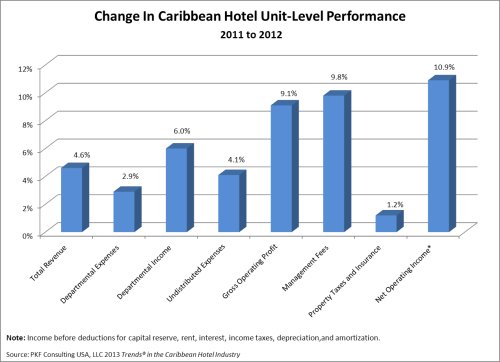

ATLANTA, Ga., August 20, 2013 – PKF Consulting USA, LLC (PKFC), announced today that the average Caribbean hotel that participated in the survey enjoyed a 10.9 percent increase in net operating income (NOI) in 2012, according to its newly released 2013 edition of Caribbean Trends® in the Hotel Industry. This is the second year in a row that Caribbean hotels have experienced a double-digit increase in NOI and the highest annual growth in profits that Caribbean hotels have seen since 2008.

“While this continued profit growth is encouraging, the Caribbean lodging market still is not back to its pre-recession levels. Recovery in the Caribbean is occurring, but lagging behind the rate experienced in the U.S.,” said Scott Smith, senior vice president at PKFC. “This is a mixed-message for a region whose economy depends primarily on the tourism industry.”

Unique Operating Environment

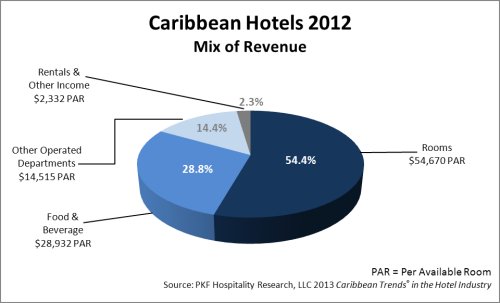

The Caribbean hotel industry is made up of a large number of resort properties, which creates the opportunity to earn profits from a variety services and amenities. Properties in the Caribbean Trends® sample reported the highest level of revenue growth (+6.4 percent) in other operated departments, meaning that visitors to the Caribbean are spending more money on extra amenities, such as golf courses, casinos and spas. “This is in contrast to U.S. resorts, where operators struggled to generate revenue beyond the rental of guest rooms,” said Smith.

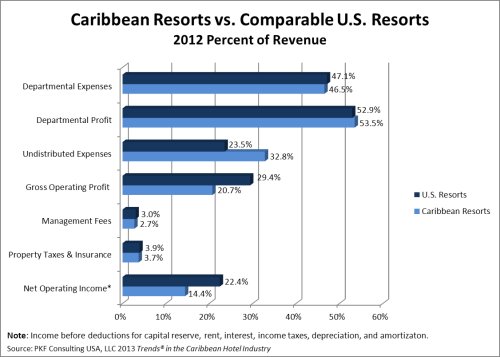

Unfortunately, Caribbean hotels have higher operating costs than comparable U.S. properties. For example, in 2012, the average Caribbean hotel incurred 20.1 percent greater food and beverage expenses than the average U.S. hotel. This is attributable to the fact that importing the necessary food, equipment and supplies to the region is very costly. Utilities continue to be a large expense in the Caribbean, as well. Many Caribbean nations lack the infrastructure to produce cost-efficient energy, and this is clearly reflected in the report. Utilities grew by 5.0 percent from last year and are 164.8 percent higher than the cost of utilities in comparable U.S. properties. Off-setting these relatively high costs are the lower labor expense ratios in the Caribbean.

New Hotel Construction

The growth in profits is attracting developers. Accordingly, there has been much development activity in the Caribbean. As reported in Smith Travel Research’s June 2013 Construction Pipeline Report, there are 17,932 rooms either under construction or planned for development in the region. In addition, several hotels are undergoing major renovations and improvements.

While Caribbean hotel performance is showing improvement, the additional supply of hotel rooms could hinder the pace of recovery. In 2012, occupancy levels at the properties that participate in the PKFC Caribbean Trends® survey grew by 4.2 percent, while average daily rates (ADR) increased by only 0.9 percent. “In a market where occupancy is driving the recovery, adding too many additional rooms could potentially be detrimental. We believe lodging demand will continue to grow within the overall region. However, when supply exceeds demand, complications could be created for individual hoteliers,” said Smith.

By far, the biggest new development to enter the Caribbean region will be the 2,200-room, mega-resort Baha Mar. This presents both a challenge, and an opportunity for the local Bahamian lodging market and the overall Caribbean hotel industry. Industry participants wonder whether there will be enough demand to sustain pre-existing Bahamian resorts in addition to Baha Mar once it opens in December of 2014. On the other hand, Baha Mar has the potential to expand the reach of both the Bahamas and the Caribbean as a tourist destination around the world. Airlift capacity to the Bahamas is being increased by 400,000 seats in anticipation of higher numbers of visitors to the islands.

“It remains to be seen if the expected increase in travel to the Bahamas truly will come from new sources around the world or just draw tourists away from other Caribbean destinations,” said Smith.

Airlift

According to PKFC’s Caribbean Trends® report, airlift continues to be a major consideration for the Caribbean hotel industry. Local hoteliers always have stressed the importance of reliable and stable airlift to the region, and in light of recent developments, such as the upcoming opening of Baha Mar and increasing levels of occupancy in the region, this has become even more important. “In order for new resorts in the area to thrive, the Caribbean is in need of increased local and long-distance, non-stop flights,” said Smith. “Many Caribbean nations still have high airport arrival taxes. However, some Caribbean nations, such as Antigua, Jamaica and the Bahamas, are working diligently to improve air travel and, as such, have recently expanded their airports.”

Another area of concern for hoteliers is the European Union’s proposed carbon tax. Under this proposal, all miles covered by international flights entering and exiting European airports would be taxed, including those originating and arriving in the Caribbean. Since Europeans account for 18 percent of inbound travel to the Caribbean, this potential increase in airfares could negatively impact overall visitation. Fortunately, the International Civil Aviation Organization meets this autumn, at which point the E.U. and other countries hopefully will come to an agreement that works for all parties.

Positive Outlook

The overall outlook in the Caribbean is a positive one, with occupancy, ADR and profits all increasing. While growth is welcome news, hotels in the region still lag pre-recession levels of performance. There also are issues, such as airlift, rising expenses and increased competition from newly constructed properties. “The challenges that Caribbean hoteliers will face in the future are multi-faceted. If handled poorly, the recovery could be extended. However, if handled properly, all participants in the region should enjoy continued healthy increases in performance,” concluded Smith.

To purchase a copy of the 2013 Caribbean Trends® in the Hotel Industry report in PDF format, please visit the firm’s online store at www.pkfc.com/store, or call (855) 223-1200. The report contains several data tables that allow Caribbean hotel owners and operators to benchmark the financial performance of their property based on room-count and ADR groupings.