By Jamie Lane

Airbnb has continued to grow throughout the United States in 2016, and recently in cities that heretofore have yet to feel the impact. CBRE Hotels’ Americas Research released a report in February 2016 entitled, The Sharing Economy Checks In: An Analysis of Airbnb in the United State. The report analyzed Airbnb performance data provided by Airdna[1]. In the report, it was found that more than 55 percent of the $2.4 billion in revenue generated by Airbnb nationwide from October 2014 to September 2015 was captured in only five U.S. cites (New York, Los Angeles, San Francisco, Miami, and Boston).

Since then, we have seen much higher growth rates around the rest of the country. From April 2015 through March 2016, there was $3.6 billion in Airbnb revenue generated in the U.S., a 50 percent increase over the annualized number just six months earlier. Of that $3.6 billion in new revenue, only 34 percent was generated in the top five markets, a decline from the 55 percent share presented in our previous study. This dramatic change in the source of revenue means that many more markets may start to feel the impact of Airbnb.

Growing Demand

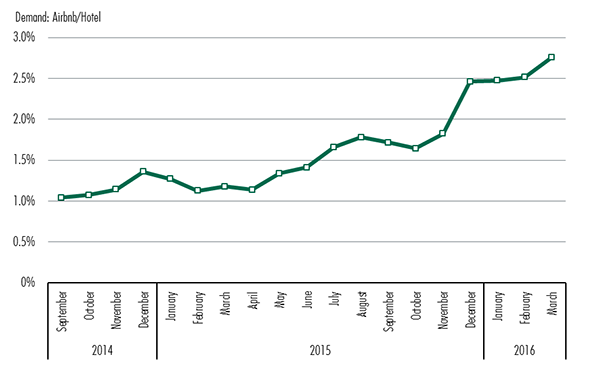

We are also able to estimate the number of bookings on Airbnb by using the data provided by Airdna. Over the past year there have been roughly 22 million bookings on Airbnb in the U.S. During the first quarter of 2016, Airbnb bookings equaled 2.5 percent of traditional hotel rooms occupied. This 2.5 percent ratio represents an increase from the 1.0 percent mark posted at the end of 2014, and the 1.5 percent ratio achieved in 2015. On a year-over-year basis, Airbnb showed a 120 percent increase in demand during the first quarter of 2016, while traditional hotel demand increased just 1.0 percent as reported by STR.

Table 1: Airbnb Accommodated Demand as a Percent of Traditional Hotel Demand

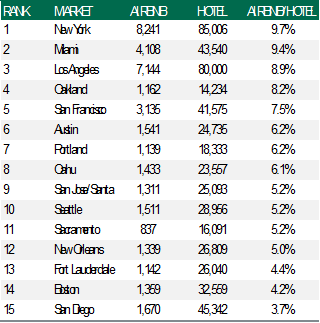

New York is still dominating the U.S. market in terms of demand for Airbnb units, but many other markets are starting to catch up. In Table 1, we show national Airbnb demand as a percent of traditional demand surpassed 2.5 percent in 2016. In Table 2, we show how average daily demand is broken down by each of the 60 markets that CBRE Hotels’ Americas Research forecasts each quarter. In the first quarter of 2016, there were 12 markets in which Airbnb demand was greater than five percent of traditional hotel demand. The top five markets were led by New York, Miami, Los Angeles, Oakland, and San Francisco. The bottom five markets (not shown in Table 2) were Detroit, Indianapolis, Fort Worth, Columbia, and Dayton, whose average daily Airbnb demand was below 150 units.

Table 2: Q1 2016 Average Daily Demand for Airbnb and Traditional Hotel Rooms by Market

Impact Unsure

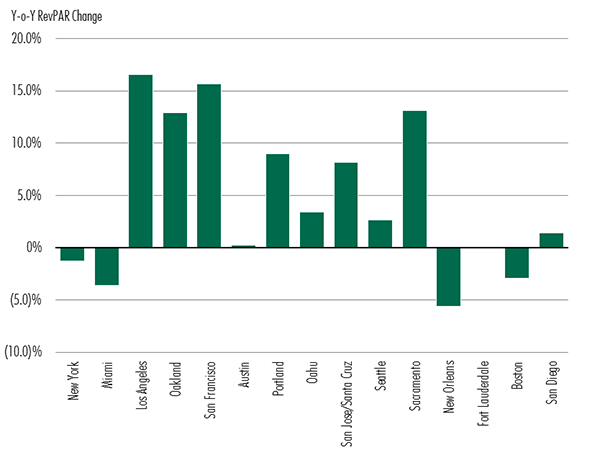

When looking at first quarter 2016 hotel RevPAR growth for the markets listed above, a pattern of underperformance is not clearly defined. U.S. RevPAR growth increased 2.7 percent during the quarter. During the sample quarter, 8 out of the 15 markets were able to achieve RevPAR growth at or above the national average. While New York and Miami hotels struggled in terms of RevPAR growth in the first part of 2016, it cannot be clearly attributed to the impact of Airbnb. New York and Miami are experiencing a wave of new hotels opening. These new hotels, as well as a slowdown in international demand due to the strong dollar, are likely impacting performance more than competition from Airbnb.

Table 3: Q1 2016 Hotel RevPAR Change

Airbnb demand is approaching 10 percent of traditional hotel demand in many markets, and also is claiming a growing percent of the demand in markets where Airbnb traditionally posed little competition. As a result of this growth, it is anticipated that Airbnb will be noticed by more hotel owners and operators during the summer 2016 travel season. By studying past hotel cycles, it is known that increased competition resulting from new supply can impair a hotel’s ability to raise rates. As we reach the part of the business cycle during which traditional hotel supply ramps up, it is important to know not only where the new hotel competitors will be opening, but also where alternative lodging accommodations are popping up.

[1] Airdna – provides data and analytics to vacation rental entrepreneurs and investors. By tracking the daily performance of over 2,000,000 listings across 5,000 cities worldwide, Airdna presents market reports and other data products that feature occupancy rates, seasonal demand, and revenue generated by short-term rentals.