Online and Mobile Bookings Continue to Benefit North American Hotels

NEW YORK – August 16, 2016 – Consistent with Q1 2016, hotel industry performance is continuing to strengthen, with Q2 2016 revenue per available room (RevPAR) increasing 3.8 percent year-over-year. According to data from TravelClick’s North American Distribution Review (NADR; Q3 2016), bookings through online travel agents (OTAs), hotel company websites (Brand.com) and in-person travel agents (global distribution systems / GDS) experienced the most growth in bookings during the second quarter, once again highlighting the vast influence of online and mobile reservations. TravelClick’s NADR report aggregates hotel bookings by channel for the transient segment (individual leisure and business travelers).

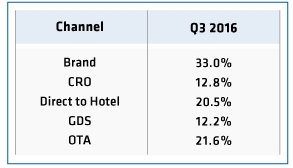

In Q2 2016, the OTA (which includes Expedia.com, Priceline.com, etc.), Brand.com and GDS channels all experienced steady growth in the transient segment, up 3.3 percent, 6.0 percent and 7.4 percent, respectively. Similar to previous quarters, Hotel Direct (calls made directly to the property and walk-in customers) and calls to a hotel’s 800-number (the CRO channel) decreased by -7.3 percent and -2.7 percent, respectively. Average daily rates (ADR) across all channels increased 1.3 percent compared to Q2 2015. Based on reservations that are currently on the books for Q3 2016, TravelClick expects to see additional positive growth, particularly for the OTA and Brand.com channels, when the quarter is complete (see chart below).

“The power of digital continues its influence in pretty much all aspects of life, and the hospitality sector is no exception,” said John Hach, TravelClick’s senior industry analyst. “For several quarters now, the OTA, Brand.com and GDS channels have specifically continued to drive revenue for North American hoteliers, and it’s clear that the mobile and online trend will continue throughout the rest of 2016 and beyond.”

Share of Transient Rooms Sold by Channel

For Q3 2016, transient ADR is ahead by 1.4 percent, with the OTA channel generating the highest ADR growth, up 2.7 percent.

The TravelClick North American Distribution Review is based on data for 25 major North American markets, comprising 231 million annual room nights and $37 billion in annual room revenue.