By Sebastian J. Colella

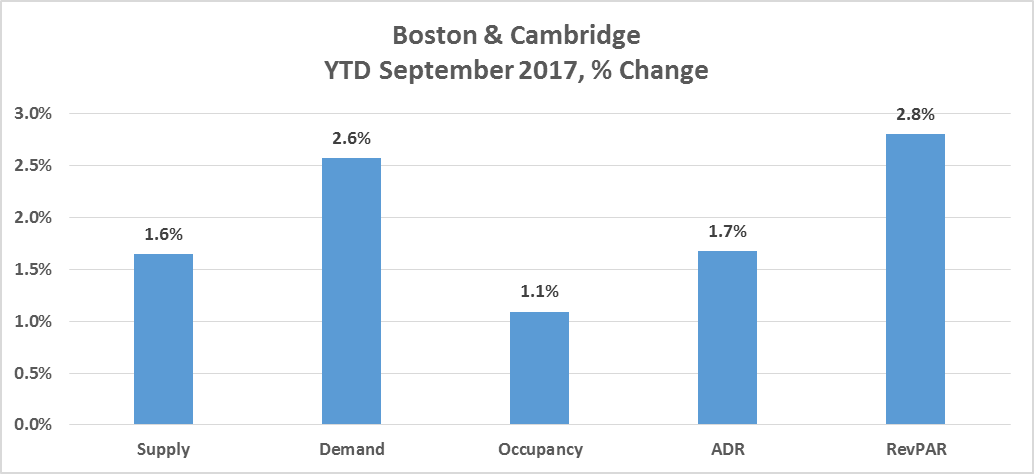

Through the third quarter, revenue per available room (RevPAR) in the Boston and Cambridge lodging market has grown 2.8% over the same time last year and the remaining three months will only help boost this performance further. Although the market’s RevPAR declined in 2016 for the first time in six years, market dynamics have improved to drive growth in both occupancy and average daily rate (ADR). The market has benefitted from a strong convention calendar with well-placed citywides, limited supply growth, and increases to both corporate and leisure demand.

Year-to-date through September 2017, lodging supply has increased 1.6%, a small increase when compared to 2016. During the same time demand increased 2.6%. As a result, occupancy has improved almost a full percentage point to where it was the same time last year. ADR growth has been slowing since 2014; through September ADR has increased a modest 1.7%. The strengthening in demand has enabled operators to drive RevPAR 2.8% over last year’s performance.

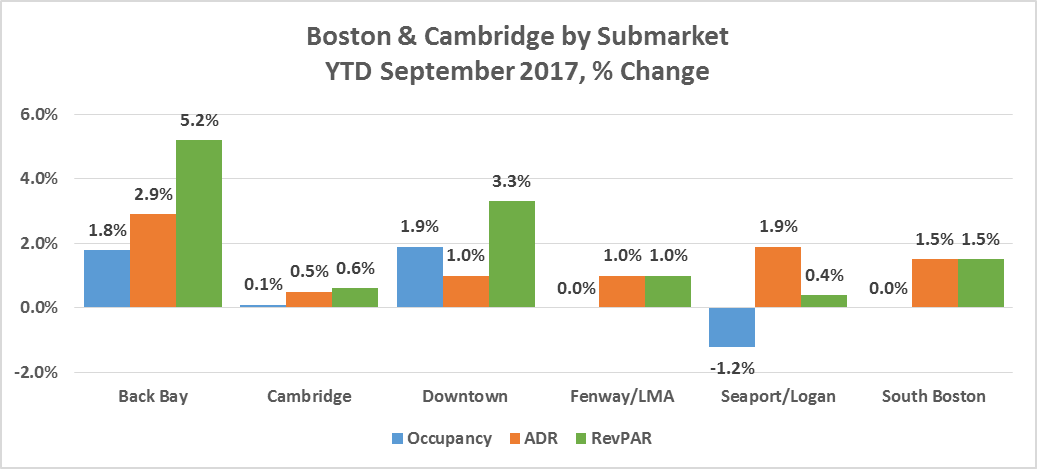

The Seaport/Logan Airport submarket is the only market that has seen a decline in occupancy in 2017, a direct result of supply increases in 2016 and 2017. Both the Back Bay and Downtown submarkets have shown considerable improvement in occupancy, both growing almost two points. All submarkets have been able to increase rates over last year, ranging between 0.8% in Downtown to 2.9% in the Back Bay. RevPAR has increased across all six submarkets with the largest increases experienced in the Back Bay.

These positive trends are expected to continue through the fourth quarter of 2017. Demand growth over the remaining three months will be a result of the convention calendar at both the Hynes Convention Center and the Boston Convention & Exposition Center outpacing roomnights each month over last year, a shift in holidays from October to September, and continued strengthening in corporate and leisure segments.

Pinnacle Advisory Group has projected that market occupancy will increase to 82% in 2017, matching the market’s highest occupancy on record. ADR is expected to increase 2.0%, with gains each month of the last quarter. RevPAR is expected to reach slightly above $212 in 2017, an increase of 3.0%, and a historic high for the Boston/Cambridge lodging market.