In 2017, MGAC Research tracked 303 non-confidential, single-asset, mid-scale-and-up hotel transactions across the US. These properties totaled over 73,500 keys, and can be explored in the interactive cluster map below:

<span data-mce-type="bookmark" style="display: inline-block; width: 0px; overflow: hidden; line-height: 0;" class="mce_SELRES_start"></span><span data-mce-type="bookmark" style="display: inline-block; width: 0px; overflow: hidden; line-height: 0;" class="mce_SELRES_start"></span>

The U.S. hotel industry performed well last year with key metrics such as occupancy, ADR, and RevPAR reaching record heights, but performance was not spread equally among markets. South Florida, Southern California, New York City, the Washington Metro Area, and the San Francisco Bay Area saw the highest number of transactions in 2017. Despite this activity along the coasts, some opportunistic hotel investors surveyed have reported a growing shift in interest from high-priced coastal cities to the secondary markets concentrated in the central US, where acquisition costs are lower and target return rates are easier to achieve.

Top 10 Largest Deals (By Transaction Amount)

Numerous casino hotels changed hands last year, with 4 of the 10 largest transactions being gaming related hotels. Favorable legislation and market conditions in 2017 spurred activity from sellers looking for capital to develop new projects, as well as buyers seeking opportunities to kick-start stalled projects. We also saw two large property divestments in the top 10 from Marriott-Starwood and Hyatt as they, along with several other major brands, shift into an asset light strategy.

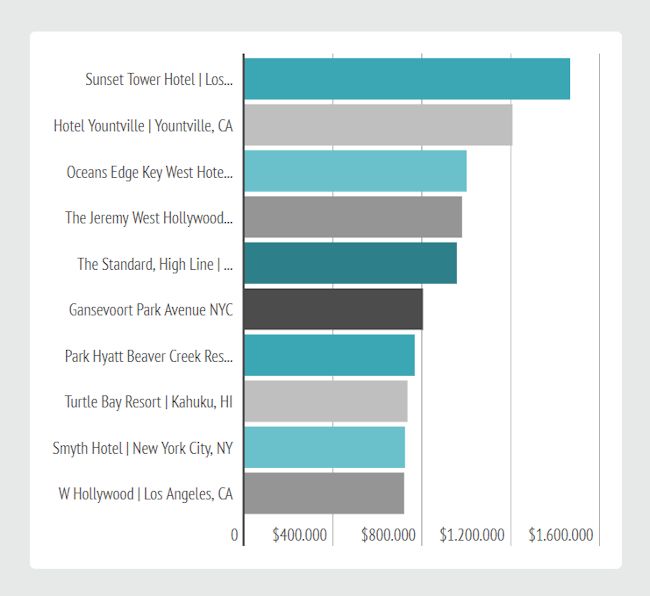

Top 10 Most Expensive Hotel Transactions (by Price Per Key)

With nearly one-third of all recorded 2017 hotel transactions, markets in Florida and California are extremely competitive and were home to 5 of the 10 most expensive hotel deals. The average cost per key in these states were $206,000 and $336,000, respectively.

Despite ongoing concerns of oversupply, New York made 3 appearances in the top 10 and continues to attract big money and reported an average cost per key of $427,000. Investors and developers remain optimistic because of record-setting tourism numbers and strong historical performance.

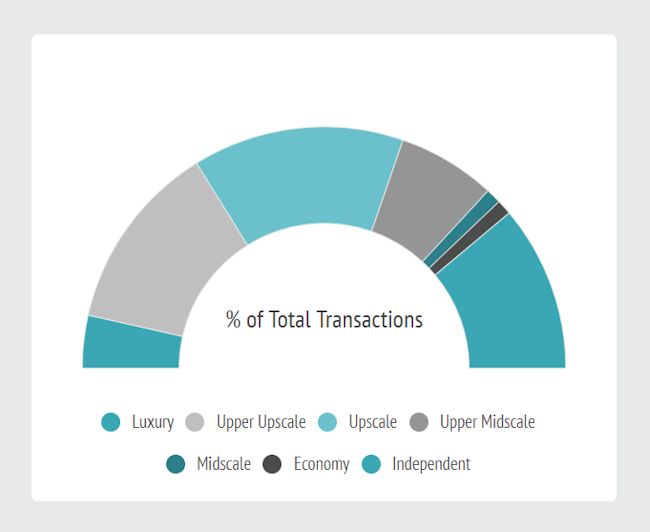

Distribution of Hotel Tiers

Marriott-Starwood and Hilton continued to be the most popular franchise branded deals in 2017. Top upscale brands were Courtyard, Double Tree, Hilton Garden Inn, and Hyatt Place. Top upper upscale brands included Marriott, Hyatt Regency, and Westin.

Top Buyers and Sellers

The top buyers and sellers each completed 4-5 non-confidential, single-asset, mid-scale-and-up hotel deals in 2017.

Disclaimer: The information contained in this analysis was obtained from sources deemed to be reliable. Every effort was made to obtain accurate and complete information; however, no representation, warranty or guarantee, express or implied, may be made as to the accuracy or reliability of the information contained herein. This should not be considered as investment advice.