Analysis by Jesper Palmqvist and Kelsey Fenerty

A later Mid-Autumn Festival created a longer holiday period than last year, combining with National Day festivities to provide impressive improvement in China’s hotel performance.

Growth across the country

As usual, China created another long national holiday by adjusting working days, leading to a holiday period of 30 September through 7 October before a return to work on the weekend of 8-9 October.

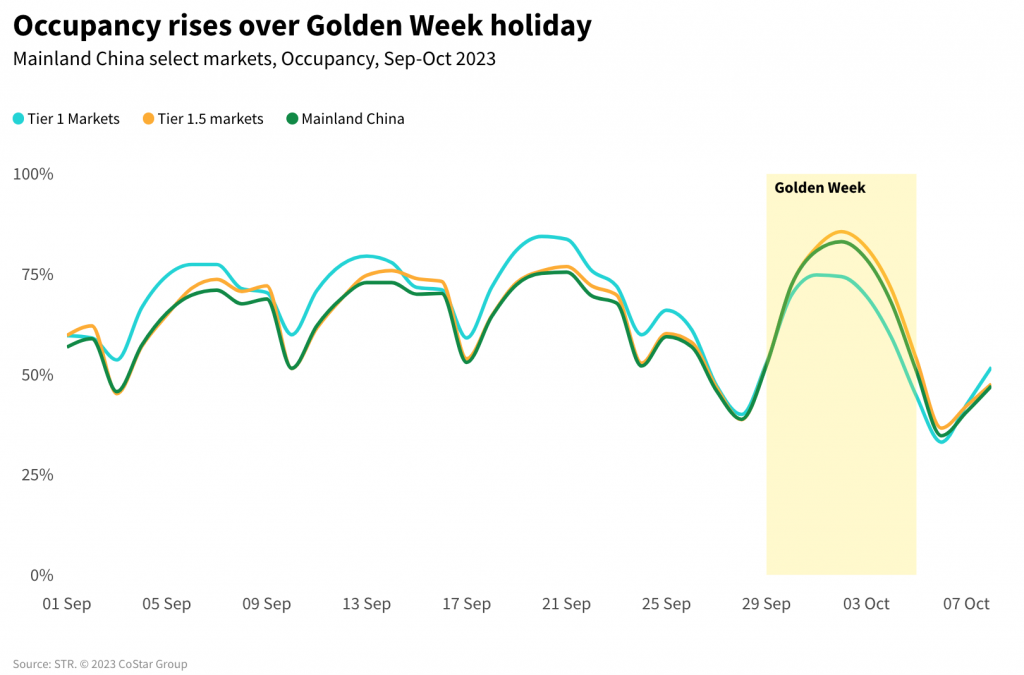

Mainland China hotel occupancy over the eight-day holiday period averaged 65.1% and peaked on 2 October (83.1%). Most of the growth came from outside the Tier 1 markets (Beijing, Shanghai, Guangzhou, and Shenzhen), as millions of people departed large cities and headed home to stay with family around the country. Tier 1 market occupancy in aggregate peaked on 1 October at a softer 74.8%. The ‘New 1st Tier’ or Tier 1.5 markets, however, saw the highest occupancy levels on 2 October (85.6%), as some of the busiest markets were Suzhou (94.1%), Chongqing (92.9%), and Chengdu (91.7%).

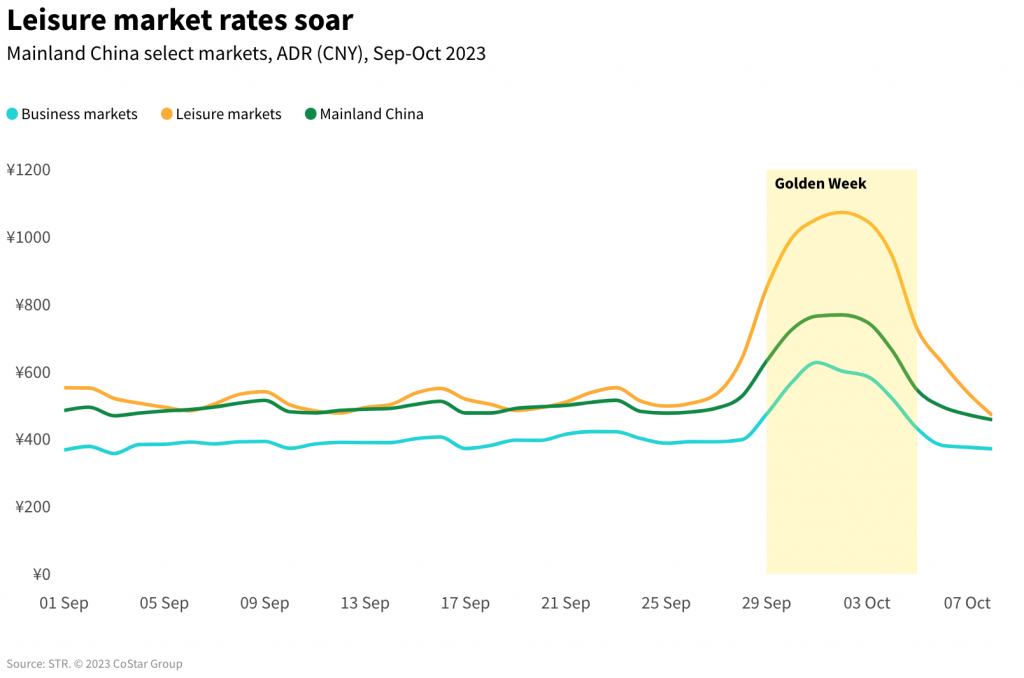

The country’s hotel performance was driven by exceptionally high average daily rate (ADR) in leisure-driven markets, where high demand pushed room rates to double of what was recorded weeks prior to the holiday – including a peak of CNY1,073.13 on 2 October.

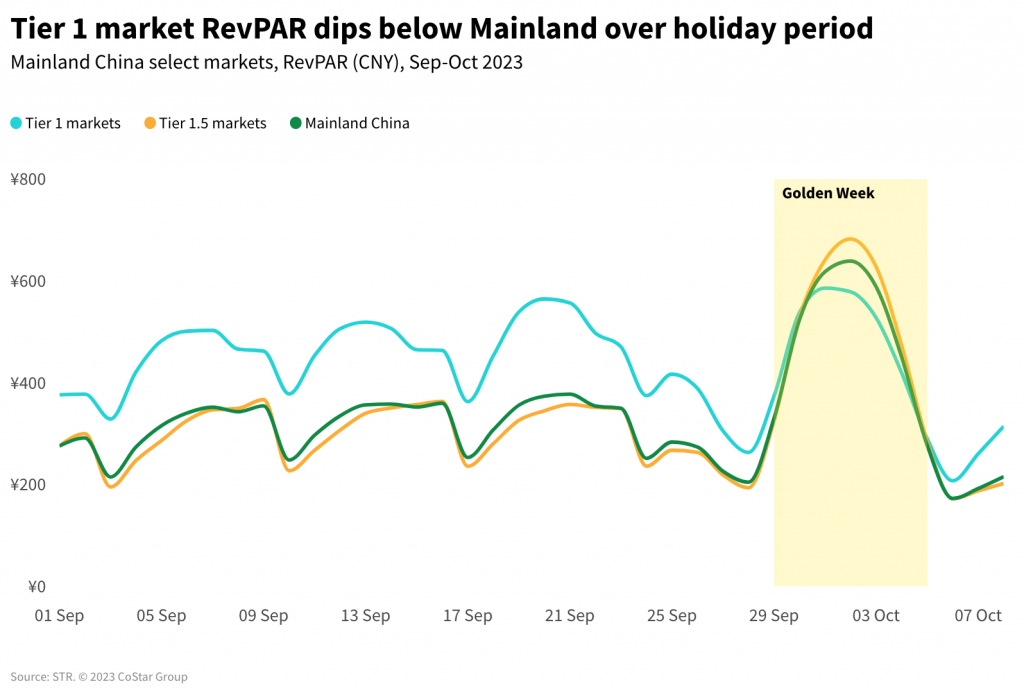

Boosted occupancy and ADR resulted in China posting overall good revenue per available room (RevPAR) at a national level, especially in smaller-tier and leisure-driven markets, which posted the highest RevPAR on 2 October (CNY682.52). Meanwhile, Tier 1 markets retained momentum as softer corporate business was countered by enough tourist demand to enjoy large and popular attractions, leading to that group’s highest RevPAR on 1 October (CNY585.87).

RevPAR is already ahead of 2019

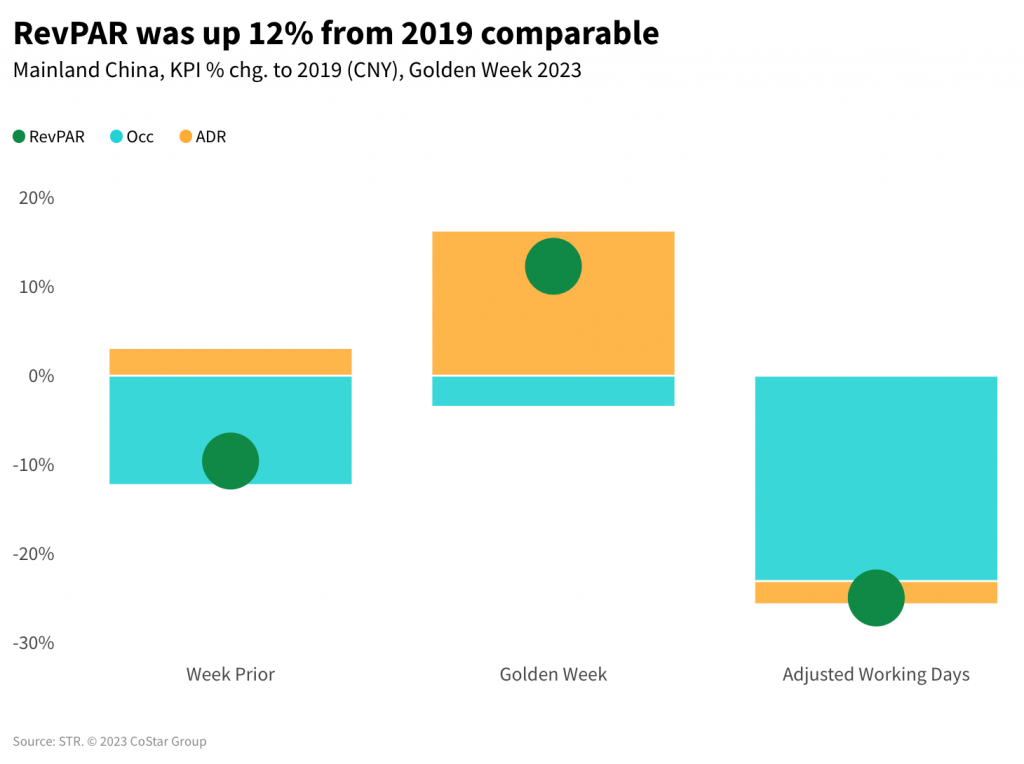

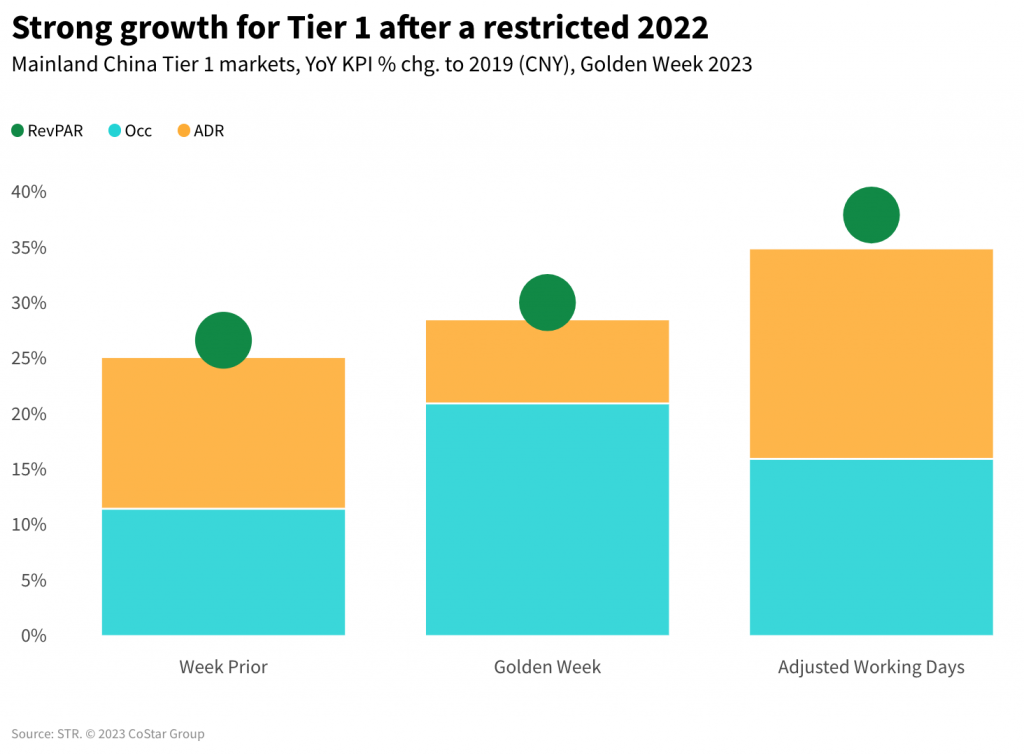

As 2022 was still a year of lockdowns and challenges for China, year-over-year comparisons are inevitably going to be favorable this year. For example, this year’s Golden Week occupancy surpassed last year by 35.0%. However, what stands out is the comparison to 2019, where RevPAR surpassed the pre-pandemic comparable by 12.3%. Even if RevPAR growth was driven predominantly by higher rates, occupancy levels were close to historic peaks as well.

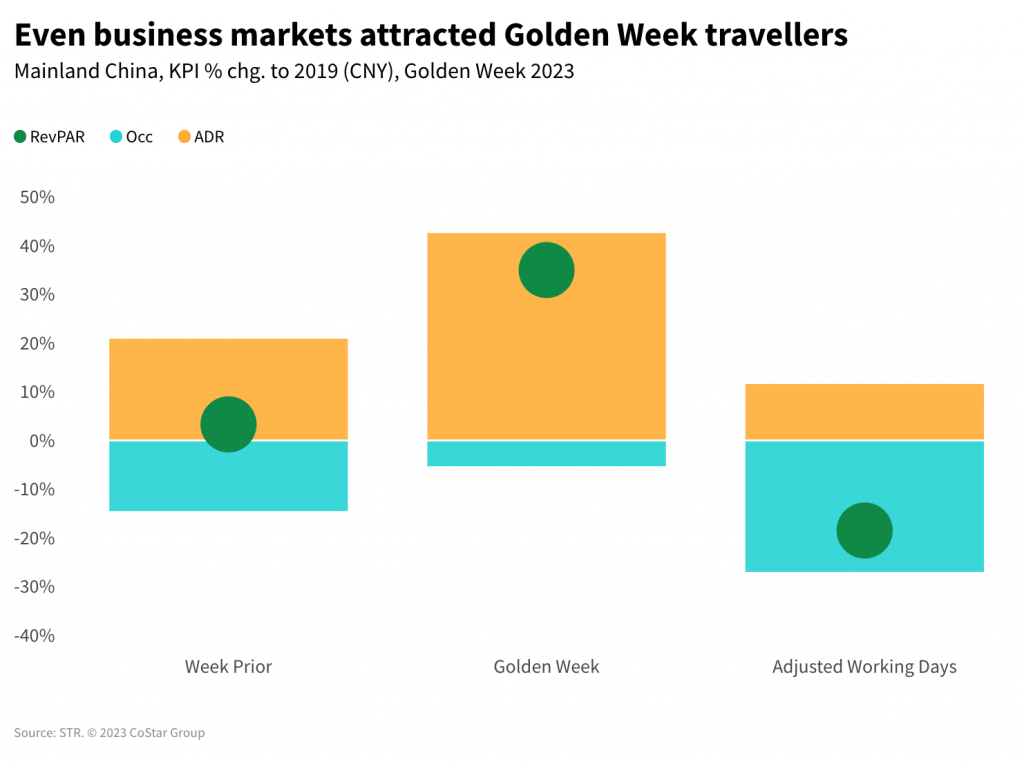

Holiday rates increased 25.5% year over year at a national level, with leisure-driven markets surpassing last year’s ADR by an impressive 40.8%. Both leisure and business-driven markets pushed ADR levels past the 2019 Golden Week by 42.6%.

Considering the difference in higher indices when comparing the peak holiday with the week prior, it would suggest that these 10 business markets not only relied on higher rates but also brought in more leisure travelers during the holiday, at least when compared with 2019.

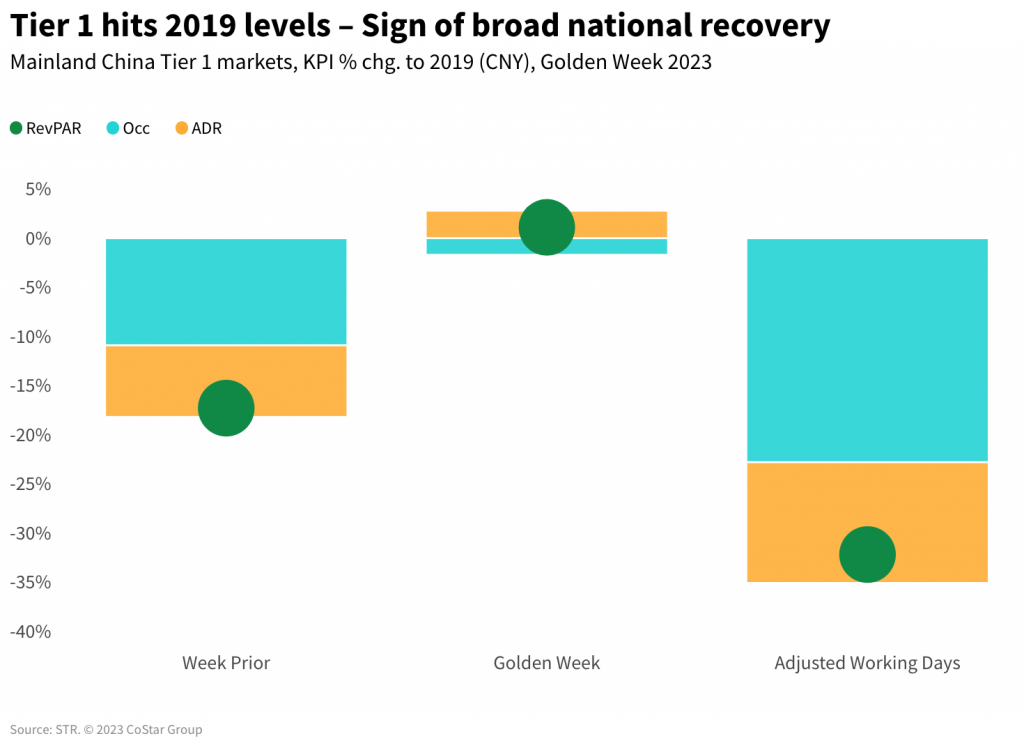

Tier 1 markets performed differently

China’s biggest four markets – Beijing, Guangzhou, Shanghai, and Shenzhen – followed a moderately different trend than the rest of the mainland. These massive markets reported strong year-over-year growth during the two adjusted working days, as they were more heavily affected by the restrictions in 2022. However, the markets’ recovery rates are getting stronger by each quarter, and they are expected to end the year at good levels with less volatility. This was already reflected in this holiday season as the Tier 1 markets reached 2019 levels.

In Summary

After several years of limited Golden Week celebrations, the 2023 rendition of the holiday proved to be a resounding success for the hotel industry – but it should be noted that the May Day holidays earlier this year saw higher performance levels. Golden Week is also the last public holiday of the year, meaning all eyes now look to conferences and corporate travel to continue driving industry recovery in 2023.

While the topline results shown above shouldn’t come as a great surprise, they continue to show the importance of major holiday periods in China, but also the broad recovery scenario in place, showing much more historically normal patterns.