By Robert Mandelbaum, Todd Casper

Based on our February 2023 Hotel Horizons® report, CBRE is forecasting that total hotel revenue for the average U.S. hotel returned to pre-COVID levels in 2022. This occurred despite the fact that the average occupancy for U.S. hotels is not expected to exceed 2019 levels until 2026.

With occupancy levels lagging during the post-COVID recovery and guest counts depressed, hotel owners and operators have had to look for alternative sources of revenue beyond the rental of guest rooms to make up for the income deficits. For some hotels in the U.S., parking has become a profitable source of revenue since COVID and helped fill in the revenue gap.

The increase in parking revenue has occurred, in part, because an increasing number of hotels started to charge guest for parking on-site. In 2019, 17.0% of all the hotels in CBRE’s annual Trends® in the Hotel Industry database reported parking revenue. This number rose to 20.4% in 2022. Further, hotels that already managed a parking operation before COVID increased the price they charged guests to park their cars.

To analyze the increase in U.S. hotel parking revenue, CBRE studied a sample of 520 hotels that reported parking revenue for our annual Trends® survey each year from 2019 through 2022. In 2022, these hotels averaged 324 rooms in size, an occupancy of 65.4%, an average daily rate of $245.25, and a RevPAR[1] of $157.05, versus the $163.07 RevPAR achieved in 2019. Since the sample consists solely of properties that reported parking revenue, it is skewed toward full-service hotels located in urban areas. This explains the relative high room counts and ADRs for the sample.

Revenue Growth

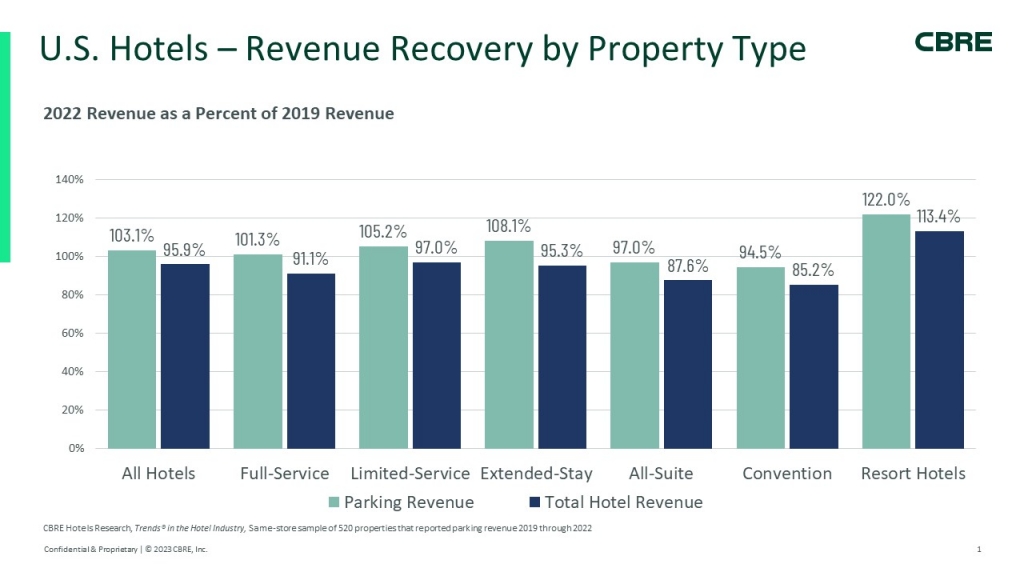

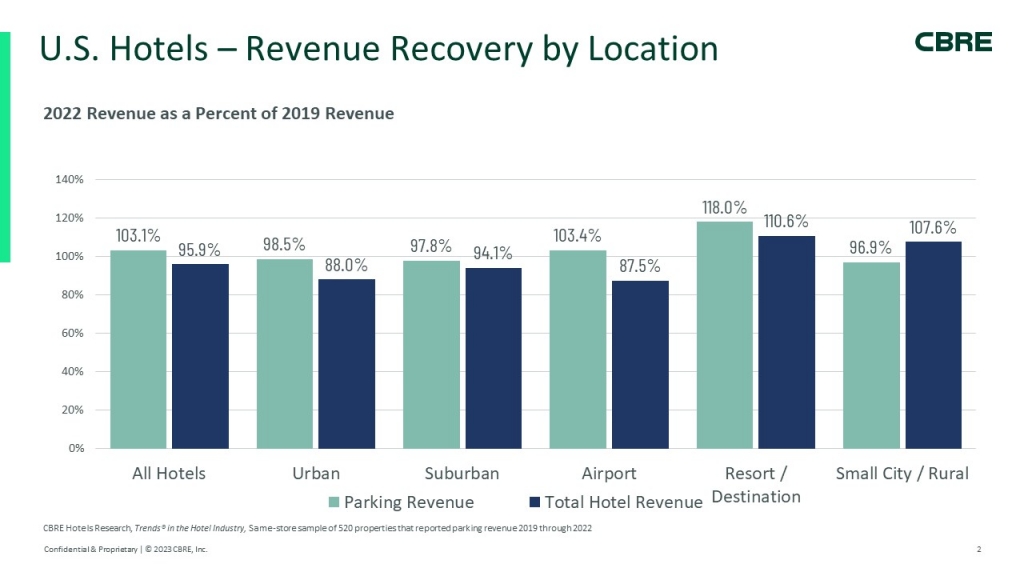

Since larger, urban hotels suffered the most during the pandemic, it is not a surprise that the average property in our sample has yet to return to their pre-COVID levels of total hotel revenue. On average, 2022 total revenue for the study sample is just 95.9 percent of 2019 total revenue.

However, parking revenue for the properties in the study sample is 103.1% of 2019 levels. This is particularly noteworthy because the number of rooms occupied at the average property in the sample from 2022 was still 14.6% less than in 2019. Parking revenue, which is measured on a per-occupied-room (POR) basis, was 20.7% higher in 2022 compared to 2019, a clear indication that hotels have significantly increased the price they charge guests to park. Parking rate increases are not only an effective way to increase revenue, but they also help offset inflationary pressures on operating expenses.

Consistent with macro travel trends, resort hotels, as well as properties located in resort/destination locations, enjoyed the greatest increases in parking revenue from 2019 to 2022, both on a POR and per-available-room basis. This implies increases in both parking prices and business volume. Limited-service and extended-stay hotels appear to have benefited from their relatively strong performance to drive parking revenue during the post-COVID recovery period. Airport properties were another group of hotels that took advantage of their location to be creative and generate more revenue from their parking lot or garage.

Several factors currently influence the decisions hotel managers make as they set parking rates:

- Kastle Systems, in conjunction with CBRE, has reported that office occupancy levels in the urban core of major U.S. markets have just returned to the 50% level. This has left a surplus of available parking spots in several downtown markets. A surplus of parking in urban areas can mute the ability of hotels to raise parking rates as lot and garage owners struggle to gain market share.

- On the other hand, the surplus of parking spaces provides urban hotel owners and operators an opportunity to lease multiple parking spots at nearby lots and garages at relatively low rates. Hotels can then capitalize on their lower cost basis and maximize profits.

- Like guest rooms, hotel parking spaces are not subject to long-term leases. Therefore, hotel parking lots can utilize technology and dynamic pricing techniques to maximize revenue during different market conditions.

- Hotel guests do not typically choose a hotel based on the cost of parking. However, location is frequently cited as an important factor. If guests must drive to stay at the preferred location, then the hotel gains pricing leverage.

Impact on Revenue

Despite these growth figures, parking is still a minor source of revenue for hotels. In 2022, parking revenue for the average hotel in our study sample was 3.1% of total revenue. However, parking revenue has grown faster (3.1%) than total hotel revenue (2.8%) from 2019 to 2022. Parking as a percent of total revenue peaked in 2020 and 2021, highlighting the increased reliance of hoteliers on this alternative source of revenue during the height of the pandemic.

When analyzing the sample by property type, parking revenue made up the greatest share of total revenue at extended-stay hotels (5.3%) and all-suite hotels (4.9%) during 2022. Urban (3.7%) and airport (3.5%) hotels enjoyed the greatest contributions from parking revenues when segregated by location category.

Parking Profits

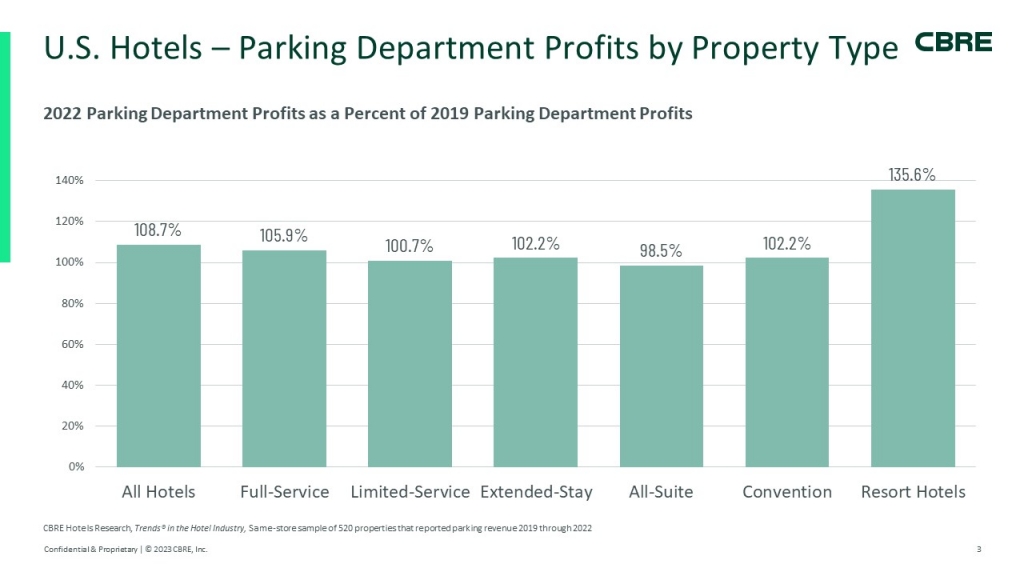

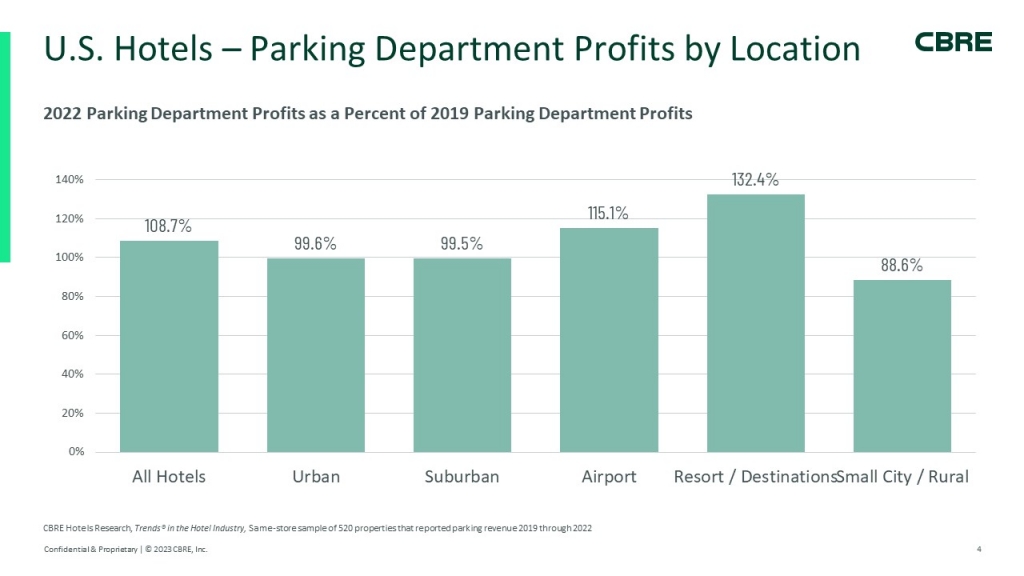

Consistent with the increase in revenue, hotel parking profits have increased from 2019 to 2022. On average, the properties in our sample achieved parking department profits during 2022 that were 8.7% greater than 2019 profit levels. Resort hotels, as well as properties in resort and airport locations, achieved the greatest gains in parking department profits.

Unfortunately, parking operations are relatively expensive to run compared to other minor operated departments. The average profit margin for a parking department in 2022 was 60.2%. This is less than the 62.1% average profit margin for all minor operated departments. Per the Uniform System of Accounts for the Lodging Industry, the profit margins are calculated before the deduction for overhead expenses such as administration, marketing, maintenance, utilities, property taxes, and insurance.

There are a few ways in which hotel owners and operators can maximize revenues and profits from parking. Managing costs, whether parking is being operated in-house or by a third party, is critical in capitalizing on this growing revenue stream.

What Should Hotel Owners be Considering?

Drive Parking Net Income by Evaluating Expenses

Parking expense considerations include evaluating the need for valet versus self-park only operations. Valet services are labor intensive and increasingly costly in today’s labor-constrained market. Technology improvements can be a way of reducing ongoing operating costs with pay-on-foot machines or even gateless app-based technology.

Other market-specific factors impacting the bottom line of hotel parking operations include parking sales tax, if any, in a local market. Urban markets vary from having no parking sales tax to potential taxes at the city, county, and state levels. In addition, the allocation of hotel expenses to parking operations can significantly impact net income associated with parking. Property taxes, insurance, utilities and other allocations are often dated and in need of refinement to optimize parking profitability. Expenses, such as security, cleaning and enhanced lighting, typically improve the perception of a parking facility and can drive long-term parking demand.

In-House vs. Third-Party Operators

Deciding whether to operate parking in-house versus with a third-party operator or parking management company is worth considering in urban parking markets. Third-party operators are often well-connected with other parking demand generators in the area and can tap into their network of parking aggregators to source e-commerce traffic. Third-party operators can also target the surrounding area for parking users that can capitalize on hotel parking spaces during non-peak hotel times.

Since the pandemic, third-party operators are less inclined to enter into long-term lease commitments, preferring management contracts or short-term agreements with less financial risk. Third-party operators can be motivated to perform with incentive-based contracts that offer upside to the operator and enhances the bottom line for parking operations. Operators will typically not assume the risk for property taxes assessed or allocated to the garage.

Own vs. Lease Hotel Parking

Should hotel owners own their parking or simply control it with long-term rights or an access agreement? As alternative investments gain favor in investment portfolios, urban parking is generating increased attention from private and institutional capital as well as infrastructure funds. Urban parking assets can offer investors well-located, covered land plays, attractive yields and the ability to quickly mark pricing to market rates in an environment of high inflation.

Parking garages and surface lots supporting hotels are increasingly being bifurcated from the hospitality ownership structure to take advantage of cap rate arbitrage of the parking asset compared to the hotel. Hotel owners don’t necessarily need to own their parking, but at a minimum, they need long-term access or rights to parking. Well-located, urban parking garages with multiple demand generators often trade at aggressive cap rates, particularly in supply-constrained urban markets.