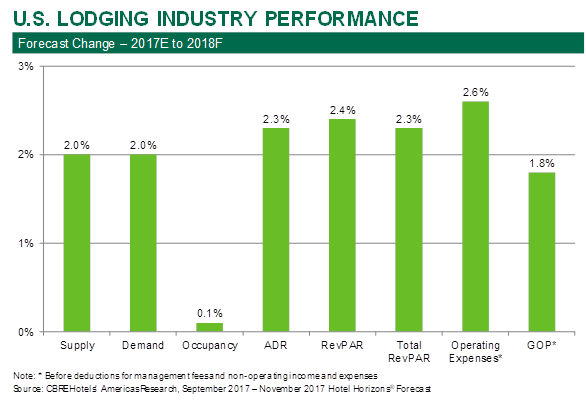

Atlanta – August 23, 2017 – The U.S. lodging industry will enjoy continued growth in all major metrics in 2018, albeit at a slower pace. Based on the recently released September 2017 editions of Hotel Horizons®, CBRE Hotels’ Americas Research is forecasting year-over-year increases in occupancy, average daily room rate (ADR), rooms revenue (RevPAR), total operating revenue, and gross operating profits (GOP) from 2017 to 2018.

“As hotel owners and operators begin the process of preparing their 2018 marketing plans and budgets it is vital that they receive critical inputs on what will drive industry performance,” said R. Mark Woodworth, senior managing director of CBRE Hotels’ Americas Research (CBRE). “Based on our analysis of the economic and operating environments, we believe that U.S. hotels will once again achieve record occupancy levels and continued growth in profits, during the upcoming year.”

CBRE is forecasting a 0.1 percent occupancy increase along with a 2.3 percent rise in ADR for 2018. The net result is a projected 2.4 percent boost to RevPAR. “The limited growth rates may be disappointing or even troubling for some industry participants. However, 2018 will mark the ninth consecutive year of rising occupancy, something we have not seen since the 1990s. While the slow growth in occupancy does indicate we are at the top of the business cycle, all factors indicate that we are in the midst of a record breaking, sustained period of prosperity for U.S. hotels,” Woodworth said. “Like occupancy, CBRE also is projecting a ninth consecutive year of growth in RevPAR, total operating revenue, and GOP in 2018.”

CBRE also has identified an uptick in new lodging supply. For 2018, CBRE is forecasting a 2.0 percent increase in the number of available rooms. This does exceed the 1.8 percent long-run average annual rate of supply growth as reported by STR. “Historically, we have seen rising supply precede industry downturns. Fortunately, as has been demonstrated for several years now, the economic factors that matter most for hotel demand growth exceeded the changes in supply,” said John B. (Jack) Corgel, Ph.D., professor of real estate at the Cornell University School of Hotel Administration and senior advisor to CBRE Hotels’ Americas Research. “Looking forward, employment levels and income gains are expected and remain attractive. These movements will result in growing levels of demand and occupancy to counter balance supply growth.”

Local Markets

The influence of new supply is somewhat muted when reviewing the national statistics. Supply growth in excess of demand is the reason why 50 of the 60 major markets in the CBRE Hotel Horizons® universe are projected to realize a decline in occupancy in 2018. The disparity between the performance of the overall national market and the major local markets is driven by the skew of development activity. Nearly 90 percent of the new hotel rooms entering the U.S. in 2018 will reside in the 60 Hotel Horizons® markets. “Now more than ever, the ‘street corner business’ adage we’ve always touted applies to the hotel industry. It is very important to gain a thorough understanding of local market conditions when preparing hotel budgets for 2018,” Woodworth noted.

Despite the increase in competition, the aggregate occupancy levels for the Hotel Horizons® markets are forecast to remain above 70 percent through 2021. In 2018, 52 of the 60 markets are projected to achieve occupancies above their long-run average. “Given such lofty occupancy levels, 49 of the Hotel Horizons® markets are forecast to enjoy an ADR increase in excess of the projected 2.2 percent rate of inflation. Real ADR growth in the face of declining occupancy speaks to the strength of most U.S. lodging markets,” Corgel added.

Pushing Profits

“In a low revenue growth environment, it is a struggle to grow profits. This is especially true given the labor shortages and resulting upward pressure on compensation rates that our clients are reporting to us,” said Woodworth. “If revenues increase at our forecast growth rate of 2.3 percent in 2018, then expense growth needs to be kept to something less than 3.7 percent in order for profits to rise. With the average hourly compensation rate for hospitality employees currently increasing at a pace of 4.1 percent, and labor costs comprising roughly half the costs of a hotel operation, you can see how the math becomes challenging.”

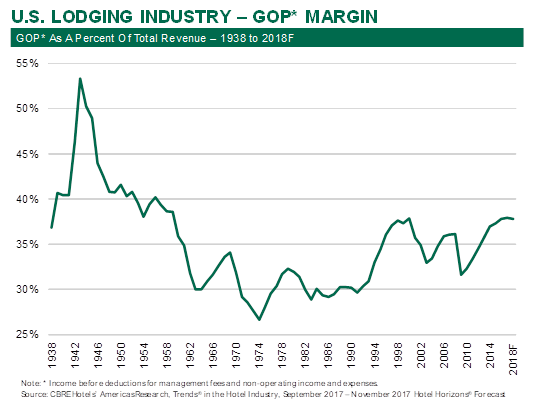

U.S. hoteliers have overcome this same obstacle in recent years. Profit margins for U.S. hotels have grown each year since 2009 and in 2017 are forecast to be at their highest levels since 1959. “Given their track record, we believe hotel operators will once again control costs sufficiently to allow for profit growth in 2018,” Woodworth said.

Life at the Top

“The market and operating metrics we are seeing at the top of this business cycle are quite remarkable given the 90-plus years our firm has been tracking the U.S. lodging industry. I understand why people are disappointed in the slow pace of growth. However, the fact that we are achieving such strong levels of occupancy and profit margins, combined with the positive economic outlook, makes us very comfortable forecasting sustained growth for the foreseeable future,” Woodworth concluded.

To assist hotel owners and operators in the preparation of their 2018 budgets, the September 2017 editions of Hotel Horizons®for the U.S. lodging industry and 60 major markets can be purchased by visiting: https://pip.cbrehotels.com

CBRE Hotels is a specialized advisory group within CBRE providing capital markets, consulting, investment sales, research and valuation services to companies in the hotel sector. CBRE Hotels is comprised of more than 385 dedicated hospitality professionals located in 60 offices across the globe.