by Matt Kurtz

Airbnb offers accommodations in nearly every major hospitality destination worldwide. Rates are often lower than comparable hotel rooms, and its popularity is rising—what does this mean for hotels?

Travelers looking for lodging in their destination cities have traditionally taken one of two courses: stay at the home of a friend or relative or book a room at a local hotel. Over the past six years, a kind of hybrid option has emerged, allowing for guests to book rooms in the houses, apartments, condominiums, trailers, treehouses, boats, and even castles of other people. The experience can have as much in common with couch surfing as with staying at a B&B or boutique hotel, but it is also quickly becoming more sophisticated, with some listings rivaling four- and five-star luxury hotel suites in destination cities. Tens of millions of travelers have opted for such accommodations, and the numbers are growing.

Airbnb, an online community marketplace connecting lodgers with hosts, leads the hospitality charge among a growing contingent known in business circles as a “disruptive service”—that is, a platform that through its innovation disrupts the established way of doing business in a given industry. In the world of lodging, Airbnb has managed to increase the amount of available lodging supply without building a single structure or room. In the words of Sangeet Choudary, an expert in networked business models, “Airbnb enables anyone with a spare room and a mattress to run their own [bed and breakfast] and benefit from a global market of travelers.” [1]

Does Airbnb’s rise threaten the livelihood of the hotel industry? What can hoteliers learn from the service in terms of keeping demand satisfied and booking rooms at their hotels?

Background

Airbnb traces its roots back to October 2007 when co-founders Brian Chesky and Joe Gebbia put the idea forward of renting out rooms in private residences to accommodate travelers in sold-out hotel markets. The two rented out the living room of their own San Francisco loft and even offered breakfast to their guests. Chesky, Gebbia, and third cofounder Nathan Blecharczyk officially launched Airbnb in August of 2008, and over the past six years, the company has taken off with the simple principle of matching people with space to rent with travelers who need a reasonably affordable place to stay.

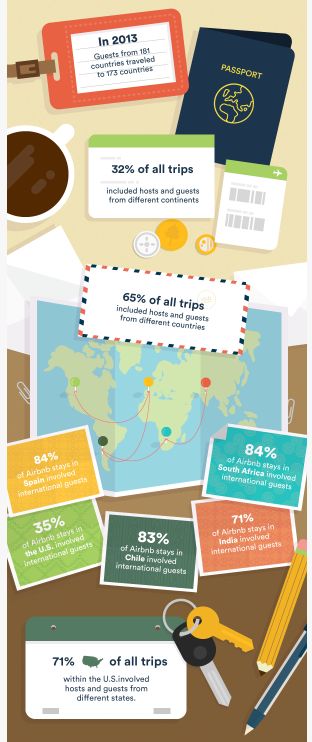

Since 2008, more than 11 million guests have stayed in one of Airbnb’s 600,000 listings worldwide. The rapidly expanding room count offered through Airbnb is on a trajectory to surpass that of the world’s largest hotel chains, including InterContinental Hotels Group and Hilton Worldwide. Airbnb’s CEO Brian Chesky hammered this point home earlier this year by tweeting that “Marriott wants to add 30,000 rooms [in 2014]. We will add that in the next two weeks.”

Airbnb’s remarkable growth in listings, bookings, and profitability has led to its most recent round of investment, including $450 million from the private-equity firm TPG in April of 2014. This has increased Airbnb’s value to $10 billion, higher than that of hospitality giants Wyndham Worldwide Corp. ($9.3 billion) and Hyatt Hotel Corp ($8.4 billion). Its rapid rise and expansion makes Airbnb a serious competitor for the traditional hotel industry. So what do hoteliers and hotel companies need to know in order to ensure that their properties continue to command top rates and capture demand?

A Growing Competitor

The first step is simply awareness of the increasing quality, availability, and economy of lodging options offered through Airbnb. Many hoteliers and hotel executives are too quick to dismiss Airbnb, thinking its listings far too humble, too inconsistent, and too unappealing to travelers accustomed to more upscale accommodations. Some hotel representatives, especially in the luxury segment, do not view Airbnb as a direct competitor and are thus unconcerned with the prospect of losing business to its growing network of rooms.

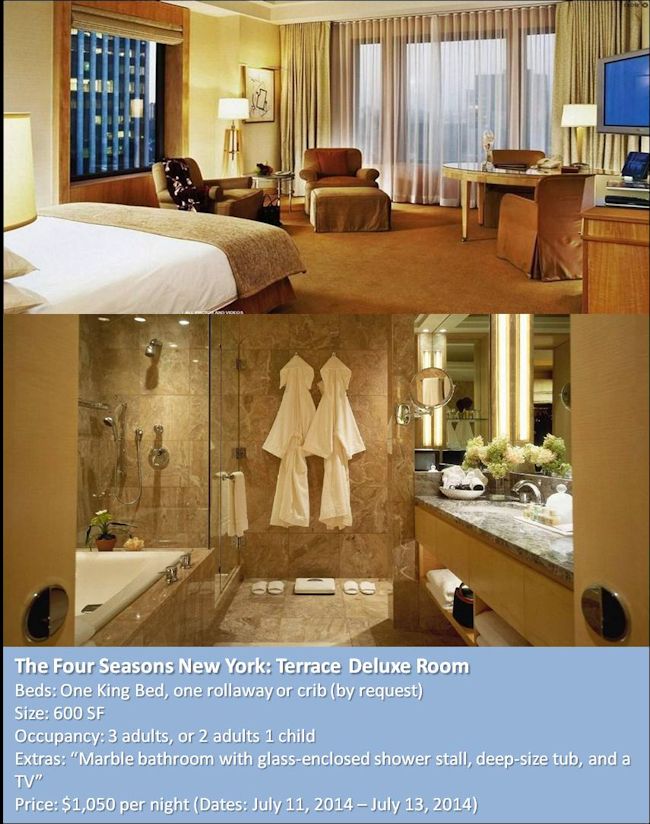

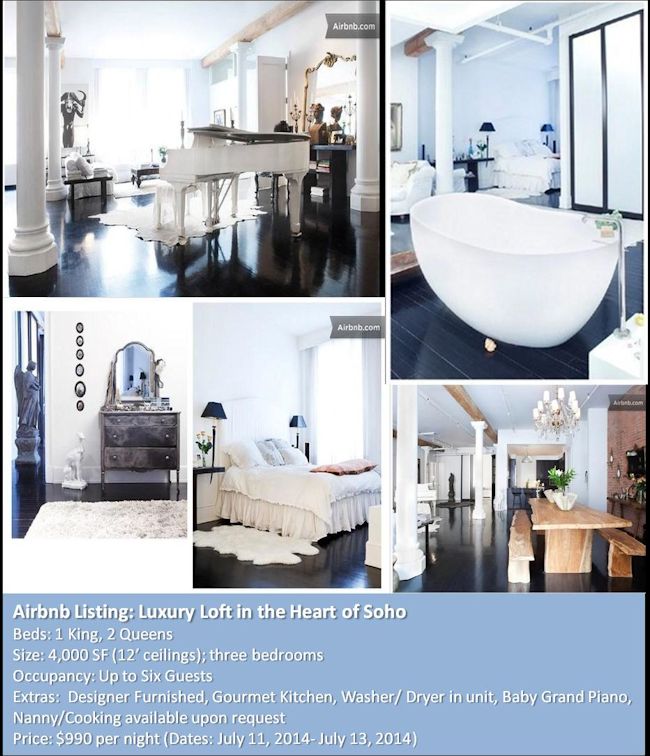

The fact is that Airbnb has made vast strides in cementing its legitimacy, and its popularity continues to climb. Airbnb’s more upscale offerings rival those of luxury hotels, sometimes even competing on the same premises (at the time of writing, the Private Villa at the Four Seasons Sharm El Sheikh has its own listing on Airbnb). The comparative price point versus hotels makes the Airbnb offerings even more alluring. As one example, a family vacationing in New York City on the weekend of July 11, 2014, has the option to stay at the Four Seasons New York in a standard 600-square-foot, one-king-bed guestroom for $750 to $1,095 per night (depending on city views); a one-bedroom, 1,200-square-foot-suite starting at $3,795 per night; or an Airbnb designer-decorated three-bedroom, 4,000-square-foot loft replete with 12-foot ceilings, gourmet kitchen, and baby grand piano for $990 per night. It would appear Airbnb provides a very viable, attractive option for luxury-oriented travelers.

While it is difficult to quantify how much business Airbnb is actually taking away from the hotel industry, it is safe to assume that the majority of the 11,000,000 travelers who have booked accommodations through Airbnb over the last six years would have otherwise stayed in hotels. Sean Hennessey, CEO of Lodging Advisors, estimates that the 416,000 Airbnb guests who visited New York for the twelve months ending July 2013 cost the city’s hotel industry approximately one million room nights.

As Airbnb bookings and listings go up year-over-year, the hotel industry faces an increased siphoning of its clientele. Moreover, similar to when additional hotel supply enters a market, hoteliers may be forced to lower their average rates to increase their occupancy and remain competitive. This is exactly what is happening with Warren Buffett’s recent announcement encouraging Berkshire-Hathaway shareholders to go through Airbnb to find accommodations for the company’s upcoming annual meeting in Omaha. The meeting, for which approximately two-thirds of the company’s 38,000 shareholders arrive in Omaha from out of town, requires a substantial number of rooms, and hotels have traditionally met the demand. But Airbnb properties offer lower rates and no two- or three-day minimums on a stay—a major advantage, as far as Buffett is concerned. [2]

Airbnb’s rising occupancy penetration levels puts the service in direct competition with hotels, and not just for leisure demand but for commercial travelers as well, as the Berkshire-Hathaway example makes clear. There is also another impact on the hotel industry, and this pertains to proposed hotel feasibility reports and valuations of existing hotel properties.

How Airbnb Impacts Hotel Feasibility Studies and Valuations

Careful analysis of lodging demand in a given market area is essential to determining the feasibility of a proposed hotel or the value of an existing one. To calculate demand, appraisers survey area hotels to establish existing occupancy levels. Occupancy levels are multiplied by the available rooms each hotel has, and these amounts are totaled to estabilsh a base level of overall demand that is accommodated by the selected competitive set. This estimate serves as a basis for projecting future demand, a basic component of a market study, feasibility study, or appraisal.

Demand is broken into two categories: accommodated and unaccommodated. Unaccommodated demand refers to the number of travelers who seek accommodations within a market area but must either defer their stay or settle for less desirable accommodations because the hotels where they want to stay have no vacancies or are over-priced. If an appraiser does not account for or properly quantify unaccommodated demand, his or her conclusions about the feasibility of a proposed property will be inaccurate.

As mentioned previously, the number of travelers opting for lodging through Airbnb is increasing, though the proportional impact on hotel penetration levels is difficult to quantify, with no mechanism yet in place to ascertain how many Airbnb guests would have otherwise stayed in hotels. Nevertheless, Airbnb’s rising prominence certainly complicates projections about future demand levels and estimations of a proposed hotel’s absorption of unaccommodated demand.

Conclusion

While its chief advantages include providing unique listings at rates well below those of comparable hotel accommodations, Airbnb does have some notable drawbacks. The company does not own or operate any of the properties or rooms listed on its website, nor do they offer any consistent amenities (such as Internet access, food and beverage outlets, concierge services, recreational amenities, or parking) that are standard at full-service hotels. This means that travelers must base their choice on reviews provided by other guests of a given property listed on Airbnb, versus relying on established, widespread familiarity with the brands of major hotel companies like Hilton, Marriott, InterContinental Hotels Group, and others. On the front end, guests have a sense of trust established by a hotel brand’s reputation over many years in many cities, and on the back they have clear options for recourse or complaint if their experience does not live up to brand standards. The expectations for an Airbnb listing are less defined, and it takes a more experienced, flexible, and confident traveler to feel secure in booking a room.

Nevertheless, hoteliers cannot afford to overlook Airbnb as a growing competitor in the lodging marketplace as the company continues to attract new bookings and listings and solidifies its reputation for providing travelers with a more immersive, more affordable experience in the culture and lifestyle of their destination city. Most hotels already provide discounted room rates on OTAs such as Expedia, Hotels.com, and Travelocity during periods of low occupancy, and it would be wise for hoteliers to look into finding ways to list their rooms on Airbnb as well. [3] Most importantly, hoteliers should keep their finger on the pulse of Airbnb’s listings in their market, and take appropriate steps to position their hotels to get out front and compete for demand.

[1] “Disruption Lessons from Airbnb.” The Build Network Staff. http://www.inc.com/thebuildnetwork/disruption-lessons-from-airbnb_Printer_Friendly.html

[2] “Airbnb has a friend in Warren Buffett.” Newsweek. May 5, 2014. http://www.newsweek.com/airbnb-has-friend-warren-buffett-249560

[3] From Airbnb’s online FAQ: “Almost anyone can be a host! It’s free to sign up and list your space. The listings available on the site are as diverse as the hosts who list them, so you can post airbeds in apartments, entire houses, rooms in bed-and-breakfasts, hotel rooms, tree houses in the woods, boats on the water, or enchanted castles. The list goes on and on! Find out more about room types on Airbnb.” https://www.airbnb.com/help/question/18.