With the pandemic largely in the rearview mirror, the last twelve months have been about interest rates, less transactions, and wild presidential election cycles worldwide. The hotel industry will be impacted in significant ways as these issues unfold. On the other hand, operational fundamentals have been strong, contributing to CEO pay marching upward.

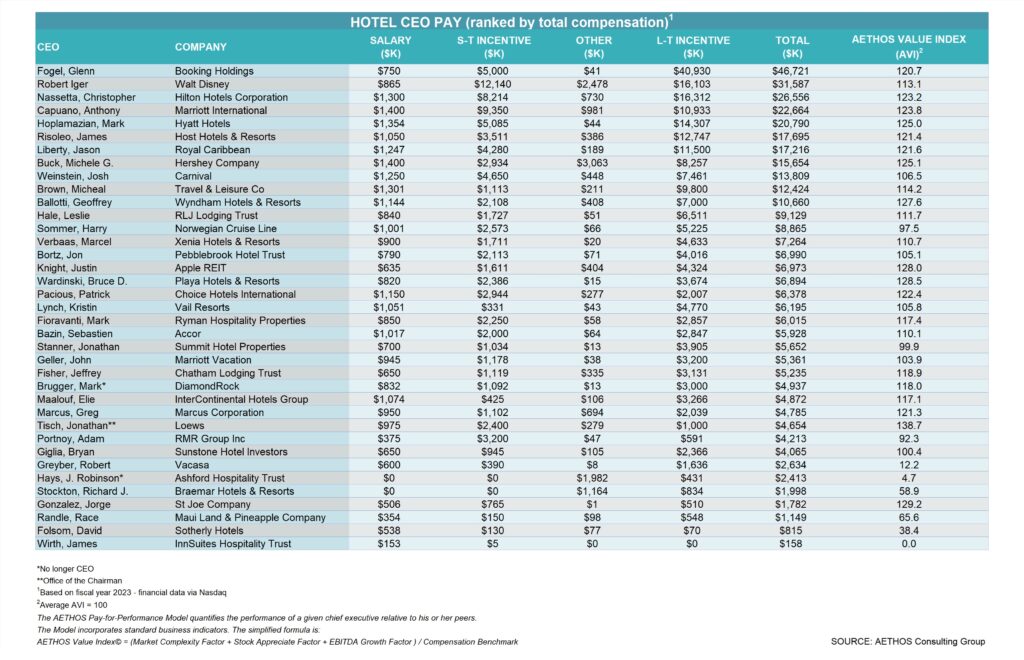

Average CEO pay in the industry rose to USD $9.8M, from the previous year’s $9.5M. Most of this increase came in the form of short-term incentive pay, making the correlation between stronger operating fundamentals and CEO pay. Interestingly, “other compensation” also increased indicating more perks and benefits for hotel leaders. By contrast, salaries and long-term incentives remained relatively flat.

One notable trend is the widening CEO-to-average worker pay ratio, which has increased to 169:1 from last year’s 146:1. According to ZipRecruiter, the average annual pay in the U.S. hospitality industry remains steady at $58,000. If this data is accurate, hospitality workers may have a point that inflation is eating away at their purchasing power. In contrast, looking towards our AETHOS office in London, the Access Hospitality 2024 report for the UK shows that the average annual pay for hospitality workers has risen to £45,300, up from £39,800. This increase translates to $57,957.50, compared to $50,920.72 USD as of July 2024.

Tenure has also been a hot topic among the financial press with a great deal of pressure on CEOs to perform. Take Walt Disney for example, which ousted Bob Chapek in favor of former CEO, Bob Iger. Then almost immediately, Disney’s board had to start a succession plan for Iger. Nevertheless, CEO tenure in the hospitality sector extended to over 10 years, continuing to surpass the Fortune 500 average of 7 years. We surmise that hotels are still a niche industry where deep industry knowledge is still preferred over “best athlete” experience.

Financially, hospitality firms demonstrated resilience with the average market capitalization climbing to nearly $17B and average EBITDA rebounding to $1.3B, up from $922M. This further supports our premise that operating fundamentals were better, and more investment dollars poured into the sector.

Individual CEO performance and compensation were noteworthy. Glenn Fogel of Booking Holdings had the highest pay package at $46.7M, of which $40M came in the form of stock. In fact, according to our AETHOS Value Index, Fogel could have been paid nearly $10M more relative to his performance. Bob Iger at Disney received the largest bonus of $12.1M. Other component leaders included Anthony Capuano of Marriott International with a salary of $1.4M, and the largest perk package of $3M going to Michael Buck at Hershey. The highest AETHOS Value Index belonged to Jonathan Tisch of Loews with an impressive score of 139, representing the best pay-for-performance in the peer group.

A key element of the AETHOS Value Index methodology is quantifying the degree to which a CEO over- or under-earns compared to their peer group. Compensation includes base salary, short-term incentives, long-term incentives, and other compensation, and is calculated by comparing the total compensation of the subject executive with that of the peer group. This essentially determines “fair pay” for a CEO.

Shivaram Rajgopal’s recent Forbes article, “What Is ‘Fair Pay’ For A CEO?” explored the rationale behind Elon Musk’s extraordinary compensation program at Tesla. Musk’s LTIP was directly linked to the increase in Tesla’s market capitalization. Rajgopal found that Musk’s most recent pay package was unrivalled at $44.9B, representing nearly 9% of the overall market capitalization increase. In contrast, the next highest paid CEO in the Fortune 500 received significantly less than 1%.

It appears that Tesla’s compensation committee and their outside consultant, Compensia, did little to compare Musk’s pay to a peer group or consider a percentage cap on his LTIP plan. We believe that the subsequent shareholder lawsuit is a harbinger of increased scrutiny on the independence of compensation committee members, and the ownership stake/requirements of public company CEOs.