By Tim Smith

COVID-19 has, and continues to, dramatically impact every aspect of our lives. At the time of writing globally there have been approximately 13.5M cases and 580,000 deaths. Almost every country has had restrictions placed on their daily lives. However, perhaps the most challenging aspect of the pandemic is the uncertainty. No-one knows how long it will go on for or when we will be able to start a meaningful recovery.

The tourism and hospitality industry has been hit the hardest, airlines not flying, hotels not open, conferences postponed and no customers for restaurants and bars. It doesn’t matter the size or strength of your business, without customers there is no business.

All we can do is plan for the future and whilst there are no certainties, we can gather data and speak to as many people as possible to judge their sentiment. The Africa Traveler and Hotel Guest Sentiment Survey simply does that, gathers data and opinions to help us all plan for the future so we can re-enter the workplace adapted for the new normal.

The United Nations World Tourism Organisation reported a 4% growth in international tourism arrivals to Africa in 2019 and pre-Covid predicted a similar growth in 2020. This shows we work in an important and resilient sector of the economy primed for further growth. All the pandemic will have done is reset the starting point for this growth. It is now our responsibility to adjust and reposition our businesses to have the greatest impact possible.

This survey is by no means exhaustive, it does however prove there to be demand to start traveling again and to kick start the industry. It also shows some changes are expected, we therefore urge all parties, government, airlines, hotel owners, operators and lenders to consider their businesses in light of these findings and to undertake further research to establish how we can all start the recovery process.

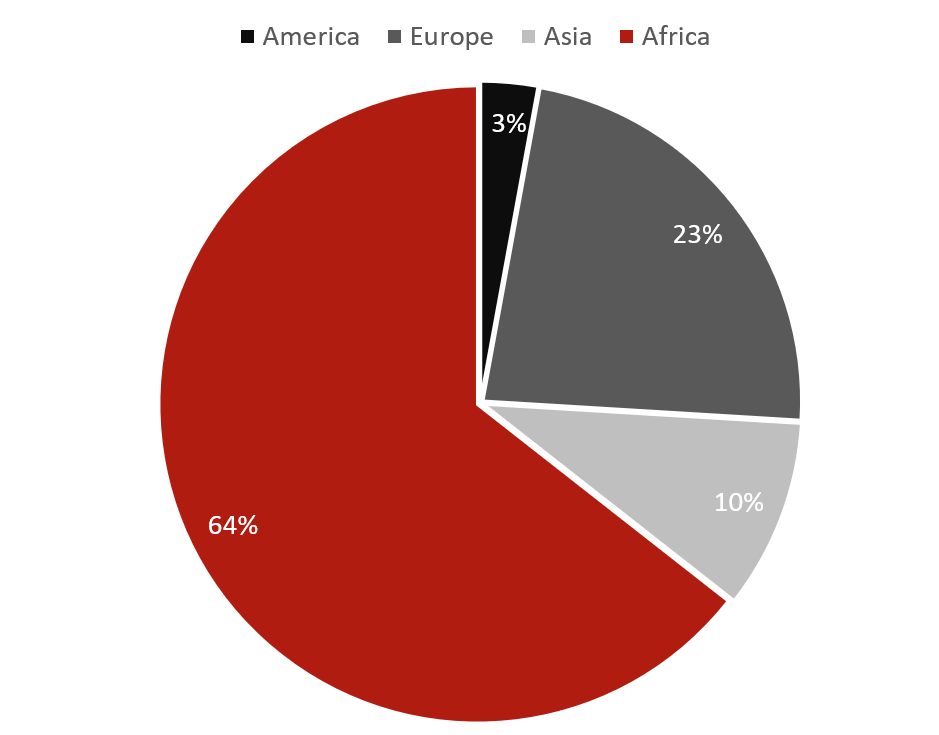

Question 1: Where are you from?

Source : HVS

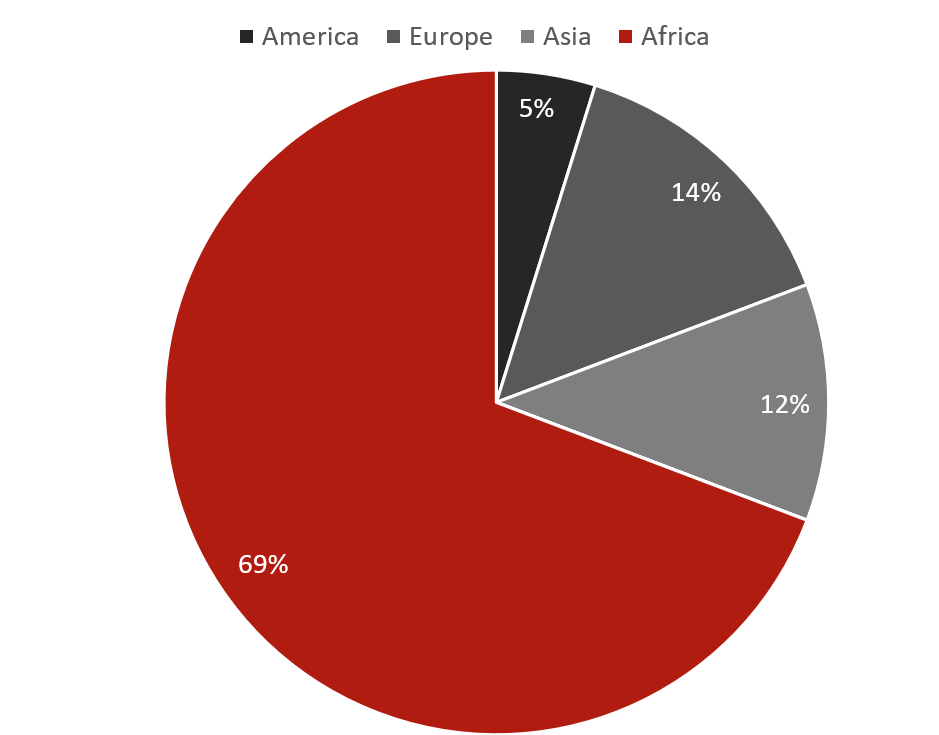

Question 2: Currently, where do you live?

Source : HVS

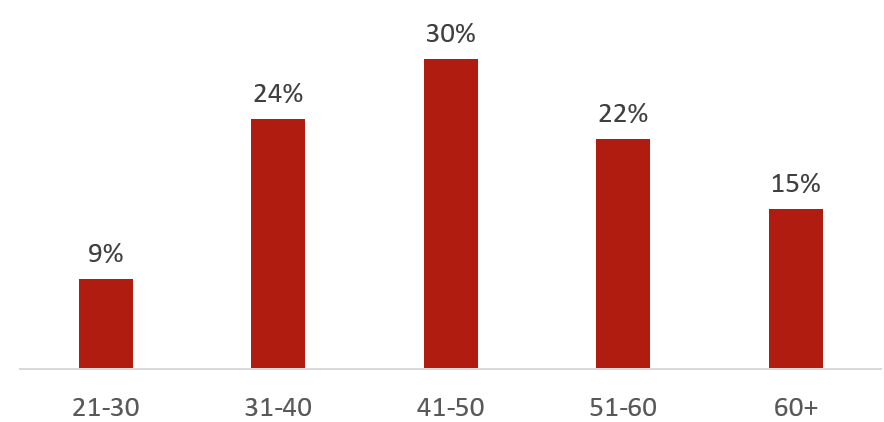

Question 3: How old are you?

Source : HVS

A third of respondents were from outside Africa, this is very encouraging as it shows the continued interest in the continent.

It would be easy to revert to key markets and but there remains much interest globally.

Allied with other findings from the survey this shows reasons for optimism for the African hospitality industry.

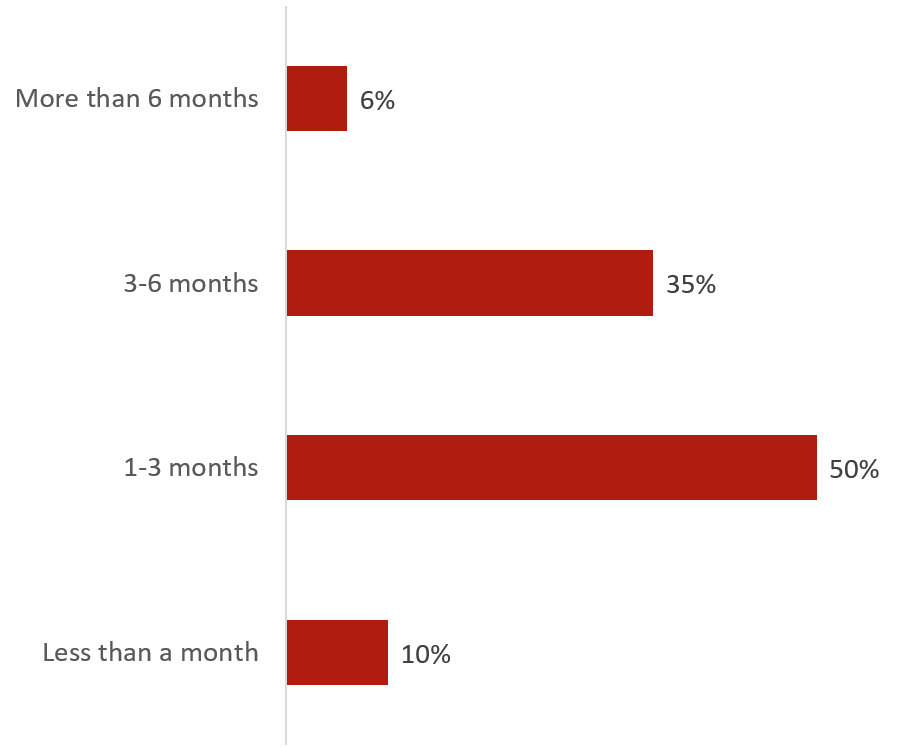

Question 4: How soon do you expect borders to open to regional travelers in Africa?

Source : HVS

By the end of September 50% of respondents expect borders to be open for regional travel and the overwhelming majority expect borders to be open by the end of the year.

This will obviously be impacted if there are any secondary spikes in cases, but it does suggest that people expect government to remember the importance of tourism to the economy as a whole.

Government has a thankless task balancing public health with economic needs so it will be interesting to see when travel will again be encouraged.

It is reported Africa has lost $55bn in travel and tourism revenue during the pandemic that is over 2% of the GDP of the continent. The impact of such a sum on some of the poorest countries is dramatic and it is in everyone’s interest to start a sensible recovery as soon as possible.

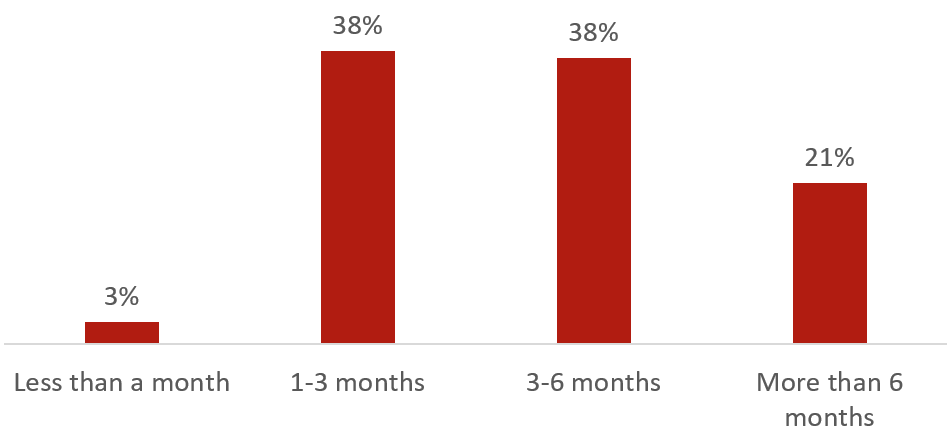

Question 5: How soon do you expect borders to open to international travelers planning to visit Africa?

Source : HVS

As we suspected people expect the borders to remain closed to international travelers for longer than regional travelers. More than a fifth of respondents expect borders to be closed in to 2021.

International travel to Africa is vital and any recovery will be muted until travelers are able to enter their chosen destination.

This will vary from country to country and will also be impacted by air bridges and the likelihood of quarantine restrictions when you return home. It is clearly a complex issue with political implications as we as public health challenges to overcome.

Tanzania has reportedly opened her borders, however without reciprocal agreements with other countries the number of visitors is expected to be muted.

It was certainly disappointing to see no mainland African countries on the UK list of countries you can visit without requiring quarantine on return to the UK.

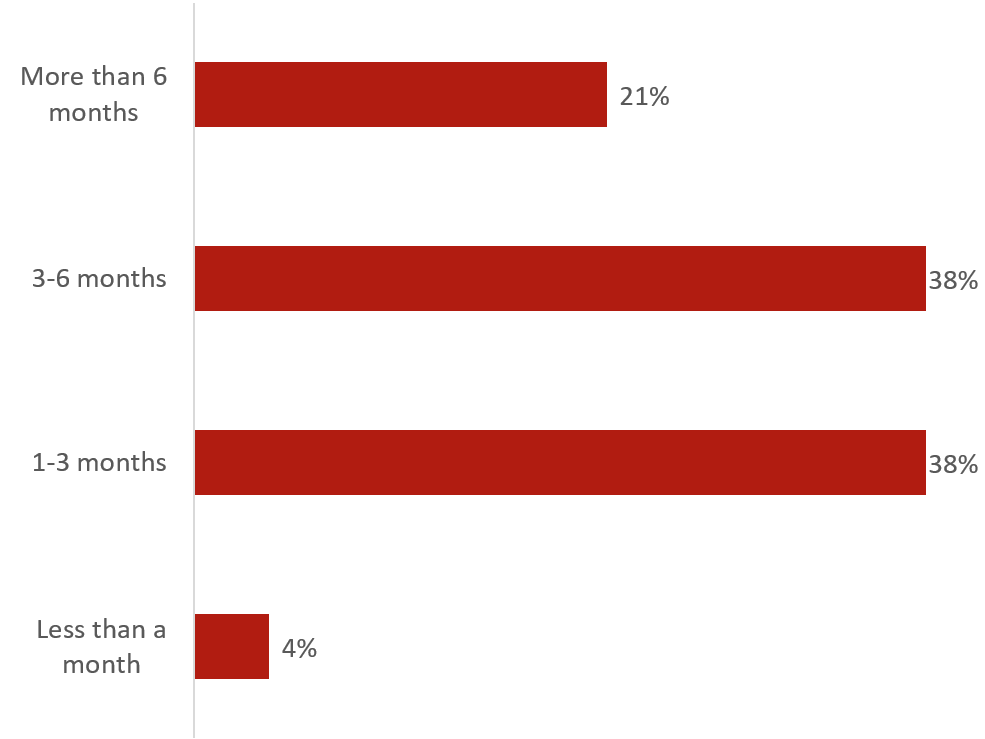

Question 6: How soon do you expect long-haul flights to resume to Africa?

Source : HVS

Respondents see long haul flights starting up as soon as borders open, believing there will be pent up demand to visit Africa. However it will have been a considerable time without long-haul flights by the time they resume.

This further highlights the uncertainty amongst respondents and the potential time it will take the aviation sector to adapt to the change in behaviour.

Additional investigation to support future predictions of recovery will require an analysis of amongst other things:

•Source of visitation and potential quarantine upon return;

•Purpose of travel;

•Choice of destination;

•Health & Safety (actual and perceived);

•Cost of travel

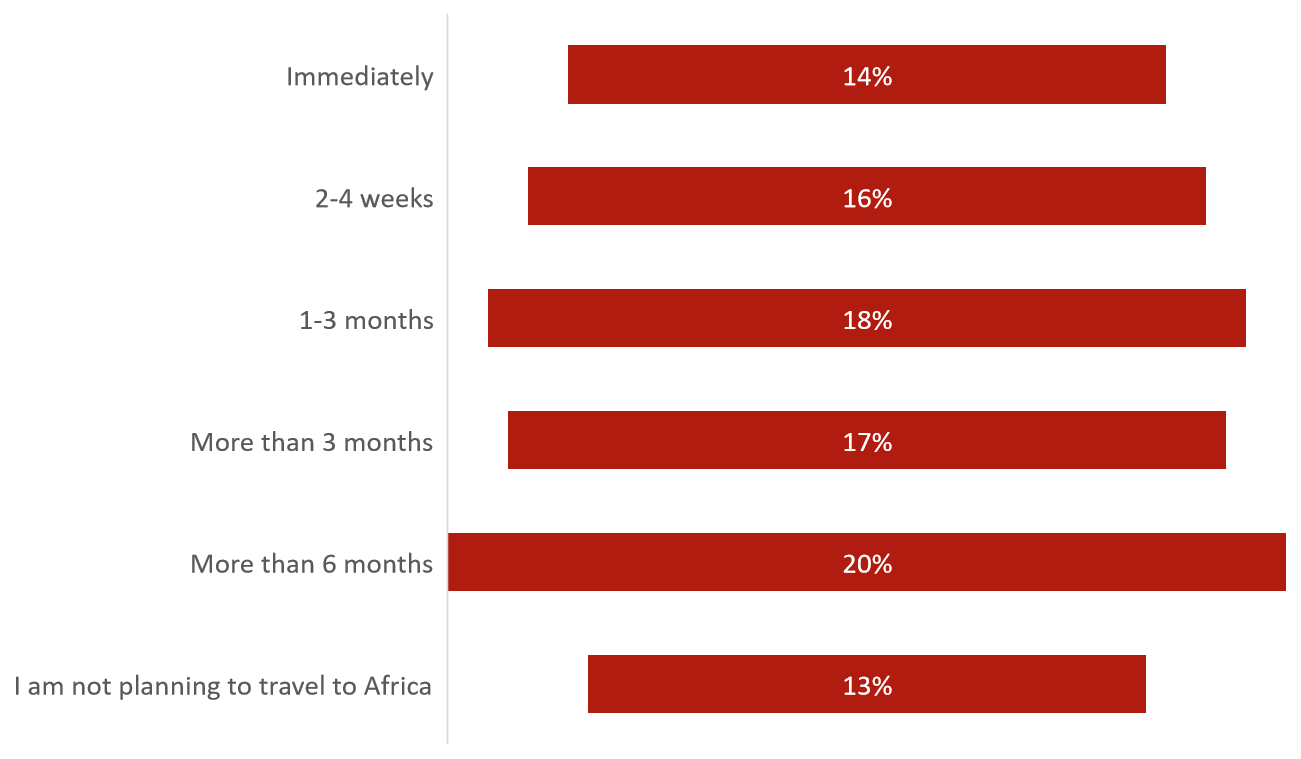

Question 7: Once the travel ban is lifted how soon are you likely to visit a different country in Africa?

Source : HVS

The good news is approximately half of all respondents expect to visit a different country in Africa within three months of the travel ban being lifted.

This is perhaps the biggest indication of the importance of the regional trade zones and agreements as the majority of these travelers are likely to be for business purposes.

More worryingly is the 13% who are not planning to travel to Africa, this represents about half of the respondents who currently live outside the continent.

Further investigation to understand the motive for travel is important. This will help in planning the re-opening of different types of hotel (commercial vs. resort vs. convention).

Question 8: What would be the likely purpose of your travel to Africa?

Source : HVS

The purpose of travel is important as it will impact how we forecast recovery and hotel performance.

Business remains the largest purpose of travel. However, encouragingly a fifth of respondents are looking to travel for leisure purposes proving the lure of the natural attractions of Africa remains as strong as ever.

Interestingly the percentage of travelers likely to travel for business is significantly higher than in our survey of the Middle East. Other regions are reporting regional leisure to be the first segment to recover, this may mean it takes longer for African hotels to start a meaningful recovery, but when it comes the recovery could be quicker than other regions.

Future performance predictions will be impacted by corporate travel policies, the health situation in different countries and the overall cost of travel. So although this result seems conclusive, caution will be needed when planning recovery strategies.

Herd immunity and sensible precautions seem to be more important to travelers than a vaccine. It will be interesting to follow up to understand whether this is because they felt Africa may be at the bottom of the queue for a global vaccine or whether they are prepared to trust government management of the pandemic.

Some commentators believe as Africans have lived with the threat of health emergencies for years, such as HIV, malaria and Ebola, they are used to restrictions and are all too practiced at taking sensible precautions.

Our survey in the Middle East showed 60% of respondents are likely to travel despite the absence of a Covid-19 vaccine. This survey was conducted earlier in the year so it will be interesting to understand whether the difference is due to location or timing.

With almost 30% of respondents more comfortable resuming travel once a vaccine is available, a continued period of low travel demand seems likely even after the travel restrictions are eased.

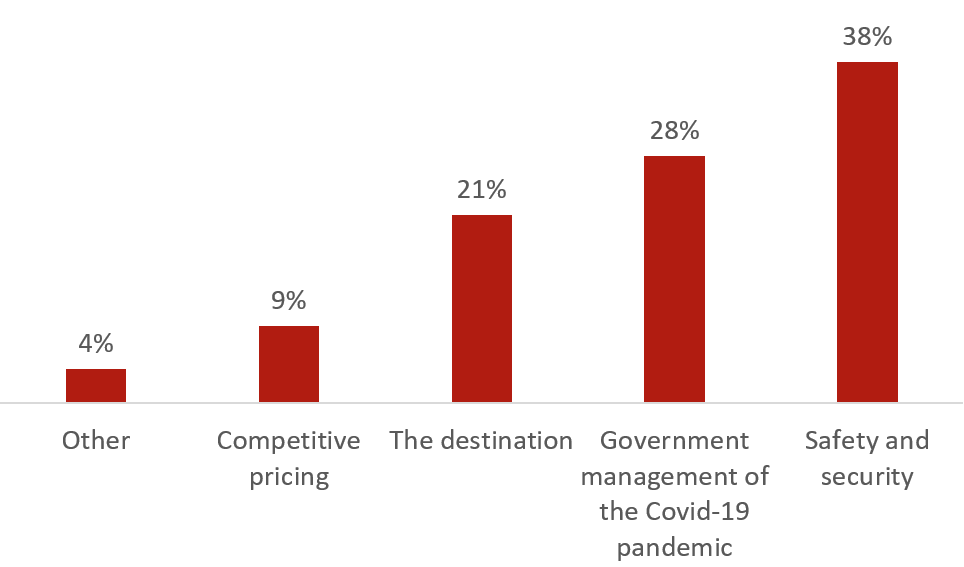

Safety and security are always the most important factor when planning a trip to Africa.

Combined, two thirds of respondents will prioritize their travel arrangements according to governmental management of the pandemic and the actual and perceived safety and security of the destination.

This shows government plays a hugely important role in restoring confidence amongst travelers. The recovery will require joint efforts between all parties if it is to be successful.

Although pricing was seen as the least important factor, large increases in prices will undoubtably have a negative impact on the recovery.

Other responses included concerns over how easy it will be to travel without the risk of quarantine and the global pandemic situation.

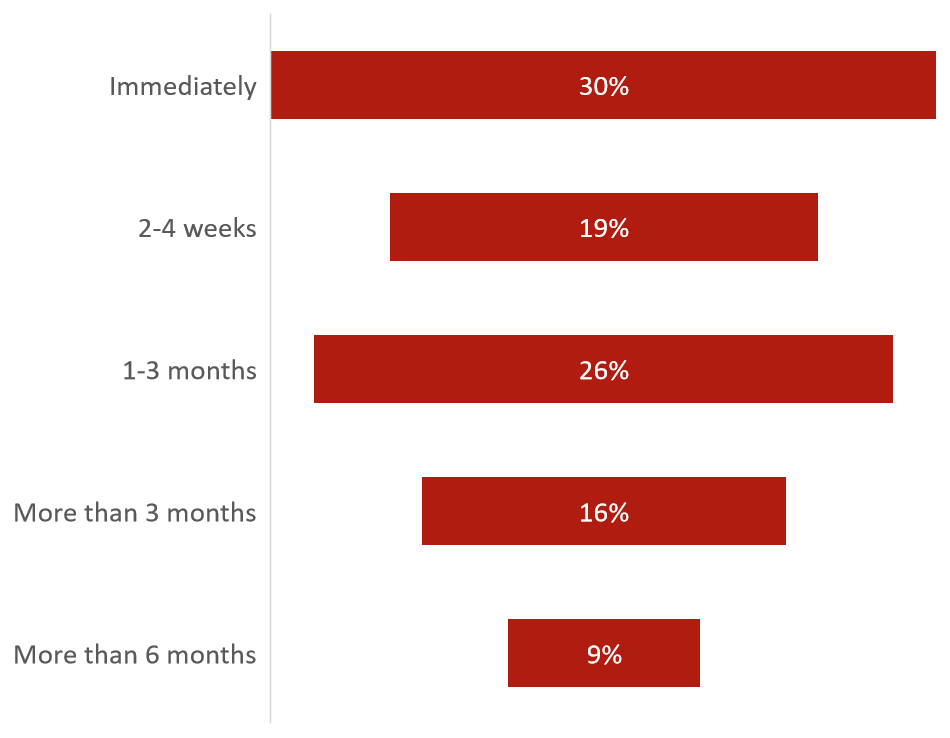

Question 11: Once the travel ban is lifted how soon are you likely to stay in a hotel?

Source : HVS

Great news for hoteliers with half of respondents expecting to stay in a hotel within a month of starting to travel and 75% within three months of opening.This is significantly higher than our Middle East survey and suggests strong confidence in the work being done by the hotel operators. It will vary from location to location and each hotel will have to work hard to gain the trust of each potential guest.

We suspect social media will have a strong role to play, giving immediate feedback to potential guests as to the current performance of hotels.

Confidence can be brittle so these numbers can and will change rapidly if any or all hotels are perceived to be the source of future infections, for example.

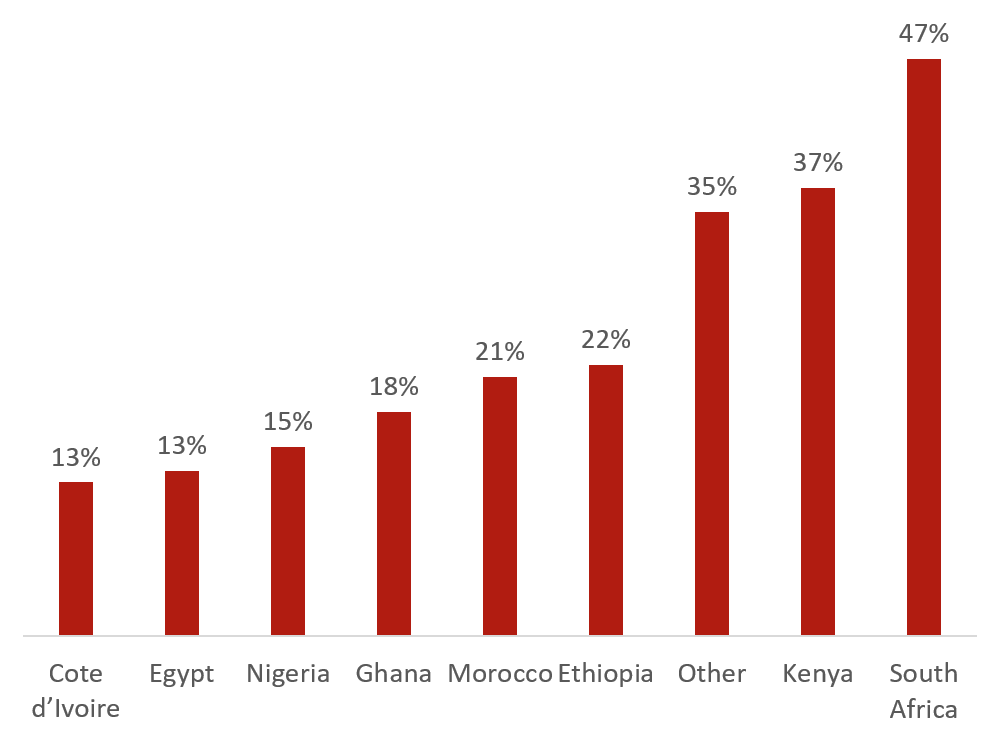

Source : HVS

In total 32 different countries were mentioned as the most likely to be visited, which is very encouraging for the whole continent.

Other countries also mentioned include Senegal, Botswana, Rwanda, Benin and Zimbabwe.

All of these responses will be dependent on the availability of flights, open borders and continued safety and strong management of the pandemic.

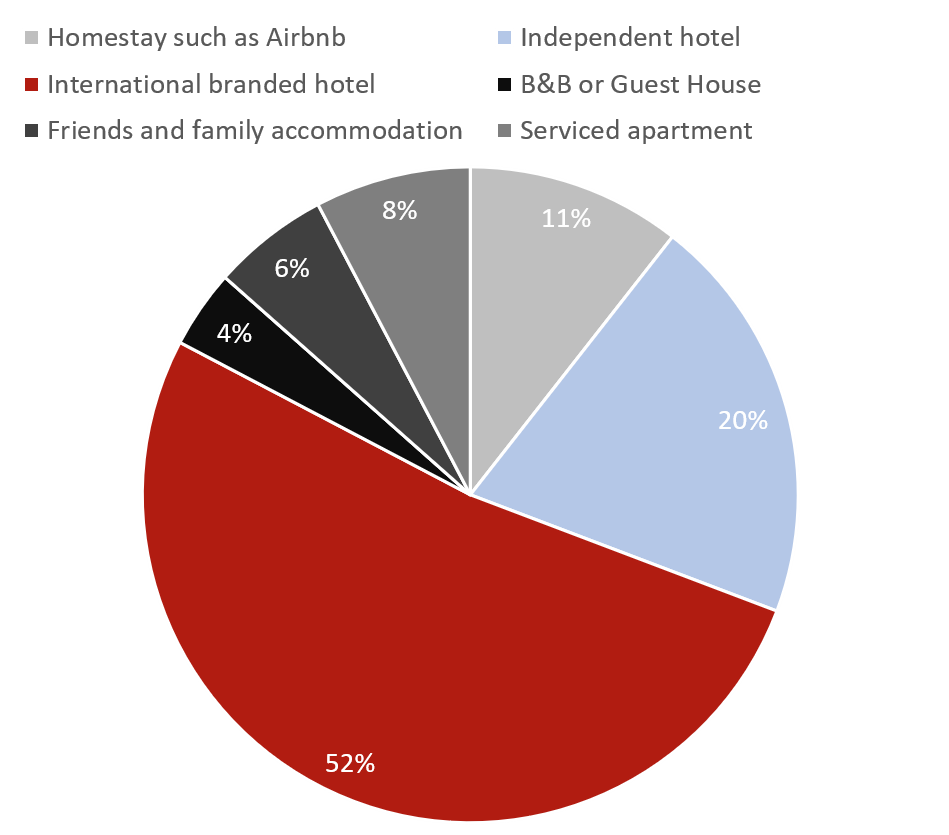

Question 13: What type of accommodation are you most likely to book for your first trip in Africa?

Source : HVS

More than half all respondents expect to stay in an internationally branded hotel, which reflects the actual and perceived safety of staying with a big brand.This proves there is work to be done by all accommodation providers to ensure all guests feel safe and that operators have done everything possible to make their stay as safe as possible.

Many of the global operators have implemented (and publicized) revised health and safety protocols at their properties to regain guest confidence. This survey demonstrates all of these efforts need to be complemented by governmental efforts.

Although homestays remain popular, some governments have suggested this will be the last accommodation type opened for travelers.

Globally many commentators believe with the additional health and safety concerns the additional space of a serviced apartment will boost demand for this sector, at least in the short-term.

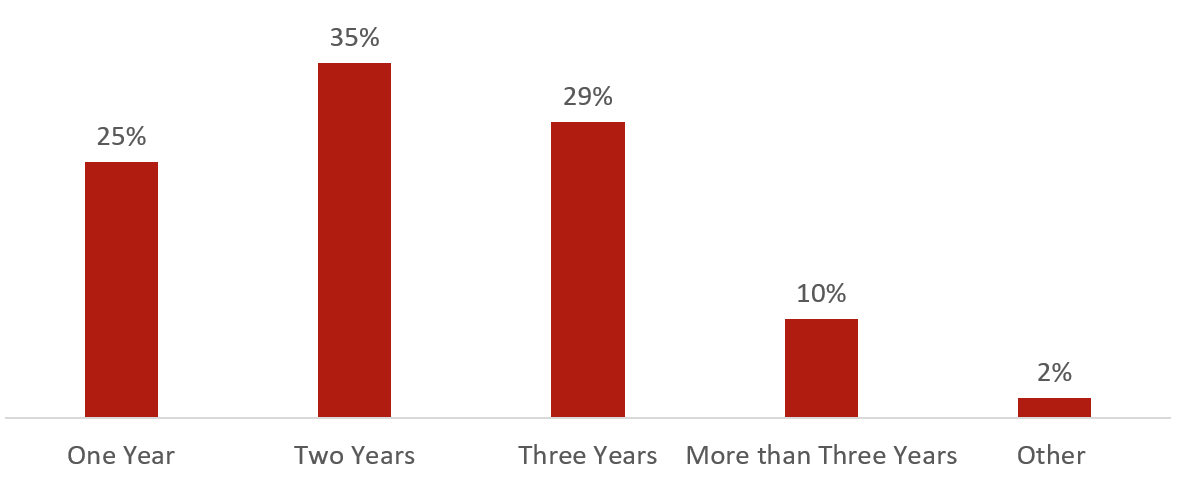

Question 14: How long do you expect the African travel and hotel industry to return to 2019 levels?

Whilst the majority of respondents expect the industry to return to 2019 levels within two years there are people who said ‘we will never return to prior lockdown levels’

Clearly there is work to be done in promoting individual hotels and destinations to new as well as existing guests.

This will depend on many factors, some within control of hoteliers, but many outside their control. It is another example of the need for a collaborative approach between the private and public sectors. Given the size of the continent, the aviation industry will also influence the speed of recovery.

The recovery can be seen as an opportunity and those countries, destinations and businesses able to re-position themselves to as many potential travelers as possible will undoubtably be the most successful.

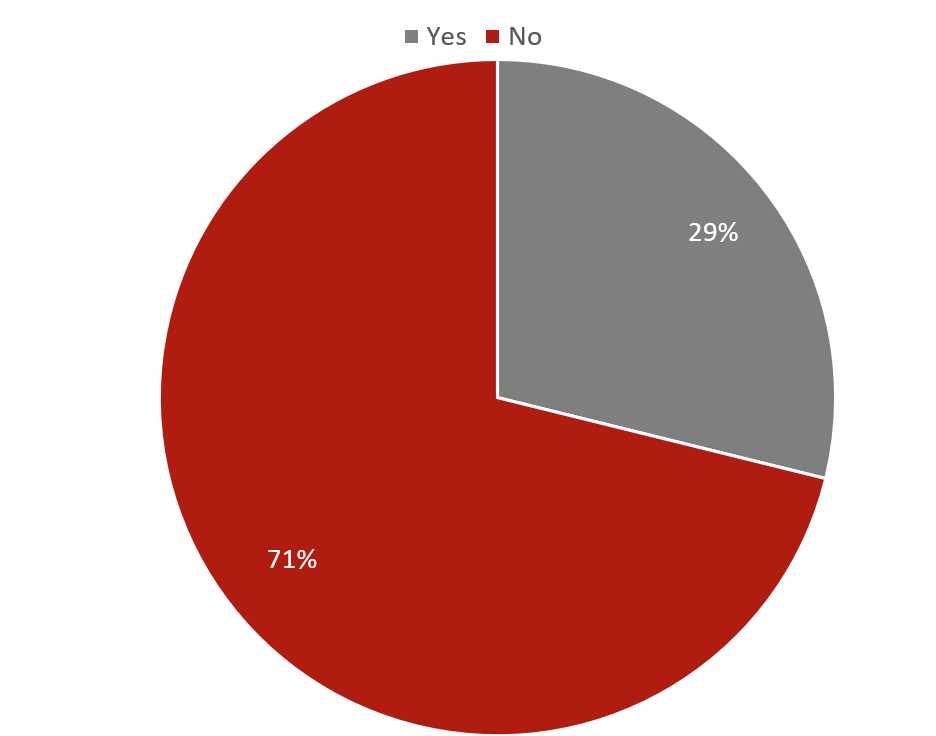

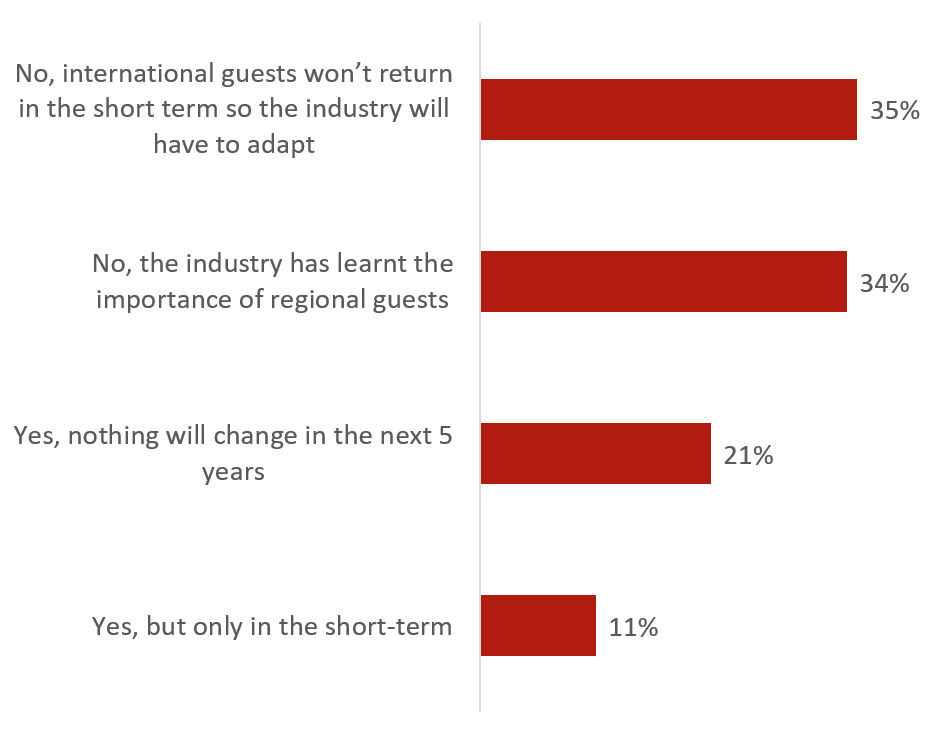

Question 15: Do you think the African travel and hotel industry will return to the same reliance on high spending international guests?

Source : HVS

Personally, this is the most exciting outcome from the survey. 69% of respondents expect the industry has or will adapt to attract more regional guests.

Only 21% of respondents believe it is unlikely to be any change now or in the future.

The concept of Africans doing it for themselves is well known but this is very exciting, the silver lining from the pandemic could be the revolution of a whole industry to promote regional travel and growth. There are many issues to overcome, if this is to be successful including, but not limited to pricing and ensuring the offer is attractive to the new guests.

As Winston Churchill whilst working to form the United Nations after WWII famously said “Never let a good crisis go to waste.”

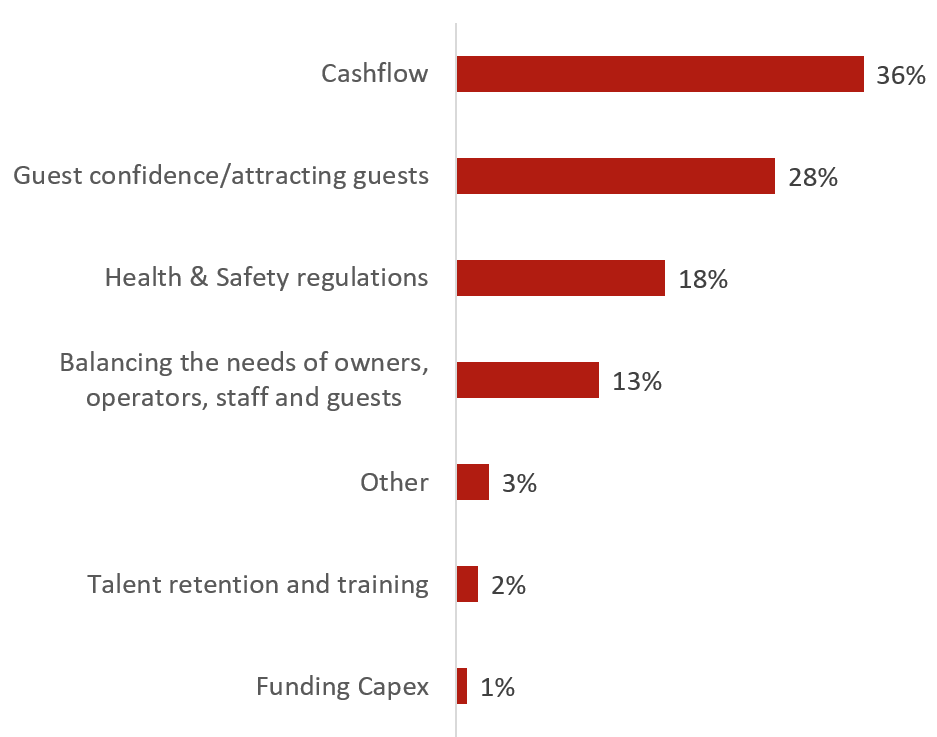

Question 16: What is the biggest challenge facing hotel re-openings?

Source : HVS

Cash remains king. If there hasn’t been any income for an extended period perhaps it is no surprise this is the biggest challenge. Interestingly in other regions of the world the answer to this question has often been related to guest confidence and health and safety regulations.

Complying with new health and safety regulations may come with additional costs and any hiring or training will also impact short-term cashflow.

These pressures on cashflow may result in some hotels delaying re-opening and some being unable to re-open at all.

Whilst only 2% of respondents consider ‘Talent’ to be the biggest challenge we consider this to be a crucial issue. The new traveler behaviour is unknown, but it is likely to result in re-training staff with new skills and brushing up skills that have not been used for six months.

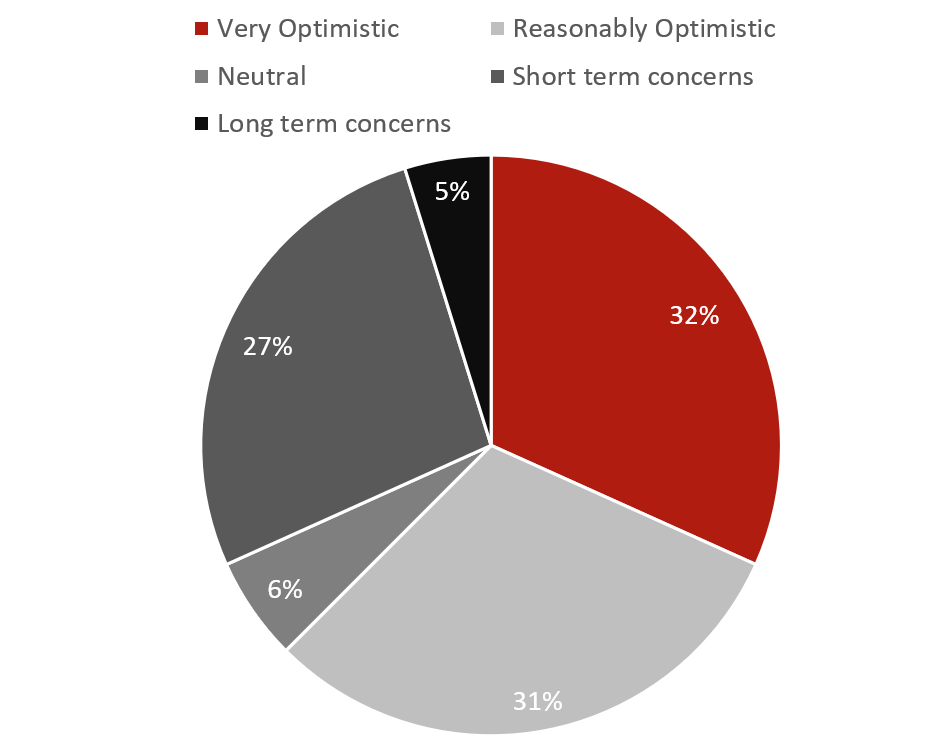

Question 17: Overall how optimistic are you about the future of the African travel and tourism industry?

Source : HVS

A third of respondents have concerns for the industry, which is perhaps where government needs to come in and help. Many of these concerns are likely to be well placed and it is important that we all work together to emerge as strong and as desirable as possible.

Whilst we hear little but bad news and many of our businesses have not received notable income for some months it is easy to see a negative side. However, the fundamental attractions and opportunities of Africa remain and it is encouraging that 63% of respondents are optimistic.

International tourist arrivals to Africa continue to increase and are predicted to rise exponentially over the next few years. We remain confident that the overall outlook for the tourism and travel industry across the continent is positive despite the short-term uncertainty.

Conclusion

•Business demand likely to recover first

•Government has a key role to play

•Safety and security remains key

•Growing influence on regional travelers

•Pent Up demand for many countries

•International branded hotels remain the most popular

•Fundamental attractions of Africa remain

This survey is far from exhaustive and it raises plenty of further questions for consideration. It does however highlight a few key issues and provides us all with additional data upon which to base our recovery decision-making.

The short-term future is uncertain and I am sure if we asked the same questions to the same respondents in three months time we would receive slightly different answers. What will not change though is that we are in a highly adaptive service industry where we thrive on serving our customers.

Many of us have re-discovered our sense of community and desire to help others during the pandemic. It is this spirit that will see us all come through the lock down and re-open the doors.

To do this we need to work with government and all our partners to ensure we are strong and flexible and ready to face the next challenge thrown at us.

Disclaimer

HVS does not provide legal or other regulated advice or guarantee results. The survey findings reflect general insight based on information available to us by the participants. These findings should be viewed as indicative only and not relied upon for future course of action. These findings may be subject to change and therefore HVS has no obligation to update these findings and makes no representation or warranty and expressly disclaims any liability with respect thereto.

.png)