rooms are expected to open in 2019.

Despite continued demand growth, the elevated level of new supply in the Phoenix market should cause occupancy to decline modestly by 2019. In addition, the introduction of upscale and upper-upscale product into submarkets that previously had little to none will likely erode some of the pricing power of lower-tier hotels currently in the market. Hotels in other areas are likely to limit ADR growth to bolster occupancy.

Phoenix Forecast

Conclusion

Greater Phoenix is experiencing a period of economic expansion, with revitalization and growth occurring throughout the region. While lodging demand growth has slowed over the past couple years, economic fundamentals remain positive, and demand growth should continue in the near term. However, high levels of new supply on the horizon will offset demand growth in 2019, prompting occupancy to decline and ADR growth to stagnate.