Historic hotels achieve a substantial premium in ADR and REVPAR over comparable contemporary hotels.

WASHINGTON, DC – February 7, 2018 The outlook for the U.S. lodging industry, particularly historic hotels, continues to be extremely strong, according to CBRE Hotels’ Americas Research (CBRE).

For the fourth consecutive year, CBRE Hotels’ Americas Research presented a Historic Hotels of America – CBRE two-year forecast at the Historic Hotels of America annual conference. CBRE relies on historical hotel performance data from STR, and economic forecasts from CBRE Economic Advisors, to prepare its lodging forecasts.

Key points presented by Mark Woodworth, Senior Managing Director at CBRE, to more than 200 owners, asset managers, general managers, and sales and marketing leaders at the Historic Hotels of America annual conference at The Omni Homestead (1766) include:

- Per STR, through the first three quarters of 2017, the aggregate RevPAR for historic hotels that are members of Historic Hotels of America placed between the national averages for all upper-upscale and all luxury hotels in the U.S.

- Over the next two years (2018 and 2019), RevPAR for historic hotels is expected to grow at an average annual rate of 1.0 percent, which is slightly less than the RevPAR forecasts for the nation’s upper upscale hotels at 1.2 percent. Most of the RevPAR growth is expected to stem from increases in ADR.

- Annual occupancy levels for hotels that are members of Historic Hotels of America remains approximately 8 percent points above the national average occupancy level through 2019.

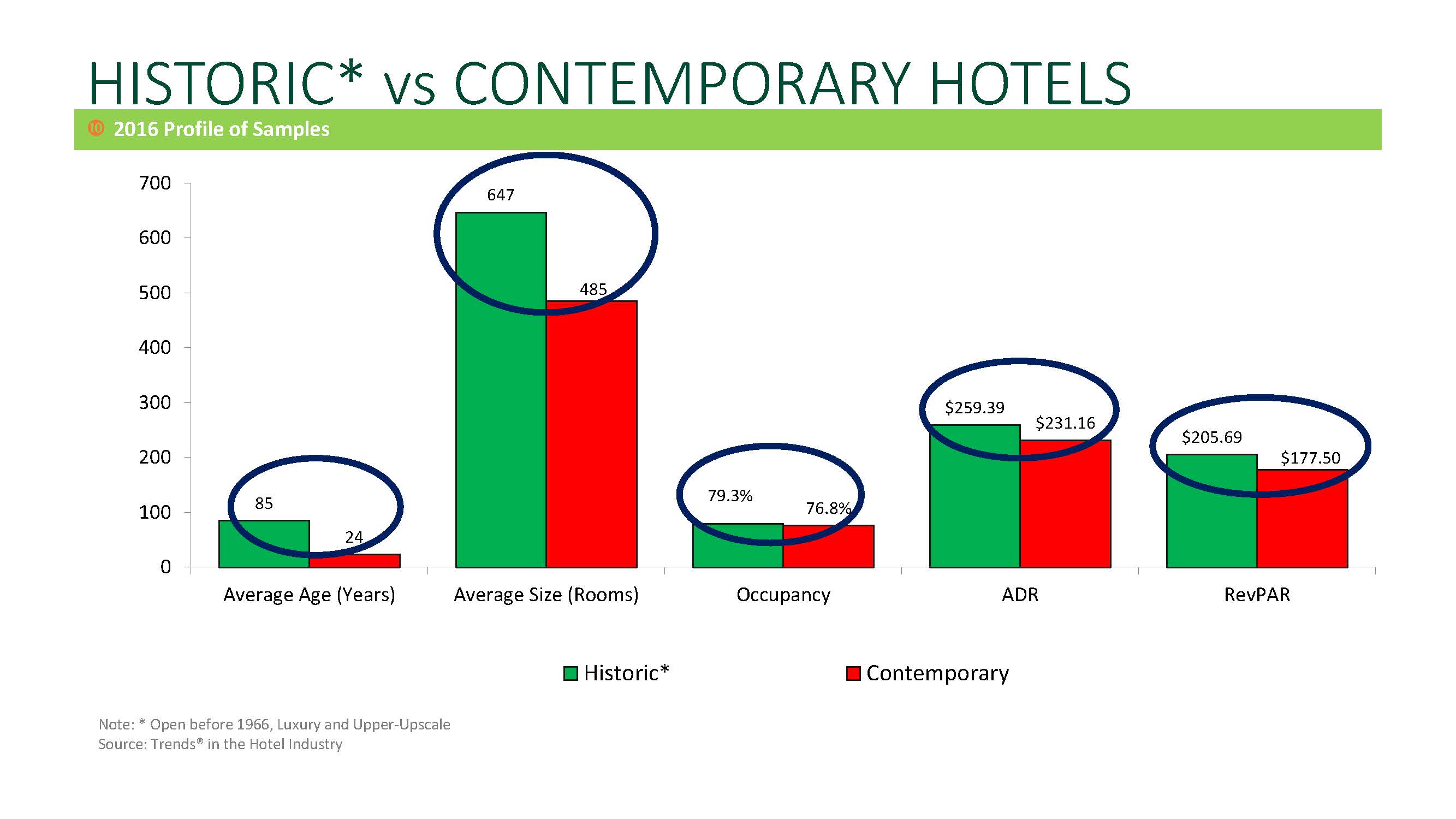

- Based on a set of information pulled from CBRE’s database of hotel operating statements, historic hotels (including those that are not members of Historic Hotels of America) had an average ADR of $259.39, higher by more than 12 percent than the $231.16 ADR for contemporary hotels. (See chart below)

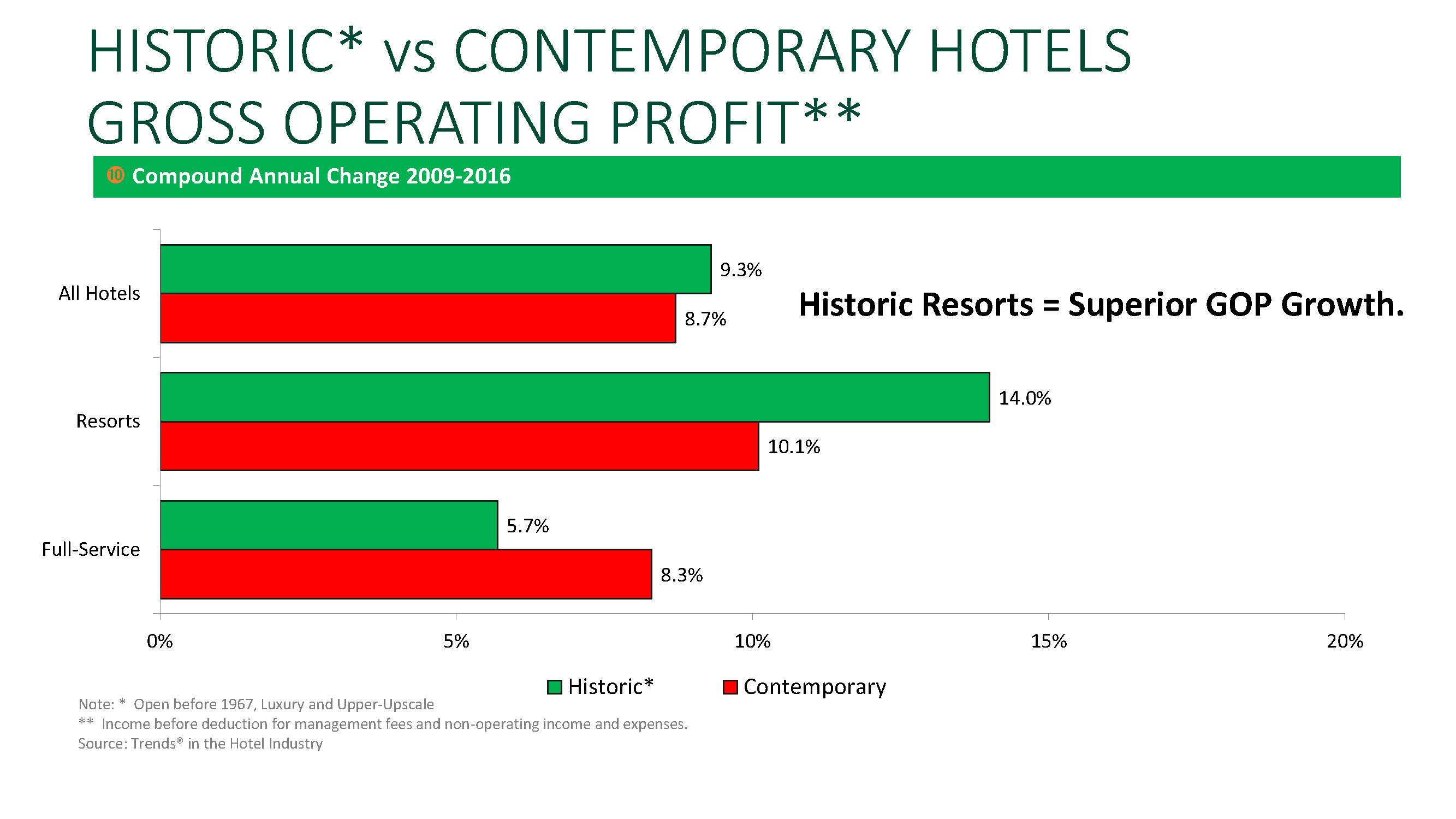

- Since 2009, historic resort hotels have achieved greater revenue and profit growth compared to their contemporary counterparts.

“The data strongly supports the idea that many consumers favor and will pay more for the unique hotel experience historic properties can offer,” noted Woodworth.

“Historic Hotels of America helps the consumer differentiate the authentic historic hotel from other older hotels,” said Lawrence Horwitz, Executive Director, Historic Hotels of America and Historic Hotels Worldwide. “Historic hotels can achieve a significant advantage in ADR and REVPAR versus contemporary hotels, especially when recognized as part of Historic Hotels of America. While promoting its history helps a historic hotel differentiate itself from other hotels, being part of Historic Hotels of America validates the differentiation. For the fourth year in a row, historic hotels inducted into and participating in Historic Hotels of America realize a competitive advantage as well as a substantial premium with their rates, occupancy and RevPAR compared to other hotels.”