By Tanya J. Pierson , Kasia M. Russell , Jessica White

The 2017 ALIS conference registered the strongest attendance since 2008, with the theme of “Please Stand By…” reflecting the uncertainty regarding the outlook for the hotel industry at this time. It was also the platform for the introduction of Hilton's newest soft brand, Tapestry by Hilton.

And the consensus is… While many were speculative entering the second half of 2016, ALIS attendees were cautiously optimistic about 2017 given recent gains in the stock market and the pro-business focus of the new administration. The industry has experienced a "soft landing,” although some of the primary concerns echoed throughout the conference were national politics, supply growth of guestroom inventory, rising labor costs, and OTA commissions. Many IREFAC panelists felt that all-inclusive and health-oriented properties were going to increase in popularity in the new year.

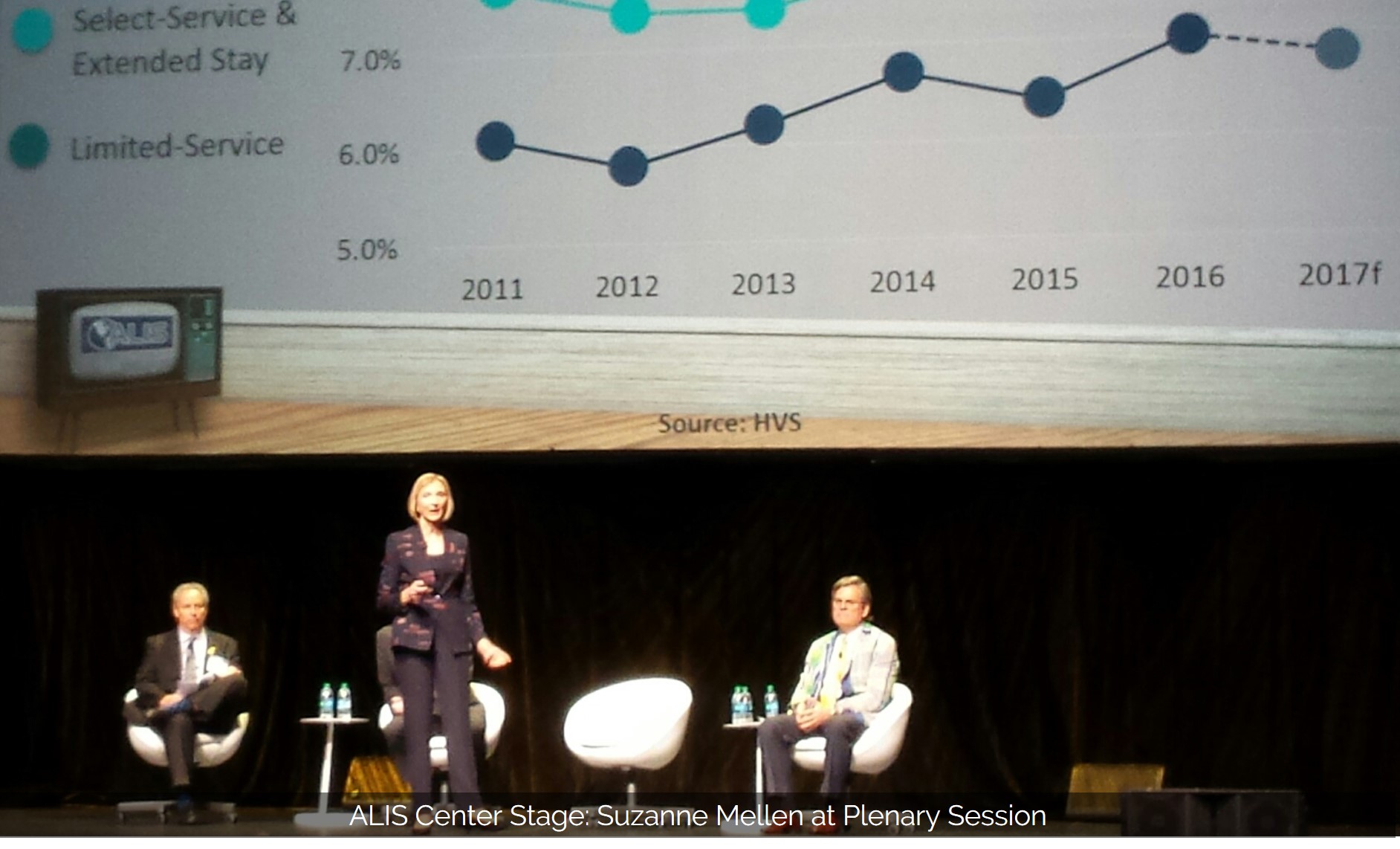

In 2016, more rooms were sold and occupancy reached historical peaks, with STR reporting an annualized national occupancy of 65.5%. Although the general outlook remains relatively positive, with demand expected to increase in 2017, new supply opening this year will likely result in first-time occupancy contraction during the current cycle. Furthermore, limited growth in ADR and rising labor costs are anticipated to lead to little gain in EBITDA in some markets.

As mentioned, underlying risk factors continue to be the entrance of new supply, as well as the strength of the U.S. dollar and its effect on foreign travel and gas prices. Recent and near-term increases in interest rates have pushed cap rates up anywhere from 10 to 30 basis points. The lack of stability around the world is expected to continue to increase the capital flow to the U.S. and strengthen the dollar.

Transactional expectations for 2017

Lending will remain strong for refinancing and acquisitions, and interest rates are expected to remain favorable, falling between 300 to 350 bps over LIBOR in 2017, with loan-to-value ratios between 55% and 65%. Financing for new development will be much more limited as construction costs rise, resulting in higher equity requirements, in conjunction with strong brand representation and sponsorship.

The biggest factors driving forecasts include GDP growth, unemployment, foreign investments, and income growth. For 2017, the highest RevPAR growth is anticipated for markets such as Sacramento, Washington D.C., Tucson, Chicago, Salt Lake City, Albuquerque, Houston, and Nashville, per the ALIS presentations. On the other hand, RevPAR contractions are likely to be realized in Cleveland, Charlotte, San Francisco, Miami, and New York.

Dual-Brand Hotel Development

The interest of dual-brand hotel development continued to grow in 2016. While historical dual-brand development was primarily focused in urban markets, it has been begun to extend to suburban areas. Some of the benefits of a dual-branded or multi-branded development include the maximization of revenues and cost savings by developers, which ultimately secures the highest cash flow possible to the ownership.

A dual-brand hotel development enables management to target a variety of customers; the combination of extended-stay and select-service hotels is a very good example. It is highly suggested that the dual-branded property is managed by one company for easy and efficient management. Under one management team, payroll expense can be allocated across lodging products, enhancing profitability. Because a dual-branded property cannot incorporate all typical prototype designs, the brands and architect should be brought in as early as possible.

Additionally, the cost savings can begin at the development stage with decreased costs in permits and entitlements. It is also suggested that the two brands belong to one parent company, contributing to additional savings in development costs and allowing for easy management. While the recreational facilities and amenities can be shared in a dual-branded hotel, it is recommended that the hotel have separate check-in or entry areas to avoid guest confusion.

Welcome to the Future!

The conference also focused on younger travelers and the future of hospitality technology. The discussion ranged from how to attract guests through social media to how to offset rising labor costs through technology.

Best Western Hotels & Resorts has implemented 360-degree tours and some virtual-reality elements into its marketing initiatives with success. Google envisions a new “heads up” world by 2020, where people will be integrated with virtual and augmented reality in their daily lives and will move away from viewing information on their mobile screens.

According to Ali Abidi, Principal at PwC, nearly 70% of online content will be consumed on mobile phones by 2020; mobile check-in and keyless entry are also expected to be the standard by 2020. Some companies are now using mobile platforms to seamlessly integrate back-of-the-house operations with the guest experience by leveraging the data guests share on social media.

Other contributors: Li Chen, Suzanne Mellen, Lizzette Casarin