By Rodney Clough

The U.S. economy continues to hold strong, showing great resiliency. The overall strength in consumer spending and confidence has benefited the U.S. hotel industry, as well, driving gains in hotel demand, although not at quite a high enough level to balance the new supply that opened in 2019. As such, occupancy is forecast to decline slightly in 2019, while ADR gains will keep RevPAR change in the positive column.

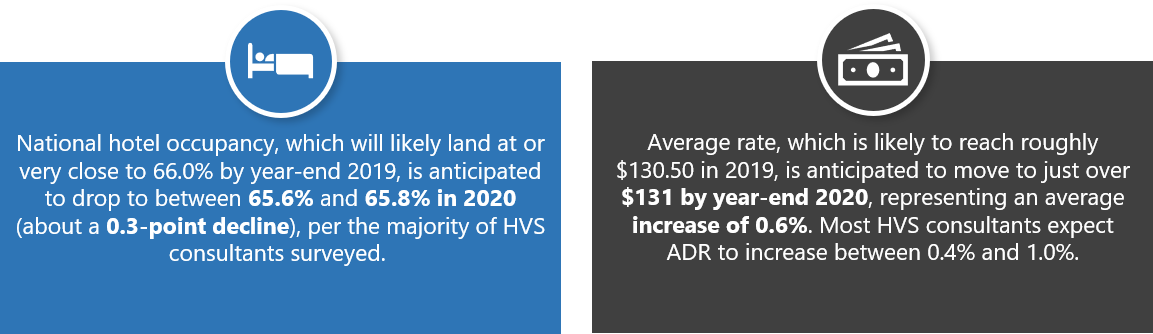

Projects that began construction when new supply starts intensified a couple of years ago are now readying to begin welcoming guests in 2020. Demand should continue to grow, but is not expected to keep pace with supply, as was the case in 2019; thus, occupancy will likely continue to drop modestly in 2020. Demand may be further siphoned off by increases in supply in the alternative lodging sector from sources such as Airbnb and VRBO, among others.

With the nation at virtual full employment, it is difficult for companies to realize expansions. This in turn limits hotel demand, as expanding companies drive significant room nights to nearby hotels with relocations, training, and related activities. In many markets, companies have begun to pull back their near-term requirements for room nights, as they move into a maintenance and defensive mode rather than a position of expansion. This change in position also reduces demand from the construction sector, as large-scale projects to support growth at corporate campuses in some markets recede. Pulling off expansions is further complicated by rising construction costs and labor costs within the construction sector itself.

A few additional concerns raised by our consultants include:

- The degree of difficulty for some international travelers to gain access to the USA due to visa restrictions will continue to be a challenge for markets that have historically benefited from significant overseas-based tourist demand.

- Election-year uncertainty will also be a limiting factor for demand growth in 2020.

- The continued launch of new brands and the saturation of brand parent companies in certain submarkets represent growing concerns, as the limited and available brand-loyal customer base is spread among more rooms.

- The concern of a forthcoming recession continues to loom.

Average rate should drive RevPAR growth in most markets where occupancy is flat or slightly declining. In markets where occupancy has already registered a downward trend, ADR may begin to slide as hotels use price discounts to compete for market share. In markets where alternative lodging sources have intensified, achieving ADR increases have been reported to be more of a challenge. On a more positive note, some municipalities have implemented regulations that should curb the impact of some of this inventory on the hotel sector.

An increase in transactions may ensue in some markets as new supply openings intensify, prompting owners of existing hotels to exit while their trailing-twelve-month statements reflect strong performance. The peak NOI may be behind us in many major markets and may not return until the new supply is absorbed. Rising labor costs and low RevPAR growth are putting significant pressure on NOI. This may shift those markets to a buyer’s market if more assets are available for the choosing and sellers are significantly motivated. The outlook in 2021 and beyond starts to perk up in many markets, as new supply additions pull back.

Private equity funds may also intensify their acquisitions, as they have been holding back capital to take advantage of a significant correction that simply isn’t materializing. This should boost transactions in 2020, after a lackluster year of sales in 2019. Construction costs keep rising, which makes buying an existing asset a more attractive investment opportunity than building a new one in many markets. Moreover, markets that have high barriers to entry and/or perceived stable and strong demand drivers, such as San Francisco and Charleston, for example, drive more asset appreciation, as well. This in turn attracts buyers to enter these and other similar hotel submarkets.

The strength of the U.S. market, relative to other overseas markets, should also bolster transactions in 2020. Furthermore, various municipalities benefit from favorable tax laws, which continue to make hotel investing an attractive option. On the flip side, a few markets are burdened by high or rising property tax levels, which ultimately limit values and the pace of transactions.

Opportunities to buy older, more dated hotels at a favorable price per key and up-brand them after a major renovation are starting to dwindle in most markets. This may limit the near-term acquisition pace in markets that have experienced many such buys in recent years.

In conclusion, expect a continued slide in nationwide occupancy driven by continued supply additions, which are anticipated to outpace demand growth levels. Demand growth, while still expected, will be constrained by companies pulling back on expansions, reduced international tourism, and election-year uncertainty, among other factors. As a result of these market dynamics, average rates should grow only slightly. The outlook for 2021 turns more favorable in most markets, as the pace of new hotel openings is anticipated to slow by comparison.