Allianz Global Assistance’s Annual Vacation Confidence Index Reveals that Generation X Travelers Will Spend Nearly Twice as Much as Millennials and More than Baby Boomers

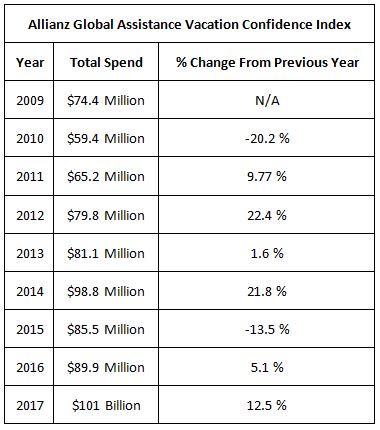

Americans are spending more on summer vacations this year, topping $100 billion for the first time, according to the eighth annual Allianz Travel Insurance Vacation Confidence Index released today by Allianz Global Assistance. This is the first time in the survey’s eight year history that vacation spending has surpassed the $100 billion mark and represents a 12.5 percent increase over last year.

Americans’ spending habits have risen for the second consecutive year – the total projected spend on summer vacations, among those confident they’ll take one, is $101.1 billion, up from $89.9 billion in 2016. On average, Americans will spend $1978 on summer vacations, a 10 percent increase from 2016 ($1798), which was an 11 percent rise from 2015 ($1621). Vacationing Millennials (ages 18-34) will spend the least ($1373) this summer, followed by Baby Boomers (ages 55+) ($1865), and Generation Xers (ages 35-54) will spend the most ($2628), on average.

“Americans are feeling better about the economy and have loosened their purse strings for summer 2017,” said Daniel Durazo, director of communications at Allianz Global Assistance USA. “We’re happy to see that for first time in the eight year history of the Vacation Confidence Index, vacation spending will hit an impressive $100 billion. This new milestone is great news for the travel industry.”

The survey, which tracks Americans’ confidence that they will be able to take a summer vacation, revealed that more than four in ten (44 percent, up one point since last year) are confident they’ll take a summer vacation (34 percent very/10 percent somewhat), and half (51 percent, up a point) are confident about the prospect of a vacation at some point in 2017. Four in ten (40 percent) aren’t confident about taking a vacation, while one in ten (nine percent) have already taken one.

While Americans are slightly more confident they’ll take a vacation this year, some are questioning its overall importance. Down a significant six points since last year, the survey found that 59 percent of Americans say that taking an annual vacation is important to them (32 percent very/27 percent somewhat), and one in four (23 percent) say that annual vacations are not at all important to them.

Allianz Travel Insurance’s Vacation Confidence Index also found no significant change in the Vacation Deficit , or percentage of Americans who think that a vacation is important but are not confident they'll be able to take one. In 2017, two in ten (21 percent) of Americans who say an annual vacation is important to them are not confident that they’ll take a vacation, down one point from 2016 but still higher than the 2015 Vacation Deficit (19 percent).

“With the vacation spend breaking $100 billion, travel insurance is a must-have,” said Durazo. “The right travel insurance policy can protect a consumer's pre-paid travel expenses when they have to cancel their trip due to certain unexpected situations, such as a covered illness or injury, and it may also provide reimbursements for things like medical emergencies, delayed travel, and lost or delayed baggage."

The Vacation Confidence Index has been conducted each summer since 2010 by national polling firm Ipsos Public Affairs on behalf of Allianz Global Assistance USA. A vacation is defined as a leisure trip of at least a week to a place that is 100 miles or more from home.

Methodology: These are some of the findings of an Ipsos poll conducted on behalf of Allianz from June 1 for 4, 2017 . For the survey, a nationally representative sample of 1,009 randomly-selected adults residing in the U.S. was interviewed by random-digit dialing telephone via the ORC Caravan omnibus. With a sample of this size, the results are considered accurate within ±3.1 percentage points, 19 times out of 20, of what they would have been had the entire population of adults in the U.S. been polled. The margin of error will be larger within regions and for other sub-groupings of the survey population. These data were weighted to ensure the sample's regional and age/gender composition reflects that of the actual U.S. population according to data from the U.S. Census Bureau.