By Anne Gompel, MAI, CHIA and Adam Zarczynski, CHIA

With the busiest airport in the world and a lower cost of doing business than peer regions, Metro Atlanta is the key inland distribution hub of the Southeast. Metro Atlanta is home to 17 Fortune 500 corporations like The Home Depot, Coca-Cola, Delta Air Lines, and UPS. It also sustains a diverse economy centered around technology, healthcare and health tech, logistics, advanced manufacturing, and now electric vehicles and clean tech. For the 10th consecutive year Area Development Magazine has ranked Georgia the number one state for business.

Atlanta’s strong economy has been spurred by an influx of residents and new businesses. Metro Atlanta, the eighth largest metropolitan area in the United States, added 73,000 people in 2022, behind only Dallas-Fort Worth and Metro Houston. The Atlanta MSA gained more than 1.0 million residents since the 2010 Census and is expected to reach 6.5 million residents by 2028.

As the growth continues throughout the Atlanta market, the scale of recent and planned developments is expected to materially improve the attractiveness and dynamic of the downtown area.

• A massive mixed-use development called Centennial Yards is now underway near State Farm Arena and Mercedes-Benz Stadium, in the section of downtown Atlanta known as The Gulch. As envisioned, this 50-acre project will create $5 billion worth of new development, including apartments, office buildings, hotels, and retail. While this project could take a decade to fully construct, the first major phase is scheduled to be finished by 2026.

• Though not spurring any new development, Atlanta is one of 16 cities in North America selected to host the 2026 FIFA World Cup, one of the world’s largest sporting events. Four to six high-profile international soccer matches will be held at Mercedes-Benz Stadium, amounting to the biggest event the city has seen since the 1996 Olympic Games. The World Cup will draw hundreds of thousands of visitors to downtown Atlanta, benefiting hotels, restaurants, and other service-oriented businesses.

• A new urban park called The Stitch is planned atop a platform spanning the Downtown Connector between Ted Turner Drive and Piedmont Avenue in Atlanta. This $713 million project will create 14 acres of public green space and transportation enhancements connecting the downtown and Midtown areas.

• A major mixed-use redevelopment has been announced for the Underground Atlanta retail and entertainment district. Developer Lalani Ventures has outlined plans for a $150 million renovation of the 12-acre site, anticipated to include housing, restaurants, retail, hotel, and office space.

• A large-scale expansion is planned for the National Center for Civil and Human Rights, which first opened in downtown Atlanta in 2014. Timed to coincide with the museum’s 10-year anniversary, this $48 million project will add 20,000 square feet to the existing museum, including conference space, classrooms, a café, and dedicated galleries for permanent and traveling exhibitions.

Central Business District Hotel Market

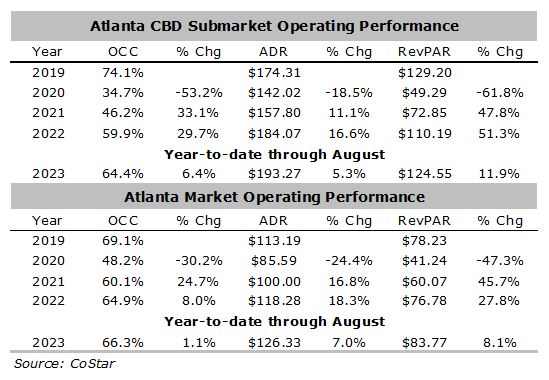

With the pandemic firmly in the rearview, many markets have seen KPIs match or exceed 2019 levels. This is not the case for the Atlanta CBD market, which is still inching towards pre-pandemic levels in terms of occupancy, though ADR levels are exceeding 2019 levels.

Despite improving significantly over the past year, the CBD’s recovery lags the overall market due to the submarket’s greater dependence on business and group travel and inventory growth in 2021. Year-end 2022 RevPAR in the CBD was 14.7% below 2019, while the Atlanta market overall was only 1.9% below 2019.

The ongoing recovery in group demand has been a key component of the submarket’s growth. The CBD is home to the Georgia World Congress Center, one of the top five largest convention centers in the U.S. According to Mark Vaughan, Executive Vice President and Chief Sales Officer for Atlanta Convention & Visitors Bureau, group segment demand is beginning to perform near 2019 levels. There has been an increased number of leads in the first half of 2023 (+149% compared to 2019), and bookings (+115%). The total attendance and room nights for leads that were turned definite are still slightly below 2019 levels (99% and 92%, respectively), but the group segment demand in the CBD was close to full recovery. Group demand is therefore anticipated to continue improving.

Larger urban hotel markets also face challenges with commercial demand due to remote and hybrid work options. The Atlanta market, despite its growth, has not been immune to the trend of vacant office space occupying its business core. According to Savills’ 2023 3rd Quarter Atlanta Market Report, the current availability rate in the Atlanta market for office space was 28.0%, up from 25.8% in the 3rd quarter of 2022. This has impacted commercial demand growth in the market.

Meanwhile, the leisure segment showed improvement in 2021 and 2022. According to Kalibri Labs, the ADR in the leisure segment has reportedly plateaued during the summer of 2023, which could indicate “a pause or the end of a leisure demand growth cycle,” especially as international visitors to Atlanta still have not fully returned.

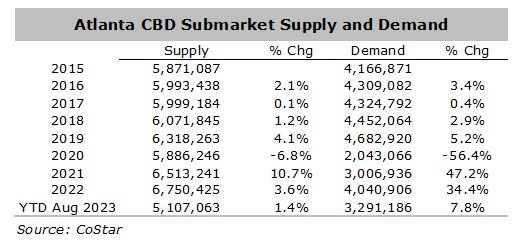

One major concern is how much new supply the CBD can handle. Atlanta’s Central Business District accounts for nearly half of all rooms under construction in the Atlanta market. Historically, supply had been outpaced by demand growth with new induced demand created from these supply additions. In recent years demand has struggled to keep pace with the supply additions due to the sharp decline resulting from the loss of convention business and reduced corporate travel following the onset of COVID-19. The following table shows the historic supply and demand of the Atlanta CBD submarket.

A modest decline in supply occurred in 2020 due to temporary closures; however, supply finished higher in 2021 and 2022 than in 2019. As demand continues to climb back towards 2019 levels, the submarket is benefiting from lower supply growth year-to-date through August. As the market prepares to welcome several additional properties, we forecast demand to achieve further growth.

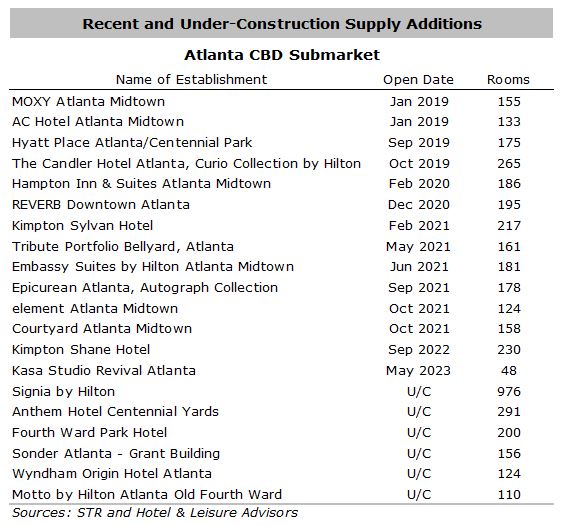

According to CoStar, there are just under 1,900 rooms under construction in the Atlanta CBD submarket, including the largest hotel project in Atlanta, the 976-room Signia by Hilton, which is poised to become the new headquarters hotel for the Georgia World Congress Center. The supply additions that have occurred in recent years and those under construction aside from the Signia Hotel have all been under 300 rooms. Adding a hotel of this size can disrupt the overall occupancy of the submarket in its early years. However, with almost 80,000 square feet of meeting space, the scale of the hotel will allow it to induce demand in the market, capture a strong base of in-house groups, and contribute to citywide events. The supply additions that have entered the submarket since 2019 and under-construction properties are shown below.

Conclusion

The strong demand recovery has been compounded by greater growth in the CBD’s room inventory, resulting in occupancy down 15% from 2019. Although ADR is at an all-time high, year-to-date RevPAR remains below pre-pandemic levels due to the slow recovery of occupancy rates. However, we forecast continued improvement in demand levels as international visitation to Atlanta is expected to fully recover by year-end 2024, and major convention bookings and leads in the group segment are strong. We forecast business transient travel to continue to grow, though to a lower level than pre-COVID. As the market continues to see interest from hotel developers due to a favorable business climate, new attractions, and being home to the world’s busiest airport, continued growth in the meetings and conventions space will be vital for occupancy to grow in the submarket. In all, the state of the Atlanta CBD hotel submarket is strong as favorable demographic changes and new recreational and commercial developments continue to reshape the landscape.