Zika, Exchange Rates and New Supply Impact Performance

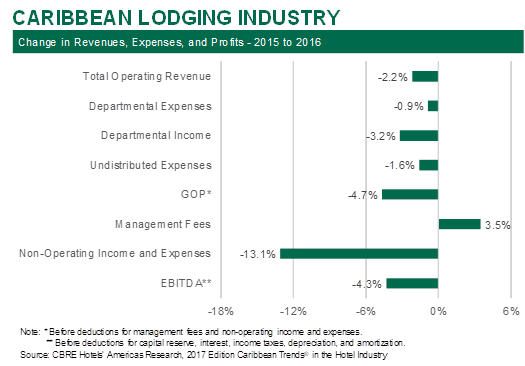

October 18, 2017, Atlanta, Ga. – CBRE Hotels Americas Research announced that the average Caribbean hotel in its survey sample suffered a 4.7 percent decrease in gross operating profit (GOP) during 2016, according to its newly released twelfth edition of Caribbean Trends® in the Hotel Industry. This decline in profitability follows four consecutive years of double-digit increases in GOP.

The decline in the bottom-line starts with the falloff in top line revenue. During 2016, occupancy for the Trends® sample declined by 2.8 percent, along with a 0.2 percent decrease in average daily rate (ADR). The net result was a 3.0 percent decline in RevPAR. All other revenue generating departments (food & beverage, other operated departments and miscellaneous income) also saw a loss in sales during the year, resulting in a 2.2 percent drop in total hotel operating revenue.

“A multitude of factors caused the decline in revenue for Caribbean hotels in 2016,” said Scott Smith, managing director, CBRE Hotels Consulting. “These include new supply, currency exchange rates and the Zika virus.”

It should be noted that during the production of the 2017 Caribbean Trends® report, the Caribbean region experienced two Category 5 hurricanes (Irma and Maria). The impact of the hurricane will be noted when we are able to review the 2017 annual operating data.

New Supply

Lodging is a cyclical industry, so it is not surprising that the strong performance of Caribbean hotels from 2012 through 2015 attracted the attention of developers from around the world. “New hotels have opened up on most all islands in the region. We have seen urban select-service properties, along with five-star all-inclusive resorts enter the market in recent years,” Smith said.

Compounding the impact of traditional hotel openings in historical destinations is the entry of alternative forms of lodging, plus the emergence of new venues. “Like elsewhere in the world, Airbnb is becoming a popular form of lodging in the Caribbean region. In fact, Airbnb has served as the entrée form of lodging for people wishing to visit Cuba, a new and emerging destination attracting visitors from other islands in the region. Plus, parts of the long-delayed Baha Mar development opened in early 2017,” Smith noted.

Other Negative Factors

The Zika virus was officially eradicated in 2017, but not before the presence of the disease scared people from traveling to the Caribbean in 2016. The negative publicity from the virus impacted both the transient and group demand group segments. Fortunately, conversations with regional hoteliers indicate that the stigma of Zika has dissipated somewhat in 2017.

Given the international appeal of the Caribbean, travel to the region is sensitive to fluctuations in currencies. In June 2016, British voters surprised the world when they voted to leave the European Union. The vote caused the British pound to fall to its lowest level against the dollar in 30 years.

“The decline in the value of the pound limited the purchasing power of U.K. travelers, dampening their spending habits on discretionary spending, including vacations. Popular British destinations such as Barbados and St. Lucia were the most vulnerable,” Smith added. “In response, I expect Caribbean hoteliers to shift their marketing focus to the U.S., where the dollar is relatively strong and purchasing power is high.”

Cost Controls

With revenues declining in 2016, Caribbean hotel operators had to focus on cost controls to limit decreases in profits. During the year, regional managers cut their operating expenses by 1.2 percent.

Despite the 2.8 percent decline in occupancy, rooms department expenses remained flat from 2015 to 2016. “The stagnation in rooms department expenses is surprising given the high degree of variable expenses within this department,” Smith said. “On the other hand, the decreases in the food & beverage and other operated department expenses make sense and were commensurate with their respective declines in revenue.”

Undistributed department expenses, which are more fixed in nature, declined by 1.6 percent during 2016. “The 7.9 percent decline in utility expenses is noteworthy given the relatively high cost of energy in the Caribbean region. This could be reflective of a payoff in the green and sustainable practices that have been prevalent in the Caribbean for several years,” Smith noted.

“The 3.5 percent rise in management fees, on the other hand, is counter-intuitive given the declines in revenue and profits experienced in 2016. Caribbean hotel owners would be advised to check the incentive clauses in their management contracts,” Smith advised.

Profits

By cutting expenses 1.2 percent, Caribbean hotel operators limited the 2.2 percent decline in revenue to just a 4.7 percent decrease in GOP.

Of all the categories analyzed by CBRE, only those Caribbean properties in the upscale and upper-midscale categories achieved an increase in GOP in 2016. During the year, these hotels in aggregate converted a 4.1 percent increase in revenue to a 1.9 percent rise in GOP. “Several of the properties in these chain-scales are select-service hotels in urban locations that accommodate business travelers. Therefore, they were somewhat insulated from the factors that negatively impacted leisure travel and resorts,” Smith said.

To purchase a copy of the 2017 Caribbean Trends® in the Hotel Industry report in PDF format, please visit the firm’s online store at pip.cbrehotels.com or call (855) 223-1200. The report contains several data tables that allow Caribbean hotel owners and operators to benchmark the financial performance of their property based on room-count, ADR groupings, and chain scale.

CBRE Hotels is a specialized advisory group within CBRE providing capital markets, consulting, investment sales, research and valuation services to companies in the hotel sector. CBRE Hotels is comprised of more than 385 dedicated hospitality professionals located in 60 offices across the globe.